Legal advice > Entrepreneurial activity > Tax consequences of an agreement for the assignment of the right to claim VAT

When engaged in entrepreneurial activity, any businessman in one way or another faces accounts receivable. These funds can be considered temporarily frozen or an asset that can be easily realized if necessary. In the article we will talk about the tax consequences of this sale, in particular about the calculation of VAT under an assignment agreement (assignment of the right of claim).

VAT on assignment agreements (assignment of claims)

The agreements under consideration are becoming increasingly relevant today.

But the taxation procedure for such agreements is not sufficiently regulated at the legal level. Because of this, many unclear points remain regarding the rate, taxes on non-VAT transactions, filling out invoices, and others. According to Article 155 of the Tax Code of the Russian Federation, tax (VAT) must be paid for the transfer or sale of property rights. Moreover, within the framework of the article, different situations of the assignment agreement are considered. But let’s look at everything in order, and start with the definition of the concept of assignment of a right of claim.

Accounting

When assigning the right of claim, the receivables are actually sold, which are reflected in the assets of the organization.

According to paragraph 7 of the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n, proceeds from the disposal of receivables from the buyer of products and goods are recognized as other income of the organization. Expenses associated with the assignment of the right of claim (buyer's receivables) are taken into account in the organization's accounting as part of other expenses on the basis of paragraph 11 of the Accounting Regulations “Organization's Expenses” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n.

Thus, the assignor organization, concluding an assignment agreement with a third party, reflects in accounting the income from the sale of the right of claim on the credit of account 91 “Other income and expenses”/subaccount 1 “Other income” as part of the organization’s other income. In this case, the debit of account 91 “Other income and expenses”/subaccount 2 “Other expenses” should reflect expenses associated with the implementation of this right (the cost of the realized right of claim, equal to the receivables under the original agreement). Accounting entries are made on the basis of the following documents:

- agreements on the assignment of the right to claim debt;

- register of documents transferred to the new creditor;

- accounting statements and calculations;

- invoices and others.

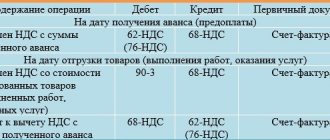

The assignment of the right of claim in the accounting of the original creditor (assignor) is formalized as follows:

Debit 76 “Settlements with various debtors and creditors”, subaccount “Assignee” Credit 91 “Other income and expenses”/subaccount 1 “Other income” - for the amount of debt of the new creditor (assignee) under the assignment agreement.

Debit 91 “Other income and expenses”/subaccount 2 “Other expenses” Credit 62 “Settlements with buyers and customers” - for the amount of sold receivables, for which it is listed on the assignor’s balance sheet.

general information

The assignment of the right of claim is regulated by Art. 388, 389 and 390 of the Civil Code of the Russian Federation. These transactions are also called assignment agreements. Their essence lies in the transfer by the creditor of the right to claim the debt to another person.

The specific terminology of the parties is applied similarly to both the seller and the buyer in a purchase and sale transaction. The entity that originally owned the debt is the assignor, and the “buyer” is the assignee.

The reasons for the formation of debt are different. The subsequent calculation depends on this. The most common options include the following:

- The assignor is the supplier who shipped the goods or provided services with deferred payment.

- The debt formed after the transfer of an advance payment for subsequent delivery or provision of services is sold.

- The debt was created due to the transfer of credit.

Claim as an investment

For the assignee, the received debt will be considered a financial investment, since he did not form the cost, but received ownership of a finished asset.

In his accounting, the assignee must include not the entire amount of the debt as financial investments, but only the amount for which it was assigned by the assignor. Table 1. Reflection of accounts receivable as a financial investment

| Debit | Financial investments | Credit 76 | The right of claim has been taken into account. |

| Debit 76 | Subconto assignor | Credit | The debt to the assignor is repaid. |

On account 58, the right of claim remains until the debtor repays his creditor. After receiving the money, financial investments must be closed:

- Debit 51 Credit 76 subconto debtor - money has been received to pay off accounts receivable.

- Debit 76 subaccount debtor Credit 91.01 – income received from the repayment of the right of claim.

- Debit 91.02 Credit 58 – the contractual assignment is written off as expenses.

Is the assignment subject to VAT?

Usually, when selling property rights, it is necessary to pay a tax fee. This is stated in paragraph 1 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation.

But this tax levy is not always assessed. To determine whether this is necessary or not, the tax treatment of the underlying liability should be examined. According to clause 1, Article 155 of the Tax Code of the Russian Federation, when selling a debt, the tax fee should be calculated in the same manner as the original obligation.

For a better understanding, we will study the taxation features of debt assignment agreements that arise from different transactions.

Taxation during assignment: nuances and examples

The assignor (original creditor) applying the general taxation system (GTS) 1. VAT, when assigning the right of claim arising from arrears in payment for goods (works, services):

The transfer of property rights is an independent transaction, different from the initial transaction for the sale of goods (works, services) and, accordingly, is an independent object of taxation, in accordance with the provisions of paragraph 1 of Art. 146 of the Tax Code of the Russian Federation.

When assigning the right of claim, the assignor does not have the obligation to calculate and pay VAT, unless the right of claim is assigned to the assignee at a cost exceeding the amount of the assigned monetary claim. These provisions are enshrined in Art. 155 Tax Code of the Russian Federation. That is, if a positive difference arises between the amount of income from the assignment of the right of claim and the amount of the assigned claim, then this difference is the tax base for calculating VAT. If the difference is negative or equal to zero, then no tax is paid.

For example: An assignor who has receivables for shipped goods in the amount of RUB 118,000. (including VAT 18,000 rubles) assigned the claim for payment to the assignee for 100,000 rubles. The tax base for VAT on the transaction = the amount received from the new creditor without VAT minus the amount of the assigned debt with VAT. Since in this case the tax base is less than zero (RUB 100,000 - RUB 118,000), VAT is not charged.

If you change the conditions of the example, according to which the assignment of the right of claim will be 130,000 rubles, then the tax base for the transaction will be positive (130,000 rubles - 118,000 rubles) and in this case it will be necessary to charge VAT at a rate of 18%

The second situation, in my opinion, is unlikely, since usually debts are sold at best at the nominal value of existing debt, but mostly still at a loss.

Please note that the very fact of assignment of the right of claim does not in any way affect the VAT on the original transaction, i.e. this VAT should not be restored, nor taken as an offset, etc. This is due to the provisions of paragraph 1 of Art. 154 Tax Code of the Russian Federation, paragraphs. 1 clause 1 art. 167 of the Tax Code of the Russian Federation, according to which VAT on the sale of goods (work, services) is calculated based on the contract prices for the shipment of goods (work, services).

2. VAT, upon assignment of the right of claim arising from the debt under the loan agreement: in accordance with the provisions of paragraphs. 26 clause 3 art. 149 of the Tax Code of the Russian Federation, transactions involving the assignment of claims under loan agreements are not subject to VAT.

Income tax

1. Income tax on the assignment of a claim arising from both arrears in payment for goods (works, services) and on the assignment of a claim arising from a debt under a loan agreement is calculated in the same way.

Let's consider the option when an organization uses the accrual method, the most common among Russian enterprises.

According to the provisions of paragraph 5 of Art. 271 of the Tax Code of the Russian Federation on the date of assignment, the amount due to be received from the assignee is recognized as income.

At the same time, in accordance with the provisions of paragraphs. 2.1 clause 1 art. 268, paragraph 1, art. 279 of the Tax Code of the Russian Federation, the amount of the assigned debt is included in expenses, and if the amount due from the assignee is less than the assigned debt, then the difference is recognized as a loss to the taxpayer.

Please note that the amount of loss is determined taking into account the provisions of Art. 279 of the Tax Code of the Russian Federation and depends on whether, on the date of assignment of the right of claim, the payment deadline established by the original contract for the supply of goods (work, services) has arrived or not.

- if the payment deadline has already arrived, then the loss is included in non-operating expenses in full.

- if the payment deadline has not yet arrived, then non-operating expenses can only be taken into account in an amount that does not exceed the maximum loss amount calculated at the taxpayer’s option either based on the methods used in controlled transactions or based on the key rate of the Central Bank. At the same time, the procedure for accounting for losses in this case should be fixed in the accounting policy, and if the maximum amount of loss is determined based on the key rate, then it should be indicated that the maximum amount of loss is determined as the amount of interest on debt obligations, based on the maximum rate established by paragraphs. 1. clause 1.2 art. 269 of the Tax Code of the Russian Federation.

For example: An assignor who has receivables for shipped goods in the amount of RUB 118,000. (including VAT 18,000 rubles) assigned the claim for payment to the assignee for 100,000 rubles. January 31, 2022 Payment due date under the original agreement from the debtor February 8, 2022 The taxpayer decided to calculate the limit based on the key rate of the Central Bank of the Russian Federation on the date of assignment - 7.75%

The loss from the assignment is 18,000 rubles. (RUB 100,000 - RUB 118,000)

The maximum amount of loss that can be taken into account in expenses = the amount receivable from the new creditor without VAT multiplied by the key rate increased by 1.25 and calculated by the number of days from the date of assignment to the date of payment fixed in the original agreement = (RUB 100,000 x 7.75% x 1.25 x 8 days / 365 days) = 212.33 rubles.

Since the loss (18,000 rubles) exceeds the maximum loss amount (212.33 rubles), it is possible to take into account only 212.33 rubles in non-operating expenses.

Sale of debt by supplier

If the seller, who has entered into a delivery agreement with deferred payment, wants to receive the debt as soon as possible, he has the right to sell the resulting debt.

Then the tax will be calculated on the income of the assignor, that is, on the excess amount received from the assignee for the sale. This provision is contained in clause 1 of Article 155 of the Tax Code of the Russian Federation. But generally, the initial transfer of debt is done at a discount. Since the assignee will receive the money due later, he also bears the risks (we are talking about possible non-repayment of the debt). That is why the assignor, as a rule, incurs a loss from such a transaction and, accordingly, does not pay VAT (due to the lack of profit).

The seller has the right to reduce the base from which the tax will be calculated if, in addition to the costs of purchasing the debt, it also includes current expenses, for example, the difference in the exchange rate or interest earned. But the tax service does not always agree to this. Such a step could lead to litigation. It is unknown how events will unfold there. Although in judicial practice there are cases when the taxpayer won the case.

Regardless of how many times the receivable is sold, the end result should be the final buyer receiving what is due. The assignee is subject to tax upon receipt of debt under any assignment agreement. According to paragraphs 2 and 4 of Art. 155 of the Tax Code of the Russian Federation, the base is the difference between the amount of debt and the costs of obtaining it. In accordance with clause 4 of Article 164 of the Tax Code of the Russian Federation, the tax fee is calculated at a rate of 20/100.

It is important to understand that, according to the law, the assignee has the right to again realize the previously purchased obligation. Then in the new transaction he will act as a assignor. In case of a significant initial discount, it is possible to make a profit during the secondary sale. If this happens, then, according to clause 2 of Article 155 of the Tax Code of the Russian Federation, you will have to pay a tax levy on the amount of income received, which will be the difference between the purchase price of the debt and the cost of its sale.

Consider the following example.

Company No. 1 supplied company No. 2 with goods for a total amount of 720,000 rubles with deferred payment. After shipment, company No. 1 sold the debt for 540,000 rubles to company No. 3. Company No. 3 resold the debt to company No. 4 for 600,000 rubles. It is clear that company No. 1 will not have to pay tax.

But company No. 3 made a profit of 60,000 rubles. It is from this amount that VAT will be calculated. In this case, the following calculation is made: 60/120*20=10 (10,000 rubles). For company No. 4, the tax fee will be calculated after the debt is repaid. It is calculated as follows: 120/120*20=20 (20,000 rubles).

Example No. 1 of preparing accounting entries

For example, LLC “Steel” accumulated receivables for goods sold to LLC “Delets” in the amount of 4,000,000 rubles. The management of Stel LLC was unable to find leverage over the debtor and decided to assign the receivable under the agreement to Stremlenie LLC for 3,500,000 rubles.

The accountant of Delets LLC made the following entry: Dt 60.01 Steel LLC Kt 60.01 Stremlenie LLC - in the amount of 4,000,000 rubles.

An employee of the accounting department of LLC "Steel" should record the following transactions:

- Dt 62.01 Kt 90.01 – revenue from the sale of goods is accrued in the amount of 4,000,000 rubles. (accounts receivable are taken into account together with VAT).

- Dt 90.03 Kt 68.02 – VAT charged on the sale of goods RUB 610,169.49. (4,000,000 / 118 * 18 = 610,169.49 - VAT 18%).

- Dt 90.02 Kt - the cost of goods sold is written off 3,000,000 rubles. The cost consists of the costs during the manufacturing process.

- Dt 76.03 Kt 91.01 – the cost of the assignment agreement of 3,500,000 rubles is taken into account.

- Dt 91.02 Kt 62.01 – accounts receivable written off for 4,000,000 rubles.

- Dt 90.09 Kt 99 – profit from the transaction of RUB 389,830.51 was taken into account. (4,000,000 - 610,169.49 = 3,389,830.51 - revenue excluding VAT; 3,389,830.51 - 3,000,000 - revenue excluding VAT minus the cost of goods).

If the assignor sells his receivable at an inflated price, then he has an obligation to show the profit that the difference will be. And charge value added tax on income.

Tax calculation for partial repayment of debt

The debtor has the right to send money to the assignee not at once, but in separate parts, and even in different tax periods. This point is not really regulated in the Tax Code. Therefore, two approaches can be used:

- Use the clarification of the Ministry of Finance on VAT No. 03-03-06/2/480041 dated November 11, 2013, where it is recommended to take into account costs based on amounts received in a specific period.

- Use clause 2 of Article 155 of the Tax Code of the Russian Federation verbatim, and charge tax from the moment the amount exceeds the cost of obtaining the debt is received.

Consider the following example.

Company No. 2, described in the previous example, transferred 360,000 rubles to company No. 4 in July 2022, and another 360,000 rubles in August 2022. Then, when applying the first approach, the calculation will be as follows: 360,000-600,000/720,000*360,000=60,000 rubles. The same calculation will be made in the 3rd quarter. But if you use the second approach, then in the 2nd quarter you will not have to pay at all, and in the 3rd quarter the tax base will be 120,000 rubles. Therefore, based on the results of the 3rd quarter, company No. 4 will pay only 20,000 rubles.

A similar situation will arise when the assignee purchased several debts and received only one of them in one tax period. But in this case, the application of the second approach is unlikely to please the regulatory authority, since the tax will be paid later.

At the same time, with the appropriate attitude, the taxpayer may well defend his position in court. Moreover, in judicial practice there were cases when assignees won the case, and the court recognized their ability to pay the tax once, regardless of how many debtors paid off their obligations.

Transfer of rights to residential and non-residential premises

When transferring property rights to residential buildings (premises), shares in them, garages and parking spaces, the tax base is determined as the difference between the income received (including VAT) and the costs of acquiring these rights (clause 3 of Article 155 of the Tax Code of the Russian Federation). Charge the tax at the rate of 18/118 (clause 4 of Article 164 of the Tax Code of the Russian Federation). The obligation to charge VAT arises at the time of assignment (subsequent assignment) of property rights (clause 8 of Article 167 of the Tax Code of the Russian Federation).

If an agreement on the assignment of the right of claim is subject to state registration, then it is considered concluded from the moment of registration (clause 3 of Article 433 of the Civil Code of the Russian Federation). Therefore, the obligation to charge VAT arises in the tax period in which:

- an agreement on the assignment of property rights was concluded that does not require state registration;

- An agreement on the assignment of property rights requiring state registration has been registered.

An example of how VAT accrual is reflected in accounting when transferring rights to residential premises

On December 2, 2014, Torgovaya LLC invested 1,000,000 rubles in the construction of a residential building. The agreement for shared participation in construction stipulates that upon completion of construction on December 29, 2015, Hermes will receive ownership of a three-room apartment.

On February 3, 2015, Hermes sold the right to receive an apartment to its employee for RUB 1,200,000. The VAT amount for this transaction is: (RUB 1,200,000 – RUB 1,000,000) × 18/118 = RUB 30,509.

The Hermes accountant reflected the contribution to the construction and sale of property rights with the following entries.

December 2, 2014:

Debit 76 Credit 51 – 1,000,000 rub. – money was invested in the construction of a residential building.

February 3, 2015:

Debit 73 Credit 91-1 – RUB 1,200,000. – the employee’s right to receive an apartment in a building under construction was realized;

Debit 91-2 Credit 76 – 1,000,000 rub. – the cost of the investment deposit is written off;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 30,509 rubles. – VAT payable to the budget has been accrued.

The amount of VAT accrued on this transaction was reflected by the Hermes accountant in the VAT return for the first quarter of 2015.

Situation: how to calculate VAT on the sale of property rights to non-residential premises?

Charge VAT in the same manner as for the sale of property rights to residential premises. That is, from the difference between the sales price and the acquisition price of property rights.

A special procedure for determining the tax base when realizing property rights to non-residential premises is not established by law. At the same time, property rights to non-residential premises and to property listed in paragraph 3 of Article 155 of the Tax Code of the Russian Federation belong to the same type of objects of civil rights. According to paragraph 3 of Article 3 of the Tax Code of the Russian Federation, taxes must have an economic basis and cannot be arbitrary, therefore the procedure for calculating VAT on the sale of property rights to both residential and non-residential premises should be the same. In addition, paragraph 3 of Article 155 of the Tax Code of the Russian Federation does not provide for exceptions in relation to non-residential premises. Thus, the tax base for the sale of property rights to non-residential premises must be determined in the same way as for the sale of rights to residential premises, that is, as the difference between the sale price and the price of acquisition of rights.

Similar explanations are contained in the letter of the Federal Tax Service of Russia dated June 27, 2014, No. GD-4-3/12291, agreed with the financial department.

It should be noted that the conclusions set out in this letter are based on Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 25, 2010 No. 13640/09. Previously, regulatory agencies took a different position. They believed that in the situation under consideration, VAT should be calculated in accordance with paragraph 2 of Article 153 of the Tax Code of the Russian Federation. That is, not from the difference between the sale price and the acquisition price, but from the entire value of the transferred rights (letter of the Ministry of Finance of Russia dated February 7, 2013 No. 03-07-11/2927, Federal Tax Service of Russia dated February 8, 2011 No. KE-4- 3/1907).

Now these explanations have lost their relevance. Recognizing the futility of legal proceedings in situations where the Supreme Arbitration Court of the Russian Federation has clearly outlined its position, the Ministry of Finance of Russia, in a letter dated November 7, 2013 No. 03-01-13/01/47571, recommended the tax inspectors not to bring the case to court. The Federal Tax Service of Russia also joined the recommendations of the financial department (letter dated November 26, 2013 No. GD-4-3/21097). These circumstances explain the change in the official position on this issue.

Situation: is it necessary to charge VAT when transferring a share in the construction of a residential building to pay off a debt under a loan agreement?

Answer: yes, it is necessary.

The transfer of property rights to residential buildings (premises), shares in them, garages and parking spaces is subject to VAT. In such cases, the tax base is equal to the difference between the income received (including VAT) and the costs of acquiring these rights (clause 3 of Article 155 of the Tax Code of the Russian Federation). In this situation, the tax base is equal to the difference between the amount of the repaid debt and the amount of expenses for acquiring a share in the construction of a residential building. Charge the tax at the rate of 18/118 (clause 4 of Article 164 of the Tax Code of the Russian Federation).

Sale of debt by buyer

The buyer's receivables are formed when he makes an advance payment. Basically, they sell the right to return it, for example, if the contract is terminated. The refund of this payment is not subject to tax. Therefore, transactions under an assignment agreement should also not be subject to taxation.

But this is only in the case of the 1st sale. If the assignee wishes to resell the debt, he will have to pay tax for such an operation, in accordance with clause 2 of Article 155 of the Tax Code of the Russian Federation. The same will happen with subsequent operations on the resale of the corresponding obligation. This position was adhered to by the Supreme Arbitration Court of the Russian Federation in its Resolution No. 33 in 2014.

The exercise of the right to demand delivery is rare, since it will require finding a person who requires the same goods or services. But formally we are talking about property rights by agreement. Therefore, tax authorities sometimes seek to charge tax on the full amount of the transaction based on clause 2 of Article 153 of the Tax Code of the Russian Federation. At the same time, when such cases came to trial, the courts generally did not support the tax authorities.

Assignment and VAT: what is the difficulty?

The sale of debt assumes that there is a debtor, a assignor - the initial creditor, and a assignee - the new creditor. As a rule, the sale of debt is carried out for less than the amount owed to the debtor. We will further consider this circumstance in connection with the calculation of VAT.

By the way! An assignment agreement is also called a creditor substitution.

It is impossible to answer the question whether a transaction under an assignment agreement is subject to VAT. First of all, you should pay attention to Art. 146-1(1) of the Tax Code of the Russian Federation, which states that the transfer of property rights should be subject to VAT. From Art. 155-1 of the Tax Code it follows that the taxation procedure for the sale of debt is the same as for the main, original obligation.

The nature of the debt also plays an important role: under a loan agreement or associated with an agreement for the sale of goods (works, services). As an example, let’s take a situation where the supplier has shipped, performed work, services with a deferred payment for them, or the buyer has made an advance and is awaiting delivery of goods (work, services). The debtor has the clearest VAT situation. If the assignment agreement is based on a loan agreement, there is no question of VAT at all, since it is not subject to VAT (Article 149-3, paragraph 15 of the Tax Code of the Russian Federation).

The debtor does not recover VAT that was not previously presented in other cases, this follows from Art. 170-3 Tax Code of the Russian Federation. The assignor and the assignee may have different tax accounting schemes related to VAT under the assignment agreement that they entered into.

Assignment of loan debt

In accordance with paragraph 26, paragraph 3 of Art.

149 of the Tax Code of the Russian Federation, the sale of debts under these agreements is not taxed. Although the article talks about both assignment and reassignment, tax authorities sometimes argue that the benefit applies only to the initial sale of debts. And this despite the presence of not only a direct instruction of the Tax Code of the Russian Federation, but also an explanatory letter from the Ministry of Finance No. 03-07-05/09 dated March 27, 2012. But if they want to protect their rights and go to court, the judicial body, as a rule, takes the position of businessmen .

It must be borne in mind that this provision applies only to loans that were issued in cash. If the loan was provided, for example, in goods, then tax will be levied on both the loan and the assignment agreement.

Is it necessary to indicate VAT in the assignment agreement?

The legislation does not directly say that the tax must be indicated in the agreement. Article 389 of the Civil Code of the Russian Federation only states that the form of the agreement must be similar to the form of the main obligation. At the same time, in order to avoid disputes with the inspection authority, nothing prevents you from indicating this provision in the agreement.

If the debt is sold at a loss or at par value, then the text may contain the wording “VAT – 0 rubles”. But when the assignor receives a profit, he will have to pay a tax fee. Accordingly, it is advisable to specify in the agreement the tax amount, which is determined by calculation based on the amount of profit.

Consider the following example.

Company No. 1 sells to Company No. 2 a debt in the amount of 660,000 rubles, the nominal value of which is 600,000 rubles. The income of company No. 2 will be 60,000 rubles. Then the calculation will be like this: 60/120/20=10. VAT will be 10,000 rubles.

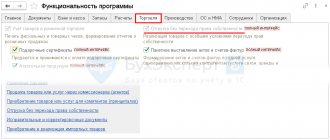

How to fill out an invoice

This document is drawn up with specific features, depending on the party to the contract who is involved in this.

The invoice is issued by the assignor regardless of the sales amount. In case of a loss or sale at par value, VAT will be equal to 0. When making a profit, the corresponding amount must be reflected, both the tax base (in column 5) and the calculated VAT (in column 7). An exception is the situation of selling a loan of money or a credit obligation. Then the invoice will not be needed at all, since it is not needed when exempt from the tax burden. This is stated in paragraph 1, paragraph 3, Article 169 of the Tax Code of the Russian Federation.

The assignee's tax base appears when the debt is repaid. Then they are given an invoice indicating the difference between the funds received from the debtor and the costs of purchasing the debt (in column 7). The amount of the tax fee is indicated in column 8. It is calculated in the same way as for the assignor.