What is the tax base for calculating VAT?

According to paragraph 1 of Art.

154 of the Tax Code of the Russian Federation, the tax base for VAT for the sale of purchased goods, products of own production, performance of work, and provision of services is revenue. Its value is determined on the basis of all income of an economic entity associated with payments for these goods (work, services, etc.). That is, in general cases, the basis for determining VAT is the value of assets specified in the supply agreement (performance of work, provision of services). However, the Tax Code lists transactions for which there are some features in determining the tax base for VAT. For example:

- When transferring property free of charge, the tax base is the market value of such assets, determined on the basis of Chapter. 14.2 Tax Code of the Russian Federation.

- In cases of sales of agricultural products purchased from citizens, or cars also purchased from citizens without individual entrepreneur status, the tax base is determined as the difference between the market price (including VAT) and the purchase price.

- Also, operations involving the sale of: property rights have specific features of forming a VAT base;

- goods (works, services) taking into account subsidies provided by the budgets of the Russian Federation;

- assets previously recorded at cost including VAT;

- services for the production of products from customer-supplied raw materials;

- goods (works, services) under forward transactions, derivative financial instruments not traded on the organized market.

How to determine the tax base for VAT if payments under the contract are made in foreign currency? The answer to this question is in ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

The regulation of the procedure for determining the basis for all cases presented is carried out in accordance with the provisions of Art. 154 Tax Code of the Russian Federation.

The moment of shipment and transfer of ownership do not coincide. When to charge VAT

(Letter of the Ministry of Finance of the Russian Federation dated September 8, 2010 No. 03-07-11/379)

As a general rule, ownership

the acquirer of a thing under a contract arises from the moment of its transfer, unless otherwise provided by law or contract (

clause 1 of Article 223 of the Civil Code of the Russian Federation

).

Art. 491 Civil Code of the Russian Federation

a special procedure for the transfer of ownership has been determined.

The purchase and sale agreement may provide that the ownership of the goods transferred to the buyer is retained by the seller until payment for the goods or other circumstances occur.

Transfer on a reimbursable basis

(including the exchange of goods, work or services)

ownership

of goods, the results of work performed by one person for another person, the provision of services for a fee by one person to another person

is recognized as the sale of

goods, work or services (

Article 39 of the Tax Code of the Russian Federation

).

Object of VAT taxation

The sale of goods (work, services) on the territory of the Russian Federation is recognized (

clause 1, clause 1, article 146 of the Tax Code of the Russian Federation

).

Thus, based on these rules, if ownership is not transferred

the seller to the buyer,

then there is no sale

.

However, according to paragraph 1 of Art.

167 of the Tax Code of the Russian Federation, the moment of determining the tax base for VAT

is the earliest of the following dates:

1)

day of shipment (transfer) of goods (works, services), property rights;

2)

day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

In addition, in accordance with paragraph 3 of Art. 168 Tax Code of the Russian Federation

When selling goods, the corresponding

invoices are issued

from the day of shipment of the goods .

Thus, it turns out that the moment of determining the tax base

for the purposes of calculating VAT,

it is not related to sales

.

The Federal Tax Service of the Russian Federation, in a letter dated February 28, 2006 No. MM-6-03/ [email protected] , explained how the shipment date is determined.

In accordance with paragraph 1 of Art. 9 of the Federal Law of the Russian Federation of November 21, 1996 No. 129-FZ “On Accounting”

all business transactions carried out by the organization must be documented with supporting documents. These documents serve as primary accounting documents on the basis of which accounting is conducted.

According to paragraph 1 of Art. 9 of Law No. 129-FZ and clause 13 of the Regulations on accounting and financial reporting in the Russian Federation

, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, primary accounting documents must contain as mandatory details

the date of preparation of these documents and the content of the business transaction

.

Thus, according to tax authorities, the date of shipment

(transfer) of goods (works, services), property rights

is recognized as the date of the first drawing up of the primary document

, issued to their buyer (customer), carrier.

The Ministry of Finance of the Russian Federation has a similar opinion (letter dated June 22, 2010 No. 03-07-09/37).

In the letter commented on, the Ministry of Finance of the Russian Federation also indicated that if, under the equipment supply agreement, the shipment

equipment was produced

in one tax period

,

and the ownership

of this equipment passes to the buyer

in another tax period

(after the supplier completes installation and commissioning), then VAT should be charged in the tax period in which

was shipped

,

regardless of moment of transfer of ownership

.

The moment of determining the tax base for VAT: concept and features

The moment of determining the tax base for VAT is the point in time at which the taxpayer has the obligation to calculate and pay tax to the state treasury. When does this happen? In accordance with Art. 167 of the Tax Code of the Russian Federation, the VAT base is considered formed:

- on the day of shipment;

- the day of receipt of funds for the products shipped to the taxpayer-seller’s bank account.

The day of shipment is characterized by the preparation of documents for sale (waybill, invoice, universal transfer document, etc.) or the signing of an act.

NOTE! The period established for issuing an invoice is 5 calendar days from the date of registration of the invoice or act.

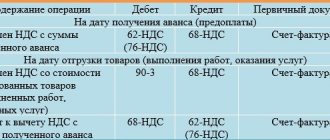

Receipt of payment to the current account can be tracked using bank statements, to the cash desk - using cash register receipts and cash book data. If the money arrives before the products are shipped, the seller should calculate the tax payable on the amounts received. Upon subsequent shipment, the previously calculated VAT on the advance payment is accepted for deduction, and the tax is accrued to the budget from the shipment itself. Thus, the settlement procedure established in the agreement between the partners affects the point in time at which the base is formed.

But the transfer of ownership in the vast majority of cases is not a factor that changes the moment of determining the base: when a shipment occurs, the tax must be immediately accrued for payment, even if the ownership right remains with the seller under certain circumstances.

ConsultantPlus experts explained what facts will allow the tax authority to identify an understatement of the VAT tax base. If you do not have access to the K+ system, get a trial online access for free.

Tax Code of the Russian Federation (Chapter 21 Value Added Tax)

◄ Previous| 143 145 145.1 146 147 148 149 150 151 153 154 155 156 157 158 159 160 161 162 162.1 163 164 165 166 167 168 169 170 171 172 173 174 174.1 176 176.1 177 | Next ► |

(as amended by the Federal Law of July 22, 2005 N 119-FZ)

1. For the purposes of this chapter, the moment of determining the tax base, unless otherwise provided by paragraphs 3, 7 - 11, 13 - 15 of this article, is the earliest of the following dates:

1) the day of shipment (transfer) of goods (work, services), property rights;

2) the day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights. (Clause 1 as amended by Federal Law No. 119-FZ dated July 22, 2005)

2. Lost power. — Federal “law” of July 22, 2005 N 119-FZ.

3. In cases where the goods are not shipped or transported, but the transfer of ownership of this product occurs, such transfer of ownership for the purposes of this chapter is equivalent to its shipment. (as amended by Federal Laws dated May 29, 2002 “N 57-FZ”, dated July 22, 2005 “N 119-FZ”)

4 - 6. Lost power. — Federal “law” of July 22, 2005 N 119-FZ.

7. When a taxpayer sells goods transferred to him for storage under a “warehouse storage agreement” with the issuance of a warehouse certificate, the moment of determining the tax base for these goods is determined as the day of sale of the warehouse certificate. (as amended by the Federal Law of July 22, 2005 N 119-FZ)

8. When transferring property rights in the case provided for in paragraph 2 of Article 155 of this Code, the moment of determining the tax base is determined as the day of assignment of the monetary claim or the day of termination of the corresponding obligation, in cases provided for in paragraphs 3 and 4 of Article 155 of this Code, - as the day of assignment (subsequent assignment) of the claim or the day of fulfillment of the obligation by the debtor, and in the case provided for by “clause 5” of Article 155 of this Code - as the day of transfer of property rights. (Clause 8 as amended by Federal Law No. 119-FZ dated July 22, 2005)

The time for determining the tax base provided for in paragraph 9 of Article 167, associated with the deadline for submitting documents specified in paragraph 9 of Article 165, is increased by 90 days if the goods are placed respectively under the customs regime of export, international customs transit, free customs zone, movement of supplies to the period from July 1, 2008 to December 31, 2009 (Federal “law” dated August 5, 2000 N 118-FZ).

9. When selling goods (work, services) provided for in “subparagraphs 1”, “2.1” - “2.7”, “3”, “8” and “9 of paragraph 1” of Article 164 of this Code, the moment of determining the tax base for these goods (works, services) is the last day of the quarter in which the full package of documents provided for by “Article 165” of this Code is collected. (as amended by Federal Laws dated July 22, 2005 “N 119-FZ”, dated July 27, 2006 “N 137-FZ”, dated November 27, 2010 “N 309-FZ”)

If the full package of documents provided for by “Article 165” of this Code is not collected within the time period specified in “Clause 9 of Article 165” of this Code, the moment of determining the tax base for the specified goods (works, services) is determined in accordance with “ subparagraph 1 of paragraph 1" of this article, unless otherwise provided by this paragraph. If the full package of documents provided for in paragraph 5 of Article 165 of this Code is not collected on the 181st calendar day from the date of affixing the mark of the customs authorities on the transportation documents, indicating that the goods are placed under the customs procedure of export or the customs procedure of customs transit at transportation of foreign goods from the customs authority at the place of arrival on the territory of the Russian Federation to the customs authority at the place of departure from the territory of the Russian Federation or indicating the placement of processed products exported from the territory of the Russian Federation and other territories under its jurisdiction under the internal customs transit procedure, the moment determining the tax base for the specified works and services is determined in accordance with “subparagraph 1” of paragraph 1 of this article. In the case of reorganization of an organization, if the 181st calendar day coincides with the date of completion of the reorganization or occurs after the specified date, the moment of determining the tax base is determined by the successor(s) as the date of completion of the reorganization (the date of state registration of each newly emerged organization, and in the case of reorganization in the form affiliation - the date of entry into the unified state register of legal entities regarding the termination of the activities of each acquired organization). (as amended by Federal Laws dated 05/29/2002 “N 57-FZ”, dated 08/22/2004 “N 122-FZ”, dated 07/22/2005 “N 118-FZ”, dated 07/22/2005 “N 119-FZ”, dated 02/28/2006 “N 28-ФЗ”, dated 07/27/2006 “N 137-ФЗ”, dated 05/17/2007 “N 85-ФЗ”, dated 11/27/2010 “N 309-ФЗ”)

In the case of import into the port special economic zone of Russian goods placed outside the port special economic zone under the customs export procedure, or when exporting supplies, the deadline for submitting documents established by “clause 9 of Article 165” of this Code is determined from the date of placement of these goods under the customs procedure export or from the date of declaration of supplies. (as amended by the Federal “law” dated November 27, 2010 N 309-FZ)

The paragraph became invalid on January 1, 2011. — Federal “law” of December 27, 2009 N 368-FZ.

9.1. When a vessel is excluded from the Russian International Register of Ships, the moment the tax agent determines the tax base is the day the corresponding entry is made in the specified register. If within 45 calendar days from the moment of transfer of ownership of the vessel from the taxpayer to the customer, the registration of the vessel in the Russian International Register of Ships is not carried out, the moment of determining the tax base by the tax agent is determined in accordance with “subparagraph 1” of paragraph 1 of this article. (as amended by Federal “law” dated July 27, 2006 N 137-FZ) (clause 9.1 introduced by Federal “law” dated December 20, 2005 N 168-FZ)

10. For the purposes of this chapter, the moment for determining the tax base when performing construction and installation work for own consumption is the last date of each tax period. (as amended by Federal Laws dated July 22, 2005 “N 119-FZ”, dated July 27, 2006 “N 137-FZ”)

11. For the purposes of this chapter, the moment of determining the tax base for the transfer of goods (performance of work, provision of services) for one’s own needs, recognized as an object of taxation in accordance with this chapter, is defined as the day of the said transfer of goods (performance of work, provision of services). (as amended by the Federal Law of July 22, 2005 N 119-FZ)

12. The accounting policy adopted by the organization for tax purposes is approved by the relevant orders and instructions of the head of the organization.

The accounting policy for tax purposes is applied from January 1 of the year following the year of its approval by the relevant order or order of the head of the organization.

The accounting policy for tax purposes adopted by the organization is mandatory for all separate divisions of the organization.

The accounting policy for tax purposes adopted by the newly created organization is approved no later than the end of the first tax period. The accounting policy for tax purposes adopted by a newly created organization is considered to be applied from the date of creation of the organization.

Paragraphs five and six are no longer valid. — Federal “law” of July 22, 2005 N 119-FZ.

13. In the event that a taxpayer - manufacturer of goods (work, services) receives payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), the duration of the production cycle of which is more than six months (according to the “list” determined by the Government of the Russian Federation ), the taxpayer - manufacturer of the specified goods (work, services) has the right to determine the moment of determining the tax base as the day of shipment (transfer) of the specified goods (performance of work, provision of services) if there is separate accounting of the operations carried out and the amount of tax on the purchased goods (work, services) , including fixed assets and intangible assets, property rights used to carry out operations for the production of goods (works, services) with a long production cycle and other operations.

Upon receipt of payment or partial payment by the taxpayer - manufacturer of goods (works, services), a contract with the buyer (a copy of such a contract, certified by the signature of the manager and chief accountant), as well as a “document” confirming the duration of the production cycle of the goods, is submitted to the tax authorities simultaneously with the tax return (works, services), indicating their name, production time, name of the manufacturing organization, issued to the specified taxpayer-manufacturer by the federal executive body exercising the functions of developing state policy and legal regulation in the field of industrial, military-industrial and fuel energy complexes, signed by an authorized person and certified by the seal of this body. (Clause 13 introduced by Federal “law” dated July 22, 2005 N 119-FZ)

14. If the moment of determining the tax base is the day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services) or the day of transfer of property rights, then on the day of shipment of goods (performance of work, provision of services) or on the day of transfer of property rights against previously received payment or partial payment, the moment of determining the tax base also arises. (Clause 14 introduced by Federal “law” dated July 22, 2005 N 119-FZ)

15. For tax agents specified in “paragraphs 4” and “5 of Article 161” of this Code, the moment of determining the tax base is determined in the manner established by “paragraph 1” of this article. (Clause 15 was introduced by Federal Law No. 119-FZ of July 22, 2005).

| ◄ Previous | 143 145 145.1 146 147 148 149 150 151 153 154 155 156 157 158 159 160 161 162 162.1 163 164 165 166 167 168 169 170 171 172 173 174 174.1 176 176.1 177 | Next ► |

In what situations does the moment of determining the tax base differ from the generally established one?

The Code establishes a list of operations for which the moment of determining the base does not fall on the date of shipment or receipt of advance payment. Let's look at some examples:

- Inability to ship and transport assets. For real estate, the tax base will be formed upon the transfer of the asset under the transfer and acceptance certificate, and for movable property - upon the transfer of ownership.

- Sales of goods using a 0% VAT rate, requiring subsequent confirmation. The tax base will be formed on the last day of the quarter in which the full package of documents is collected.

- Realization of property rights. The tax must be calculated for payment to the budget on the day of assignment of the claim or the day of termination/fulfillment of the corresponding obligation or on the day of transfer of property rights.

- Carrying out construction and installation work on your own. VAT is charged on the last day of the quarter.

- Transfer of assets for own needs. The moment the tax base is determined will be the date of the said transfer.

- Sales of goods transferred by the taxpayer for storage under a warehousing agreement with the issuance of a warehouse certificate. The tax base will be formed on the day the warehouse receipt is sold.

A complete list of operations with the nuances of forming the tax base is given in Art. 167 Tax Code of the Russian Federation.

Article 167 of the Tax Code of the Russian Federation - The moment of determining the tax base

1. For the purposes of this chapter, the moment of determining the tax base, unless otherwise provided by paragraphs 3, 7 - 11, 13 - 15 of this article, is the earliest of the following dates:

1) the day of shipment (transfer) of goods (work, services), property rights;

2) the day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

2. Lost power. — Federal Law of July 22, 2005 N 119-FZ.

3. In cases where the goods are not shipped or transported, but the transfer of ownership of this product occurs, such transfer of ownership for the purposes of this chapter is equivalent to its shipment, except for the case provided for in paragraph 16 of this article.

4 - 6. Lost power. — Federal Law of July 22, 2005 N 119-FZ.

7. When a taxpayer sells goods transferred to him for storage under a warehousing agreement with the issuance of a warehouse certificate, the moment of determining the tax base for these goods is determined as the day of sale of the warehouse certificate.

8. When transferring property rights in the case provided for in paragraph 2 of Article 155 of this Code, the moment of determining the tax base is determined as the day of assignment of the monetary claim or the day of termination of the corresponding obligation, in cases provided for in paragraphs 3 and 4 of Article 155 of this Code - as the day of assignment (subsequent assignment) of the claim or the day of fulfillment of the obligation by the debtor, and in the case provided for in paragraph 5 of Article 155 of this Code - as the day of transfer of property rights.

9. When selling goods (work, services) provided for in subparagraphs 1, 2.1 - 2.8, 2.10, 3, 3.1, 8, 9, 9.1 and 12 of paragraph 1 of Article 164 of this Code, the moment the tax base for these goods (work, services) is determined ) is the last day of the quarter in which the full package of documents provided for in Article 165 of this Code is collected.

If the full package of documents provided for in Article 165 of this Code is not collected within the time limits specified in paragraph 9 of Article 165 of this Code, the moment of determining the tax base for the specified goods (works, services) is determined in accordance with subparagraph 1 of paragraph 1 of this Code. articles, unless otherwise provided by this paragraph. If the full package of documents provided for in paragraph 5 of Article 165 of this Code is not collected on the 181st calendar day from the date of affixing the mark of the customs authorities on the transportation documents, indicating the placement of goods under the customs procedure of export, re-export or customs transit, the moment of determination the tax base for the specified works and services is determined in accordance with subparagraph 1 of paragraph 1 of this article. In the case of reorganization of an organization, if the 181st calendar day coincides with the date of completion of the reorganization or occurs after the specified date, the moment of determining the tax base is determined by the successor(s) as the date of completion of the reorganization (the date of state registration of each newly emerged organization, and in the case of reorganization in the form affiliation - the date of entry into the unified state register of legal entities regarding the termination of the activities of each acquired organization).

In the case of import into the port special economic zone of Russian goods placed outside the port special economic zone under the customs procedure of export (re-export), or when exporting supplies, the deadline for submitting documents established by paragraph 9 of Article 165 of this Code is determined from the date of placement of these goods under the customs procedure. procedure for export (re-export) or from the date of declaration of supplies (and for taxpayers who sell supplies for which customs declaration is not provided for by the customs legislation of the Customs Union - from the date of registration of transport, shipping or other documents confirming the export of supplies outside the territory of the Russian Federation air and sea vessels, mixed (river-sea) navigation vessels).

The paragraph became invalid on January 1, 2011. — Federal Law of December 27, 2009 N 368-FZ.

9.1. In the cases provided for in paragraphs 6, 6.1 and 6.2 of Article 161 of this Code, the moment of determining the tax base by the tax agent is established in accordance with subparagraph 1 of paragraph 1 of this article.

9.2. For the purposes of this chapter, the moment of determining the tax base for the sale of services provided for in subclause 9.2 of clause 1 of Article 164 of this Code is the last date of each tax period.

10. For the purposes of this chapter, the moment for determining the tax base when performing construction and installation work for own consumption is the last date of each tax period.

11. For the purposes of this chapter, the moment of determining the tax base for the transfer of goods (performance of work, provision of services) for one’s own needs, recognized as an object of taxation in accordance with this chapter, is defined as the day of the said transfer of goods (performance of work, provision of services).

12. The accounting policy adopted by the organization for tax purposes is approved by the relevant orders and instructions of the head of the organization.

The accounting policy for tax purposes is applied from January 1 of the year following the year of its approval by the relevant order or order of the head of the organization.

The accounting policy for tax purposes adopted by the organization is mandatory for all separate divisions of the organization.

The accounting policy for tax purposes adopted by the newly created organization is approved no later than the end of the first tax period. The accounting policy for tax purposes adopted by a newly created organization is considered to be applied from the date of creation of the organization.

Paragraphs five and six are no longer valid. — Federal Law of July 22, 2005 N 119-FZ.

13. In the event that a taxpayer - manufacturer of goods (work, services) receives payment, partial payment on account of upcoming deliveries of goods (performance of work, provision of services), the duration of the production cycle of which is more than six months (according to the list determined by the Government of the Russian Federation), The taxpayer - manufacturer of the specified goods (work, services) has the right to determine the moment of determining the tax base as the day of shipment (transfer) of the specified goods (performance of work, provision of services) if there is separate accounting of the transactions carried out and the amount of tax on the purchased goods (work, services), in including fixed assets and intangible assets, property rights used to carry out operations for the production of goods (works, services) with a long production cycle and other operations.

Upon receipt of payment, partial payment by the taxpayer - manufacturer of goods (works, services), a contract with the buyer (a copy of such a contract, certified by the signature of the manager and chief accountant), as well as a document confirming the duration of the production cycle of goods (works) is submitted to the tax authorities simultaneously with the tax return , services), indicating their name, production date, name of the manufacturing organization, issued to the specified taxpayer-manufacturer by the federal executive body exercising the functions of developing state policy and legal regulation in the field of industrial, military-industrial and fuel and energy complexes , signed by an authorized person and certified by the seal of this body.

14. If the moment of determining the tax base is the day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services) or the day of transfer of property rights, then on the day of shipment of goods (performance of work, provision of services) or on the day of transfer of property rights against previously received payment or partial payment, the moment of determining the tax base also arises.

15. For tax agents specified in paragraphs 4, 5, 5.1 and 8 of Article 161 of this Code, the moment of determining the tax base is determined in the manner established by paragraph 1 of this article.

16. When selling real estate, the date of shipment for the purposes of this chapter is the day of transfer of real estate to the buyer of this property under a transfer deed or other document on the transfer of real estate.

Results

So, we said that the tax base for VAT on sales is revenue.

The tax base is determined on the earliest date: either the day of shipment or the day of receipt of the advance payment to the seller. The Tax Code reflects all types of transactions for which the calculation of the tax base or the determination of the moment of its formation differs from standard principles. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Innovations

Clause 3 of the article in question provides that if the products are not shipped or transported, but they become the property of the buyer, this event is equivalent to delivery. An exception is the case of the sale of an immovable object. In accordance with paragraph 16 of the norm in question, the date of transfer of such property to the acquirer acts as the day of shipment. This paragraph was introduced into the norm of Federal Law No. 81. It should be said that the Ministry of Finance previously indicated that in the case of the sale of real estate, the moment of establishing the VAT base is the date of transfer of ownership of the object, indicated in the relevant document, or the calendar date on which the funds were transferred for it. The earliest one is selected. In accordance with clause 14 of the norm in question, if the control date is the date on which the funds were credited from the buyer, the calendar date on which the object became the property of another entity, the moment of establishing the VAT base also arises. Explanations on this issue are provided in the Letter of the Ministry of Finance dated April 28. 2014.