Let's consider one of the operations constantly carried out by personnel officers and accounting departments. Let's figure out how to properly maintain, fill out and register timesheets manually. We will also determine why this is required, what forms are suitable, what details will be required, what marks to put down, and the like.

What is this document and why is it needed?

It contains information about how many hours each specific person from the entire staff actually worked and how many absences he made during the reporting period. Its presence is mandatory, according to Resolution No. 1 of the State Statistics Committee, adopted on January 5, 2004.

It is useful because it helps:

- objectively reflect the degree of staff employment;

- register tardiness, time off and absenteeism and thus respond to violations and closely monitor the production process;

- obtain accurate statistics and perform analytics based on them.

An accountant must know how to make a payroll time sheet in order to correctly accrue salaries, bonuses, and compensation to the organization’s employees. The HR officer needs this to track attendance and justify imposed fines, penalties or other sanctions.

This document is issued immediately after dismissal (at the request of a former subordinate), and may also be requested by the tax service during the audit process.

How to make changes to an employment contract

If before the introduction of summarized accounting, the employee was on a different regime, for example, a 5-day work week with two days off, then an additional agreement is drawn up to the employment contract, which reflects the conditions for the use of summarized recording of working time. In the section “Working hours” of the additional agreement to the employment contract, it is advisable to indicate the following points:

1. The employee is provided with a summarized recording of working time.

2. The procedure for introducing summarized recording of working time is established by the Internal Labor Regulations.

3. The accounting period is a month.

4. The standard working time for the accounting period is established based on a 40-hour work week with two days off.

5. The date and time the employee goes to work, the duration of work, the end time of work, and days off are determined in the work schedule.

6. Work schedules are brought to the attention of the employee no later than 1 month before they come into effect.

7. A break for rest and food (45 minutes) is provided every 4 hours of work.

8. The hourly rate for calculating wages for salaried employees is calculated by dividing the official salary by the average annual standard number of hours and remains unchanged during the current year.

Note!

The employer is obliged to notify employees of changes in the terms of the employment contract (in our case, the transition to summarized recording of working hours) in writing no later than 2 months in advance (Part 2 of Article 74 of the Labor Code of the Russian Federation) - for example, issue an order to amend the PVTR with employee list application.

If the employee refuses the working conditions in the new regime, i.e. in new organizational conditions, then the employment contract is terminated in accordance with clause 7, part 1, art. 77 Labor Code of the Russian Federation.

When switching to summarized recording of working hours, the employer is obliged to develop a work schedule that contains information about the standard working hours, the number of days off and working days, the boundaries and duration of the working day, as well as the combination of working periods with rest periods.

Who fills it out

This task is assigned to an authorized person - either a specialist hired separately for this purpose, or an expert from the personnel service or even the head of a structural unit (depending on the company’s general organization). The last two, among other things, must also confirm the correctness of the entered data with their signature and immediately transfer the business paper to the chief accountant.

In modern practice, work time sheets are usually kept by employees specifically assigned by order containing their full name. and the position of a specific performer. If such a document is missing, find out whether such an obligation is provided for in the concluded contract. If not, then any demands from management to solve such problems are unlawful.

In large organizations, an authorized person enters information into the form and shows it to the head of the department, who checks, endorses and transfers the business paper to the personnel officer; he, having personally verified that there are no errors, also signs and sends it to the accountants.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

How to correctly draw up and maintain a monthly timesheet

Current legislation states that this can be done using one of the following methods:

- continuous – not only attendance or absenteeism are recorded, but also all changes to the usual schedule;

- by deviations - only deviations from the standard work schedule are recorded, for example, business trips.

The first option is much more applicable in practice, because here everything is almost completely automated. Plus, it allows you to more accurately summarize hours spent from different shifts and see potential overtime, which helps you more flexibly adjust the future staff schedule.

Is there any unified form?

Yes, Goskomstat approved two types of time sheets: T-12 and T-13. Although it is not necessary to strictly adhere to them - if necessary, the company has the right to invent and use its own, it’s just that the standard ones are more convenient, since they are well known to other organizations.

T-13 is more popular because it is presented not only in paper, but also in electronic version, so it can be integrated into the card system and enter data on absenteeism and tardiness automatically. The main thing is to debug the software so that no errors occur.

T-12 is more interesting for accountants, since it allows you to reflect salaries, bonuses and other deductions, but it is not yet possible to post it through a PC, and this is its comparative disadvantage.

General rules for keeping timesheets

The accounting register must be opened on the first working day of the month, and it is drawn up from the first calendar day (even if the month begins on a weekend or holiday). At the end of the month the timesheet is closed. Some companies record interim results after the 15th, but only if production needs require it.

The key principles for maintaining this document must be declared in local regulations (for example, in the standard provision on time sheets). And the employee responsible for the time sheet must be guided by these regulations. Here it is worth clarifying and consolidating certain important points:

- The timesheet can be kept for individual structural divisions or for the company as a whole (the main thing is to determine this point immediately).

- The accounting must define coding by type of working/non-working time.

- The time sheet must reflect not only the hours worked, but also the time during which the employee did not carry out his work duties, although he should have done so (absenteeism, violation of labor discipline in the form of absence from the workplace, early leaving, downtime, etc.) .

- Each employee begins to appear on the timesheet strictly after it is registered in personnel records - there is an employment order, an employment agreement is signed. Similarly, employees are excluded from the time sheet - after the dismissal order comes into force.

- As soon as an employee is included in the time sheet, he is assigned a personnel number. Moreover, this number does not change throughout his employment in the company. If a person moves to another position, his personnel number remains the same. And even after an employee’s dismissal, his number cannot be assigned to anyone for another three years.

- Entering data into the timesheet in advance is strictly prohibited. It can only be filled in after the fact. Even if the timekeeper is sure, for example, that on the last day of the month everyone is already at work, it is not a fact that everyone will work the required 8 hours. Therefore, correct execution of the timesheet requires filling it out only the next day after a month has passed.

Methods for filling out the timesheet

There are actually 3 ways to maintain a timesheet:

- electronic;

- using automated accounting;

- on paper.

Of course, today the electronic method is used most often. Here you can always make adjustments, because there are often situations when the timesheet has to be corrected.

The most common simple accounting option today is to maintain a timesheet virtually manually in Excel. This method allows you to use entered formulas to calculate indicators, summarize them, and keep a timesheet throughout the year in a single file. Here you can keep statistics both for a specific employee, and for a division, and for the company as a whole. But still, this is a rather labor-intensive process for the timekeeper, which needs to be done regularly.

A more convenient and efficient way to maintain timesheets is to work through the 1C system. It also makes it possible to make adjustments to the electronic document. As a rule, internal online accounting is associated with a access system.

At large enterprises, even in order to go out for lunch, you need to check in, and the amount of time worked is automatically recorded in the time sheet

At large enterprises, especially in production, electronic systems for recording and monitoring employee working time are successfully used. Every second is recorded when an employee enters the enterprise and when he leaves. The most common types of such online surveillance include:

- electronic pass, when an employee, passing through the terminal, swipes a card, after reading the code on it, the information goes directly into the accounting program;

- there are terminals that can only be passed using a fingerprint (a more serious method, because the electronic card can also be given to another person for duty);

- retinal scanning - maximum degree of protection;

- video surveillance of workers, which allows, among other things, to monitor the production process itself;

- turning on and starting an employee’s work on a computer or going online or Skype (this is especially true for IT companies and Internet workers, including remote workers);

- recording telephone conversations (start/end) - for call center operators or online stores.

Such automated accounting allows you to eliminate the human factor and systematize the process.

Data from the online control system immediately enters the common database and forms a time sheet in real time. To the point that the immediate manager can see at any time: what time his subordinate came to work, what he did at the workplace and how many times he logged into social media. networks. Some systems allow you to generate an employee working time card.

The main thing here is that the use of any of the online control methods must be documented in the internal regulations, as well as in the labor contracts of employees. Only in this case is the use of any type of monitoring of the work process legal.

Step-by-step instructions for drawing up and filling out a time sheet on form T-13

An important clarification right away: we choose continuous as a method - in this case it is more convenient and clearer.

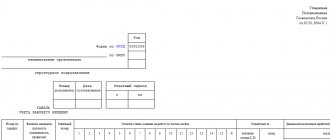

Step one: Name of the organization and its structural unit

At the very top you should indicate the name of the company and the division whose specialist created the document, for example, a production workshop or marketing department.

Step two: enter the OKPO code

This abbreviation hides information from the All-Russian Classifier of Companies of all OPFs, stored in the Rosstat database. Attention, you must enter it strictly in the special header in the upper right corner as follows:

- 8 digits – for officially registered legal entities;

- 10 – for individual entrepreneurs (individual entrepreneurs).

Step three: enter the number and date

When deciding how to draw up a time sheet, be sure to take into account the following point: the number is assigned strictly according to the procedure followed at the enterprise, as of the last day of the current month, which is necessarily reflected in writing in the fields intended for this - as shown below:

Step four: selecting a reporting period

Usually this is the interval between the beginning and end of the reporting period (the document we are considering is regular). In the case of our example, from June 01 to June 30.

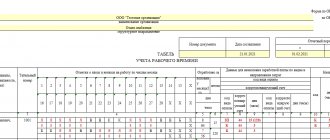

Step five: entering employee data

Each person entered into the document is assigned a separate line. He also receives an individual number, which subsequently goes through all internal documentation, is retained during the term of service and is not transferred to anyone else until dismissal (and even for a certain period after it).

Step six: information about hours and attendance

Having analyzed how time sheets are kept, we come to a logical conclusion: this information is filled out in an abbreviated format so as not to overload the form. In general, the following conventions are accepted:

- I – attendance (if there is no absenteeism, then in the cell below you must indicate the time, in hours, that the person actually worked during the shift);

- K – business trip;

- B – a day off as required by law;

- OT – scheduled (regular) vacation.

Step seven: calculating the final number of days/hours

The most accurate and accurate calculation is carried out in 2 stages:

- first in the fifth column - for every half month;

- after - in the sixth, the result for the reporting period.

Step eight: entering information to determine payment amounts

Employees' working time sheets should be filled out with codes that are strictly suitable for this purpose - they establish the type and amount of monetary compensation provided for a particular volume of tasks completed. There is a whole list of these identifiers - it is in the public domain, this is reference information. In the form (below in the screenshot) two popular ones are taken:

- 2000 – labor costs;

- 2012 – vacation pay.

These funds are written off to a corresponding (special accounting) account. It can be different - separately for salary, travel allowance, vacation pay - or general, for everything at once.

The main thing is that for each type of payment in the ninth column it is necessary to indicate the number of hours or days spent by a person on work (actually). Here in the “red” cell are attendance and business trip allowances, and in the “green” cell are vacation pay.

If during the period under review one type of salary is applicable to all personnel, then the corresponding code can be given at the top of the form, and the seventh from eighth columns can be left blank.

Step nine: information about the reasons and duration of absences

In the example we took of compiling and processing a work time sheet, the employee did not come to the enterprise for 13 days, but 3 of them were on a business trip, and 10 were on vacation. Information about this should be entered in the 10-12th columns - and always with a letter abbreviation explaining the reason, and a number indicating the period of absence, in days or hours:

Step ten: signatures of each responsible person

They must be entered at the end of the calendar month. If we take our case, this is the responsibility of the manager (as an authorized subordinate), the head of the department and the HR specialist. If at least some of the details are missing, the document cannot be considered valid.

The time sheet is an important reporting document.

Article 91 of the Labor Code of the Russian Federation clearly defines that the employer must regularly keep records of the time actually worked by each employee of the organization. A time sheet is a register of working hours for all employees of an enterprise - the primary document for accounting and personnel records. It is on its basis, based on man-hours worked, that wages are calculated for all employees of the company. According to it, the accounting department calculates subsidies, vacation payments, compensation for sick leave, etc.

The need to maintain this document is determined by the presence of hired personnel in the company, regardless of its legal form and status. This requirement applies to both large organizations and individual entrepreneurs who have at least one employee.

The report card is the basis for calculating tax and insurance fees. The information specified in the register also influences the reduction of the tax burden on the business. Therefore, the first thing that is checked by fiscal controllers or labor inspectors is how the timesheet is kept.

The main functionality of the accounting sheet

The key functions of the timesheet include the following:

- correct calculation of monthly payments to company employees;

- reporting to regulators and controllers;

- fiscal justification of expenses for the wage fund;

- recording the actual location of all employees for certain types of working hours;

- state labor control;

- calculation of overtime and adjustment of wages in case of constant violations of labor discipline (carrot and stick);

- justification for the legality of dismissing an employee for absenteeism.

In addition to all of the above, this accounting document insures the employer in labor conflicts, both when an employee files a complaint with the inspectorate or a court claim, and in internal disputes.

The timesheet is a good analytical tool, on the basis of which you can monthly observe the dynamics of changes in working hours across the enterprise. By superimposing financial indicators, monitor business performance and make adjustments to the work and rest schedules of employees. This is a good register for personnel and management accounting.

Video instructions: how to organize timekeeping

Vacation notes

The key feature of how to correctly fill out a worksheet is the ability to enter the appropriate codes:

- correct type;

- proper duration;

- suitable method (consecutive or by deviation).

They are written with the following abbreviations:

| FROM | Another paid one |

| OD | Additional |

| U | Educational (salary retained) |

| UD | Educational (salary is not saved) |

| UV | Training (with a shortened day, without interruption from work) |

| BEFORE | Administrative |

| R | Pregnancy, childbirth |

| coolant | Caring for a baby up to 3 years old |

| Far East | Add. (not paid) |

| OZ | In other situations prescribed by law (also unpaid) |

Other designations

When deciding how to make a time sheet, remember that it may contain the following notes:

| Presence | |

| RV | Appearing on a holiday, a day off (or a day equivalent to it due to quarantine) |

| VM | Shift workers |

| WITH | Overtime |

| Business trips, professional courses | |

| TO | Business trip |

| PC | On-the-job training |

| PM | Studying in another locality, with the cessation of work |

| Absence on site | |

| ETC | Absenteeism |

| B | Sick leave |

| T | Unpaid sick leave |

| PV | Absenteeism, but forced, due to unlawful removal |

| NS | Partial shift mode |

| Champions League | Abbr. day |

| G | Failure to appear for a valid reason (state or public duties) |

| IN | Weekends or holidays |

| NN | The reason is not clear |

| OB | Add. day off (paid) |

| NV | Add. day off (not paid) |

| RP | Simple, provoked by superiors |

| VP | Downtime provoked by an employee |

| NP | Downtime due to circumstances beyond anyone’s control (there is a high probability that it will have to be worked out in the future) |

| ZB | Strike |

| BUT | Removal with retention of salary |

| NB | Unpaid suspension |

| NZ | Suspension of labor caused by delays in salary |

| Digital wage codes | |

| 2000 | Standard deductions (salary, bonus) |

| 2010 | Money provided for by the GPA |

| 2300 | Sick leave payments special due to sick leave |

Overtime pay

According to Part 1 of Art. 99 of the Labor Code of the Russian Federation, overtime work is the performance by an employee, at the initiative of the employer, of work outside the working hours (shift) established in the organization or in excess of the normal number of working hours for the accounting period (with cumulative accounting).

There are two ways of compensation for overtime work (Article 152 of the Labor Code of the Russian Federation):

- increased overtime pay;

- providing additional rest time

Overtime work is paid for the first two hours at least one and a half times the rate, for subsequent hours - at least double the rate. the corresponding sizes can also be established in the collective agreement.

If an employee for whom summary accounting has been established worked an incomplete accounting period (for example, was sick or was on vacation), then when determining his standard working hours in such a period, the time of absence for valid reasons must be excluded.

Thus, when calculating overtime hours for the accounting period, you need to focus not on the standard standard of working time, but on the one reduced for this employee.

Another important point!

According to Art. 101 of the Labor Code of the Russian Federation an irregular working day is a work regime in which individual employees can, by order of the employer and, if necessary, be occasionally involved in performing duties outside the working hours established for them.

Work on irregular working hours, unlike overtime work, is not paid additionally. In fact, employees working on such a schedule receive wages as during normal working hours. But they are entitled to additional vacation days .

If an employee with irregular working hours is involved in work on weekends and non-working holidays, as well as at night, then such work is subject to payment in a special manner.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

What to do after

Let's figure out how to work with a time sheet. It should be printed out, submitted to all certifying persons, and then a salary or bonus should be calculated on its basis. Then, when the document is no longer needed, it must be archived and carefully stored for 5 years so that it can be presented to the tax authorities or a resigning employee.

Summarized accounting

The specifics of the activities of some organizations are such that their employees do not work five days a week, but go to work according to a schedule. Moreover, their working day can be more than 8 hours. At the same time, in a week it turns out sometimes more than 40 hours, sometimes less.

In such a situation, summarized working time recording . With this method, the accounting period can be a month, a quarter or another period of time, but not more than one year. This is stated in Part 1 of Art. 104 Labor Code of the Russian Federation. It is used when, due to working conditions, the daily or weekly working hours cannot be met.

The employer is obliged to establish an accounting period: month, quarter, half-year or year, at the end of which the actual time worked must coincide with the standard working time according to the production calendar. Overtime during some time periods of the accounting period must be compensated for by shortcomings during other time periods.

This type of accounting is the most labor-intensive and complex.

Important to remember!

The standard working hours is 40 hours per week. At the same time, the features of the production schedule - be it a five-day, six-day or working with “floating” weekends - are not particularly important. Any excess of the norm is regarded as overwork .

With summarized accounting, the number of working hours in a quarterly, monthly or annual schedule is established based on the general norm. At the same time, working days and weekends must alternate in such a way that at least once a week the employee rests for at least 42 hours in a row.

How to fix errors

Form T-13 is convenient in that it is created automatically from those already existing in the database, therefore, with normally configured software, all information should be entered correctly. Although this is not a reason for the head of a structural unit to relax, it is still better to check before signing.

But even if you know exactly how a time sheet is made and prepared according to the T-12 form, when filling it out manually you are not immune from clerical errors and inaccuracies caused by carelessness. If you discovered them before the sighting, this is not a problem at all - the printout can simply be redone. If later, you will have to create a corrective document, indicate the correct data in it and assign it a number following the incorrect primary one. As an appendix to it, a memo is required detailing the reasons for making the changes and clarifying papers, for example, a copy of the sick leave certificate if absenteeism is being corrected.

Otherwise, any defect discovered during a tax audit threatens to entail a fine of 30-50 thousand rubles (for legal entities), and if the situation repeats, even more severe sanctions will be imposed.

We examined in detail how to draw up and fill out time sheets for individual entrepreneurs and organizations, manually entering the appropriate notes.

And you can easily find the programs necessary for automating business processes, as well as accounting, in the Cleverence catalog - contact us for a profitable order of reliable, functional, easy-to-learn software. Number of impressions: 10112

Instructions for filling and sample T-12

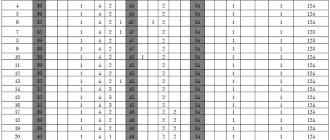

Filling out the T-12 form is different. Let's consider only the first section on working time recording.

Differences appear starting from column 8. Columns 8-17 are filled out only at the end of the reporting month. Column 8 indicates the total number of days worked - the sum of the upper cells from columns 5 and 7. The value for column 9 is obtained as the sum of the lower cells of columns 5 and 7. In columns 10-13 from column 9 we highlight the number of overtime, nights, weekends and other hours work.

In columns 14 and 16 we enter the number of days and hours of absence. In the 15th column we enter the code for the reason for non-appearance, taken from the same “symbols”. In column 17 we enter the total number of weekends and holidays per month for each employee.

The completed form is signed by the responsible person, the head of the department and the personnel officer at the end of the month.