What's new in payroll in 2022 was provided for in 2022

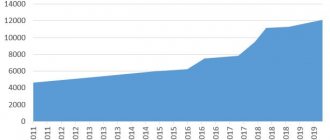

An important role in changes in wage calculation in 2022 is played by the established minimum wage.

This figure is revised annually, in general cases upward. For 2022, the federal minimum wage is set at 12,130 rubles. Regional authorities have the right to approve their own sizes, but they are not lower than the federal value. Thus, each individual, within the framework of an employment contract, provided that the monthly working hours are fully worked out, cannot receive a monthly salary of less than 12,130 rubles. This figure will also be needed to calculate and pay benefits for temporary disability, maternity and others.

As for insurance premiums calculated from wages, the values of the maximum bases for 2022 have been updated:

- for contributions to VNiM - 912,000 rubles, if this threshold is exceeded, contributions stop accruing;

- for contributions to compulsory pension insurance - 1,292,000 rubles; if this limit is exceeded during the year, in the remaining months, contributions to pension insurance are calculated based on a rate of 10% instead of the standard 22%.

For 2022, salary indexation is provided for most categories of public sector employees: employees of the Ministry of Internal Affairs, military personnel, medical workers, and teachers.

Calculation and taxation of wages in 2022: answers to questions from 1C:Lecture hall listeners

On March 17, 2022, the next lecture in the 1C:Consulting series “Topical issues of calculating salary taxation in 2022” was held at 1C:Lecture Hall. Application of 1C:ZUP.

A video recording of the lecture and answers to questions is available for viewing by users: ITS PROF, ITS Construction, ITS Medicine, ITS Budget PROF.

Lecturer - Elena Arnoldovna Kadysh, methodologist at 1C, author of 1C: Consulting seminars on payroll accounting and taxation, numerous books and manuals in the 1C: Accounting and Tax Consulting series, answered questions from students asked when registering for the lecture.

As of 01/01/2021, there was a debit balance on account 69.01 in the amount of 1934 rubles. (expenses from the Social Insurance Fund slightly exceeded accruals). In connection with the transition to direct payments from the Social Insurance Fund, how can these funds be counted against the 2022 payments for insurance premiums to the Social Insurance Fund?

As of January 1, 2022, excess expenses will no longer be offset against 2022 contributions. In this case, you must apply for a refund to the FSS office with an application. The list of documents that must be provided was approved by order of the Ministry of Health and Social Development dated December 4, 2009 No. 951n (with amendments and additions):

- written statement from the policyholder;

- reference-calculation;

- copies of documents confirming the validity and correctness of compulsory social insurance expenses.

The employee's work schedule is two every two, ten-hour work shift. Wages are hourly. The employee is employed at 0.75 times the salary, that is, he works 7.5 hours. In February, the cost per hour according to the tariff turned out to be less than the cost per hour based on the minimum wage. How to correctly reflect the additional payment up to the minimum wage in the 1C program?

The procedure for setting up the calculation of additional payments up to the minimum wage is described in detail on 1C:ITS. In order to adapt the described mechanism for your case, we will analyze the legal requirements regarding establishing the obligation to pay wages not lower than the minimum wage.

According to Art. 133 of the Labor Code of the Russian Federation, the monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (job duties) cannot be lower than the minimum wage. Normal working hours cannot exceed 40 hours per week (established by Article 91 of the Labor Code of the Russian Federation). In the case of summarized recording of working hours, the duration of working hours for the accounting period (month, quarter and other periods) should not exceed the normal number of working hours. The accounting period cannot exceed one year, and for recording the working time of workers engaged in work with harmful and (or) dangerous working conditions - three months.

Thus, comparison with the minimum wage in this case is carried out not with the hourly tariff rate, but with the amount of payment for a fully worked month. The employee remuneration system is taken into account in the “Calculation base” indicator. Also, in the accrual calculation formula, instead of the indicators “TimeInDays” and “NormaDays”, “TimeInHours” and “NormaHours” will be required. The indicator “Share of Part-time Working Time” (in your case 0.75) is determined from the employee’s personnel documents (0.75 rate).

Reduced insurance premiums – micro-enterprise enters the affected industry. How are zero tariffs applied to subsequent declarations?

In connection with the pandemic, in 2022, to support business, reduced tariffs were introduced for medium and small enterprises (Federal Law No. 102-FZ of April 1, 2022), and for those included in the list of affected industries, Federal Law No. 172- The Federal Law has granted the right not to pay insurance premiums for April, May, June 2022.

This support measure applied to the following categories of legal entities and individual entrepreneurs (employers):

- SMEs and non-profit organizations operating in the most affected industries;

- socially oriented non-profit organizations;

- religious organizations.

However, this right did not mean the abolition of the obligation to provide a calculation of insurance premiums. The procedure for filling out the Calculation for the first half of 2022 in the case of applying a “zero” tariff was explained by letter of the Federal Tax Service of Russia dated 06/09/2020 No. BS-4-11 / [email protected] Starting with the Calculation of insurance premiums for 9 months. 2022, these SMEs have the right to apply a reduced rate of insurance premiums, provided for in paragraphs. 17 clause 1 art. 427 Tax Code of the Russian Federation.

With regard to the subsequent reflection of the offset of zero contributions in the Calculation of insurance premiums, it should be noted that the Calculation form did not and does not contain indicators reflecting the amount of contributions paid. If an organization had the right to apply a “zero” tariff, and it transferred contributions during the second quarter of 2022, it was necessary to submit a Calculation for the first half of 2022, completed in accordance with the explanations given in the above letter. In this case, the tax authority reflects the overpayment on the payer’s personal account, and in subsequent periods it will be automatically taken into account against the payment of contributions.

How does the 6-NDFL report in 2022 reflect personal income tax at a rate of 15% on income exceeding 5 million rubles?

The legislation does not provide for separate rules for reflecting data on income and tax at a rate of 15% in 6-NDFL. However, due to the fact that field 010 of Section 1 indicates the BCC through which the withheld tax is transferred, there should be as many sheets of Section 1 as the BCC was used to transfer the withheld tax in the reporting period. For the transfer of personal income tax at a rate of 15%, a separate BCC is provided; therefore, the amount of tax calculated at a rate of 15% is reflected on a separate sheet of Section 1 6-NDFL.

With regard to Section 2, the order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11 / [email protected] directly states (clause 4.2) that if a tax agent paid individuals during the tax period (reporting period) income taxed under different rates, Section 2 is completed for each tax rate.

I am interested in personal income tax reporting for a separate division located in Murmansk.

Regardless of the region, the procedure for generating personal income tax reporting for a separate division is regulated by:

- Tax Code of the Russian Federation,

- By Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

The procedure for filling out 6-NDFL for separate divisions in ZUP ed. 3.1 is described on 1C:ITS.

Please tell us about the changes in personal income tax (Federal Law dated February 17, 2021 No. 8-FZ). It says that we must separately take into account the total amount of 5 million for each type of income: salary and dividends. But then the tax office will still retain the difference, why can’t they immediately be considered the total mass?

Calculation of personal income tax by “total weight” contradicts the requirements of the law. The final calculation of the taxpayer's obligations to pay personal income tax for the tax period (year) is made by the tax authority. The tax agent is obliged to calculate personal income tax on a progressive scale separately for each tax base and separately from other tax agents.

When the correct calculation of personal income tax of 15% is implemented, the base should be calculated not by income categories, but by all income categories related to the “main base”. Now he calculates the base for each income category separately.

The calculation of personal income tax at a rate of 15% is carried out taking into account the current legal requirements. According to clause 2.1 of Art. 210 of the Tax Code of the Russian Federation, a set of tax bases in respect of which the tax rate provided for in paragraph 1 of Art. 224 of this Code, includes the following tax bases, each of which is determined in relation to the income of individuals - tax residents of the Russian Federation separately

:

1) the tax base for income from equity participation (including income in the form of dividends paid to a foreign organization on shares (stakes) of a Russian organization recognized as reflected by the taxpayer in the tax return as part of income);

2) the tax base for income in the form of winnings received by gambling participants and lottery participants;

3) the tax base for income from transactions with securities and transactions with derivative financial instruments;

4) the tax base for repo transactions, the object of which are securities;

5) tax base for securities lending transactions;

6) the tax base for income received by participants of the investment partnership;

7) the tax base for transactions with securities and for transactions with derivative financial instruments accounted for in an individual investment account;

tax base for income in the form of amounts of profit of a controlled foreign company (including fixed profit of a controlled foreign company);

9) tax base for other

income in respect of which the tax rate provided for in paragraph 1 of Article 224 of this Code is applied (

main tax base

).

How to submit information to the tax office about the impossibility of withholding tax (NDFL) from an employee for 2022 (in 2022)? The employee was fired in March 2022. How to show this in the 6-NDFL report? Should 6-NDFL be shown in current reports for the first quarter of 2022 or only for 2022 as part of the annual reporting?

According to clause 1.18 of the order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11 / [email protected] , information on the income of individuals of the expired tax period and the amounts of tax calculated, withheld and transferred to the budget system of the Russian Federation, and information about the impossibility withhold tax, the amounts of income from which tax was not withheld, and the amount of unwithheld tax are presented as part of the Calculation in the form of a Certificate. In turn, Certificates as part of the 6-NDFL report are submitted to the tax authority only at the end of the tax period - as part of the annual report.

Consequently, in current 6-NDFL reports for the first quarter of 2022, information about the impossibility of withholding tax is not provided, even if the employee is fired during the first quarter of 2022.

Does it mean that due to the combination of reporting 2-NDFL and 6-NDFL, recalculation of property deductions brought in the second quarter of 2021 can only be made starting from April 1, 2021? After all, now personalized reporting will be sent to the tax office on a quarterly basis.

Regardless of the frequency of reporting, the tax period for personal income tax is one year. Therefore, all calculations and recalculations for the purposes of calculating personal income tax are carried out on an accrual basis from the beginning of the year.

“Personalized” personal income tax reporting is included in the 6-NDFL report only for the year.

Thus, when an employee provides a Notification of the right to a property deduction during 2022, the employer - tax agent is obliged to recalculate personal income tax from the beginning of the tax period specified in the Notification.

How to accrue dividends to the founder in 1C ZUP 8.3? When accrued by the “Dividends” document, personal income tax calculated and withheld from an amount exceeding 5 million rubles is not reflected at a rate of 15% in tax registers and in reports 2-NDFL, 6-NDFL, or is reflected incorrectly.

In accordance with the provisions of the Tax Code of the Russian Federation, taking into account the amendments made by Federal Law No. 8-FZ of February 17, 2021, income from equity participation, including dividends, represents a separate tax base to which a progressive personal income tax scale is applied.

In the 1C:ZUP program ed. 3.1 document details become visible automatically when the obligation to apply a progressive scale arises. The visibility of details is configured in the organization's accounting policy. In this case, the “Perform calculations on a progressive scale” checkbox is checked automatically when the tax base exceeds the threshold of 5 million rubles.

Document Dividends

it looks like this:

In 6-NDFL for the first quarter of 2022, the accrual of dividends carried out in March is reflected in Section 2 as follows. The tax base in full is reflected in the sheet of Section 1 under BCC 18210102010011000110, corresponding to personal income tax at a rate of 13%:

According to the BCC, corresponding to personal income tax at a rate of 15%, only the amount of tax is reflected:

This filling is due to the fact that the Tax Code of the Russian Federation provides for the distribution of the tax amount according to the BCC, while the tax base is not divided into parts.

In Section 1, the amount of withheld tax is also reflected separately for each of the BCCs as of March 30, 2021, since the “Dividends” document indicates March 29, 2021 as the date of payment of income:

If in the future there are official clarifications that do not correspond to the algorithm for filling out the 6-NDFL report described here, the algorithm will be promptly adjusted by the program developers.

Is the personal income tax benefit for a child provided until the end of the year in which he turns 18, or only until the month of the year in which he turns 18?

Until the end of the year (last paragraph of paragraph 1 of Article 218 of the Tax Code of the Russian Federation).

Is it necessary to withhold personal income tax and from what amount should the calculation be made when issuing an interest-free loan issued to an employee from the cash desk of an LLC?

The procedure for calculating material benefits subject to personal income tax received from savings on interest is regulated by clause 2 of Art. 212 of the Tax Code of the Russian Federation. According to these provisions, yes, it is necessary, from the amount of excess interest calculated based on 2/3 of the current refinancing rate established by the Central Bank of the Russian Federation on the date the taxpayer actually received income, over the amount of interest calculated based on the terms of the agreement.

In the new form 6-NDFL, the second section in line 112 does not include income under codes 2300, 2012. But it does appear in line 110. What is the reason for this? Or is this a bug in the program?

According to clause 4.2 of the order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11 / [email protected] , line 112 reflects the amount of accrued income under employment agreements (contracts) generalized for all individuals. As of today, there are no official clarifications regarding what specific income codes are recognized as income under employment contracts.

The filling of line 112 can be justified as follows. Income codes 2300 and 2012 reflect guarantees provided for by the legislation of the Russian Federation, and not payments under employment contracts. The obligation to make payments under these codes does not depend on the provisions of the employment contract.

However, it should be borne in mind that official clarifications are expected in the future regarding the procedure for generating 6-NDFL report indicators. If the legislator’s point of view on this issue differs from the currently existing filling algorithm provided in “salary” products, the algorithm will be promptly adjusted. We recommend updating the configuration promptly.

The bonus was accrued and paid on December 31, 2020 (personal income tax was also transferred on December 31, 2020). The bonus amount was not included in the 6-NDFL report for the fourth quarter of 2022, since the deadline for transferring personal income tax was 01/11/2021.

1. Should the amount of transferred personal income tax be included in section 1 of the new 6-NDFL report for the first quarter of 2022 for lines 021 and 022 with the date of personal income tax transfer 01/11/2021?

2. Should the amount of the accrued bonus be included in section 2 of the new 6-NDFL report in line 112?

- Yes, unless it was reflected in Section 2 of 6-NDFL for 2020 “forcibly”, by adjusting the report “manually”. This is due to the fact that the deadline established by the Tax Code of the Russian Federation for the transfer of such tax is 01/11/2021, that is, a date within the first quarter of 2022, and not the fourth quarter of 2022.

- This amount is not included in Section 2 of the new 6-NDFL report, since it reflects those incomes that occurred already in 2021, and the personal income tax calculated on these incomes.

Is it possible to conclude a fixed-term employment contract for a period of more than 1 year (up to 3 years) on the basis of Art. 59 Labor Code of the Russian Federation? By agreement of the parties, a fixed-term employment contract can be concluded with persons entering work for employers - small businesses (including individual entrepreneurs), the number of employees of which does not exceed 35 people.

If we are talking about concluding a fixed-term employment contract, in accordance with Part 2 of Art. 59 of the Labor Code of the Russian Federation (by agreement of the parties by a small business entity), then, according to Art. 58 of the Labor Code of the Russian Federation, the term of such an agreement cannot exceed five years (clause 2 of Article 58 of the Labor Code of the Russian Federation). Therefore, if all conditions are met, concluding a fixed-term employment contract for 3 years is possible.

Vacation is transferable from one month to another. As ZUP calculates by month, Accounting calculates everything in one month (the first). When applying reduced tariffs for NSR subjects, total differences are obtained. Which option is correct?

Auditor's response to ITS.

Insurance premiums must be calculated in the month in which vacation pay was accrued. This is exactly what happens in 1C:ZUP ed. 3.1. The breakdown of the same amounts of vacation payments by month of validity is necessary for their correct reflection in accounting and tax accounting for corporate income tax purposes. No amount differences arise in this case.

Personal income tax on gifts over 4,000 rubles. transferred the next day. In f. 6-NDFL for the first quarter of 2022 there is no transfer date for gifts the next day. According to income code 4800, transfers must be made the next day to f. 6-NDFL.

In order for the withholding of personal income tax on gifts to employees to be reflected correctly in the program, you must complete the following settings.

In the Settings - Payroll

You must select

the Gifts and prizes given to employees

.

As a result, in the Salary

in the group

see also

a hyperlink

Prizes, gifts

. The hyperlink takes you to the list of relevant documents, with the help of which the program registers the fact of issuing a prize or gift in kind to an employee (list of employees), its value, and also calculates personal income tax.

The document also indicates other signs of this income (whether the income is included in the deduction base for writs of execution, whether it is provided for in the employment contract, etc.).

The date of transfer of personal income tax when filling out form 6-NDFL is the next business day after the date specified in the document field Date of issue

.

Please note that the income code in the case of issuing gifts is not 4800, but 2720 (Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected] “On approval of codes for types of income and deductions”).

In the certificate ref. “Appendix No. 1 to the order of the Ministry of Labor and Social Protection of the Russian Federation dated April 30, 2013 No. 182n as amended. orders of the Ministry of Labor and Social Protection of the Russian Federation dated November 15, 2016 No. 648n, dated January 9, 2022 No. 1n” from 01/01/2021 additional leave for the Chernobyl NPP is reflected, until 01/01/2021 the leave was not reflected and is not reflected. Based on what regulatory act?

It is not entirely clear where exactly in the Certificate for calculating benefits additional leave for citizens affected by the Chernobyl accident is reflected or not, and whether we are talking about leave paid from the Federal budget, or leave provided and paid for by the employer. In any case, setting up the program and the procedure for reflecting such leave in it is described in detail on 1C:ITS.

In December 2022, the employee was given an advance, and she brought sick leave according to the BIR, and then went on maternity leave. Released in February 2022. Is it possible, with the consent of the employee, to withhold an unpaid advance payment after more than three years?

According to the requirements of Art. 137 of the Labor Code of the Russian Federation, deductions from an employee’s salary are made only in cases provided for by this Code and other federal laws.

Deductions from an employee’s salary to pay off his debt to the employer may be made to reimburse an unpaid advance issued to the employee on account of wages no later than one month from the date of expiration of the period established for the return of the advance, repayment of debt or incorrectly calculated payments, and provided that the employee does not dispute the grounds and amounts of the withholding.

Since provided for in Art. 137 of the Labor Code of the Russian Federation, the deadline has expired, we can only talk about the voluntary return of the unearned advance. To avoid disputes with regulatory authorities, it is better not to withhold an overpaid advance, but to invite the employee to voluntarily deposit the appropriate amount into the organization’s cash desk.

together with its partners, invites everyone to face-to-face seminars and webinars in the 1C:Consulting series - “Accounting and taxation of wages in state and municipal institutions in 2022 using 1C: Salaries and personnel of a government institution.”

Registration

What salary calculation changes have been planned since March 18, 2020

Initially, a nationwide vote for the bill on amendments to the Constitution of the Russian Federation was planned for April 22, 2022. Wednesday, April 22, was supposed to be a non-working day so that everyone could come and express their opinion on amending the basic law or vote against it.

The president was supposed to sign the decree declaring this date a day off on March 18, the day of Crimea’s annexation to Russia. In this case, it would turn out that April 22, 2022 is a paid day off. The payment procedure would depend on what system the employee works on - salary or another. The norm of working days according to the production calendar would decrease; employers would have to pay employees for this day at double the rate.

In the final version, the president signed the decree on March 17, but the fight against the coronavirus epidemic in Russia that unfolded at the end of March made adjustments and instead of one day off, the country first received a week, and then a whole month of non-working days. How these changes affected wages will be discussed in the next section.

What changes in payroll in 2022 resulted from measures to combat coronavirus?

On March 25, 2022, the Russian president, as one of the measures to combat the spread of the new disease, declared the days from March 30 to April 3 non-working. On this issue, the Ministry of Labor and Social Protection issued a letter dated March 26, 2020 No. 14-4/10/P-2696, in which it explained the work procedure during this period, as well as the new rules for calculating wages in 2022 for March and April and transferring vacations, falling within this period:

- The presence of additionally established non-working days is not a basis for reducing employee salaries.

- Piece workers must be paid remuneration for the specified non-working days in accordance with current local regulations.

- If an employee is on vacation, the specified non-working days are not included in the number of vacation days and the vacation is not extended for these days.

- Payments to employees who continue to perform work functions should not be made at an increased rate for these days, since they are not weekends or holidays.

- Issues regarding the continuation or termination of work carried out on a rotational basis are regulated by agreement of the parties to the employment contract.

In addition, the letter contains a list of organizations that are not subject to the presidential decree establishing non-working days. This list was then supplemented by the department’s letter dated March 27, 2020 No. 14-4/10/P-2741.

On April 2, the president’s second address related to coronavirus infection took place. In it, he called for extending the period of non-working days until April 30. Further, non-working days were extended until May 11, 2022.

To learn about the deadlines for paying taxes and paying wages due to coronavirus, read the following articles:

- “Is it possible to defer taxes due to coronavirus?”;

- “When should wages be paid in April 2020”;

- “Salaries in May due to holidays are issued according to special rules.”

ConsultantPlus experts have prepared a review “Non-working weeks: what to do as a personnel officer and accountant.” If you have access to K+, skip ahead to this review. If you don't have access, get it for free for a trial period.

Obligation to increase to the new minimum wage

From January 1, 2022, accountants must apply Order No. 561n of the Ministry of Labor of Russia dated August 09, 2019, which established the cost of living per capita and for the main socio-demographic groups in the Russian Federation as a whole for the second quarter of 2019.

That is, you need to increase your salary if it does not reach the new minimum wage. And the indicated value now serves as the main guideline for him.

KEEP IN MIND

The minimum wage from 01/01/2020 increased by 7.5% - from 11,280 rubles. up to 12,130 rub.

For more information about this, see “The new minimum wage from 2020: what it affects and how employers can apply it.”

Paying wages below the federal minimum wage/minimum wage in the region is a violation of labor laws. Why parts 6 and 7 art. 5.27 of the Code of Administrative Offenses of the Russian Federation provides for administrative liability.

This is also the basis for:

- unscheduled inspection by the labor inspectorate (paragraph 4, part 7, article 360 of the Labor Code of the Russian Federation);

- summons to the commission for the legalization of the tax base and the base for insurance premiums (letter of the Federal Tax Service dated July 25, 2017 No. ED-4-15/14490).

How to calculate salaries according to the new rules in 2022 for March and April

The procedure for calculating wages for non-working days in March-April 2022 depends on whether these days were actually non-working days for a particular organization or whether it was included in the list of exceptions provided for by presidential decrees and letters from the Ministry of Labor.

Let's try to make a new calculation of wages from 2022 for employees of an organization for which March 30 and 31 were non-working days.

Salary calculation for a salaryman

According to the Ministry of Labor, the salary for March should be paid in full to a salaryman if he worked all days from March 1 to March 27. If the salary consists not only of salary, then it will be necessary to take into account all permanent bonuses for non-working days on March 30 and 31 in the same way as if the person went to work on these days.

Example:

The employee's salary is 42,000 rubles. The person worked 19 working days in full in March. March 30 and 31 became non-working days for the organization. You need to calculate accrued wages.

Salary accruals: RUB 42,000. / 21 workers days × 19 work. days = 38,000 rub.

Salary for days not worked: 42,000 rubles. / 21 workers days × 2 non-working hours days = 4000 rub.

For March you need to credit 38,000 + 4,000 = 42,000 rubles.

Calculation of wages for a piece worker

The Ministry of Labor left the issue of remuneration for piece workers for non-working days on March 30 and 31 to employers. However, here you need to understand that for a fully worked month, the salary cannot be less than the minimum wage. Thus, payment to piece workers for non-working days can be calculated either in the amount of earnings for production according to the norm, or average earnings, or the daily part of the minimum wage.

Example:

According to the norm, a piece worker produces 30 products per day for 50 rubles, his earnings per shift are 1,500 rubles. For 19 working days in March, he will be credited with 28,500 rubles. It is necessary to calculate the accrual options for non-working March 30 and 31.

- Payment from earnings for production according to the norm

For two missed shifts, March 30 and 31, the pieceworker will receive less than 1,500 rubles. × 2 non-working hours days = 3,000 rub. The payment amount will be 3,000 rubles.

- Payment from the daily part of the minimum wage

The region has not established the value of its own minimum wage, so you need to rely on the federal minimum wage, i.e. 12,130 rubles. For two shifts on March 30 and 31, the piece worker must be charged 12,130 rubles. / 21 workers days × 2 non-working hours days = 1155.24 rub.

As you can see, the first option is more profitable for the employee and less for the employer, since there was no production, and more money needs to be paid.

In general cases, this issue is regulated by local regulations or labor/collective agreements, i.e. payment is made in accordance with their provisions.

ConsultantPlus experts told us everything about an employer’s responsibilities in connection with the coronavirus outbreak. If you do not have access to the system, register for free and proceed to the instructions.

How to calculate salary using formula

The Labor Code does not establish rules for calculating parts of the salary, but referring to the explanations of the Ministry of Labor, we can conclude that the calculation of the first part includes not only the salary, but also all allowances and additional payments established for the employee. The monthly amount is distributed in proportion to the days worked.

To calculate the advance:

- The number of days worked in this part of the month is determined. If the employee was on vacation or sick leave, then these days are not taken into account in the calculation.

- Take into account all charges. This includes salary, bonuses, additional payments, including for the additional amount of work that was established this month, night shifts, etc. Using only the salary amount for calculation will entail the imposition of fines on the employer.

The following accruals are not taken into account when generating the advance calculation:

- A monthly bonus, which is awarded based on the results of work for the month.

- Payments that are of an incentive nature based on the results of work for the month.

The formula for calculating wages for the period that the employee actually worked in the current month is as follows:

(Salary + Additional payments and allowances + Bonus payments) / Number of working days in a month × Days worked

For each monthly payment, the accounting department calculates deductions, minus which the amount will be given to the employee. The standard deduction is personal income tax, amounting to 13% of income. Additionally, amounts for writs of execution and trade union dues can be deducted from the salary.

Bonus payments can be established after the first payment of earnings due. Then they will be calculated in the usual way and the second payment, the so-called final payment for the month, will be the difference between the calculated salary for the entire month using the bonus and the first payment (usually called an advance).

Will there be a new wage system in 2022?

Officials do not plan to introduce any new wage system. They are currently developing a bill on a new labor regime - part-time remote employment.

The meaning of this regime is that the employee will be able to combine work on the employer’s premises with remote work. Currently, you can only choose one of these options in an employment contract.

In the context of the fight against coronavirus infection, the issue of the new regime is more acute than ever, because many employees have been transferred to remote work, but for one reason or another are required to attend the office. Legislators propose to formulate all the main points concerning this regime in a new article of the labor code “Temporary remote work”.

What changes are expected in salary payments in 2022

In June 2022, changes are also expected in salary payments. When making payments to employees, the accountant will have to fill out field 20. Previously, it was not required to fill it out when transferring salaries.

Here are the designations of the new codes in salary payments for 2020 with a breakdown:

- 1 - payment of wages, remuneration under civil and personal agreements, vacation pay and other income from which it is possible to collect debts;

- 2 - transfer of child benefits, travel allowances and other funds from which debts cannot be collected;

- 3—transfer of amounts of compensation for damage to health and compensation from the budget to persons affected by radiation and man-made disasters, from whom it is allowed to collect only alimony for minor children or compensation for loss of a breadwinner.

Based on the entered value, banks and bailiffs will understand whether or not it is possible to make deductions from the transferred funds.

Results

In 2022, various changes in the calculation and calculation of wages have already occurred and will continue to occur. Some of them were planned in advance: an increase in the minimum wage, indexation of salaries of budget workers and maximum limits on the bases for insurance premiums. Accountants will begin processing salary payments in a new way from June 2022. They will have to enter the value of the required code in field 20, which previously remained empty for the specified translations.

However, most of the changes are related to the implementation of measures to combat the coronavirus pandemic. The end of March, April and the beginning of May suddenly became non-working days, but employers are required to pay for these days. The Ministry of Labor explains how to calculate the standard working time, transfer vacation days and pay for the transaction. The development of a bill on the introduction of a new working regime related to the combination of office work and remote work has also accelerated.

To ease the tax burden, the government has provided the opportunity for small and medium-sized businesses to calculate insurance premiums on a portion of the income accrued to employees at reduced rates.

All this will undoubtedly affect the work of HR and accounting specialists. We monitor and report on all innovations online.

Sources:

- Labor Code

- tax code

- Decree of the Government of the Russian Federation dated April 2, 2020 No. 409 “On measures to ensure sustainable economic development”

- Decree of the President of the Russian Federation dated March 17, 2020 No. 188 (as amended on March 25, 2020) “On the appointment of an all-Russian vote on the issue of approving amendments to the Constitution of the Russian Federation”

- Decree of the President of the Russian Federation dated March 25, 2020 No. 206 “On declaring non-working days in the Russian Federation”

- Decree of the President of the Russian Federation dated April 2, 2020 No. 239 “On measures to ensure the sanitary and epidemiological well-being of the population on the territory of the Russian Federation in connection with the spread of the new coronavirus infection (COVID-19)”

- letter of the Ministry of Labor of Russia dated March 26, 2020 No. 14-4/10/P-2696 “On sending Recommendations to employees and employers in connection with Decree of the President of the Russian Federation dated March 25, 2020 No. 206”

- letter of the Ministry of Labor of Russia dated March 27, 2020 No. 14-4/10/P-2741 “On supplementing Recommendations for employees and employers in connection with Decree of the President of the Russian Federation dated March 25, 2020 No. 206”

- Directive of the Bank of Russia dated October 14, 2019 No. 5286-U “On the procedure for indicating the code of the type of income in orders for the transfer of funds”

- Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Let's sum it up

- With the advent of 2022, a number of new rules related to the calculation, payment of salaries, as well as reporting on them, come into force.

- The main innovation of 2020 in terms of wages is associated with an increase in the federal minimum wage, which affects both the level of minimum possible earnings and the amount of social benefits that depend on this indicator.

- When calculating wages in 2022, you will also have to focus on new rules for remuneration of women working in rural areas, an updated list of income exempt from personal income tax, and the transfer of days off established only for this year.

- Employers who have employees from whose income deductions are made under a writ of execution, from June 2022 will have to include additional information about the payment type code and about deductions made from income in documents sent to the bank for transfers to such persons.

- For statistical reporting forms containing information on salaries, updated forms have been used since 2020.