What is Form T-12 (working time sheet)

Based on the T-12 form, introduced into document management practice by the State Statistics Committee in Resolution No. 1 dated January 5, 2004, a time sheet is generated, which is intended for use for the following purposes:

- keeping records of employee visits to their place of work in accordance with the established schedule;

- determining indicators for calculating employee salaries;

- generation of certain statistical data on personnel (for example, sent to Rosstat or research agencies).

It should be noted that the form in question must be filled out manually (on a PC using Word or a similar program, or printed out with a ballpoint pen). And the time sheet, intended to be filled out automatically when access control systems are activated, is compiled on the basis of another Goskomstat form - T-13. The selected form of the 2022 time sheet must be indicated in the accounting policy.

ConsultantPlus experts explained what sanctions are provided for errors in timesheets. Get trial access to the system and upgrade to the Ready Solution for free.

Read about what the T-13 form is in the article “Unified Form No. T-13 - Form and Sample” .

Where and when to submit the report

Form 12-F is submitted by all legal entities, with the exception of small and microenterprises, the banking and insurance sectors and budgetary institutions.

Individual entrepreneurs are also exempt from it. The form is annual. Report for the previous year by April 1 of this year. If April 1st falls on a weekend, the deadline is moved to the next working day. For 2022, submit the form by April 1, 2019. For 2022 - until April 1, 2020. Submit the report on Form 12-F to the territorial statistics office in paper or electronic form.

When is it expected to use the work time sheet form 0504421 according to OKUD

The work time sheet form corresponding to OKUD number 0504421 (T-12 has a very similar name to it, so sometimes confusion can arise when applying a particular document) was introduced into business circulation by the Ministry of Finance of the Russian Federation, which issued order No. 52n dated March 30, 2015. This document is used for the same purposes as T-12, but is subject to use in government agencies.

The time sheet corresponding to form 0504421 also has a fairly similar structure to form T-12. Therefore, for an employee of the HR department, as a rule, there is no problem adapting to a document approved by the Ministry of Finance if he is accustomed to using the form from Goskomstat, and vice versa.

Is the use of time sheets f. allowed in private companies? 0504421

The use of timesheets in form 0504421 is not prohibited for private companies. The fact is that from 01/01/2013, companies that are not directly required by law to use specific unified forms of primary sources are allowed to use any others. Therefore, a private company has the right to use, in order to monitor the time spent at work by hired employees, a time sheet on the form T-12, form 0504421, or another form developed independently. One way or another, the company must have such a document - due to the fact that, in accordance with the provisions of Art. 91 of the Labor Code of the Russian Federation, each employer must monitor the time spent at work by hired employees.

Read more about filling out the T-12 form in the material “Unified Form No. T-12 - Form and Sample” .

Filling out Form 12-F

Form 12-F in the latest version was approved by Rosstat Order No. 421 dated July 24, 2019 in Appendix No. 3, OKUD code 0608011. Information about respondents, the procedure for submitting and filling out the form is also provided there. The form consists of a title page and a large information plate, which contains all the information about expenses.

First, let's deal with two questions: where to get the data to fill out Form 12-F and whether VAT needs to be taken into account when filling it out. Even organizations on OSNO do not need to indicate VAT. And basic information about the use of funds can be obtained from financial statements, contracts, primary documents, etc. — sources differ for individual indicators.

Let's look at the procedure for generating a report.

Title page

Fill out the title page in the standard manner. Indicate the reporting year, name of the enterprise, postal address with zip code and OKPO code of the reporting organization or identification number for a separate division and the head division of the legal entity.

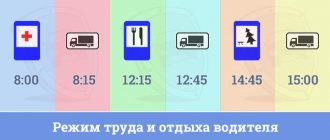

How are vacations indicated on the time sheet?

Unified forms for keeping records of employee visits at Russian enterprises T-12 and T-13 involve reflecting information about vacations using the codes given on the title page of form T-12.

These codes are presented in two varieties: alphabetic and digital. The use of both is equivalent. Moreover, the organization’s local regulations may also stipulate a certain mixed application option or involve the use of completely different codes. The employer also has the right to independently develop and use a report card form with symbols in it.

Let's see what designations apply to vacations.

Primary and additional leave

When an employee goes on regular paid leave, and the company uses the T-12 or T-13 form, the letter code OT or digital code 09 is recorded in the accounting table, which is given in the report card, for each day of the employee’s vacation.

If the rest is additional, then a different code is entered: OD (10).

Study and unpaid leave (administrative leave)

In the provisions of Art. 128 of the Labor Code of the Russian Federation, leave at the expense of the employee is divided into 2 types:

- provided by the employer voluntarily at the request of the employee - in this case, the DO code (16) is reflected in the timesheet;

- mandatory provided by the employer at the request of the employee - OZ code (17) is used.

Study leave also has 2 types according to labor legislation (Article 173 of the Labor Code of the Russian Federation):

- leave for study with preservation of earnings - reflected using code U (11);

- unpaid leave for passing entrance exams, sessions, state exams - is recorded in the report card using the UD code (13).

You can learn more about the legislative regulation of the provision of study leave in the article “Study leave under Article 173 of the Labor Code (nuances).”

Maternity and child care leave

Maternity leave provided in accordance with Art. 255 of the Labor Code of the Russian Federation, is reflected in the report card using code P (14). Child care leave provided under Art. 256 of the Labor Code of the Russian Federation, is fixed using the coolant code (15).

A scenario is possible in which an employee on maternity leave will work part-time. If this is so, then when recording her visits in the report card, the “double” code I (01) and OZH (15) will be used. These codes can be specified in one cell of the timesheet using the “/” symbol (for example, Я/Ож or 01/15), or you can add an additional line to the timesheet form.

Theoretically, there can be three codes in one cell. For example, if an employee agreed to go on a business trip and worked a day off there. In this case, the table will write: K/RV/Coolant (06/03/15).

Report 12: three important indicators in its preparation

Each organization is obliged to submit monthly, before the 12th day of the month following the reporting period, the state statistical reporting 12th “Labor Report” (hereinafter referred to as the labor report) to the statistical authorities. In this material we propose to understand the procedure for calculating the most important statistical indicators.

The labor report is submitted to the statistical authorities either in the form of an electronic document using special software, or on paper to the state statistics authorities at the place of registration (clause 2 of Instructions No. 163).

Document:

Belstat Resolution No. 163 of August 19, 2013 “On approval of the state reporting form 12 “Labor Report” and instructions for its completion” (hereinafter referred to as Instructions No. 163).

Indicator “Average headcount”

The average headcount does not include:

– external part-time workers;

– citizens working under civil law contracts;

– employees on maternity leave to care for a child until he or she reaches the age of 3 years (including the adoption of a child under the age of 3 months);

– those who did not show up for work due to temporary disability or caring for the sick (subject to the presence of a certificate of incapacity for work or a certificate);

– those on leave without pay (including in connection with obtaining an education), except for those on leave granted at the initiative of the employer;

– persons under investigation until a court verdict is passed;

– patients with chronic alcoholism placed for treatment in drug treatment departments of psychiatric (psychoneurological) institutions;

– donor employees for days of donating blood and its components (except for days when average earnings are maintained at the expense of the employer), as well as rest days provided after this.

Employees hired on a part-time basis are taken into account as whole units when calculating the payroll number, and in proportion to the time worked when calculating the average payroll.

Example (we will do the calculation using the example of June)

The healthcare institution (dentistry) employs 125 people, of which:

1 – external part-time worker at 0.5 rate;

42 are doctors, of which 1 doctor is hired at 0.5 times the salary, 1 doctor works on an individual schedule daily for 4 hours;

48 – medical workers with secondary specialized medical education (on June 6, 2022, the main employee was dismissed);

34 – administrative, managerial and other personnel, of which 1 employee has a shortened working week on the basis of part three of Art. 114 Labor Code (disabled group II).

Document:

Labor Code of the Republic of Belarus (hereinafter referred to as the Labor Code).

Important!

Persons transferred to work on a part-time basis at the initiative of the employer are reflected in the average number of employees as whole units (subclause 10.5, clause 10 of the Labor Instructions).

Document:

Resolution of the Ministry of Statistics of the Republic of Belarus dated July 29, 2008 No. 92 “On approval of the Instructions for filling out labor statistics in state statistical observation forms” (hereinafter referred to as the Labor Instructions).

In the organization, 2 doctors work part-time, so they worked 146 person-hours (132 × 0.5 + 4 × 20, where 132 hours is the monthly norm for June 2022 for dentists with a 33-hour work week; 20 – number of working days in June 2019).

The total number of man-days worked by these workers will be 22 (146 / 6.6 hours, where 6.6 is the average daily rate for dentists with a 5-day work week (33 hours / 5 days)).

The average number of people working part-time for June will be 1 person (22/20 working days according to the calendar).

For reference:

an employee who has reduced working hours, in accordance with the law, is counted as a whole unit in the average number of employees (subclause 10.6, clause 10 of the Labor Instructions).

Data for calculating the average headcount are presented in the table.

* On June 6, an employee was fired, but the number of employees for this day does not decrease, since the day of dismissal is the last working day.

Thus:

– average number of employees – 120 people ((1,174 + 1,419 + 1,020) / 30) – reflected in line 1 gr. 1 section I “Number of employees, wages and hours worked”;

– doctors (all specialties) – 39 people (1,174 / 30) – reflected in page 123 gr. 1 section IV “Number and wage fund of certain categories of workers”;

– medical workers with secondary specialized medical and pharmaceutical education – 47 people (1,419 / 30) – reflected on page 124 gr. 1 section IV.

Important!

The following are not included in the average number of citizens who performed work under civil contracts:

– employees who are on the payroll of the organization and have entered into a civil contract to perform work in the same organization;

– individual entrepreneurs without forming a legal entity;

– citizens who have entered into a civil contract for the creation of intellectual property.

Indicator “Staff headcount on average for the period”

The average number of employees on payroll for the last month of the reporting period is calculated by summing the number of employees on the payroll for each calendar day and dividing the resulting amount by the number of calendar days in the month.

In the example discussed above, the payroll number will be 124 people (3,717 / 30 = 123.9). It is reflected on page 20 gr. 1 section II “The average number of employees on the payroll for the period, the average number of citizens performing work under civil contracts, and external part-time workers.”

The list of employees on average for the period does not include employees on maternity leave, in connection with the adoption of a child under the age of 3 months, caring for a child until he reaches 3 years old, external part-time workers and citizens who performed work under civil law contracts.

The average number of employees on the payroll for the reporting period is determined by summing the average monthly number of employees for all months that have elapsed during the reporting period and dividing the resulting amount by the number of months in the reporting period (clause 9 of the Labor Instructions).

The average number of citizens who performed work under civil contracts is determined based on the accounting of these persons for each calendar day as whole units during the entire period of validity of this contract.

The average number of external part-time workers is calculated in proportion to the actual time worked.

In our example - 1 person (since 0.5 is rounded to 1), which is reflected in page 20 gr. Section 5 II.

Important!

An employee registered within one organization as an internal part-time worker or working more than full-time is not included in the average number of external part-time workers.

Indicator "Wage Fund"

The wage fund (WF) includes:

– accrued wages to paid and unpaid employees and external part-time workers for work performed and time worked;

– incentive and compensatory payments;

– payment for unworked time;

– other payments included in the salary package, regardless of the sources of financing and the timing of their actual payment.

Important!

Funds accrued for labor and social vacations are included in the wages of the reporting month only in the amount attributable to vacation days in the reporting month. Amounts due for vacation days in the next month are included in the next month's payroll.

The full list of payments included in the FZP is named in paragraphs. 58–66 of the Labor Instructions, and payments that are not included are in clause 70 of the Labor Instructions.

In the example discussed above, the workers’ wages for June amounted to 169,263.4 rubles. , including:

– wages for time worked and work performed, incl. additional payments for combining professions (positions), expanding the service area (increasing the volume of work performed), performing the duties of a temporarily absent employee - 98,264.6 rubles. (including the salary of an external part-time worker - 368.6 rubles);

– payment for labor leave – 10,624.3 rubles. (including vacations in June - 6,655.9 rubles, July - 3,214.2 rubles, August - 754.2 rubles);

– monetary compensation for unused labor leave – 57.2 rubles;

– bonus – 37,117.3 rubles. (including bonus for external part-time worker - 55 rubles);

– financial assistance to all employees – 3,100 rubles;

– one-time payment in connection with the anniversary date – 100 rubles;

– one-time payment for Medical Worker Day – 20,000 rubles. (including persons on parental leave to care for a child under 3 years old - 200 rubles).

Important!

It should be noted that the salary is reflected in thousands of rubles, and the average monthly salary (line) is indicated in rubles.

In addition, two employees were given bouquets worth 70 rubles for their anniversaries.

The salary reflected in the labor report will be 165.1 thousand rubles. ((169,263.4 – 3,214.2 – 754.2 – 200) / 1,000). The data is reflected on page 2 gr. 1 section I.

The salary of an external part-time worker will be 0.4 thousand rubles. ((368.6 + 55.00) / 1,000) and is reflected in page 3 gr. 1 section I.

The cost of flowers, payments to persons on parental leave for children under 3 years of age, as well as vacation pay for July and August are not taken into account in the personal wages for June.

The average monthly salary will be 1,372.5 rubles. ((165.1 – 0.4) × 1,000 / 120) and is reflected in page 5 gr. 1 section I.

Galina SAZONOVA, economist

What to put on your report card if your vacation falls on a holiday

In accordance with Art. 120 of the Labor Code of the Russian Federation, non-working holidays falling during the period of the annual main or annual additional paid leave are not included in the number of calendar days of leave and are not taken into account.

Holidays established by regional legislation are also excluded from vacation (see Resolution of the Presidium of the Supreme Court of the Russian Federation dated December 21, 2011 No. 20-ПВ11).

It follows that holidays falling on vacation in the report card must be designated by code “B” or 26.

And if you want, you can set your own code for this. This was indicated by the Ministry of Labor in letter No. 14-2/B-370 dated April 27, 2017.

How to designate non-working paid days if the employee was at home in self-isolation? The answer to this question is in ConsultantPlus. If you don't already have access to the system, get a trial online access for free.

Results

The Russian legislator has introduced forms for monitoring the presence of employees at work, adapted for employers of any form (including companies, both private and public). Employers who are not government agencies have the right to use any form of appropriate accounting documents. However, the T-12 uniform continues to be one of the most comfortable.

Sources:

- Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1

- Order of the Ministry of Finance of Russia dated March 30, 2015 N 52n

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.