Reasons for refusing the simplified tax system

Why they refuse:

- Termination of activities. In this case, the liquidation procedure is practically no different from the general system and includes the implementation of all the necessary stages, including the preparation of an interim liquidation balance sheet.

- Transition to another tax regime. A change in the tax regime occurs on the basis of a voluntary decision of the taxpayer or due to forced circumstances.

Reasons for voluntary refusal:

- buyers (customers) who provide the largest turnover of the company are VAT payers. Cooperation with a simplified counterparty becomes unprofitable for them due to the impossibility of refunding tax amounts;

- next year it is planned to open branches or increase staff;

- Individual entrepreneurs switch to the regime for the self-employed (used in some regions of Russia).

Forced refusal occurs due to exceeding the maximum amount of revenue or other criteria, compliance with which is mandatory under the simplified tax system. In all cases, it is necessary to notify the tax authorities of the change in regime.

Sample notification of the choice of the Federal Tax Service for personal income tax payment

Now let's fill out the notification using an example.

Example

LLC "Confectioner" has two separate divisions located on the territory of one municipal formation of the city of Moscow. The main enterprise is registered with the Federal Tax Service Inspectorate No. 20, one division is registered with the Federal Tax Service Inspectorate No. 19, and the other is registered with the Federal Tax Service Inspectorate No. 18.

The company, taking into account the latest changes in legislation (clause 7 of article 226, clause 2 of article 230 of the Tax Code of the Russian Federation), from 01/01/2020 decided to submit reports and pay personal income tax through tax inspectorate No. 19. The Federal Tax Service Inspectorate No. 19 must be notified about this with a notice of choice tax authority for personal income tax.

Filling out the first page of the personal income tax notice

Fill out the second page of the personal income tax notice

Sample notification of choosing a tax authority for personal income tax

How to notify the tax office

In case of a voluntary transition, a notification to the tax service must be submitted no later than January 15 of the year in which the transition is planned. If you decide to change the regime later than this period, the transition is possible only next year. The recommended form of notification is 26.2-3 (Order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected] ). Submission of a tax return payable in connection with the application of the simplified system and payment of the tax is carried out within the usual deadlines:

- for organizations - no later than March 31 of the year following the expired tax period;

- for individual entrepreneurs - no later than April 30 of the year following the expired tax period.

In case of termination of an activity in respect of which the simplification was applied, it is necessary to submit a notification within 15 working days after the relevant decision is made.

Required documents

In order to take advantage of the benefit provided by law, the owner of the property must notify the Federal Tax Service of his right and provide supporting documents. The basis for selecting an object for tax exemption is an application from a citizen, filled out on a standard form in strict accordance with the approved format.

For each of the preferential categories, it is required to submit documents confirming its civil status. When applying for a pensioner's benefit, attach a copy of the pension certificate.

If a citizen entitled to tax exemption has already provided documents to confirm the benefit, re-submission of the package of documents will not be required. If the benefit has not previously been applied, the tax officer will recalculate the tax only after the citizen provides documents.

According to the latest changes in relation to property tax, adopted in 2022, an individual entitled to a benefit can choose the property that will be exempt from taxation. Notification of selected tax objects occurs by writing a statement by the owner of the property.

This document is filled out according to the sample and submitted no later than November 1 of the year for which the tax will be calculated. Thus, in order to receive the correct calculation taking into account the implementation of the benefit, it is necessary to contact the tax office in a timely manner.

In the absence of notification from the property owner, the tax officer will select the exempt object at his own discretion. The application form was approved by a separate letter from the Federal Tax Service BS-4-11/ [email protected] in 2022. Despite the fact that the notification form is only recommended, filling out the form according to the proposed format will eliminate the need to compose the text yourself and rewrite it if the specified information is insufficient.

Procedure for termination of activities

The procedure for terminating activities under the simplified tax system is divided into several stages:

- Decision-making.

- Submission of notification in the appropriate form. It must be completed manually or in a machine-readable manner. The document is provided in person, transmitted via telecommunications channels or sent by registered mail.

- Filing reports and paying taxes.

Risks of refusing the simplified tax system

It is necessary to analyze current turnover, sources of replenishment of working capital and the reliability of counterparties. It is advisable to request the following documents from existing and potential buyers (customers):

- copies of tax returns and financial statements for the last reporting period;

- a certificate of the status of settlements with the budget;

- certificate of turnover on the current account.

In addition, it should be clarified whether the main suppliers are VAT payers. If you work with companies that use special regimes, VAT refunds are impossible, which means that the point of refusing simplification is lost.

In what cases is the notification not completed?

The notice is not filled out:

- upon liquidation;

- during the planned transition to OSNO or another special regime for those types of activities that are subject to a single tax under the simplified tax system;

- if the established criteria for simplification are exceeded (forced refusal).

How to use?

The exercise of the right to a benefit is carried out in accordance with paragraphs 3-4 of Art. 407 NK. Regardless of the number of reasons for tax exemption, every citizen has the right to take advantage of the exemption for one object of his choice. However, at the regional level, other additional benefits are possible that provide an additional reduction in the amount of tax paid.

The procedure for applying regional benefits and the grounds for use are approved in paragraph 2 of Art. 399 NK.

Federal legislation does not extend the list of benefits for real estate with a cadastral value of three hundred million rubles or more, as well as real estate of organizations, the tax on which is determined based on the total cadastral price. This case concerns premises in shopping and administrative complexes, as well as these entire objects.

What to do with overpaid taxes

The resulting surplus is returned to the taxpayer or counted against other tax payments. Taxpayers dispose of overpayments as follows:

- take into account excess funds against future payments for this type of tax or fee;

- return the overpayment to the taxpayer’s bank account;

- offset the overpayment against debts on other tax obligations;

- are calculated for existing fines, penalties and arrears.

Such norms are established in Article 78 of the Tax Code and apply to all tax obligations established in Russia, including advance payments and state duties. Taxpayers should be aware that the offset of overpayments will be satisfied only if there are no debts on other taxes and fees.

IMPORTANT!

Application forms for the refund of overpaid taxes and for the offset of overpaid amounts were approved by Order of the Federal Tax Service No. ММВ-7-8/ dated 02/14/2017. On October 23, 2021, Federal Tax Service Order No. ED-7-8/ dated August 17, 2021 came into force. From now on, taxpayers are required to use new application forms for credit and refund of overpaid taxes and fees.

The forms have remained virtually unchanged. We updated the barcodes and added lines for the date and number of payment orders if you are returning an overpayment of state duty. But the new forms have one significant difference from the old ones: the tax calculation period code in the form for KND 1150057 and KND 1150058 is no longer indicated. Tax officials excluded this line from the application.

How to fill out an application for credit

Form the offset document on the unified form KND 1150057. Please note that individual entrepreneurs and organizations fill out only the first and second pages of the document; the third page is provided for requests from individuals who are not individual entrepreneurs.

Let's consider an example: Clubtk.ru LLC made a mistake when transferring insurance premiums for September 2022: payment for compulsory health insurance was sent to pension insurance in the amount of 150,000 rubles. The accountant began filling out an application to offset the resulting overpayment under OPS against future payments.

Step 1. Fill in the TIN, KPP and full name of the organization. We indicate the application number and the code of the territorial office of the tax office to which the application is submitted. If the application is made by an individual entrepreneur, his last name, first name and patronymic (if any) should be indicated. Place dashes in empty cells.

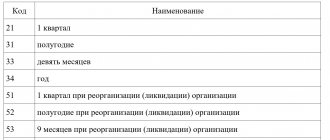

Step 2. We determine the status of the taxpayer and indicate the number of the article of the Tax Code of the Russian Federation, which is the basis for a written application for offset. The following values of the basis articles are allowed:

- Art. 78 - to offset excess funds for insurance premiums, fees, penalties, fines;

- Art. 79 - for the return of overcharged amounts;

- Art. 203 - to offset excise tax surpluses;

- Art. 333.40 - for the return of overpayments on state duties.

Please offset the overpayment. We indicate the payment code.

Step 3. Fill out OKTMO and KBK.

We check OKTMO and KBK in the payment order for the transfer of tax liability.

We write down the code of the tax authority in which the overpayment is listed.

Step 4. We indicate the number of completed application pages, the number of application sheets, information about the manager and contact phone number. We set the date of preparation and have the finished document certified by the manager.

Step 5. We fill out the continuation of page 1. We enter a code indicating the taxpayer’s decision on how to manage the money overpaid to the budget. To offset against other payments, indicate “1”, and against future periods – “2”. Now write down the tax period, OKTMO and KBK tax to which you plan to transfer the overpayment. We write down the code of the tax authority in which the debt is registered.

IMPORTANT!

Now it is allowed to offset overpaid taxes between contributions at any level: federal, regional, local.

Current example of filling out form 1150057 for LLC “Clubtk.ru”: