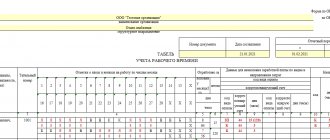

Unified forms of accounting sheets

The Labor Code of the Russian Federation (Article 91) establishes the employer’s obligation to keep records of the time worked by employees. For this purpose, unified forms of working time sheets are provided, approved by Decree of the State Statistics Committee of January 5, 2004 No. 1. The use of these forms is not mandatory, therefore the employer has the right to develop his own. Form No. T-13 is used most often, as it is used for automated processing of credentials.

Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n approved the OKUD form 0504421 for use by public authorities (state bodies), local government bodies, management bodies of state extra-budgetary funds, state (municipal) institutions. The same order determines how to keep a time sheet in Excel or another format using a special form.

IMPORTANT!

Regardless of what form is used, the essence of what a time sheet is and the purposes of maintaining it are the same. With its help, the employer records the number of working hours worked and missed by the employee.

How to record time worked on a timesheet

For any length of the working day, regardless of the established modes, the accounting of employees’ working time is reflected in two ways:

- method of continuous registration of attendance and absence from work;

- by recording only deviations (no-shows, overtime, etc.).

If the length of a working day (shift) is unchanged, then it is allowed to register only deviations in the employee working time table in Excel (another format), since the terms of the employment contract or internal labor regulations determine the number of working hours for each working day.

If the number of hours worked on different days (shifts) is different, for example, when recording the total time worked, then when filling out a time sheet, the continuous registration method should be used. This will allow, after the end of the accounting period, to identify possible overtime hours and adjust the employee’s further involvement in work within the limits of the norm for the length of time worked established for this category.

Notations in the working time sheet about the reasons for absence from work, part-time work or beyond its normal duration at the initiative of the employee or employer, shortened working hours, etc. are made on the basis of documents executed properly (certificate of incapacity for work, certificate of performance of state or public duties, a written warning about downtime, an application for part-time work, the employee’s written consent to work overtime in cases established by law, etc.).

ConsultantPlus experts discussed how to make corrections to a timesheet. Use these instructions for free.

to read.

When is Form T-13 used?

Every employer is required to keep records of the working hours of its employees (Article 91 of the Labor Code of the Russian Federation).

For this purpose, he can use any form suitable to the peculiarities of his mode of operation, including those developed by himself. There are 2 forms, approved by one resolution of the State Statistics Committee, which can be used for the purposes of recording time worked, either unchanged or modified:

- Form T-12, the 1st section of which is built as a time sheet.

- Form T-13, which, in fact, is called a time sheet.

Form T-13 was approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. You can download it on our website.

The tables of the 1st section of the T-12 form and the T-13 form are very similar, but there are also differences:

- Data on the days of the month related to a specific employee in the T-12 form are arranged horizontally sequentially from the first to the last day. In the T-13 form they are divided into 2 parts (half of the month), which are located under each other.

- Taking into account the fact that for each day, in addition to the number of hours worked, the reason for the employee’s presence or absence at work is indicated, due to the peculiarities of constructing tables in the T-12 form, each person is allocated 2 lines, and in the T-13 form - 4 lines.

- In the final part of the table of the T-13 form there are columns that are missing in the T-12 form. They reflect the codes of payment types and the corresponding accounting account in which accrued wages will be recorded.

You can use any of the above forms. The very fact of its presence is decisive. Without a reliable time sheet, it is impossible to correctly calculate wages.

Read about what replaces wages for individual entrepreneurs in the material “Individual entrepreneurs do not have the right to pay themselves a salary .

Rules for filling out a time sheet

General requirements and rules for how to fill out a work time sheet are contained in the instructions for the use and completion of forms of primary accounting documentation for recording labor and its payment, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1. Special designations are used. When reflecting the amount of time worked, an alphabetic (I) or numeric (01) code is entered next to the employee’s last name, and the duration of work is indicated in the lower lines. If the work schedule falls at night, then complete the form with columns to indicate the necessary details.

If an employee is sent on a business trip, then the time he is on a business trip is marked by putting down an alphabetic (K) or numeric (06) code, and the duration of work is indicated in the lower lines. If, while on a business trip, the employee also worked on weekends, then on such days an alphabetic (РВ) or numeric (03) code is entered, and the duration of work is indicated in the lower lines.

We have collected in the table the designations in the timesheet in form 0504421 in 2022.

| Event | Letter code | Digital code | |

| Duration of work during the day | I | 01 | |

| Duration of work at night | N | 02 | |

| Duration of work on weekends and non-working holidays | RV | 03 | |

| Overtime duration | WITH | 04 | |

| Duration of work on a rotational basis | VM | 05 | |

| Business trip | TO | 06 | |

| Advanced training without work | PC | 07 | |

| Advanced training with a break from work in another area | PM | 08 | |

| Annual basic paid leave | FROM | 09 | |

| Annual additional paid leave | OD | 10 | |

| Additional leave in connection with training while maintaining average earnings for employees combining work with training | U | 11 | |

| Reduced working hours for on-the-job trainees with partial pay retention | UV | 12 | |

| Additional leave in connection with training without pay | UD | 13 | |

| Maternity leave (leave in connection with the adoption of a newborn child) | R | 14 | |

| Parental leave until the child reaches the age of three | coolant | 15 | |

| Unpaid leave granted to an employee with the permission of the employer | BEFORE | 16 | |

| Leave without pay under the conditions provided for by the current legislation of the Russian Federation | OZ | 17 | |

| Additional annual leave without pay | DB | 18 | |

| Temporary disability (except for cases provided for by code “T”) with the assignment of benefits in accordance with the law | B | 19 | |

| Temporary disability without benefits in cases provided for by law | T | 20 | |

| Reduced working hours versus normal working hours in cases provided for by law | Champions League | 21 | |

| Time of forced absence in the event of dismissal, transfer to another job or suspension from work being declared illegal, with reinstatement to the previous job | PV | 22 | |

| Absenteeism while performing state or public duties in accordance with the law | G | 23 | |

| Absenteeism (absence from the workplace without good reason for the time established by law) | ETC | 24 | |

| Duration of part-time work at the initiative of the employer in cases provided for by law | NS | 25 | |

| Weekends (weekly vacation) and non-working holidays | IN | 26 | |

| Additional days off (paid) | OB | 27 | |

| Additional days off (without pay) | NV | 28 | |

| Strike (under conditions and in the manner prescribed by law) | ZB | 29 | |

| Absences for unknown reasons (until the circumstances are clarified) | NN | 30 | |

| Downtime caused by the employer | RP | 31 | |

| Downtime due to reasons beyond the control of the employer and employee | NP | 32 | |

| Downtime due to employee fault | VP | 33 | |

| Suspension from work (preclusion from work) with payment (benefits) in accordance with the law | BUT | 34 | |

| Suspension from work (preclusion from work) for reasons provided for by law, without accrual of wages | NB | 35 | |

| Time of suspension of work in case of delay in payment of wages | NZ | 36 | |

We offer you to see a sample of filling out a time sheet according to form No. T-13 in 2022.

For government organizations, an example of filling out a time sheet using the OKUD form 0504421 is relevant.

Filling out form T-13

The header part of the T-13 form provides information about the employer (name, OKPO code, name of department), number and date of the document, and the period for which it was compiled.

The basis for adding an employee to the time sheet is an order for his hiring, and for exclusion - an order for dismissal. The full name of each employee must be indicated in full. All reasons for absence must be documented.

When filling out data for a specific person, the reason for presence/absence is indicated in the 1st top and 3rd lines from the top using an alphabetic or numeric code, and in the lines below them (2nd and 4th) - the number of hours worked. For data on absence in the lines allocated for the number of hours, either zero or nothing is entered. Days that are extra for a particular month are crossed out with an “X”. Weekend o. The length of a normal working day indicated in the timesheet must correspond to the number of hours established in the employee’s employment contract or determined by law (for example, for shortened pre-holiday days). The duration of overtime work is established by order of the employer.

For types of absence counted in calendar days (vacation, sick leave), the mark is affixed in a continuous manner, i.e. including on weekends. Departure/arrival on a day off related to a business trip is noted as a business trip day.

You can download a sample of filling out the T-13 form for an 8-hour working day with a 40-hour working week on our website.

In this example, work takes place on a weekend. It is carried out by order of the manager with the consent of the employee. The order must indicate how this day will be paid: either double (Article 153 of the Labor Code of the Russian Federation), or by providing time off on a working day.

If you have access to ConsultantPlus, check whether you filled out the timesheet correctly. If you don't have access, get a free trial of online legal access.

Read more about payment for work on a day off in the material “Art. 153 Labor Code of the Russian Federation: questions and answers.”

Who fills out the time sheet?

Depending on the size of the company and the number of employees in it, the maintenance of employee time sheets is assigned to one or more employees authorized to do so. If the TURV for each division of the organization is carried out separately, then it is advisable, when appointing a responsible person, to issue an order indicating the position, surname, name, patronymic of the employee responsible for drawing up the document for each structural division, and the person replacing him during absence.

We will show you a sample order appointing someone responsible for filling out the timesheet.

Weekends and holidays in the report card

They are reflected in accordance with the production calendar, which takes into account all established holidays and their transfers in accordance with government regulations. Days off for different categories of employees vary depending on the work schedule established for them. The document uses different holiday accounting codes. It depends on how the organization pays for these days and on what basis they are provided.

A day off in accordance with the employee’s schedule is indicated by a letter (B) or numeric (26) code. It does not affect the established wages.

If, at the initiative of the company, employees receive an additional day off, and the company reduces the monthly work rate for them, then the employees receive a full salary, and these days are not paid by the company. For such days, the timesheet contains an alphabetic (B) or numeric (26) code.

Another case of a company establishing an additional day off is when employees go on a day off, and the company pays for these days according to the average. It turns out that workers receive a salary for days worked, and an average salary for additional paid days off. For such a case, an alphabetic (OB) or numeric (27) code is provided.

Do you want to get a job with us as an assistant teacher and find out what the salary will be?

The Timesheet form was taken from ConsultantPlus, slightly altered to improve visual perception, the timesheet data was transferred to one sheet, the header was fixed, the sheet was broken and the headings were printed, formulas were added for calculating days and hours worked and missed. Added sheet "Clock" (standard working hours per day per position), the cells of which are referenced by formulas from the “Timesheet” sheet, it can be hidden. When referencing cells in the Clock worksheet, you should add a $ symbol in front of the column and row values to secure the cell address when copying formulas.Title page:

The number of working days in a month can be calculated using the formula: =NETWORKDAYS(DATE(YEAR(TODAY()),MONTH(TODAY()),1),DATE(YEAR(TODAY()),MONTH(TODAY())+1; 1)-1;Holidays20) where holidays specified anywhere in the range referred to here as "Holidays20" are excluded. Here you need to manually enter all holidays and non-working days of the year from the production calendar

The timesheet is signed on the last day of the month : =DATE(YEAR(TODAY());MONTH(TODAY())+1;0) - we get the 30th, 31st or 28th(29th) day of the month.

The current month is calculated using the formula: =VLOOKUP(MONTH(TODAY());{1;"January":2;"February":3;"March":4;"April":5;"May":6;" June": 7; "July": 8; "August": 9; "September": 10; "October": 11; "November": 12; "December"}; 2;) In the formula we write down the desired end of the month ( January or January).

Last two digits of the current year : =DATE(YEAR(TODAY()),MONTH(TODAY())+1,0)

Full date (last day of the current month of the current year): = EON-MONTH(TODAY();0)

or, if the last working day is required, excluding holidays/non-working days: =WORKDAY(MONTH(TODAY(),0)+1,-1;Holidays2020)

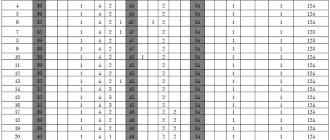

Sheet "Table"

Range of columns “Notes on absence from work by day of month”: days worked - empty cells. We manually enter holidays - B, absences: A - your account, B - illness, O and OU - vacations; 0 (zero hours) - quit or got a job not since the beginning of the month. Range of columns “Worked for”: for half a month, days worked are calculated using the formula: =COUNT EMPTY(AW10:BL10) That is, we count empty cells in the range AW10:BL10 days of half a month;

the hours worked using the formula: =BM10*hours!$AO$10, where BM10 is the address of the cell with days worked for half a month, which we multiply by hours!$AO$10 is the address of the cell on the “hours” sheet, where the norm of hours per day is indicated positions. We add a $ sign to the cell address to secure the address when copying the formula.

For a month, the number of days worked is obtained by simply adding the days worked for two halves of the month, for example: =BM10+BM12, where BM10 and BM12 are the addresses of cells with the number of days worked for the first and second halves of the month.

The number of hours worked per month can be obtained by adding up the hours for half a month: =BM11+BM13, or multiplying the number of days worked by the standard hours per day for the position from the “hours” sheet: =BX18*hours!$AO$34.

Filling the range of columns “No-shows for the month”:

Formula =IF(SUM(COUNTIF(AW10:BL10,{"OU";"B","A","O";0}))=0;"";SUM(COUNTIF(AW10:BL10; {"OU ";"B";"A";"O";0}))) counting missed working days ,

and the formula =IF(SUM(COUNTIF(AW10:BL10;{"OU","B","A","O";0}))=0;"";SUM(COUNTIF(AW10:BL10;{" OU";"B";"A";"O";0}))*hours!$AO$10) counting

missed working hours .

Similarly, we count missed teaching working days and hours. In these formulas, we count the number of cells with gap designations: (see symbols on the title page) O, OU, A or B: COUNTIF(AW10:BL10;{"OU","B","A","O"} ) If there are other types of omissions in the institution, you can add their designations to the formula separated by commas.

PS If suddenly a person quits or starts working in the middle of the month (we put a zero on the report card), add 0 (zero) to the list of symbols: {"OU";"B";"A";"O";0}.

Using the same formulas, we solve the problem of displaying zero values on the sheet , that is, so that “0.00” is not displayed if the employee has no gaps. We set the condition: if the number of cells with data in the form O, OU, A or B is equal to zero, then no data is displayed in the cell with the formula (double quotes “” in the formula), otherwise the number of gaps is displayed. Important: we do not include weekends (B) in the formula so that they are not considered no-shows.

We calculate the number of missed days and hours for women on maternity leave using a formula similar to counting working days for other employees, setting only for the first woman on maternity leave the number of days missed for half a month.

It is logical to automate the calculation of hours and days of substitution only for employees for whom an increase in the volume of work or combination is established by order for the tariff period (in the example, this is a laundry operator, a worker on KORP for work on several buildings). It makes no sense to calculate non-systematic replacements of short-term absent employees using formulas.

P/S At the time of publication (January 2022), the sample shows an example of a timesheet for February 2022, but January dates are displayed on the title page, and the number of working days is taken from the “timesheet” sheet for February. Accordingly, in which month you download this file, you will have such dates on the title page, because the formula TODAY() is involved, but the content of the “timesheet” sheet will not change.

Create a copy of the file in GoogleSheets

When uploaded to Google Drive, all formulas are transferred and work perfectly, except for the formulas for calculating missed days and hours. It only counts the value that is written first in the formula, in this case it is “OU”.

The formula for counting multiple values doesn't work either:

=IF(SUM(COUNTIFS(AW10:BL10;"OU";AW10:BL10;"B";AW10:BL10;"A";AW10:BL10;"O"))=0;""; SUM(COUNTIFS( AW10:BL10;"OU";AW10:BL10;"B";AW10:BL10;"A";AW10:BL10;"O")))

The formula worked only in this form:

=IF(SUM(COUNTIF(AW10:BL10,"ОУ")),COUNTIF(AW10:BL10,"B"),COUNTIF(AW10:BL10,"A"), COUNTIF(AW10:BL10,"O"))= 0;"";SUM(COUNTIF(AW10:BL10,"OU");COUNTIF(AW10:BL10,"B");COUNTIF(AW10:BL10,"A");COUNTIF(AW10:BL10,"O") )) that is, each value of no-show is counted separately.

Please leave your comments and suggestions in the comments.

Storage period for time sheets

This is a personnel document concerning the organization of work, for which Art. 22.1 of the Law on Archival Affairs establishes a special storage period, namely:

- five years from the end of the year in which it was compiled, if the timesheet took into account the time worked only of those employees who work under normal working conditions;

- 50 years from the date of drawing up the TURV, if it took into account the work of employees engaged in harmful or dangerous work.

Accounting and taxes

Based on the data indicated in the report card, the accounting department calculates wages and various benefits. The same data affects the payment of taxes. Let's pay attention to the main risks.

When passing tax audits, including income tax, the company must provide reliable data on the number of days and hours worked by each employee in order to confirm the correctness of the accruals. If violations are discovered, the amount of income tax indicated in the reports will be recognized as incorrect, which will entail the imposition of penalties.

When withholding personal income tax from an employee’s earnings, the organization, as a tax agent, must find out whether this person is a tax resident of the Russian Federation in order to use the correct tax rate in the calculation. The report card will be able to confirm the actual presence of the employee in the country. This feature should especially be taken into account by those employers who send employees on business trips to Belarus or Kazakhstan, because when crossing these borders, no marks are made in the citizen’s passport. If a dispute arises, the company will be able to prove that it applied the correct rate, withheld and charged personal income tax in full.

Form T-12: differences and rules for filling out

T-12 is a slightly more complex form, since it also calculates wages. Sheets 3 and 4 are intended for this - they are filled out by the accounting department. Sheet 1 lists the codes (designations in the report card) for both forms. Working hours in T-12 are noted on sheet 2. The data is also entered into the table, but it has more columns.

Columns 1-3 in the T-12 report card are the same as in the T-13 form. Next, there is a slight difference in the presentation of data - in T-12 all calendar days are placed on one line. Working hours for the period from the 1st to the 15th are reflected in column 4, for the period from the 16th to the 31st - in column 6. Columns 5 and 7 are intended to indicate the total data for the first and second half of the month.

Columns 8-13 reflect data for the month:

- 8 – number of days worked;

- 9 – total number of hours, including overtime (column 10), night (column 11), weekends/holidays (12), others (column 13).

In column 14 you need to make a calculation of the missed days and hours for the month, and next to this you need to detail these data: in column 15 indicate the reason for each absence in the form of a code, in column 16 - the number of days and hours. Column 17 reflects weekends and holidays.