Terms of remuneration in TD

Among all the items that must be included in the TD, one of the mandatory ones is employee remuneration (Article 57 of the Labor Code of the Russian Federation). Labor relations between the parties are concluded on a voluntary basis, and therefore the employer and employee have the right to agree on the amount of wages.

In accordance with Art. 129 of the Labor Code of the Russian Federation, wages are the remuneration that an employee receives for performing his labor functions . Its size can be different and is set for each individual depending on the position held, work experience and professional skills.

The employee’s salary for the month worked should not be lower than the minimum wage (Article 133 of the Labor Code of the Russian Federation).

Each enterprise or organization has its own remuneration system , which is regulated by internal regulations. The remuneration system, as well as the procedure for paying wages, must be specified in the employment contract.

In addition to the basic salary at some enterprises, due to the specifics of their activities, employees are paid travel allowances, overtime and other additional payments. The TD must also contain information about their presence. The amount of such remuneration may be established by agreement of the parties to the trading house.

Any changes to the terms of the employment contract can only be made with the consent of the employee; making a unilateral decision is considered illegal.

Changes in the terms of labor relations occur on the basis of a written additional agreement between the parties. The employee confirms his consent to change the contract with a personal signature on the document .

Types of remuneration

An employee can receive remuneration for performing his job duties in two types:

- Basic salary . It is calculated for the total amount of time worked, taking into account the quantity and quality of work done, salary, bonus, and various allowances for special working conditions.

- Additional salary . This type refers to payments to the employee for time not worked, to which he is entitled in accordance with the law (vacation pay, maternity leave, etc.).

There are two forms of remuneration for work: time-based and piece-rate. Each of them is also divided into several forms.

Time form:

- Simple - to calculate it, the employee’s tariff rate for one hour or working day is taken as a basis and multiplied by the amount of time worked.

- Time-based bonus - a bonus is added to payments for hours or days worked.

Piece form of payment:

- Direct - the amount of wages directly depends on the amount of work performed, taking into account the prices established for them.

- Piece-rate bonus - the employee receives a bonus for exceeding established standards.

- Piece-progressive - the amount of payment increases for exceeding the plan.

- Indirect piecework - applied to employees of auxiliary production and is calculated as a certain percentage of the earnings of main employees.

- Accord - established for the completion of a set of works.

Many enterprises use mixed forms of remuneration.

Salary

By remuneration or, in other words, wages we mean remuneration for work, the volume of which depends on a number of factors. The qualifications of the employee, his professional skills, as well as the complexity, quality and quantity of tasks performed are taken into account. In addition, the amount of the final payment is affected by the presence of compensatory and incentive additives.

The conditions under which remuneration is made cover the following:

- on the size of the tariff rate or salary of the hired person;

- on the availability and amount of established additional payments and allowances;

- the presence and volume of incentive or incentive accruals, for example, bonuses.

The tariff rate means a fixed amount of payment, which is charged to an employee who has fulfilled the established labor standard for a certain period of time. Salary is also a fixed amount of remuneration for work, which is due to an employee for performing official duties for a calendar month. Moreover, both the salary and the tariff rate do not include any compensation, incentives or social payments.

Is it necessary to indicate the salary amount?

How much an employee will receive for a specific position will depend on the rules established in the remuneration system of a given employer (Article 135 of the Labor Code of the Russian Federation). This issue is given a separate paragraph in the TD.

In Art. 57 of the Labor Code of the Russian Federation states that information about the amount of an employee’s earnings must be entered into the TD , including the size of the tariff rate or salary of the official, as well as all other additional remunerations. Thus, the document must clearly indicate the amounts of payments that are due to the employee for the performance of his work duties.

Drawing up a TD indicating an incorrect amount of earnings with reference to internal regulations is a violation of the law.

Does the contract include information about allowances?

The enterprise may establish various additional payments for employees (additional payments, allowances, bonuses). Their size can be indicated:

- in TD between the employee and the employer;

- in the form of a link to an internal regulatory document in the organization or a collective TD that establishes them.

If the salary amount must be indicated in the TD, then the amount of incentive payments can only be contained in local regulatory documents (Rostrud Letter No. 428-6-1 dated March 22, 2012).

The employee must be familiar with the types and amounts of incentive payments against signature (Article 68 of the Labor Code of the Russian Federation).

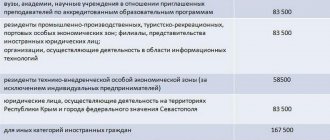

Coefficients for calculating official salaries

According to labor legislation, an official salary is a fixed amount of payment for labor activities for the performance of one’s own official duties. The official salary cannot include social, incentive or compensation payments.

The Labor Code of the Russian Federation defines the basic salary as the wage rate of an employee of a state or municipal organization carrying out the professional activities of a worker or employee without taking into account additional payments.

Thus, the minimum wage established at the state level serves as the basis for establishing the official salaries of employees.

The salary of any employee directly depends on many factors, including:

- work load;

- specialized education;

- qualification;

- work experience.

Attention! The official salary is a fixed amount of remuneration, established depending on the position held by the employee, qualifications, specialized education and length of service at the given enterprise.

The amount of remuneration for the work activities of employees is established based on salary schemes , which are developed at the level of an organization or an entire industry:

- Industry schemes are used to determine the salaries of employees of organizations financed from budgetary sources.

- Salary schemes approved at the level of firms financed from their own funds take the form of a staffing table indicating the range of specialist positions and the corresponding salary amounts.

The salary schedules for both groups may indicate a salary range, called a salary range.

Establishing minimum and maximum wages makes it possible to determine employee salaries individually, based on their qualifications, work experience, volume of work performed and business qualities.

The level of professionalism of both specialists and workers is determined by gradation into categories, due to which employee salaries are differentiated. Most organizations are characterized by a three-stage gradation.

According to labor legislation, the wage regulations may provide for the establishment of a personal increasing coefficient :

- by position;

- for length of service (more on this).

If an increasing coefficient is established, the amount of upcoming payments is determined by mathematically multiplying the salary by the coefficient.

A personal increasing coefficient can be assigned taking into account:

- vocational training;

- complexity of the work performed;

- employee's degree of responsibility.

The decision on the bonus is made by the head of the enterprise in relation to each employee individually. The length of service coefficient can be set for employees depending on their overall professional experience at a given enterprise.

Question: Is non-payment of a bonus a violation of labor laws if the employment contract states that wages consist of an official salary and a bonus? View answer

Terms of transfer and date of payment of wages

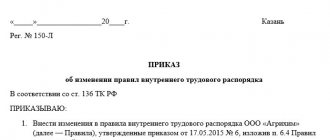

Employers transfer salaries to their employees in installments not on their own initiative, but in accordance with labor legislation. Art. 136 of the Labor Code of the Russian Federation states that salaries must be transferred at least every half month . Even if the parties can agree to pay the entire amount once a month, and sign an agreement on this, it will still be considered illegal.

The days when employees are paid their salaries must be contained in the following documents:

- in internal labor regulations;

- in a collective agreement;

- in the TD of each employee (what else should be contained in the TD?).

The Labor Code of the Russian Federation establishes restrictions on the minimum number of payments per month , but the employer is not deprived of the right to make transfers more than 2 times.

Prepaid expense

An advance is not a specific amount, but an employee’s salary for the period of time actually worked in the first half of the month. It is calculated on the basis of the established salary, as well as various additional payments, the amount of which does not depend on the results of the month worked.

The specific date when the advance must be paid is not established by law. The employer chooses a specific date and indicates it in internal regulations, the collective agreement and TD.

According to Art. 136 of the Labor Code of the Russian Federation, wages must be paid at least every half month, that is, approximately 15 calendar days must pass between the advance and wages. In addition, it should be borne in mind that the payment date must be set as a specific number, and not a time period .

If the due date falls on a weekend or holiday, payments are made the day before.

How to reflect payment in an employment contract

Article 57 of the Labor Code directly talks about remuneration in an employment contract, and how to register it - indicate a specific amount. The components of the salary are listed. This:

- official salary;

- additional payments;

- encouragement.

If the salary is indicated accurately, then the law does not oblige you to describe in detail other payments and allowances in the employment contract. They can be mentioned by referring to the local regulatory act, where they are described in detail.

| Example No. The Employee’s official salary is 35,500 (thirty-five thousand five hundred) rubles. |

The employer sets bonuses, incentives and compensation payments, as provided for by the laws of the Russian Federation and local regulations of the organization. It is necessary to indicate which ones exactly.

| Attention! The wording “according to the staffing table” instead of an exact indication of the salary in an employment contract is illegal. |

Article 136 of the Labor Code obliges employees to pay wages twice a month, but does not require the dates of payment to be specified in the employment contract with the employee. If the dates are established by a collective agreement or included in the internal labor regulations, indicate this in the employment agreement and refer to this LNA, indicating its name. If there is no trade union at the enterprise, the collective agreement does not specify salary dates, they must be entered into the text of the employment contract.

| Example No. The monthly salary is paid for the time actually worked, the basis is the time sheet. Payment for the first ½ month is due on the 20th day, for the second ½ month – on the 5th day of the next month. No. Salary is paid to the Employee by transfer in rubles to a bank card. |

Is it possible to write a salary in TD according to the staffing table?

Among all local documents, the employer must have a staffing table . This document indicates the number of positions available in the organization, the salary for each of them, as well as additional incentive payments.

The salary amount is one of the mandatory items that the employer must reflect in the TD with the employee (Article 57 of the Labor Code of the Russian Federation). Since information on the salary amount is present both in the staffing table and in the TD, this data must be identical.

Inconsistency in the amount of wages in the documents may be considered a violation of the law, for which the employer may be held liable in accordance with Art. 5.27 of the Code of Administrative Offenses (CAO RF).

Remuneration in kind

In some cases, employers resort to paying wages in kind . As a rule, this happens when the company experiences a cash shortage, but there is a large amount of unsold products.

The part of the salary paid in kind should not exceed 20% of the total earnings.

Payments in kind can only be made under these conditions:

- The TD or collective agreement indicates the possibility of making payments in kind, indicating the amount, which should not exceed 20% of the total salary.

- The employer must receive a written statement from the employee indicating his consent to receive non-cash earnings.

Holds

Deductions from an employee’s salary are funds that are due to him for the period of time worked, but will not be paid, and will be used to ensure the requirements put forward to the employee in accordance with the law.

Monies may be charged on such grounds:

- withholding tax payments (Article 226 of the Tax Code of the Russian Federation);

- maintenance of convicts (Article 107 of the Criminal Executive Code of the Russian Federation);

- payment of alimony (Article 109 of the Family Code of the Russian Federation);

- other cases in accordance with the Law of October 2, 2007 No. 229-FZ.

The TD indicates the salary accrued to the employee . To document the deduction of funds from an employee’s earnings, the employer must issue an appropriate order.

Making an entry about the bonus in the employment contract

So, how to write a bonus in an employment contract?

If there is a provision on incentive payments in the text of the employment contract, it is possible to write, for example, the following content:

“Bonus payments to employees are carried out in accordance with the rules of the employer’s Regulations on Bonuses.”

If the employer does not have an internal regulatory document or an individual bonus scheme has been established for the employee, then, for example, the following entry may be made in his employment contract:

“If the employee performs job duties conscientiously, the employee is paid a monthly bonus in the amount of 20% of the salary.”

Read about what else should be reflected in the employment contract in the material “Procedure for concluding an employment contract (nuances).”

Agreement without specifying the PO

Often, when applying for a job, an employee sees in front of him a TD in which the wage clause is drawn up incorrectly. The contract does not contain a specific salary amount, but only contains a reference to another document that sets the salary amount at the enterprise. It shouldn't be this way.

If the contract does not specify wages, the employer may be held liable for improper preparation of the TD in accordance with Art. 5.27 Code of Administrative Offenses of the Russian Federation. The amount of the administrative fine is :

- for officials - from 10,000 rubles. up to 20,000 rubles;

- for individual entrepreneurs - from 5,000 rubles. up to 10,000 rubles;

- for employers with the status of a legal entity - from 50,000 rubles. up to 100,000 rub.

Remuneration is, of course, one of the important points of an employment contract, but in addition to remuneration for work, other conditions must be specified in this document. We invite you to read about how to indicate in this agreement:

- place and nature of work;

- rights, duties and responsibilities of the parties;

- working hours, including flexible and shift schedules.

All terms of the employment relationship are discussed between the employee and his employer, and then indicated in the TD. Whatever the parties agree on, the points in the document should not contradict current legislation. Establishing unlawful conditions will violate the rights of the employee, for which the employer will be held liable.

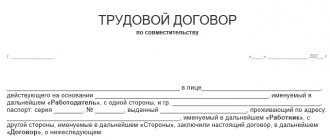

How to draw up a fixed-term employment contract

Often, an employer is faced with a choice: to issue an employment contract for an indefinite period or to conclude a fixed-term employment contract with the employee? Some small businesses resort to the second option in order to save money: they draw up a fixed-term employment contract for three months, and if the employee performs well, they enter into an additional agreement and recognize the employment contract as valid for an indefinite period. If the employee is not satisfied, they part with him due to the expiration of the fixed-term employment contract. In this case, they do not need to think about how to legally fire a person for unsatisfactory completion of the probationary period. But this approach is unacceptable.

To draw up a fixed-term employment contract, there must be a reason (circumstance), which is determined based on the norms of the Labor Code or federal law. Therefore, it is important not only to state the reason (circumstance) for concluding a fixed-term employment contract, but also to indicate a specific article of the code or federal law.

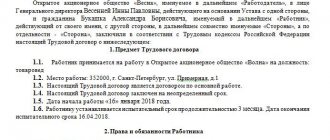

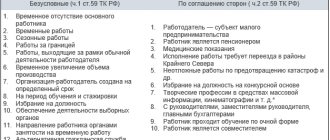

In what cases can a fixed-term employment contract be concluded?

First of all, you need to focus on the provisions of Art. 59 Labor Code of the Russian Federation. In Part 2 of Art. 59 of the Labor Code of the Russian Federation names the conditions when an employment contract can be fixed-term by agreement of the parties. For example, if the employer is a small business with up to 35 employees (in the field of retail trade and consumer services - 20 people); if the agreement is concluded with old-age pensioners, with creative workers of the media, cinematography organizations, theaters, etc. Thus, the employer can draw up both an employment contract for an indefinite period and a fixed-term employment contract, if at the time of hiring the employee agreed to sign such an employment contract.

Fulfilling the duties of an absent employee

In Art. 57 of the Labor Code of the Russian Federation specifies that when concluding a fixed-term employment contract, the duration of its validity and the circumstances (reasons) that served as the basis must be included. For example, the basis may be work during the performance of the duties of an absent employee (Part 1 of Article 59 of the Labor Code of the Russian Federation). To register it correctly, you need to indicate the deadline. But it is impossible to specify the deadline in dates in this situation.

Let’s say an employee went on maternity leave for all three years. Having hired another specialist at her workplace, you cannot specify in his employment contract the period with the dates “from... to...”. You prescribe a date by the occurrence of an event. So, you can indicate that “the employee is hired from <date> until the absence of the absent employee” or “the employment contract terminates with the departure of the absent employee.”

Why in this case is the deadline prescribed by the occurrence of an event, and not by a specific date? Because an employee who has gone on maternity leave can go to work without warning on any day convenient for her. And then a situation will arise in which there will be two employees at the same rate.

When using the basis “during the performance of the duties of the absent employee,” it is very important to remember that under no circumstances is it necessary to clarify the reasons for the absence of the absent employee. The law does not require this. The Labor Code requires only an indication of the period and the reason (circumstances) that served as the basis. And the basis in this case will not be maternity leave, but the absence of the employee.

Example wording: “The employment contract was concluded for the duration of the duties of an absent employee - marketing specialist Ivanova I.I., who, in accordance with labor legislation and other regulatory legal acts containing labor law norms, retains his place of work. The employment contract is terminated when marketing specialist Ivanova I.I. starts working.”

Fixed-term employment contract with an old-age pensioner

When drawing up a fixed-term employment contract with an old-age pensioner (the basis is stated in Part 2 of Article 59 of the Labor Code of the Russian Federation), employers often commit a violation - they do not indicate the reason (circumstance). If a person is a pensioner, this does not mean that he should immediately be transferred to a fixed-term employment contract.

It’s another matter if, when hired, an old-age pensioner agrees to sign a fixed-term employment contract. In this case, the reason is stated in the contract and an article of the Labor Code is indicated: “an employment contract is concluded with an old-age pensioner entering work (paragraph 2, part 2, article 59 of the Labor Code of the Russian Federation).”