General rules for payments on sick leave

When determining the order of payments, you need to take into account the general conditions. They will be relevant when paying sick leave on two sheets. Consider these conditions:

- The amount of payments is calculated based on the employee’s total income for 2 years, regardless of which company the person worked for previously.

- If two sick days were incurred during the same period, only one of them will be paid.

- The employer is obliged to compensate only the first three days of illness of the employee. Everything else is reimbursed from the Social Insurance Fund.

That is, even if the sick leave period is significantly extended due to the second certificate of incapacity for work, the employer is obliged to pay only the first three days.

How is sick leave paid for part-time work in 2022?

How the part-time worker’s sick leave is paid in 2022 depends on the place where the part-time worker was employed in the 2 years preceding the year of incapacity.

It may turn out that he worked: 1. For the same employers as in the year when he went on sick leave.

2. With other employers, not those for whom he works in the year he went on sick leave.

3. With the same employers, but also had other jobs.

Paying sick leave to a part-time worker has its own peculiarities in each case. First of all, from the point of view of determining the employer who is obliged to provide compensation to the employee for certificates of incapacity for work.

For information on the rules for applying for a job on an external part-time basis, read the article “How to properly apply for an external part-time job?” .

If you have an internal part-time worker, then you can calculate and pay sick leave for such an employee using a Ready-made solution from ConsultantPlus. To see explanations, get a trial access to K+. It's free.

Is it legal to have two certificates of incapacity for work?

In what cases do two leaves appear? Let's look at an example. An employee went on sick leave due to a work-related injury. During his period of incapacity, he caught a cold and consulted a therapist. Accordingly, 2 certificates of incapacity for work appeared. Also, two documents are issued if an employee is on sick leave due to the illness of his child, but falls ill himself.

That is, this is a completely standard ordinary situation. Therefore, if an employee has provided two certificates of incapacity for work, it is completely unlawful to accuse him of forgery or fraud.

Features of payment for two sick leaves

Let's consider the features of payments in different circumstances:

| Circumstances | Payout Features |

| The duration of the second certificate of incapacity for work is included in the validity period of the first document. | Payment is made based on the first certificate of incapacity for work. |

| The situation is similar to the first example, however, the employee’s total length of service, on the basis of which the calculation is made, has changed. | Payments under a previously issued document are made before the start date of the second one. Payment is made based on previous experience. Then payments are made on the second certificate of incapacity for work. Payment is made based on new length of service. |

| The validity periods of the documents do not overlap each other. That is, the action of the second sheet ends later than the completion of the first document. For example, the first certificate of incapacity for work is valid until February 1, and the second – from January 29 to February 5. | First, payments are made under the first document before the second one comes into effect. Then payments are made on the second certificate of incapacity for work. |

Payments for only one certificate of incapacity for work are possible only if the deadlines for the documents completely overlap. In addition, both sheets must provide for payments on the same basis. In all other cases, payment is made according to both documents.

Topic: Number of days on sick leave at employer expense

Payment of sick leave at the expense of the employer Therefore, if the second certificate of incapacity for work issued to an employee by an outpatient clinic from April 26 to April 30, 2021 is primary, then sick days (April 26, 27 and 30) are paid at the expense of the employer. If such a sheet is marked “continued” and indicates the number and series of the previous certificate of incapacity for work issued by the hospital (from April 16 to April 25, 2022), then it is paid for from the Social Insurance Fund for temporary disability.

- determination of average daily earnings 700,000 / 731 = 957.59 rubles;

- then the amount due for child care is deducted 957.59 * 10 = 9,575.90 rubles;

- after this you need to determine the amount that comes with the subtraction of 50%: 957.59 * 4 * 50% = 1,915.18 rubles;

- in the end, you need to deduct the amount for the remaining days due to illness 957.59 * 6 = 5,745.54 rubles;

- Next, you need to get the total amount of all calculations: 5,745.54 + 1,915.18 rubles + 9,575.90 = 17,236.62 rubles.

Payment according to sheets issued in different calendar periods

What is meant by certificates of incapacity for work issued in different calendar periods? Let's look at an example. One document was issued at the end of the year, and the other at the beginning of the year. This situation involves differences in billing periods. Consequently, the size of average earnings, which is the basis for calculations, changes. For sheets issued in 2016, the years 2014 and 2015 are taken as the calculation period. For sheets issued in 2022, 2015 and 2016 are taken as the calculation period. Let's consider the features of payment for such sick leave:

- If the payment for the second certificate of incapacity for work is greater, payments under the document must be made in full. In this case, the expiration date of the first certificate of incapacity for work is not taken into account.

- If the payment for the second document is less, payment of the first sheet is made before the end of the calendar period, payment of the second - after the end of the first one.

If discrepancies are found during the calculation process, payment is made according to the sheet with the highest allowance. That is, all discrepancies are interpreted in favor of the employee.

How to pay benefits in this case?

If an employee of an enterprise provides 2 bulletins, which partially overlap in terms of validity, then initially it is necessary to make payment for the first of them. This issue is regulated by Articles 7 and 8 of Federal Law No. 165 of 1999 and Article 6 of Federal Law No. 255 of 2006.

In this case, all calendar days included in the period of validity of the first sick leave are paid. The second document is payable directly from the day following the date on which the first sick leave was closed. The period of sick leave is paid in a single amount.

Benefits cannot be paid two or more times in one period. The employee himself can choose the sheet to be paid, taking into account the benefits for himself.

For various diseases

Is it possible to take more than one certificate of incapacity for work for different diseases? The man suffered a broken arm. With this problem, he went to the trauma center, where he received the corresponding document. During treatment for a broken arm, the same person fell ill with pneumonia and, having gone to another clinic, received a second bulletin.

As a result, the employee ended up with 2 sick leave certificates, the validity periods of which partially overlap. Since they were issued for different diagnoses, we are talking about different insurance cases.

Periods overlap

In such situations, it is necessary to initially pay benefits for all calendar days during which the first sick leave notice was in effect.

Reference: accrual on the second sheet is calculated from the calendar day following the closing day of the first.

Moreover, in the case where the reason for opening the second sheet was an injury or illness of the employee himself, the first 3 days on such a sheet are paid directly by the employer himself.

Starting from the fourth day after the first sheet is closed, benefits are paid using FSS funds. This procedure is clearly regulated by Federal Law No. 255.

If the validity period of the second ballot overlaps with the first, the employee’s benefit is paid exclusively according to the first document. However, there are exceptions to these general rules.

At the time of issuance of the second bulletin, the threshold insurance period increased

There are cases when, at the time of opening the second sick leave, the threshold value of the employee’s insurance period (6 months, 5 or 8 years) is exceeded, which entails an increase in the amount of benefits. In this case, the initial document is paid only until the opening date of the second .

The second one is paid in full, based on the increased insurance period, that is, in an increased amount. In this case, the period of overlapping two sick leaves one on top of the other is paid exclusively on the second sheet, taking into account the increased insurance period.

The initial sheet moves from one calendar year to another

The opening of the first sick leave was completed at the end of this year, and the second - in the first days of the next. This means that the calculation periods, and at the same time the amount of average earnings on which the benefit paid is calculated, will be different for the two sick leaves.

For example, when the initial sheet is opened in December 2022, the calculation period for benefits for it will be 2016 and 2022. According to the second sheet, which was opened in early January 2022, the years 2022 and 2022 will be taken into account.

If the average earnings on which the benefit for the first sheet is calculated is greater than for the second, first the entire calendar period of the first sick leave is paid and only then does payment begin for the second document.

If the situation is the opposite, then the initial certificate of temporary disability is paid only until the opening date of the second one. The latter is paid in full. The benefit is paid in full for the sick leave for which the pay period contains more earnings.

Second paper received during child care bulletin

During the crossing period, only 1 sick leave is still paid ; if the second sick leave lasts longer than the first, payment will be made for the remaining time. For example, from October 1 to October 5, my mother had one sick leave to care for her child, but on the 4th of this month she fell ill herself and took out sick leave for herself until October 10.

In this case, the first 5 days of sick leave will be paid for child care (according to the rules for calculating benefits in this case), and the days from October 6 to October 10 will be paid for the employee’s illness, taking into account the length of service. If the benefit for the first sick leave in connection with child care is less than the benefit for the second sick leave due to the illness of the employee himself, compensation must be made according to the second ballot.

Important: when choosing which of two simultaneous sick leaves to pay for, they always focus on the benefit of the employee. The benefit is calculated at the higher value after appropriate calculations.

Two certificates of incapacity for work: for illness of a child and illness of an employee

Payments are made after the end of the sick leave period. If another certificate of incapacity for work is in force at this time, the amount of the benefit may be changed. Both certificates of incapacity for work are sent to the accounting department.

Let's look at an example. An employee’s child falls ill, which is why the first one goes on sick leave. According to the law, from the 11th day of sick leave, benefits are accrued in the amount of 50% of the original amount. However, if on the 11th day there is a second sheet issued on a different basis, all payments are made on it.

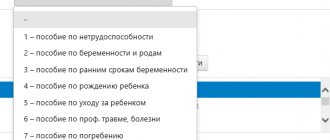

Certificate of incapacity for work issued during leave under the BiR

What to do if an employee is on maternity leave and presents the employer with a second certificate of incapacity for work on another basis? Let's consider all situations:

| Sheet validity period | Payment procedure |

| Incapacity for work due to illness ends on the date preceding the rest period under the BiR. | Sick leave must be paid in full on a general basis. |

| The sickness sheet overlaps the B&R sheet. | The employee independently determines which document she will receive benefits from. |

| The sheet was issued when the employee was on leave under the BiR. | Payment for a certificate issued due to illness is not carried out. |

The employer must take all these rules into account. If he does not pay sick leave when he should, the employee can go to court.

Nuances associated with two sick leaves

Let's consider various features associated with two certificates of incapacity for work:

- If both children fall ill at the same time, one sick leave certificate is issued for the entire period. If one of the children recovers earlier, the document must be extended for one child.

- If an error is made on one of the certificates of incapacity for work, this cannot be grounds for refusal to pay benefits.

- If one of the sheets does not indicate the reason for disability, the document is returned to the employee. The employee must contact the medical institution to get a code.

- If a person violated the hospital regime, a corresponding mark is placed on the sheet. From the date of violation of the regime, restrictions on payments are introduced. The amount accrued per day is equal to the minimum wage divided by the number of days in the month.

- Both sick leaves must be sent to the accounting department no later than 6 months from the end of the period of incapacity for work.

Important! If any controversial issues arise that are not regulated by law, you can act on the basis of local acts.

Two sick leaves in a row - is it possible to issue them?

Russian legislation ensures the protection of the rights of all workers and provides them with a certain package of social guarantees. In particular, every employer on the territory of the Russian Federation is obliged to ensure the payment of contributions to the Social Insurance Fund for its employees in the event of their temporary disability. At the same time, for such periods, employees are released from work by issuing a sick leave, which subsequently entitles them to receive compensation for the time they are absent from the workplace.

In addition to compensation, the amount of which ranges from 60 to 100% of average earnings, sick leave also ensures that the worker retains his job and position, with the exception of cases of an excessively long illness, in which the question may arise about the presence of permanent disability by the employee and, accordingly, assignment to such worker with a disability group.

In general, the process of obtaining sick leave is quite simple:

- An employee who feels unable to carry out work duties consults a doctor, undergoes diagnostics, and, if the fact of temporary incapacity due to illness is confirmed, opens a sick leave certificate from the doctor.

- The worker complies with the doctor’s instructions and treatment and, if necessary, extends the sick leave if the ability to work has not been restored within the initial period established by the doctor.

- Upon restoration of working capacity and the end of a specific illness or healing of an injury, the worker returns to work and presents the employer with a sick leave certificate.

- The employer pays for sick leave for the employee and receives compensation for the money spent from the Social Insurance Fund. However, the first three days of each sick leave must be paid by the employer themselves.

Both HR specialists and ordinary employees have a question: could a situation arise when two sick leaves are issued in a row or simultaneously? This situation may indeed arise. For example, a person broke his leg, received sick leave, and by the time it ended, he fell ill with bronchitis. Since this is a completely different reason for disability, he needs to issue another sick leave. And in this situation, additional questions arise related to the procedure for registering several sick leaves in a row.

It is not necessary to go to work for at least a day when taking out two sick leaves in a row. One document can be opened during the validity of the second, including - the period of one sick leave may be fully included in the validity of another. This is not prohibited by law and will in no way interfere with receiving legal payments.

What should an employee do if the employer does not accept second sick leave?

If the employer does not accept the second sick leave, the employee should take into account that the reason for this is most likely simple ignorance of the laws. Therefore, at the first stage, it makes sense to familiarize the manager with the regulations. However, if the employer deliberately violates the law, you should contact the labor inspectorate. However, you need to consider the disadvantages of this step:

- The need to collect documentary evidence of the offense, and this is not always possible.

- Long wait for a solution to the problem.

- There is no guarantee of results.

Therefore, before contacting the labor inspectorate, you need to think about whether the benefit from a positive outcome of the case is sufficient to take the risk.