About leave and deductions

According to the rules of the Labor Code of the Russian Federation, the right to leave for the first year of work arises for an employee after 6 months of continuous work.

By agreement of the parties, the employee may be granted paid leave before the expiration of this period. The employer is obliged to provide certain categories of employees with leave upon application before the expiration of the specified period. For example, for women before or immediately after maternity leave. Leave for the second and subsequent years of work can be granted at any time of the working year in accordance with the order of provision of annual paid leave established by a given employer.

The working year is 12 months and, unlike the calendar year, is calculated not from January 1, but from the day the employee starts working for a specific employer (Letters of the Ministry of Labor of Russia dated October 25, 2018 N 14-2 / OOG-8519, Rostrud dated June 14, 2012 N 853-6-1). For example, if an employee joined you on December 15, 2019, the working year will be from December 15, 2019 to December 14, 2020.

By the way, the Ministry of Labor gave clarifications that vacation should not begin earlier than the working year for which it is granted. In this case, the end of the vacation may occur in the next working year (Letter of the Ministry of Labor of Russia dated October 25, 2018 N 14-2 / OOG-8519).

The same approach is supported in judicial practice (Definitions of the Nizhny Novgorod Regional Court dated August 17, 2010 in case No. 33-7171, St. Petersburg City Court No. 33-16777/2012, Appeal determination of the St. Petersburg City Court dated May 25, 2017 No. 33-10206 /2017 in case No. 2-17215/2016).

This means that if an employee got a job with you on 12/01/2018 and as of 11/30/2019 (working year from 12/01/2018 to 11/30/2019) took all 28 calendar days off (as a general rule), the next vacation can be granted to him no earlier than December 1, 2022. The order of granting vacations is planned annually by the employer. No later than 2 weeks before the start of the calendar year, the vacation schedule is approved. At the same time, certain categories of employees have the right to go on vacation upon application, without taking into account the schedule. For example, such leave is provided to employees who have three or more children under the age of 12 (Article 262.2 of the Labor Code of the Russian Federation).

When planning vacations, you must keep in mind that it can be divided into parts, but at least one part must be at least 14 calendar days (Article 125 of the Labor Code of the Russian Federation). Moreover, 14 calendar days are provided specifically for the working year, and not the calendar year (Letter of the Ministry of Labor of Russia dated September 24, 2019 N 14-2 / OOG-6958). This means that if an employee has vacations that have not been taken off, 14 days for the current working year must be counted without taking into account these vacations. Vacations not taken can be added to this vacation or provided at another time. By the way, Rostrud discourages excessively splitting vacations, otherwise the employee will not be able to take advantage of the vacation to restore his ability to work.

So, vacation cannot be granted before the beginning of the working year, but can be used before its end. Moreover, the law does not establish norms allowing the employer to provide vacation in the working year, taking into account the days worked. Accordingly, unworked days may arise if the employee quits before the end of the working year for which the leave was granted.

Deductions from an employee’s salary are made only in cases provided for by the Labor Code of the Russian Federation and other federal laws.

In accordance with paragraph 5, part 2, article 137 of the Labor Code of the Russian Federation, if an employee is dismissed before the end of the working year for which he has already received annual paid leave, deductions can be made from his salary for unworked vacation days.

But there are a number of restrictions.

Firstly , there are restrictions on individual grounds for dismissal . For example, deduction cannot be made if an employee leaves due to the liquidation of an organization or a reduction in the number or staff of employees.

Secondly , the amount of all deductions made by decision of the employer cannot exceed 20% of the payment remaining after deduction of personal income tax (Part 1 of Article 138 of the Labor Code of the Russian Federation, Letter of the Ministry of Labor of Russia dated October 22, 2018 N 14-1 / OOG-8142, Ministry of Health and Social Development of Russia dated November 16, 2011 N 22-2-4852). If the amounts paid are not enough for deductions, it is impossible to recover from the employee the amount of unearned vacation pay (part 4 of article 137 of the Labor Code of the Russian Federation, paragraph 3 of article 1109 of the Civil Code of the Russian Federation, paragraph 5 of the Review of judicial practice of the Supreme Court of the Russian Federation for the third quarter of 2013, Determination of the Supreme Court of the Russian Federation dated September 12, 2014 N 74-KG14-3, Letter of the Ministry of Labor of Russia dated October 23, 2018 N 14-1/OOG-8448). So it is useless to go to court for recovery (Decision of the Supreme Court of the Russian Federation dated October 25, 2013 N 69-KG13-6, Determination of the Moscow City Court dated 08/08/2011 in case No. 33-23166).

In addition, if the employee has a writ of execution, deductions for unearned vacation can be made only after deductions for all writs of execution, since writs of execution have priority over deductions by the decision of the employer (Part 2 of Article 99 of Federal Law of October 2, 2007 N 229 -FZ “On Enforcement Proceedings”). Moreover, the increased limits (50% and 70%) apply only to deductions under executive documents (parts 2, 3 of Article 138 of the Labor Code of the Russian Federation, parts 2, 3 of Article 99 of the Federal Law of October 2, 2007 N 229-FZ ). It is impossible to sum up the established limits (Letter of Rostrud dated May 30, 2012 N PG/3890-6-1).

Thirdly , it should be remembered that deductions can not be made from all amounts, but only from payments due to the employee upon dismissal (Letter of the Ministry of Labor of Russia dated October 22, 2018 N 14-1/OOG-8142, Ruling of the Supreme Court of the Russian Federation dated 05.02 .2018 N 59-KG17-19). This means that if an employee, for example, was ill before dismissal, it is impossible to withhold overpaid vacation pay from temporary disability benefits (see, for example, the Appeal Determination of the Samara Regional Court dated June 4, 2012 N 33-5116/2012). In addition, it is impossible to make deductions from payments that are not subject to foreclosure in accordance with federal law (Part 4 of Article 138 of the Labor Code of the Russian Federation). This is, for example, reimbursement of travel expenses according to the advance report, compensation for the use of the employee’s personal property (clauses “a”, “b”, paragraph 8, part 1, article 101 of the Federal Law of October 2, 2007 N 229-FZ “On Enforcement Proceedings” ").

In all cases when you are subject to a deduction limitation, you can agree with the employee on a voluntary return of the amount.

For example, he can write an application for deduction from salary (or other payments).

Then we will not be talking about retention in the sense of Art. 137 and 138 of the Labor Code of the Russian Federation, but about the employee’s will to dispose of his wages, as indicated by Rostrud, for example, in Letter dated 10/07/2019 N PG/25778-6-1 (for the meaning, see also Letters of Rostrud dated 09/26/2012 N PG /7156-6-1, dated September 16, 2012 N PR/7156-6-1). In addition, the employee can repay the debt in cash to the organization's cash desk. By the way, according to the meaning of the explanations presented in the Letter of the Federal Social Insurance Fund of the Russian Federation dated August 20, 2007 N 02-13/07-7922, deductions at the will of the employee can also be made from temporary disability benefits (the letter discussed overpaid benefits). Withholding for unworked vacation days is a right, not an obligation, of the employer and is at his discretion (Letter of the Ministry of Labor of Russia dated October 22, 2018 N 14-1/OOG-8142). So the employer can refuse deductions.

If, taking into account all the rules and restrictions, the organization has enough payments to deduct for unworked vacation days, such deduction should be issued by order of the manager (since the deduction is made by decision of the employer). Considering that there is no established form for such an order, it is drawn up in any form.

Principles for calculating vacation pay

Types of vacations:

- regular paid;

- additional (paid);

- study leave;

- for pregnancy and childbirth, etc.

In our case, only one type of vacation is considered - regular.

The amount of paid vacation pay can be represented by the formula:

Average daily earnings (SDZ) * Number of vacation days (KolD).

The main task here is to calculate SDZ. To calculate it, take the accrued salary for 12 months before the vacation, divided by the number of days worked.

If the employee’s length of service in the organization is less than a year, the ratio of the number of months from the date of hire to the actual time worked (number of days) is taken.

The amount of accrued wages includes all payments included in the wage system. That is, all social payments, travel or food compensation are not included in the calculation of average earnings for the period.

In general, the formula for calculating vacation pay looks like this:

In the case when an employee has worked all of his days for a period in full, the formula for calculating the number of working days looks much simpler: the average number of calendar days is .3, multiplied by 12 months.

Income tax

Vacation pay is included in labor costs in the amount of accrued amounts (clause 7 of Article 255 of the Tax Code of the Russian Federation).

When recalculating vacation pay and deducting it from salary (or voluntary return), there is no need to make adjustments to the previously calculated tax base, since the accrual of vacation pay in the original amount was not erroneous. From the explanations of the Ministry of Finance it follows that when withholding unearned vacation pay, the corresponding amounts previously included in expenses should be taken into account as part of non-operating income by analogy with the return (restoration) of costs that were previously included in expenses (for example, restored reserves) (Article 250 Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated December 3, 2009 N 03-03-05/224). A similar opinion is presented in the Letter of the Federal Tax Service of the Russian Federation for Moscow dated January 11, 2007 N 21-08/ [email protected] The inclusion of withheld (returned) amounts in non-operating income is justified by the fact that such receipts are not related to the sale of goods (works, services) ) (and therefore do not relate to sales income under Article 249 of the Tax Code of the Russian Federation), while the list of non-operating income is open. In turn, there are no grounds for adjusting expenses in the form of previously paid vacation pay, since payments were made in accordance with the labor legislation of the Russian Federation.

The Federal Tax Service of Russia in Moscow explains the situation when the employer does not withhold the amount of advance vacation pay as follows: “the expenses of the employing organization incurred in connection with the dismissal of an employee who did not work the days of the granted vacation are not taken into account when forming taxable profit due to their non-compliance with the provisions Art. 252 of the Tax Code of the Russian Federation" (Letter dated June 30, 2008 N 20-12/061148). The Letter of the Federal Tax Service of Russia for Moscow dated April 17, 2006 N 21-07/ [email protected] clarifies that this is a situation where the employer had the opportunity to withhold the amount from the dismissed employee in accordance with the Labor Code of the Russian Federation, but did not do so.

Thus, according to the logic of the tax authorities, if the employer himself refuses to make deductions, the amount of vacation pay regarding unworked days cannot be included in expenses. However, it is not explained how to adjust the income tax base.

Considering that vacation pay was initially paid and included in expenses in the correct amount, there is no reason to make adjustments to the initial reporting.

In this regard, previously recognized expenses can be adjusted by increasing non-operating income in the current period by the amount that the employer refuses to withhold. At the same time, the organization has no reason to exclude from expenses insurance premiums accrued on vacation pay for unworked days not returned by the employee. After all, Article 270 of the Tax Code of the Russian Federation does not contain a prohibition on accounting for expenses of insurance premiums accrued for payments and remunerations that are not recognized as expenses for the purposes of Chapter. 25 of the Tax Code of the Russian Federation (Letters of the Ministry of Finance of Russia dated October 21, 2016 N 03-03-06/1/61454, dated June 9, 2014 N 03-03-06/1/27634, dated July 15, 2013 N 03-03-06/1/ 27562).

At the same time, there is an approach that the employer is not obliged to increase the tax base for income tax in the current period by the amount of unearned vacation pay, which he refused to withhold, since from the point of view of labor legislation the employee does not have any debt.

The employer only has the right (but not the obligation) to make a deduction.

Refusal of such deductions does not create a debt for the employee and can be an element of the organization’s personnel policy, focused on the interests of employees and raising the positive image of the company to attract and retain the best human resources. Moreover, due to the principle of freedom of economic activity, the taxpayer carries out it independently at his own risk and has the right to independently and individually assess its effectiveness and expediency. The validity of expenses taken into account when calculating the tax base must be assessed taking into account the circumstances indicating the taxpayer’s intentions to obtain an economic effect as a result of real business or other economic activity (Definitions of the Constitutional Court of the Russian Federation dated December 16, 2008 N 1072-О-О, dated June 4, 2007 N 366-O-P, dated 06/04/2007 N 320-O-P, Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated 10/12/2006 N 53). If the employer was unable to withhold the amount of advance vacation pay due to the above restrictions on withholding (established by labor legislation), nothing needs to be adjusted, since the employer does not have the right to collect this amount. In this case, in our opinion, there should be no risks in terms of income tax.

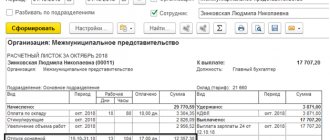

Accounting and tax accounting

As with all income, personal income tax is deducted from wages and transferred to the treasury by the employer acting as a tax agent at a standard rate of 13% for residents (persons living in Russia for more than 183 days a year without traveling) and 30% for non-residents ( not living within Russia for 183 consecutive days a year), as well as insurance contributions to extra-budgetary funds at a general rate of 30%.

The vacation itself is carried out at the expense of the company, the payment is included in the list of expenses to reduce the tax base for income tax.

And the dismissal of an employee before the end of the year entails an excess payment to him in the organization’s accounting department and the deduction of this amount. Consequently, it is necessary to change the amounts for taxes and insurance contributions to state funds.

Firstly, on the day of payment for vacation, the company did not make any errors in keeping records of operations, since the problem is not related to the vacation pay themselves, but to the termination of the employment contract before the end of the calendar year.

Data clarification for the time before the vacation and during the vacation is not carried out; there are no errors according to the law. Corrective actions are necessary during the period of dismissal itself.

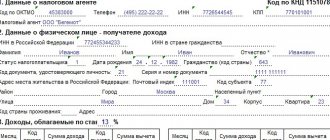

Personal income tax

The amounts of paid vacation pay are employee income subject to personal income tax (clause 6, clause 1, article 208, clause 1, article 210 of the Tax Code of the Russian Federation). Personal income tax is calculated on the date of actual receipt of income, determined in accordance with Art. 223 of the Tax Code of the Russian Federation (clause 3 of Article 226 of the Tax Code of the Russian Federation). In relation to vacation pay, such a date is the day of payment of income (transfer to the employee’s card or issuance in cash through the cash register) (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated March 28, 2018 N 03-04-06/19804, Letter Federal Tax Service of Russia dated 06/13/2012 N ED-4-3/ [email protected] together with Letter of the Ministry of Finance of Russia dated 06/06/2012 N 03-04-08/8-139).

Personal income tax is withheld directly from the taxpayer’s income when it is actually paid to the employee (clause 4 of article 226 of the Tax Code of the Russian Federation). Personal income tax on vacation pay is transferred no later than the last day of the month in which such payments were made (clause 6 of Article 226 of the Tax Code of the Russian Federation). If any deductions are made from the taxpayer’s income by order, by decision of a court or other authorities, such deductions do not reduce the tax base (paragraph 2, clause 1, article 210 of the Tax Code of the Russian Federation).

According to the explanations of the Ministry of Finance, if an employee returns to the employer the amounts of vacation pay actually paid to him earlier, such amounts will not be recognized as his income.

Personal income tax amounts withheld and transferred to the budget from the specified vacation leave are overpaid by the tax agent. Accordingly, the amount of the employee’s personal income tax obligations for the tax period must be adjusted. At the same time, the tax agent - employer has an overpayment of personal income tax, which can be returned to him within the framework of Article 78 of the Tax Code of the Russian Federation (Letter dated October 30, 2015 N 03-04-07/62635 (sent by Letter of the Federal Tax Service of Russia dated November 11, 2015 N BS- 4-11/ [email protected] )).

The Federal Tax Service, in turn, explains that in the case when an organization (tax agent) recalculates the amount of vacation pay and, accordingly, the amount of personal income tax, then in section 1 of the calculation in Form 6-NDFL the total amounts are reflected taking into account the recalculation made (Letter of the Federal Tax Service of Russia dated 05/24/2016 N BS-4-11/9248). The Letter of the Federal Tax Service of Russia for Moscow dated March 12, 2018 N 20-15/049940 clarifies that the total amounts, taking into account the recalculation made, are reflected in Section 1 of the updated calculation in Form 6-NDFL for the period in which vacation pay was accrued. Thus, if by the time of recalculation of vacation pay you have already submitted Form 6-NDFL, it must be adjusted by entering the amount of vacation pay, taking into account the withholding (refund) of tax.

Certificates in form 2-NDFL also need to be adjusted if you have already submitted them by the time of recalculation. If not, the final data must be generated taking into account recalculation.

The specified approach is presented in paragraph 1 of the Letter of the Federal Tax Service of Russia dated October 11, 2017 N GD-4-11/20479.

If the employer does not withhold vacation pay for unworked days (of his own free will or due to legal restrictions), no adjustments need to be made to personal income tax reporting. After all, personal income tax has already been withheld from the employee’s income, while vacation pay remains vacation pay (payments are not reclassified). The employee does not receive additional income. On this issue, see Letters of the Ministry of Finance of Russia dated December 26, 2017 N 03-04-06/86736 and the Federal Tax Service of Russia for Moscow dated June 28, 2018 N 20-15/138129.

We deduct excessively issued vacation pay

Having decided to withhold overpaid vacation pay from the resigning employee’s salary and having calculated the deduction for unworked vacation days, the employer issues a corresponding order. It must be remembered that the amount of deductions cannot exceed 20% of the amount due to be paid to the employee (Part 1 of Article 138 of the Labor Code of the Russian Federation). If the amount to be deducted from the employee’s salary exceeds 20% of the amount paid or the employee has not received payments at all from which deduction could be made, the employee can voluntarily deposit the amount for unworked vacation days into the employer’s cash desk or transfer them to a current account. It is impossible to recover this amount from an employee in court (Part 4 of Article 137 of the Labor Code of the Russian Federation, Ruling of the Supreme Court dated March 14, 2014 No. 19-KG13-18).

Insurance premiums

The employer calculates insurance premiums in the general manner from the amount of vacation pay (clause 1 of Article 420 of the Tax Code of the Russian Federation).

The base for insurance premiums is calculated on an accrual basis from the beginning of the year until the end of the corresponding month (clause 1 of Article 431 of the Tax Code of the Russian Federation). Since, in connection with the withholding (return) of the amounts of unpaid advance payment, the amount of previously calculated insurance premiums is reduced, the employer is not required to submit an updated Calculation of insurance premiums (clauses 1, 7, Article 81 of the Tax Code of the Russian Federation). However, it is necessary to adjust the liability for insurance premiums. Since contributions are considered a cumulative total from the beginning of the year, it is believed that adjustments to contributions in connection with the withholding (return) of vacation pay for unworked days can be made in the current period. However, this approach is not entirely correct and does not take into account the situation when an employee voluntarily returns amounts in an amount greater than the final payments upon dismissal. After all, negative values in the calculation of insurance premiums are not allowed (Letter of the Federal Tax Service of Russia dated August 24, 2017 N BS-4-11 / [email protected] ).

In addition, information from Section 3 of the Calculation of Insurance Premiums must be correctly reflected in the individual personal accounts of the insured persons. In this regard, there is a need to adjust the amount of vacation pay in the period in which they were initially accrued, as indicated, for example, in paragraph 2 of Letter of the Federal Tax Service of Russia dated October 11, 2017 N GD-4-11/20479. This option is recommended to be used in any case (even if the dismissal payments are enough to withhold) so that the information from the Calculation of Insurance Premiums is comparable with forms 2-NDFL and 6-NDFL.

If the organization refuses to make deductions or is unable to make them due to restrictions, no adjustments need to be made to the calculation of insurance premiums, since the amounts of previously calculated contributions do not change (Letter of the Ministry of Finance of Russia dated July 26, 2018 N 03-15-06/52554) .

Postings for estimated vacation liabilities

There are differences in the algorithm for accounting for vacation pay by companies that use simplified accounting methods (as presented above) and enterprises that belong to large and medium-sized businesses and are required to maintain full-fledged accounting.

The difference is that vacation pay is an estimated liability (letter of the Ministry of Finance of the Russian Federation No. 07-02-06/107 dated June 14, 2011), and companies that carry out full accounting are required to create special reserves for vacation pay (RO). With simplified accounting, enterprises have the right to write off accrued vacation pay as expenses immediately without creating a reserve (clauses 3, 8 of PBU 8/2010).

RO is accrued on account credit. 96. When the reserve is accrued, the “vacation” entries look like this:

| Operations | D/t | K/t |

| Vacation reserve accrued | 20 (23, 25, 26, 44) | 96 |

| Accrual of vacation pay to an employee | 96 | 70 |

| Calculation of insurance premiums (according to subaccounts) | 96 | 69 |

| Withholding personal income tax from vacation pay | 70 | 68.1 |

| Payment of vacation pay to an employee | 70 | 50 (51) |

Thus, vacation entries when using the vacation reserve contain account 96, the use of which stabilizes and additionally guarantees the employer’s obligation to pay for vacations. In this case, vacation pay (posting D/t 70 K/t 50, 51) is reflected traditionally, without affecting account 96. The volume of the reserve decreases as vacation pay is accrued. RO is replenished monthly or quarterly, or annually, depending on which algorithm is fixed in the company’s accounting policy.

Another vacation. What the law says

Every employee has the right to receive paid leave, also called annual leave. The Labor Code explains which categories of workers can count on vacation leave. These include:

- Employees for whom this place of work is considered their main place of work.

- Part-timers.

- Working from home or remotely.

- Employees performing part-time duties.

This list includes almost everyone who takes part in labor activities at the enterprise. Thus, every employee has the right to leave within a specified period and for a certain number of days.

What is the duration of the annual basic paid leave at the enterprise? The standard vacation for most organizations is twenty-eight calendar days. More specifically, Article 115 of the Labor Code emphasizes that an employee cannot receive less than twenty-eight calendar days of annual leave per year. However, there are other categories of persons who have the right to a longer period of rest, due to the complexity of the work, as well as workers who receive additional leave, for example, due to harmfulness, or disabled people of the second group.

How many days can I take a vacation?

As for the rights of the employee, it is worth recalling Article 122 of the Labor Code. It says here that a citizen has the right to take his leave for any time by notifying the employer two weeks in advance. This is also prescribed in advance in the vacation schedule for the next year. So the employee has the right to receive full leave at any convenient time.

As for dividing the allotted days, the Labor Code gives a hint here too. It says that you can take vacation in parts. However, it is worth noting that one part must be at least 14 calendar days. But the size of subsequent ones is not regulated. However, not every employer is ready to issue vacations of two or three days. Therefore, the employee should negotiate with the employer or personnel department employees.

What is deduction for unworked vacation days upon dismissal?

This happens when the employee has already taken his vacation in advance and has not worked enough time to repay the pay for these days. The employer has the right to withhold overpaid vacation pay upon final settlement with the employee.

Debt to the employer can only arise if the limit for the next paid leave is exceeded. Upon dismissal, the employer has the right to withhold the amount of paid vacation days that the employee had not paid at the time of dismissal.

Nicholas Mikuslas

- the employee’s refusal to transfer to another job required in accordance with a medical report issued in the manner established by federal laws and other regulatory legal acts of the Russian Federation, or the employer’s lack of relevant work (clause 8, part 1, article 77 of the Labor Code of the Russian Federation);

- liquidation or reduction of personnel or staff (clause 1, 2, part 1, article 81 of the Labor Code of the Russian Federation);

- change of owner of the organization’s property (in relation to the head of the organization, his deputies and the chief accountant) (clause 4, part 1, article 81 of the Labor Code of the Russian Federation);

- conscription of an employee for military service or sending him to an alternative civil service replacing it (clause 1, part 1, article 83 of the Labor Code of the Russian Federation);

- reinstatement of an employee who previously performed this work by decision of the state labor inspectorate or court (clause 2, part 1, article 83 of the Labor Code of the Russian Federation);

- recognition of the employee as disabled (clause 5, part 1, article 83 of the Labor Code of the Russian Federation);

- death of an employee (clause 6, part 1, article 83 of the Labor Code of the Russian Federation);

- the occurrence of emergency circumstances interfering with the implementation of work activities (clause 7, part 1, article 83 of the Labor Code of the Russian Federation).

When an employee is granted vacation, personal income tax is withheld from accrued vacation pay. If, by order of the employer, the excess accrued amount of vacation pay is withheld from the employee’s salary, then it is necessary to return the personal income tax attributable to the withheld amount in the manner established by Article 231 of the Tax Code of the Russian Federation. Therefore, in accounting, deductions for unworked vacation days are reflected by reversing the amount of vacation pay (letter of the Ministry of Finance of Russia dated October 20, 2004 No. 07-05-13/10).

If an employee decides to quit

However, controversial issues begin to arise if an employee who took leave for an unworked period decides to quit. It’s worth noting right away that the employer cannot keep him at the enterprise. HR department employees should also not refuse to hand over a work book, as this would be illegal.

There are two ways of peaceful settlement. In the first case, the employer simply withholds the amount that was written out for unworked time. This situation is possible when dismissal occurs at the end of the month in which all days were worked. In this case, there will be enough funds to repay the entire amount. The second option is also to pay off the debt, but in cash to the company’s cash desk.

It is worth noting that some people mistakenly believe that an employer cannot withhold more than twenty percent of accrued wages. In this case, they refer to Article 138 of the Labor Code. But it should be understood that here we are talking specifically about salary. Withholding for the unworked period is regulated by Article 137. Therefore, the employer can withhold the entire amount of wages after calculating the tax.

It is worth noting that the calculation of vacation days can only be rounded towards the employee. That is, the employer cannot make a deduction for three days instead of 2.33. And in two whole days - maybe. This is enshrined in the Labor Code.

Deductions for unworked vacation days upon dismissal in 1C ZUP: postings, order

- the amount of earnings is enough, and the accounting department simply deducts for unworked vacation days upon dismissal (of a pensioner or any other employee - it doesn’t matter);

- earnings are not enough, the employee agrees to voluntarily return “the excess amounts received to the cash desk;

- the salary is not enough, the employee does not want to compromise, the organization files a lawsuit and collects funds through the court.

When an employee is dismissed, amounts provided for days not worked must be withheld from his salary. If this is impossible due to the lack of earned funds, the employer can go to court for recovery. But if it is not proven that the employee’s actions led to a violation of the payment procedure, then the claim will most likely be denied.

Additional holidays. Prepaid expense

Additional leaves may be granted to a number of employees. These include those who work in the Far North, are disabled in the second group, or work in hazardous working conditions.

In all these cases, the law provides for additional days of rest, which are paid by the employer. An interesting fact is that each of them, with the exception of additional sick leave, can be taken by the employee in advance, that is, for time not yet worked. Thus, these types of leaves are also subject to withholding.

But in the case of leave, which is provided to those employed in enterprises with hazardous working conditions, additional days are provided strictly for the time worked. Therefore, there is no such thing as “taking a vacation in advance” for this type. That is, there is no way to keep them.

Approximate vacation registration scheme

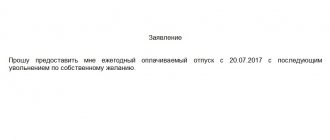

In most organizations, taking leave is a simple matter. If the employee is following the schedule that was drawn up in the previous year, then no personal statements are required. Two weeks in advance, HR department employees draw up an order, which is signed by the head of the enterprise or structural unit, as well as the employee himself. You should be careful, since the order specifies the dates of vacation, as well as the number of days of rest. By signing the document, the employee gives his consent to these dates and a specific number of days.

If the vacation needs to be postponed or days taken from the past, then you should write an application, which is reviewed by the employer. After the signature of the management persons, an order is also issued. Based on the order, a calculation note is drawn up, which is sent to the accounting department.