Basics of mediation relationships

In economic activity involving an intermediary, there are three participants.

The first is a person who sells or purchases goods (work, services) with the involvement of an intermediary, the second is a third-party supplier or buyer, the third is an intermediary between them. Russian legislation contains three legal forms for carrying out intermediary activities: 1) commission agreement (Chapter 51 of the Civil Code of the Russian Federation), the principal attracts a commission agent; 2) agency agreement (Chapter 52 of the Civil Code of the Russian Federation), the principal attracts an agent;

3) contract of agency (Chapter 49 of the Civil Code of the Russian Federation), the principal engages an attorney.

The intermediary (commission agent, agent, attorney) undertakes, for a fee, to carry out legal and other actions (transactions) on behalf of the principal (principal, principal) on behalf of the principal (principal, principal) on his own behalf, but at the expense of the principal (principal, principal) or on behalf and at the expense of the principal (principal) , principal).

An activity that is intermediary in economic content can be formalized in an agreement containing other terms (for example, the attorney is named “Executor”). If business transactions must be reflected in the accounting registers on their merits (paragraph 5 of clause 6 of PBU 1/2008 “Accounting Policy of the Organization”, approved by Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 N 106n), then the rules for filling out invoices, maintaining purchase books and sales books (approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137) include the exact names:

- agent and commission agent in the Rules for filling out an invoice (Appendices N1 and N2 to Resolution N1137) and the rules for maintaining a purchase book (Appendix N4);

- commission agents (agents, attorneys) in the rules for maintaining a sales book (Appendix N5).

According to the author, in order to avoid claims from tax authorities when re-invoicing VAT by an intermediary, when concluding an agreement, you should use the names established by the Civil Code of Russia.

I would also like to draw your attention to the overbilling by the landlord of utility costs and the cost of electricity to the tenant when renting out premises. Essentially, the lessor acts as an intermediary between the tenant and energy supply organizations, however, contracts with these organizations, as a rule, are concluded by the lessor before concluding a transaction with the tenant. Consequently, the same condition of all three types of intermediary agreements specified in the Civil Code of the Russian Federation is not met (Articles 971, 990, 1005 of the Civil Code of the Russian Federation): the action of an intermediary on behalf of the principal (principal, principal). Thus, the extension of the rules approved for commission, agency and commission agreements to compensate for the landlord’s expenses, in the author’s opinion, does not comply with the law.

The intermediary issues invoices for his own remuneration (including payment in advance by deduction from the amounts received for the principal, principal, principal) in the usual manner, which is not discussed in this article.

The person engaging the intermediary is hereinafter referred to as the “principal”.

Reissue an invoice - what needs to be done for this?

Over-invoicing is a very common practice in legal relations between individuals and legal entities. This article discusses this issue in detail. Often in commercial activities situations arise when a third party pays for goods or services provided by one enterprise, and the transaction is concluded thanks to the active participation of intermediaries. It is in such situations that the re-invoicing procedure is initiated.

Why is overbilling practiced?

The legislation does not establish the procedure for re-invoicing and deducting VAT in such situations. Therefore, managers of various organizations are increasingly asking the question: Can the so-called input VAT on the transactions in question be taken into account? In most examples, this ability is determined by the way in which rebilling transactions are documented.

Accountant at work

The following questions should be clarified:

- Does the agreement indicate the need to reimburse costs including VAT?

- Which party should be responsible for accounting for expenses?

- On what basis will invoices be issued?

To reduce the likelihood of claims from authorized regulatory organizations, you need to be aware of certain nuances that are important for each party involved in the transaction.

As an example, consider a lease agreement. In accordance with Art. 606 of the Civil Code of the Russian Federation, according to the drawn up agreement, the owner of the premises must present a residential property to his tenant for operation.

The property must always be in good condition; repairs are carried out at the expense of the lessor.

The most common example in which a re-invoicing procedure can be initiated is through intermediary transactions. When considering such an example, we can make the assumption that such a transport company, on its own behalf, but at the expense of the customer, is capable of providing cargo transportation services for a certain fee.

In such a situation, agents have an obligation to provide reports to the principals under the conditions provided for in a specific agreement. If the agreement is missing certain conditions, the agent will have to draw up a report on the progress of fulfilling the conditions specified in the drawn up agreement.

How are invoices reissued correctly?

In accordance with generally accepted rules, certain evidence of expenses incurred by the agent at the expense of the customer must be attached to the agent's reporting. This rule is discussed in paragraphs. 1.2 tbsp. 1008 of the Civil Code of the Russian Federation. All possible situations that arise in the process of issuing and recording invoices by the parties involved in drawing up an intermediary agreement are indicated in the Rules for maintaining lists of provided invoices, databases with purchases and sales in the process of VAT calculations, described in the current resolution of 02.12. 2000 No. 914.

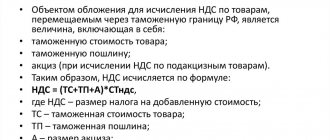

Situation 1. Purchase of goods on behalf of an intermediary at the expense of the principal

The principal instructs the intermediary on his own behalf, but at the expense of the principal, to find a suitable supplier and agree on the supply of goods (works, services) for the principal.

Invoices received by the intermediary from the supplier:

- are subject to registration by the intermediary in part 2 of the journal for recording the issuance of received and issued invoices (clauses 10, 11 of the Rules for maintaining a journal for recording received and issued invoices used in VAT calculations (hereinafter referred to as the journal keeping rules), approved by Resolution N 1137 );

- are not subject to inclusion in the intermediary’s purchase book, since he does not have the right to deduct (clause “d”, clause 19 of the Rules for maintaining the purchase book (hereinafter referred to as the rules for maintaining the purchase book), approved by Resolution No. 1137);

- must be copied, and copies must be certified and transferred to the principal (clause “a”, clause 15 of the journal keeping rules);

- reissued by the intermediary in the name of the principal.

Table 1. Information indicated by the intermediary in the invoice reissued in the name of the principal

| Invoice Line | Line filling order |

| Line 1 (number and date) | Serial number in accordance with the individual chronology of the intermediary Date of the invoice issued by the seller in the name of the intermediary (clause “a”, clause 1 of the rules for filling out an invoice used in VAT calculations (hereinafter referred to as the rules for filling out an invoice), approved by Decree of the Government of the Russian Federation of November 26, 2011 N1137) |

| Line 2 (seller) | Information about the seller who entered into an agreement with the intermediary: full or abbreviated name of the organization (clause “c” of paragraph 1 of the rules for filling out an invoice) |

| Line 2a (seller's address) | Location of the third-party supplier (paragraph “d”, paragraph 1 of the rules for filling out an invoice) |

| Line 2b (TIN and KPP of the seller) | TIN and KPP of a third-party seller (clause “d”, clause 1 of the rules for filling out an invoice) |

| Line 4 (consignee and his address) | Full or abbreviated name of the consignee (Principal) (clause “g”, clause 1 of the rules for filling out an invoice) |

| Line 5 (details of the payment document) | Numbers and dates of payment and settlement documents for the transfer of funds from the intermediary to a third-party supplier and from the principal to the intermediary (clause "h" clause 1 of the rules for filling out an invoice) |

| Line 6 (buyer) | Full or abbreviated name of the buyer (principal) (clauses “and” clause 1 of the rules for filling out an invoice) |

Re-issued invoices from the intermediary:

- are subject to registration in part 1 of the journal of received and issued invoices (clause 7 of the journal rules);

- are not subject to inclusion in the sales book, since the intermediary does not have an obligation to charge VAT (clause 3 of the Rules for maintaining the sales book (hereinafter referred to as the rules for maintaining the sales book), approved by Resolution No. 1137).

Reissued invoice received from the intermediary:

- the principal registers in part 2 of the journal for recording the issuance of received and issued invoices (clause 11 of the journal rules) and in the purchase book.

The principal is obliged for four years to keep copies of invoices (including adjustments, corrected ones) received by the principals on paper, issued by the seller of goods to the intermediary when purchasing goods for the principal, and transferred by the intermediary to the principal, duly certified by the intermediary for four years.

If the seller issues invoices (including adjustments, corrected ones) in electronic form, the principal must store invoices issued by the seller of the specified goods to the intermediary, received by the intermediary and transferred by the intermediary to the principal in electronic form (clause 13, paragraph “a” clause 15 of the journaling rules). A similar procedure for issuing a re-issued invoice is provided if the contract provides for prepayment when purchasing goods (works, services).

Features of re-issuance of invoices when purchasing products

If products are purchased for a principal, the procedure for creating invoices will be different:

- The SF in the name of the agent is issued by the supplier.

- The document is registered in the sales book.

- The agent enters the account in the second part of the SF accounting journal.

- The agent, on his own behalf, fills out the SF with the same meanings addressed to the principal. The “seller” line records the actual supplier.

- The agent enters the SF in part 1 of the accounting journal.

The last step is the registration by the principal of the SF previously issued by the agent. A purchase ledger is used for registration.

If an agent makes purchases (purchases goods, pays for work or services) for several principals at once and receives a common invoice for the purchase he made, then when re-issuing it needs to be “sorted”. Each specific principal should receive not a single list, but an invoice relating only to his order. This requirement is stated in the letter of the Federal Tax Service No. GD-4-3 / [email protected] dated April 18, 2014.

If the agent has received from sellers for the same principal several invoices of the same date, he is allowed to combine them into a single one when reissuing. In this case, all data must be given using the “;” sign. This is permitted in paragraphs. “c” clause 1 of the Rules for filling out an invoice, approved by Government Decree No. 1137 of December 26, 2011.

Situation 3. Sale of goods of the principal on behalf of the intermediary

The principal instructs the intermediary to sell the principal’s goods (works, services) to third parties on his own behalf.

Operations for sales through an intermediary on one’s own behalf are formalized by two invoices.

1. Intermediary:

- registers the invoice issued by him in the name of a third-party buyer upon shipment of goods in part 1 of the log of received and issued invoices (clause 7 of the journal rules);

- does not make an entry in the sales book, since the goods belong to the principal and the intermediary does not have an obligation to charge VAT (clause 20 of the rules for maintaining the sales book);

- informs the principal of the invoice indicators for re-invoicing by the principal on his behalf.

The obligations for the intermediary to provide the principal with certified copies of invoices issued by the intermediary to the buyer, as well as for the principal to store such copies, are not provided for by Resolution No. 1137 (Letter of the Ministry of Finance of the Russian Federation dated July 27, 2012 No. 03-07-09/92).

2. The principal, having received the indicators of the invoice issued by the intermediary, re-issues the invoice in the name of the third-party buyer and registers it in part 1 of the log of received and issued invoices and in the sales book (clause 7 of the journal rules, clause 20 of the rules maintaining a sales book).

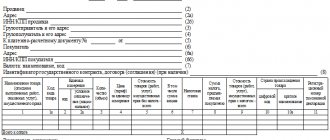

Table 2. Information indicated in the invoice reissued by the principal in the name of the buyer

| Invoice Line | Line filling order |

| Line 1 (number and date) | Serial number in accordance with the individual chronology of the principal Date of the invoice issued by the intermediary in the name of a third-party buyer (clause “a”, clause 1 of the rules for filling out an invoice used for VAT calculations (hereinafter referred to as the rules for filling out an invoice |

| Line 2 (seller) | Information about the principal: full or abbreviated name of the organization (clause “c” of clause 1 of the rules for filling out an invoice) |

| Line 2a (seller's address) | Location of the principal (clause "d" clause 1 of the rules for filling out an invoice) |

| Line 2b (TIN and KPP of the seller) | INN and KPP of the principal (paragraph “e”, paragraph 1 of the rules for filling out an invoice) |

| Line 3(shipper) | Full or abbreviated name and postal address of the shipper (intermediary), if delivery is not carried out from the warehouse of the seller (principal); if delivery is carried out from the warehouse of the seller (principal), an entry is made “he” (clause “e”, clause 1 of the rules for filling out an invoice) |

| Line 5 (details of the payment document) | Numbers and dates of payment and settlement documents for the transfer of funds from the buyer to the intermediary and from the intermediary to the principal (clause “h” of clause 1 of the rules for filling out an invoice is similar to the case of purchasing goods (works, services) through an intermediary) |

| Line 6 (buyer) | Full or abbreviated name of the actual buyer (and not the intermediary) (clauses “and” clause 1 of the rules for filling out an invoice, Letter of the Ministry of Finance of the Russian Federation dated May 10, 2012 N 03-07-09/47) |

Having received a re-issued invoice from the principal (which indicates the date of the intermediary’s original invoice), the intermediary registers it in part 2 of the journal for recording received and issued invoices (clause 11 of the journal rules).

In this case, the intermediary does not make an entry in the purchase book (clause “c” of clause 19 of the rules for maintaining a purchase book). The principal must accrue VAT for payment in the period when the intermediary sold the goods to a third-party buyer (clause 1, clause 1, article 167 of the Tax Code of the Russian Federation). If the intermediary reports the shipment in the next period, the principal is obliged to draw up an additional sheet of the sales book and submit an updated VAT return.

A similar procedure for issuing a re-issued invoice is provided if the contract provides for prepayment when purchasing goods (works, services).

The author considers the disputes regarding the moment of determining the tax base when transferring goods to commission by moving them to the warehouse of the commission agent for sale to the buyer from the warehouse of the commission agent to be completed from the moment the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation of May 30, 2014 No. 33 came into force. “16. The provisions of Article 167 of the Tax Code of the Russian Federation do not provide for special rules regarding the moment of determining the tax base for the sale of goods (work, services) with the involvement of third parties on the basis of agency agreements, commissions, and agency agreements. Consequently, the taxpayer is obliged to determine the tax base according to the rules of Article 167 of the Tax Code of the Russian Federation even in the case when it sells goods (work, services) with the participation of an attorney (commission agent, agent), ensuring for these purposes timely receipt of documents from the attorney (commission agent, agent) confirmed data on the completion of operations for the shipment (transfer) of goods (works, services) and their payment.”

How can I correctly re-invoice?

An invoice for payment is a document that the seller of goods or services gives to the buyer so that, using his details, the client can pay for the goods or services received or make an advance payment.

This paper indicates the exact details of both companies (seller and buyer), their name and address. In addition, the date of preparation and the title of the document must be indicated.

Why is this necessary?

The invoice may be reissued in the case when the document is issued to one person, and another person will pay for it. This is permissible in the following cases:

- When the legal entity purchasing the product or service is a representative of another company. In this case, the invoice comes to the name of the trustee, who in turn must reissue it to the principal.

- As part of the commission agreement. In this case, the paper is first submitted for payment to the commission agent, and after payment he forwards it to the committent.

- Within the scope of the rental agreement.

In these cases, the invoice must be reissued to another person (individual or legal).

How to do it?

In order to redirect a document, it is necessary that the contract contains a column indicating that another company can make payment for the company. Without this column, this action is impossible.

The thing is that if this is not stated in the agreement, there is simply no one to redirect the account to.

The operating principle of selling goods through an intermediary:

- If the sale of products occurs through an intermediary, he indicates himself in the invoice for payment and draws up two copies of the document. One copy is given to the buyer, the second remains with him.

- The intermediary indicates his copy in the accounting journal, but does not register it in the sales book.

- He must also make a copy of it and send it to the customer.

- The customer receives a copy of the document and issues an invoice to the intermediary, which in turn is recorded in the accounting journal, but is not recorded in the purchase book.

- At the conclusion of the transaction, the intermediary gives the customer an invoice for the amount of remuneration for the transaction.

- After this, the customer records it in the purchase book.

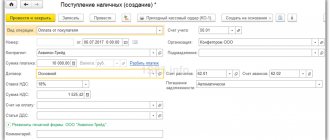

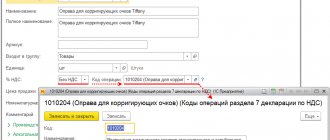

To learn how to generate a consolidated invoice for an intermediary in the 1C program, watch the following video:

Accounting entries in this case are indicated on account 76: first, the intermediary puts funds from the buyer as receipts, then he puts the same funds as expenses, transferring them to the customer.

The main thing in re-invoicing is to indicate in the contract that the costs or income from the transaction are transferred to another company.

znaydelo.ru

Reissue of invoices under an agency agreement

So, the agent must re-register the sales contract when he executes the order of the customer, acting on his own behalf, thereby acquiring the rights and obligations of a participant in the transaction (Article 1005 of the Civil Code of the Russian Federation), including the right to register the sales contract as a person making sales (Article 1005 of the Civil Code of the Russian Federation), 169 of the Tax Code of the Russian Federation). Therefore, according to the Rules for maintaining the accounting journal of the Federation Council, approved. By Government Decree No. 1137 of December 26, 2011, the agent, having received the SF issued in his own name from the supplier, is obliged to:

redirect a certified copy of the SF to the customer-principal;

re-expose this SF to the principal, preserving as much as possible all the data in it, but changing some of them:

— in line 1, the agent leaves the date of registration of the sales contract by the seller, but assigns the number according to his own accounting chronology;

— in lines 2, 2a and 2b, records the data of the seller, not the intermediary (if he acts as a supplier);

— in line 5, the agent indicates the details of payment orders for the transfer of funds to him by the customer (for purchases), as well as the details of payment orders for payment of supplies to sellers;

— lines 6, 6a and 6b record the details of the actual buyer, i.e. principal.

In an invoice issued by an intermediary on his own behalf, it is not prohibited to indicate additional information about himself or the completed transaction. In this case, the sequence of lines and details in the document cannot be disrupted.

The SF is endorsed by the head and chief accountant of the intermediary company. If the agent is a businessman, then he signs, supporting the data from the certificate of state registration of the individual entrepreneur.

Please note that during the process of re-issuing invoices under an agency agreement, neither received nor reissued invoices are registered with the agent in the purchase or sales book. Information about them is entered only in the log of issued/received SF. If the agent does not have the obligation to submit a VAT return to the Federal Tax Service, then at the end of the reporting quarter, before the 20th day, he will have to submit this journal to the tax authorities for verification (clause 5.2 of Article 174 of the Tax Code of the Russian Federation). Tax intermediaries transfer information on agency activities from the journal to the VAT return, which they submit to the Federal Tax Service.

Thus, reissued invoices under an agency agreement are a procedure initiated as part of business transactions with the participation of an intermediary, when services/goods are actually supplied to one company, but are intended and paid for by another.

Procedure for completing the transaction

- Company A sends a letter to its debtor (company B) with a request to cover its debt to another company (company B) to pay off its debt.

- Company B, based on the letter, transfers funds to the main creditor - company B.

- Company B sends a copy of the executed payment order to Company A, to which it had a debt.

A letter of guarantee for payment for another organization and a payment order with the appropriate mark must be kept in the company that paid off someone else's debt. The main debtor must also have supporting documents on hand (a copy of the letter and a copy of the payment), since without them he bears certain risks. Unscrupulous entrepreneurs may begin to collect funds paid from the main debtor, citing an erroneous payment. And then he will have to pay off his debt to the creditor himself.