Article 79 of the Tax Code of the Russian Federation - Refund of amounts of excessively collected taxes, fees, insurance contributions, penalties and fines

1. The amount of excessively collected tax shall be refunded to the taxpayer in the manner prescribed by this article.

Refund to the taxpayer of the amount of overcharged tax if he has arrears on other taxes of the corresponding type or debt on the corresponding penalties, as well as fines subject to collection in cases provided for by this Code, is made only after offset of this amount towards the repayment of the specified arrears (debt) in in accordance with Article 78 of this Code.

1.1. The amount of excessively collected insurance premiums is subject to return to the payer of insurance premiums, taking into account the specifics provided for in this paragraph.

The return to the payer of insurance premiums of the amount of excessively collected insurance premiums if he has arrears on the corresponding penalties and fines is made only after this amount is offset against the repayment of the said debt under the relevant budget of the state extra-budgetary fund of the Russian Federation, to which this amount was credited, in accordance with Article 78 of this Code.

Refunds of the amount of excessively collected insurance contributions for compulsory pension insurance are not made if, according to a message from the territorial management body of the Pension Fund of the Russian Federation, information about the amount of excessively collected insurance contributions for compulsory pension insurance is taken into account on the individual personal accounts of the insured persons in accordance with the legislation of the Russian Federation on individual (personalized) accounting in the compulsory pension insurance system.

2. The decision to return the amount of overcharged tax is made by the tax authority within 10 days from the date of receipt of a written application (application submitted in electronic form with an enhanced qualified electronic signature via telecommunication channels or submitted through the taxpayer’s personal account) of the taxpayer for the return of the amount of overcharged tax. tax

Before the expiration of the period established by the first paragraph of this paragraph, an order for the return of the amount of excessively collected tax, issued on the basis of a decision of the tax authority to return this amount of tax, is subject to sending by the tax authority to the territorial body of the Federal Treasury to effect a refund to the taxpayer in accordance with the budget legislation of the Russian Federation .

3. An application for the refund of the amount of excessively collected tax may be submitted by the taxpayer to the tax authority within three years from the day when the taxpayer became aware of the fact of excessive collection of tax from him, unless otherwise provided by the results of a mutual agreement procedure in accordance with an international treaty of the Russian Federation on tax issues.

If the fact of excessive tax collection is established, on the basis of the specified application, the tax authority makes a decision to return the amount of the excessively collected tax, as well as interest accrued in the manner prescribed by paragraph 5 of this article.

4. The tax authority, having established the fact of excessive tax collection, is obliged to inform the taxpayer about this within 10 days from the date of establishing this fact.

The specified message is transmitted to the head of the organization, an individual, or their representatives personally against a receipt or in another way confirming the fact and date of its receipt.

5. The amount of excessively collected tax is subject to refund with interest accrued on it within one month from the date of receipt of a written application (application submitted in electronic form with an enhanced qualified electronic signature via telecommunication channels or submitted through the taxpayer’s personal account) of the taxpayer for the return of the amount of excess collected tax.

Interest on the amount of excessively collected tax is accrued from the day following the day of collection until the day of the actual refund.

The interest rate is assumed to be equal to the refinancing rate of the Central Bank of the Russian Federation in force on those days.

6. The territorial body of the Federal Treasury, which has refunded the amount of excessively collected tax and interest accrued on this amount, notifies the tax authority of the date of refund and the amount of money returned to the taxpayer.

7. If the interest provided for in paragraph 5 of this article is not paid to the taxpayer in full, the tax authority makes a decision to return the remaining amount of interest, calculated based on the date of actual return to the taxpayer of the amounts of overcharged tax, within three days from the date of receipt of the notification of the territorial authority of the Federal Treasury on the date of return and the amount of funds returned to the taxpayer.

Before the expiration of the period established by the first paragraph of this paragraph, an order for the return of the remaining amount of interest, issued on the basis of a decision of the tax authority to return this amount, must be sent by the tax authority to the territorial body of the Federal Treasury for the refund.

8. Refund of the amount of overcharged tax and payment of accrued interest are made in the currency of the Russian Federation.

9. The rules established by this article also apply to the offset or return of amounts of excessively collected advance payments, fees, insurance premiums, penalties, fines and apply to tax agents, payers of fees, payers of insurance premiums and the responsible participant in the consolidated group of taxpayers.

The provisions established by this article apply to the return or offset of excessively collected amounts of state duty, taking into account the specifics established by Chapter 25.3 of this Code.

Amounts of corporate income tax for a consolidated group of taxpayers, excessively collected from members of this group, are subject to offset (refund) to the responsible participant of the consolidated group of taxpayers.

The rules established by this article also apply to the offset or return of interest paid in accordance with paragraph 17 of Article 176.1 of this Code.

Which article of the Tax Code should be applied when returning or crediting?

in the Tax Law category Tags: arbitration practice, tax refund procedure, Legal advice

In the course of business activities, enterprises often encounter situations where VAT or other taxes are unlawfully collected by the tax authority. In this case, the taxpayer, on the basis of paragraphs. 5 p. 1 art. 21 of the Tax Code of the Russian Federation has the right to timely offset (refund) of amounts of overpaid (excessively collected) taxes, penalties, fines, and the tax authority, in accordance with paragraphs. 7 clause 1 art. 32 of the Tax Code of the Russian Federation is obliged to refund overpaid taxes.

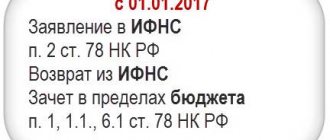

The rules for offset (refund) of tax are established by Art. Art. 78 of the Tax Code of the Russian Federation, which is devoted to excessively paid amounts, and 79 of the Tax Code of the Russian Federation, which is devoted to excessively collected amounts. Please keep in mind that the rules provided for in these articles also apply to the offset or return of amounts of excessively collected advance payments, fees, penalties, fines and apply to tax agents and payers of fees.

The procedure for return (credit) prescribed in Art. Art. 78 and 79 of the Tax Code of the Russian Federation differs, so first let’s determine what the difference is between excessively paid and excessively collected tax amounts.

Excessive payment of tax, as a rule, occurs when a taxpayer, calculating the amount of tax payable to the budget independently, that is, without the participation of the tax authority, for any reason, including due to ignorance of the tax law or an honest mistake, makes an error in the calculations . This opinion was expressed by the Constitutional Court of the Russian Federation in Determination No. 173-O dated June 21, 2001.

The transfer by a taxpayer of funds to pay tax acquires the nature of a collection in the case when the payment of amounts additionally accrued by decision of the tax authority is made. This was indicated by the Supreme Court in Resolution No. 13592/04 of March 29, 2005.

In Determination No. 503-O of December 27, 2005, the Constitutional Court of the Russian Federation noted that if a tax is credited to the budget on the basis of a requirement to pay a tax, in which, according to clause 4 of Art. 69 of the Tax Code of the Russian Federation indicates the amount of tax calculated by the tax authority and subject to payment to the budget (despite the fact that such a requirement is sent to the taxpayer based on the results of desk tax audits or in the course of proceedings in a case of a tax offense), then in the event of an incorrect calculation of tax amounts there is no reason to talk about the fact of excessive payment of tax and, accordingly, Art. 78 of the Tax Code of the Russian Federation cannot be applied.

In arbitration practice, there are examples when judges indicated that amounts that were unlawfully accrued based on the results of a tax audit and voluntarily paid by the taxpayer only on the basis of a decision of the tax authority, that is, even before sending a claim, will be considered excessively collected. Thus, the Resolution of the Federal Antimonopoly Service NWO dated 09.09.2008 N A05-992/2008 states the following: the fact that the taxpayer transferred the amounts of taxes and penalties to the relevant budgets before sending him a request for payment of illegally accrued tax payments does not affect the compulsory nature of the payment. This means that these amounts are subject to refund in accordance with Art. 79 of the Tax Code of the Russian Federation as excessively collected.

Our company’s lawyers have extensive experience in protecting the rights of taxpayers in arbitration courts; in addition, while providing legal services, they make every effort to optimize the taxation of an enterprise and prevent tax offenses.

Commentary on Article 79 of the Tax Code of the Russian Federation

The rules established by the legislator in paragraph 1 of the commented article apply to cases of excessively collected taxes and only when there has been:

- forced fulfillment of the obligation to pay taxes due to the fact that the payer did not fulfill the said obligation voluntarily and within the prescribed period;

— the amount collected during enforcement turned out to be greater than required. At the same time, the reasons for the excessively collected tax for the application of Art. 79 of the Tax Code of the Russian Federation do not play a role.

The amount of excessively collected tax in accordance with paragraph 1 of the commented article is returned not only to the taxpayer, but also to the payer of the fee, as well as to the tax agent. On the other hand, in Art. 79 of the Tax Code of the Russian Federation does not mean either representatives of payers or the persons mentioned in Art. 51 Tax Code of the Russian Federation.

A refund of the overcharged amount is made if:

the payer does not have any arrears in taxes or arrears of penalties and fines;

Although the indicated arrears and debt are present, they are owed to another budget (non-budgetary fund).

According to paragraph 2 of Art. 79 of the Tax Code of the Russian Federation, the decision on the return of excessively collected taxes is made by the head (his deputy) of the tax inspectorate that allowed the excessive collection, or by a higher body (which, for example, checked the legality of tax collection and identified excessively collected amounts) within 10 days, counting from the day this was established fact based on a written statement from the payer. Therefore, it is necessary to clearly record the date and fact of its submission. In general, the application can be brought in person and handed to the inspector against a signature or sent by registered mail with acknowledgment of delivery to the addressee.

The said application is submitted within one month from the day when the payer became aware of the fact of excessive collection of taxes from him. In this case, you need to pay attention to two points:

- it does not matter how he learned about it (for example, during an internal audit, audit, from the tax authority);

— the countdown of the mentioned monthly period begins from the next day (after the day when the payer became aware of the fact of excessive collection).

A statement of claim to an arbitration court - if the payer is an organization or an individual entrepreneur - or to a court of general jurisdiction - if the payer is an individual who is not an individual entrepreneur - is filed within three years (the limitation period), starting from the day when the person learned or should have learned about the fact of excessive collection.

Please note that this refers to a calendar period of three years. The countdown of the three-year period begins from the next day (after the day when the payer learned or should have learned about the fact of excessive collection).

The tax authority to which the application was submitted is obliged to:

- consider the said application;

— admit the fact of excessive collection of taxes or, conversely, establish the unfoundedness of the payer’s demands;

- report the recognition of the fact of excessive collection within the time frame that we will consider in paragraph 3 of Art. 78 Tax Code of the Russian Federation;

— make a decision on tax refunds within ten days from the date of registration of the application. The decision must contain information about the specific amount of the excess collected, an unambiguous indication of its return to the payer, as well as the amount of interest accrued on the amount of the excessively collected tax (we will talk about this in paragraph 5 of Article 79 of the Tax Code of the Russian Federation).

In paragraph 4 of the commented article of this Code, the legislator establishes:

First. The tax authority is obliged to send a message to the payer, observing the following rules:

- if the fact of excessive collection is established;

— in writing (indicating the payer’s TIN);

- no later than 10 days from the date of establishment of the fact of excessive collection of taxes. In this case, the countdown begins from the next (after the day this fact was established) day;

Second. Although paragraph 4 of the commented Article 79 of the Tax Code of Russia does not oblige to notify the applicant that the tax authority has not established the fact of excessive collection, such an obligation nevertheless follows from the general legislation on the procedure for considering complaints, applications, appeals, etc. organizations and individuals by federal and other government agencies, including tax authorities. The results must be reported to the payer within a month from the date of receipt of the application from him (this also follows from paragraph 1 of Article 21, paragraph 2 of Article 32 and Article 140 of the Tax Code of the Russian Federation).

The rules established in paragraph 5 of the commented article prescribe the return of the amount of excessively collected tax simultaneously with the interest accrued on it. Interest on the amount of excessively collected tax is accrued from the day following the date of collection until the day of actual return of the amount of excessively collected tax, inclusive. In this case, the moment of return of the said amount is considered to be the day it is credited to the payer’s bank account.

The interest rate is assumed to be equal to the refinancing rate of the Central Bank of the Russian Federation in force for the period from the day following the day of collection to the day of the actual refund of the overpaid tax. This means that all changes that this rate has undergone during the specified period are taken into account.

Federal Treasury authorities must notify tax authorities that they have transferred the amount of excessively collected tax and interest.

When applying the norms specified in paragraph 8 of the commented article of the Code, attention should be paid to a number of important circumstances. Firstly, officials return the amount of overcharged tax and accrued interest exclusively in rubles. Secondly, Art. Art. 123, 125 of the Customs Code establishes that amounts of excessively collected customs duties are subject to return at the request of the person (from whom they were collected) within one year from the date of collection. At the same time, returns were allowed both in the currency of the Russian Federation and in foreign currency, the rate of which is quoted by the Central Bank of the Russian Federation.

Clause 9 of Art. 79 of the Tax Code of the Russian Federation, the rules of these articles also apply to advance payments, fees, penalties and fines.