Deadlines for transferring tax deductions First, let’s look at the time frame after submitting a set of documents

How to return an overpayment of overpaid taxes If an organization or individual entrepreneur has identified a fact

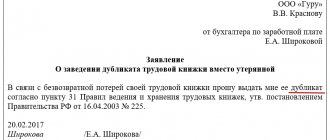

Rules for the maintenance and storage of work records In accordance with current legislation, the work book is included in

Who should buy a work patent Citizens of other states coming to work in the Russian Federation

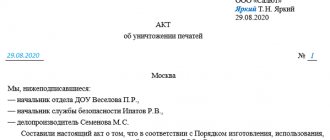

How to draw up an Act on the Destruction of the Seal and Stamp in 2022 As for registration,

First, about the pleasant things Spoiler: there is less paperwork. Cash limit for Organizations and Individual Entrepreneurs –

About vacation and deductions According to the rules of the Labor Code of the Russian Federation, the right to vacation for the first year

In the 1C Accounting 8.3 program, the calculation of income tax and tax under the simplified tax system is automated

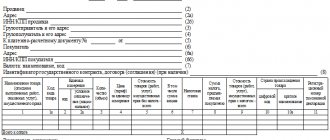

Mandatory details of invoices Mandatory details of invoices are determined by several paragraphs of Art. 169 Tax Code of the Russian Federation: p.

Reasons for refusing the simplified tax system Why they refuse: Termination of activity. In this case, the liquidation procedure is practically