Why keep accounting documents?

Any accountant knows that every document drawn up in a company or received from counterparties has its own value and must be preserved.

Based on the information contained in the primary documents, accounting is carried out and financial statements are prepared. Verification of accounting and accounting data by all regulatory authorities is carried out using primary documents. All primary accounting records and reports must be stored for legally defined periods.

The storage periods for accounting documents are regulated by the Law “On Accounting” dated December 6, 2011 No. 402-FZ and the approved list of storage periods.

To learn about what groups documents arising in the activities of an organization are divided into and what their storage periods may be, read the article “Basic storage periods for documents in an organization (archive).”

WE TRANSFER ELECTRONIC DOCUMENTS TO THE ARCHIVE

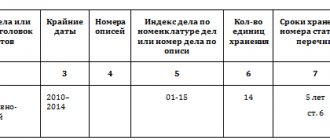

The procedure for transferring electronic documents to the organization’s archive is described in clause 4.34 of the 2015 Rules. The algorithm is as follows:

Step 1: the structural unit prepares electronic documents for transfer to the archive - independently saves them in unchangeable formats, and, if necessary, creates files.

Step 2: electronic files are recorded on separate storage media (each in two copies), for which covers are then designed.

Step 3: electronic files with long and permanent storage periods are entered into the appropriate inventories (see Examples 3 and 4).

Step 4: inventories with attachments are transferred to the organization’s archive on paper.

Step 5: The archivist scans all media with an anti-virus program, and then checks each recorded document file (the file that visualizes the document) for reproducibility.

Step 6: a record of acceptance and transfer is made in the inventory of cases. The inventory is signed by the archivist and the employee who transferred the documents to the archive.

What is more important - the list or law No. 402-FZ

Comparing the storage periods for accounting documents specified in the list and Law No. 402-FZ, the following conclusions can be drawn:

- the list establishes different storage periods depending on the type and significance of documents classified as accounting;

- Law No. 402-FZ provides for a 5-year storage period for accounting documents, but does not specify the terms by type of documentation;

- in paragraph 1 of Art. 29 of Law No. 402-FZ states that the basis for determining the storage periods for documentation is a list.

Thus, when deciding the fate of an invoice, balance sheet or accounting certificate, it is necessary to proceed primarily from the deadlines indicated in the list. However, their storage period cannot be less than 5 years.

Note! The State Duma amended Art. 23 and 24 of the Tax Code of the Russian Federation, which increase the storage period for taxpayers and tax agents of accounting and tax accounting data and documents related to the calculation and payment of taxes. They will need to be retained for 5 years instead of four.

The storage period for accounting documents specified in Art. 29 of Law No. 402-FZ, also concerns the accounting policies and standards of the company, including documents existing in electronic form. The latter also cannot be destroyed within a 5-year period. The storage period begins with the year following the year of their last use (Clause 2, Article 29 of Law No. 402-FZ).

WE COMPLETE AN INTERNAL INVENTORY OF ELECTRONIC CASES AND DOCUMENTS

Electronic files and documents are transferred to the organization’s archive along with paper ones, according to the general algorithm:

1) an annual assessment of value is carried out;

2) based on the results of the examination, files with expired storage periods are destroyed;

3) the remaining cases are entered into the inventory and sent for storage.

The form for the inventory of electronic files and documents, which simultaneously plays the role of an act of acceptance and transfer of documents to the organization’s archive, is given in Appendix No. 24 to the 2015 Rules (Example 3). This inventory is completed in the structural unit.

Rules for compiling an inventory. The inventory graphs are intuitive; there is nothing to comment on here. Let's consider the “organizational aspects” of compiling this inventory:

- inventories are compiled separately for electronic files of permanent storage and temporary (over 10 years) storage periods;

- in the inventory of electronic files for permanent storage, the column “Storage period” is omitted;

- inventories are compiled in two copies (one will remain in the archive, the other, with the signature of the archivist who accepted the documents, will be returned to the unit);

- The fund number may not be indicated and this column may be excluded altogether if the organization has only one archival fund (this information is given to the unit by the archivist or the secretary responsible for storing documents);

- the title of the inventory indicates the year for which the documents are being submitted;

- the name of the structural unit is included in the name of the inventory section;

- the name of the section, indexes, headings, storage periods for files are established in accordance with the nomenclature of files;

- the inventory is agreed upon with the head of the office management department (office, preschool educational institution service, etc.), with the expert commission of the structural unit (if there is one) and signed by the head of the structural unit;

- the second part of the inventory (transferred-received) is filled out when receiving and transmitting documents to the archive;

- the serial number of the inventory is assigned in the archive.

In our opinion, it is advisable to supplement the inventory with the number and type of media transferred to the archive.

We prepare an appendix to the inventory. According to the 2015 Rules, inventories of electronic files and documents have attachments. The inventory appendix is an internal inventory of each electronic file (Example 4).

In contrast to the transfer of paper documents to the archive, in which an internal inventory (if necessary, its preparation) is sewn into the volume when transferring electronic files:

- an application must be compiled for each electronic case;

- is not embedded in the media and is not recorded on it, but is drawn up in paper form as an appendix to the inventory of electronic files and documents transferred to the archive.

Let's understand deadlines using an example

Landscape Design LLC, formed several years ago, has steadily gained a foothold in its market segment. The accounting part of the work was carried out by a team of 4 people. Each specialist was assigned specific accounting areas, and the chief accountant was in charge of reporting and interaction with controllers.

Over the past period of accounting work, countless folders with documentation have accumulated in closets and utility rooms. It's time to deal with them.

Most of the primary data were acts of work performed - on their basis, the company’s revenue was regularly determined, reflected in its financial statements.

Read about the preparation of certificates of completed work in this article .

Significant volumes of paper deposits consisted of invoices for purchased materials, payment slips, salary slips and related calculations.

A separate shelf was completely filled with accounting records, declarations, reports to the pension fund and social security, as well as statistical forms.

Each accountant compiled a list of cases with accounting documentation for his area, and the chief accountant systematized all the information in a single table, one of the columns of which was dedicated to the standard storage periods for documents taken from the list.

Where to store documents of the organization and individual entrepreneurs?

If there are few documents, then the easiest way is to create your own archive - store them in a safe (fireproof cabinet) or allocate a separate room for the archive. The law does not provide specific requirements for the design of the archive; the main thing is that it fulfill its function of collecting and storing documents.

Documents of the last three years, as well as those that are constantly required in work (most often, registration) constitute the so-called operational archive, therefore they are not stored for long-term storage. Documents stored for no more than five years, upon expiration of the storage period, must be destroyed by burning or cutting in a shredder.

Other documents with a shelf life of more than five years must be deposited. To do this, they are filed in volumes with no more than 250 sheets in one volume. Each sheet of the volume is numbered, and an internal inventory and cover are drawn up. Documents can also be transferred for safekeeping to specialized archival organizations, but this makes sense if there are a large number of them.

Table “Retention periods for accounting documents in an organization”

| Document from Landscape Design LLC | Shelf life according to the list |

| Certificates of work performed under contracts for core activities | Within 5 years after the end of the term for which the contract was concluded |

| Treaties and additional agreements thereto | Within 5 years after expiration (unless otherwise specified in specific items of the list) |

| Powers of attorney for receiving money and goods and materials | At least 5 years after the expiration of the power of attorney or its revocation |

| Statements for the issuance of salaries, benefits, financial assistance and other payments | At least 6 years (from 02/18/2020, previously the period was 5 years) In the absence of personal accounts: 50 years - if the documents were completed after 01/01/2003; 75 years old - if documents were completed before 01/01/2003 |

| Register of information on the income of individuals | At least 5 years (from 02/18/2020, previously the period was 75 years) |

| Employment contracts and personal cards of employees | No less than: 50 years - if the documents were completed after 01/01/2003; 75 years old - if documents were completed before 01/01/2003 |

| Time sheets, working time logs | At least 5 years (at least 75 years under dangerous, difficult and harmful working conditions) |

| Information about the income of individuals | At least 5 years In the absence of personal accounts: 50 years - if the documents were completed after 01/01/2003; 75 years old - if documents were completed before 01/01/2003 |

| Annual accounting (financial) statements | Constantly* |

| Accounting policies, chart of accounts, forms of primary accounting documents | At least 5 years |

| General ledger, turnover sheets, account cards, etc. | At least 5 years |

| Fixed asset accounting cards | At least 5 years after disposal of the object |

| Declarations (calculations) for all types of taxes | At least 5 years |

| Calculations for insurance premiums (annual and quarterly) | 50 / 75 years |

| Information submitted to the Pension Fund for individual (personalized) accounting | At least 5 years, in electronic form - 75 years |

| Reporting to statistics: – annual and more frequently, one-time; – semi-annual and quarterly; – monthly – ten-day, weekly | - Constantly*. – 5 years or permanently* in the absence of annual ones. – 3 years or constantly* in the absence of annual, semi-annual, quarterly. - 1 year |

| Correspondence about penalties and fines imposed on the company | At least 5 years |

Do not ignore the * sign in the table. It means that the document must be kept for the entire time the company operates.

All documentation indicated in the table directly or indirectly relates to accounting, therefore, the chief accountant of Landscape Design LLC increased the periods exceeding the 5-year storage period provided for by Law No. 402-FZ to the limits indicated in the list.

Considering that the company has not yet celebrated its 5th anniversary since the start of work, none of the documents presented in the table can be destroyed. To clear out the paper-cluttered premises, the accounting department allocated a special office, where they placed documents awaiting expiration.

See also “The Ministry of Finance reminded how long primary materials need to be stored.”

For more information about the storage periods for tax documentation, documents on insurance premiums, including accident insurance premiums, see the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

WE PUT ELECTRONIC DOCUMENTS IN ACCOUNT IN THE ARCHIVE

Traditionally, in the archive, all cases received from departments are entered into accounting documents - archival inventories.

For electronic files, special inventories are provided, the forms of which are given in the 2015 Rules:

- inventory of electronic files and permanent storage documents (Appendix No. 17);

- inventory of electronic files and documents with temporary (over 10 years) storage periods (Appendix No. 18).

Please note: there is no inventory of electronic personnel files. All personnel matters are kept in paper form, and this will probably continue for a long time.

How to fill out an archival inventory. Archival inventories of electronic files and documents are filled out according to the same rules as inventories of ordinary paper files. The only difference is that instead of the number of sheets of the case, the number of megabytes of memory that it occupies is indicated. In addition, “volumes” are practically excluded in electronic files, unless it is such a voluminous file that it had to be recorded on several media.

Example 6 shows a sample of filling out an inventory of electronic files and documents with temporary (over 10 years) storage periods. The inventory of electronic files for permanent storage is compiled in the same way, the only difference is that it does not contain the “Storage period” column.

The inventory form (table) does not differ from that filled out by structural units when transferring electronic documents to the archive (see Example 3). The difference is that Example 6 presents an annual section of the inventory of electronic files and documents, general for the organization. The archivist will use it to collect all documents submitted by the departments. Pay attention to Example 6: the inventory includes, among others, the documents that were indicated in Example 3.

Appendices 17 and 18 to the 2015 Rules also have appendices that are similar in form to internal inventories of electronic files (see Example 4). In practice, this means that the archivist does not need to re-compile these “internal inventories” for each case. It is enough to ensure that colleagues from other departments pass them on when submitting their documents to the archive.

Nuances of accounting for storage periods of accounting documentation

In the practical activities of Landscape Design LLC, there were cases of selling fixed assets at a loss. For the purposes of accounting and tax accounting for fixed assets, the same documents are used. The difference lies only in the recognition of expenses associated with their disposal. This fact must also be taken into account when determining the storage period for documents.

For example, 2 years ago the company purchased a VAZ-21102 car (OKOF code 15 3410010). Based on the fact that, according to the classification of the fixed asset, it belongs to the 3rd depreciation group, the useful life (USI) was set at 5 years. Due to constant breakdowns, it was decided to sell the car at any price offered. The proceeds from the sale turned out to be less than the residual value of the property, and the loss from the sale according to tax accounting standards for 3 years (the remaining SPI) will be evenly taken into account when calculating income tax.

IMPORTANT! The nuances of tax accounting for losses from the sale of fixed assets are reflected in clause 3 of Art. 268 Tax Code of the Russian Federation.

Read about the specifics of grouping expenses for tax accounting purposes in this material .

Thus, all documents related to the formation of the initial and residual value, the term of the joint venture investment, contracts and acts of sale, as well as certificates and calculations for accounting for losses from the sale of fixed assets must be preserved for at least 4 years after the end of inclusion of the specified loss in the tax base . This is due to the fact that during an audit, tax authorities have the right to examine documents for the 3 years preceding the audit. Thus, documents on the specified fixed asset will have to be stored for at least 9 years.

The case considered is not the only one where the storage period for documents is extended. In the next section we will present other situations.

Determining the shelf life of delivery notes and invoices in non-standard situations

If the right to deduction is used later

The right to deduct tax is valid for three years after the end of the period for receiving the invoice. If the company decides to exercise its right later, then the storage periods are shifted, since the four-year storage period of the s/f begins to count from the end of the period in which the refundable VAT is included in the declaration.

For example, if the company received goods in the second quarter. 2016, and VAT on them was deducted in the II quarter. 2022, then the beginning of the storage period for c/f and invoices for tax purposes is shifted by one year.

If the s/f is received later than the goods with the invoice

If goods with an accompanying invoice are received in one period, and an invoice for them is received later in another period, then the shelf life is shifted. Moreover, not only the storage period of the s/f is shifted, but also the invoice used as the basis for confirming the acceptance of values for accounting.

If materials are received according to the invoice, but not paid for

In this case, a debt arises that can be written off after three years due to the expiration of the statute of limitations. The invoice must be stored for 4 years. from the end of the limitation period, a total of 7 years.

If an act of reconciliation with the debt specified in it is drawn up annually with the counterparty, which is signed by both parties, then the three-year limitation period begins to count anew from the moment of signing this act. Accordingly, the storage period for the invoice and invoice confirming this debt is shifted.

If the reconciliation act is signed annually, then the limitation period will constantly shift, and at the same time, the end period for the need to store documents will be postponed every year. In this case, the storage period can increase indefinitely, and storage of the invoice must be ensured by both the buyer and the seller.

Other cases of increasing the shelf life of primary products

If Landscape Design LLC operated with a loss, and then took it into account when calculating income tax, the documents would have to be kept for the entire period of transferring the loss plus 4 years after it was completely written off. In this case, it is impossible to get rid of either the primary document confirming the loss received, or other certificates and calculations on the basis of which this loss was transferred.

For example, accounting and tax documents for a loss received in 2022 and taken into account over the next 10 years will have to be stored until the end of 2035.

Read more about the nuances of accounting for losses in the article “How and for what period can losses be carried forward?” .

The storage period for accounting documents will also have to be increased in the following case. Landscape Design LLC provided services to a customer who did not promptly pay for the work performed and did not respond to letters and complaints. The company was not excluded from the state register, but did not repay its debt. Landscape Design LLC was able to take into account bad receivables only in 2022, and all documents of the organization related to this situation will have to be stored until the end of 2026.

Supporting documents

The FSBU introduces the concept of a supporting document. It is understood as a document containing information about a fact of economic life, on the basis of which mandatory details are included in the primary accounting document. It is assumed that, unlike the primary accounting document, the source document is not intended to document the fact of economic life for accounting purposes and therefore may not contain all the mandatory details inherent in the primary accounting document.

Examples of supporting documents are contracts, cash receipts, invoices for payment, judicial acts, etc. The FSB provides that if the supporting document served as the basis for the formation of a primary accounting document, then information about the specified supporting document will need to be included in the primary accounting document.

Results

Invoices, certificates of work performed, salary payment statements, reports - taxpayers are required to keep these and many other accounting documents for the periods established by a special list. These terms cannot be reduced, but in some cases they have to be increased (when carrying forward losses, writing off bad receivables, selling fixed assets at a loss).

Sources:

- Federal Law of December 6, 2011 No. 402-FZ

- Order of Rosarkhiv dated December 20, 2019 No. 236

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

An example of determining the shelf life of delivery notes and invoices

In the third quarter 2016 The company received a delivery note and an invoice from the seller. According to the invoice, the company received goods that were delivered to the receipt in the same period. Based on the s/f, the added tax on these values in the same quarter is sent for deduction, and the s/f itself is entered using a registration entry in the purchase book.

Sales of income received in the third quarter. valuables were produced in the next IV quarter, their value in the IV quarter. included in tax expenses.

| Document | Storage period | The number from which the period is calculated | Last day of the storage period |

| Invoice | 4g. from the end of the quarter in which the tax was deducted | 01.10.2016 | 30.09.2022 |

| Consignment note, when used as a basis document for accepting valuables for accounting and confirming the presence of the right to deduct tax | 4g. from the end of the quarter in which the tax was deducted | 01.10.2016 | 30.09.2022 |

| Consignment note, when used as a basis document to confirm the value of the value of valuables for inclusion in tax expenses | 4g. from the end of the year in which this cost is included in tax expenses | 01.01.2017 | 31.12.2022 |

| Consignment note used as a primary document for accounting purposes | 5l. from the end of the year in which the received values are delivered to the parish | 01.01.2017 | 31.12.2022 |

Thus, if the period is unambiguously determined by the invoice, then for the delivery note you need to choose the longest period. In this example, the last day of the storage period for c/f is 09/30/2022, for the invoice – 12/31/2022.

Organization of archival storage of electronic documents

The introduction of EDI has proven its feasibility in practice. Its formation saves employees time, allows you to keep documentation in proper condition and quickly retrieve them from the storage facility. Paper archives consisting of countless folders are a thing of the past. EDI is gradually growing, while the regulatory framework is becoming outdated. Company owners have to be guided by the Rules established by the Order of the Ministry of Culture of the Russian Federation in 2015.