Current legislation divides the concept of a representative into legal and authorized. If we consider the terms within the framework of the actions of legal entities, then:

- A legal representative is a person who can represent the interests of an enterprise on the basis of the law or constituent documents, in other words, a director or another person designated in local documents who has the right to act without a power of attorney.

- An authorized representative is a person, usually an employee, who has the right to act in the interests of the enterprise solely on the basis of a power of attorney, or another legal entity. To confirm the authority of an individual, you will have to issue a power of attorney from a notary.

Types and features of powers of attorney from legal entities

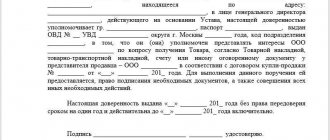

The general rules for drawing up powers of attorney are regulated by the Civil Code. Thus, according to the general rules, a power of attorney must be drawn up in writing. A power of attorney must meet two basic requirements:

- be certified by the signature of the head of the enterprise (legal representative) and a seal (despite the abolition of seals at the legislative level, in practice documents without them are not accepted and are not used in business);

- contain the date of issue, otherwise the power of attorney may be invalidated.

OPTIONS FOR TRANSFER OF MANAGEMENT POWERS

Along with the sole executive management body, represented by an elected individual, companies (LLC and JSC) have the right to decide to transfer powers to a third-party manager - a commercial organization or an individual entrepreneur (hereinafter referred to as the Manager).

The Company has the right to engage a Manager on a contractual basis to perform the functions of its executive body, and to establish the amount of remuneration and compensation paid to him.

If an organization decides to manage a sole executive body - an individual (hereinafter referred to as the Manager), an employment contract is concluded with him, taking into account all the requirements of the Labor Code of the Russian Federation for this type of labor relationship.

An important point: pension authorities recommend concluding this agreement regardless of whether the manager is an owner of the company. That is, this subject can be both the director and owner of the organization.

This is explained by the fact that the status of the owner reflects his rights and obligations in relation to the results of the company’s activities, and his activities as a manager are associated with the performance of labor functions, which is expressed in the concluded employment contract.

The rights and obligations of the Manager and the Manager to the owners have certain differences, which underlie the choice of management option for the company. In terms of responsibility for one’s actions, the law equalizes these categories of management.

FOR YOUR INFORMATION

The sole executive body of the company, the managing organization or the manager, when exercising their rights and performing their duties, must act in the interests of the company, exercise their rights and fulfill their duties in relation to the company in good faith and reasonably (Article 71 of Federal Law No. 208-FZ).

A person who, by virtue of the law, another legal act or the constituent document of a legal entity, is authorized to act on its behalf, shall be liable if it is proven that in the exercise of his rights and performance of his duties he acted in bad faith or unreasonably, including if his actions ( inaction) did not correspond to the usual conditions of civil turnover or normal business risk (paragraph 2, paragraph 1, article 53.1 of the Civil Code of the Russian Federation).

Types of powers of attorney provided for in business transactions

- One-time, for performing certain actions, for example, submitting a report to the fiscal authority or signing a specific contract.

- Special, for certain actions, for example, within the framework of a specific agreement to receive certain material assets.

- A general power of attorney for an authorized representative is consent to perform various legally significant actions for a certain period of time.

The notarized form of power of attorney is provided not only for individuals and individual entrepreneurs, but also in cases where the transaction is made in notarial form between legal entities, that is, the powers must be confirmed in the same form as the agreement is concluded.

Article 29 of the Tax Code of the Russian Federation. Authorized representative of the taxpayer (current version)

The commented article defines persons who can act as authorized representatives.

An authorized representative of a taxpayer must have a power of attorney.

The procedure for issuing a power of attorney is determined by Article 185 of the Civil Code of the Russian Federation.

The procedure for notarization of powers of attorney is established by Article 59 of the Fundamentals of the Legislation of the Russian Federation on Notaries, approved by the Supreme Council of the Russian Federation on February 11, 1993, N 4462-1.

A power of attorney gives the right to perform legal actions to the person to whom the power of attorney was issued in relation to the person who issued the power of attorney.

The law requires compliance with the form of the power of attorney in the form of its notarization, if such a form is required by law.

The powers of representatives of individuals must be confirmed by a notarized power of attorney or a power of attorney equivalent to a notarized one in accordance with the civil legislation of the Russian Federation.

For example, the performance of actions by a representative (in particular, payment of training expenses) on behalf of the represented person on the basis of a written power of attorney, concluded in a simple, not notarized form, should be understood as the exercise of the civil rights of the represented person.

In this regard, the refusal in such a situation to an individual to provide a social tax deduction in the absence of a notarized power of attorney issued by him to his representative to pay for education is not based on the norms of the current legislation.

In paragraph 4 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 N 57 “On some issues arising when arbitration courts apply part one of the Tax Code of the Russian Federation” it is explained that by virtue of the paragraph of the first paragraph 3 of Article 29 of the Tax Code of the Russian Federation, the authorized representative of the taxpayer-organization exercises his powers on the basis of a power of attorney issued in the manner established by the civil legislation of the Russian Federation, unless otherwise provided by the Tax Code of the Russian Federation.

In particular, an exception to the above general rule is provided for in paragraph 4 of Article 29 of the Tax Code of the Russian Federation, according to which the responsible participant in a consolidated group of taxpayers is an authorized representative of all participants in the consolidated group of taxpayers on the basis of the law.

At the same time, a trust management agreement is not a sufficient legal basis for the trustee to represent the interests of the management founder in the field of taxation. The corresponding powers of the manager must be formalized taking into account the requirements of paragraph 3 of Article 29 of the Tax Code of the Russian Federation.

However, courts must keep in mind that the trustee does not need a power of attorney to perform the duties directly assigned to him by the provisions of part two of the Tax Code of the Russian Federation (for example, Articles 174.1, 214.1, 214.4, 275, etc.).

An authorized representative of a taxpayer - an individual exercises his powers on the basis of a notarized power of attorney or a power of attorney equivalent to a notarized one in accordance with the civil legislation of the Russian Federation (paragraph two of paragraph 3 of Article 29 of the Tax Code of the Russian Federation). These provisions also apply to individuals who are individual entrepreneurs.

Clause 2 of Article 185.1 of the Civil Code of the Russian Federation lists the types of powers of attorney that are equivalent to notarized ones.

Thus, a representative of an individual entrepreneur has the right to act either on the basis of a notarized power of attorney, or on the basis of a power of attorney issued in accordance with Article 185.1 of the Civil Code of the Russian Federation.

Such clarifications are given in the letter of the Federal Tax Service of Russia dated August 22, 2014 N SA-4-7/16692.

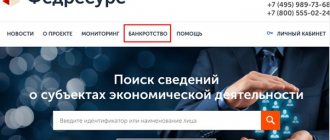

The powers of representatives of legal entities must be confirmed by a written power of attorney concluded in a simple form.

A power of attorney on behalf of a legal entity is issued signed by its head or another person authorized to do so by its constituent documents, and it is not necessary to put the organization’s seal on the power of attorney (clause 4 of Article 185.1 of the Civil Code of the Russian Federation).

The legislation of the Russian Federation does not provide for a notarized form of power of attorney when submitting tax reports and other information by legal entities to the tax authorities.

For example, the head of a separate division may be an authorized representative of a taxpayer organization (see letter of the Ministry of Finance of Russia dated 08/05/2011 N 03-02-07/1-278).

According to paragraph 15 of the Review of judicial practice of the FAS East Siberian District related to the application of Chapter 14 of the Tax Code of the Russian Federation (tax control) (recommended by Resolution of the Presidium of the FAS East Siberian District dated 06/09/2011 N 4), a power of attorney issued to an authorized representative of the taxpayer may indicate general authority to represent interests in relations with government agencies. Neither the legislation on taxes and fees, nor civil legislation prescribe the need for a special indication in the power of attorney of the authority to participate in the consideration of tax audit materials.

Comment source:

“ARTICLE-BY-ARTICLE COMMENTARY TO PART ONE OF THE TAX CODE OF THE RUSSIAN FEDERATION” (UPDATE)

Yu.M. Lermontov, 2016

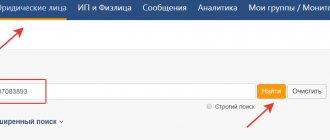

Rights of a legal entity when issuing a power of attorney

The legal representative of a legal entity has the right to revoke a previously issued power of attorney at any time. The power of attorney is terminated in a number of other cases:

- if its validity period has expired;

- the legal entity has ceased its activities;

- termination of relations between legal entities or between an enterprise and an individual.

There are no requirements in the legislation for the execution of a power of attorney on the company’s letterhead, so it can be drawn up on a regular A4 sheet.

Other persons authorized to sign

Authorized persons of an organization are persons who have the right to sign documents for the manager, chief accountant, and other officials on the basis of an order, power of attorney or other document.

In printed forms of documents, information about such authorized persons can be filled in:

- automatically, if the information in the Authorized Persons ;

- manually, by selecting a person from the Individuals .

Automatic substitution

Automatic insertion of data on authorized persons is possible for printed forms of the following documents:

- Sales (acts, invoices);

- Invoice to the buyer;

- Invoice issued;

- Implementation adjustments;

- Provision of services;

- Provision of production services;

- Sales of processing services.

To do this, you need to fill in the information about the authorized person in the information register Authorized Persons : button Main menu - All functions - Information Registers - Authorized Persons.

The following details must be filled in on the authorized person's card.

The following fields are required:

- Who does he sign for?;

- Authorized person;

- Based.

The User field is required if the Users in 1C is not empty. Otherwise, the data on the authorized person will not be automatically filled in.

You can assign authorized persons only for the following categories of responsible persons specified in the Signs for :

- Supervisor;

- Chief Accountant;

- Responsible for registration - used only for the printed form of the Universal Transfer Document (UDD).

For other authorized persons, this mechanism does not work, despite the fact that all categories of authorized persons are available for selecting and filling out information.

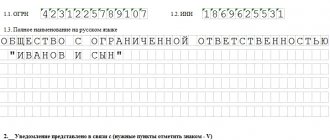

It is necessary to include manager A.P. Ivanov, an acting manager and authorized to sign documents for the manager on the basis of Order No. 39 of August 16, 2018, among the authorized persons.

To automatically indicate an authorized person in printed form of documents, you must fill in the data for him in the Authorized Persons .

Then, in printed forms of documents, the information about the manager will automatically include the data of the specified authorized person.

Authorized Persons register does not provide for an indication of the date from which the authorized person temporarily performs the duties of a manager. The acting manager A.P. Ivanov will be indicated in the Manager when printing old and new documents until the data on him is deleted from the register.

It is necessary to include in the authorized persons authorized to sign in printed forms of the Universal Transfer Document (UDD) the accountant A.V. Kuznetsova, responsible for registration, on the basis of Order No. 19 of January 10, 2018.

To automatically indicate an authorized person in a printed UPD form, you must fill in the data for him in the Authorized Persons .

When the information in the Sales document (act, invoice) Responsible is automatically filled in using the link Details of the seller and buyer .

The printed form of the Universal Transfer Document (UDD) displays the person responsible for the correct registration of the fact of economic life.

Manual filling

If indicating information about an authorized person in printed forms of documents is not required on an ongoing basis, but is only necessary for substitution in individual documents, then it is better to manually select such a person directly in the document form.

Specifying an authorized person in the information register Authorized Persons will lead to constant substitution of data about the authorized person in all documents until the entry from the information register is deleted.

You can manually select an authorized person in the following documents:

- Implementation adjustments - Advanced tab;

- Provision of services - Additional tab;

- Provision of production services - Additional tab;

- Sales (acts, invoices) : type of transaction Goods - link Details of the seller and buyer;

- type of transaction Services - link Details of the seller and buyer;

- type of transaction Goods, services, commission - link Signatures;

- type of operation Shipment without transfer of ownership - link Signatures;

- type of operation Equipment - link Signatures;

The indicated links and tabs open a form for indicating an authorized person directly in the document.

In this case, the entered information when recording a document is automatically recorded in the Authorized Persons .

If data on the Who Signs , then it will be overwritten by the new person authorized to sign the documents.

Removing information about authorized persons

You can remove the output from the printed forms of an authorized person acting temporarily:

- From the document itself in the form of signatures of responsible persons. For example, to delete the person authorized for registration in the document Implementation (deed, invoice) - link Signatures, you need to clear the field of the authorized person in the Responsible for registration (UPD) .

Information about the person temporarily replacing the manager will be deleted after recording the document. Simply clearing the authorized person field without recording the document will not delete the authorized person information.

- Directly from the information register Authorized persons : button Main menu – All functions – Information registers – Authorized persons.

In the Authorized Persons , you need to go to the line with the authorized person to be deleted and click on the Del (or use the MORE - Delete button).

Rights and obligations of the labor protection commissioner

Rights of the labor protection commissioner:

- monitor compliance of working conditions with legislation;

- participate in the work of the commission for the acceptance of equipment put into operation;

- receive information from the employer about the state of labor protection in the organization;

- demand the suspension of work at the site where violations posing a threat to the health and life of workers were discovered;

- demand elimination of violations identified during inspections;

- send appeals to supervisory authorities about violations of working conditions;

- participate in the consideration of labor disputes;

- participate in the work of the accident investigation commission.

Responsibilities of the Occupational Safety and Health Commissioner:

- take part in creating safe working conditions that meet the requirements of Russian legislation;

- monitor compliance by the head of the organization with the requirements of labor legislation in the field of labor protection;

- identify and record violations of labor protection requirements;

- represent the interests of the organization’s employees in disputes regarding labor protection;

- advise employees on labor safety issues.

Procedure for electing a labor protection commissioner

The Labor Protection Commissioner is elected at a general meeting of the labor collective by voting. A meeting can be initiated by both the organization’s employees (work collective) and the trade union organization.

Depending on the size of the organization, several commissioners may be elected. If the organization has several divisions, then it makes sense to elect an authorized representative for each division.

Employees who, by virtue of their position, are responsible for labor protection (officials, work managers) should not be elected as authorized persons.

When the choice is made, it is necessary to draw up the appropriate protocol.

Sample minutes of a labor collective meeting

The protocol on the election of a labor protection commissioner must necessarily contain the following information:

- number of meeting participants;

- names of the chairman and secretary of the meeting;

- name of the meeting agenda;

- number of votes “for”, “against”, “abstained”.

Next, the employer issues an order to appoint a labor protection representative based on the submitted protocol.

Sample order for the appointment of a labor protection commissioner

Attention! The employer does not have the right to reject the selected candidate or appoint his own candidates as labor safety representatives.

The employer is obliged to send the elected occupational safety representative for training at a specialized training center in the appropriate program. The employer pays for the training.

The legislation does not regulate the term for which the labor protection commissioner is elected.

As a rule, the occupational safety representative is elected for a term of 2 years. Reason : Resolution of the Ministry of Labor of the Russian Federation dated 04/08/1994 N 30 “On approval of Recommendations for organizing the work of an authorized (trusted) person for labor protection of a trade union or work collective” ( replaced by Resolution of the Executive Committee of the FNPR dated 09/26/2007 No. 4-6 “ On Methodological Recommendations for organizing monitoring (monitoring) of the state of conditions and labor protection in the workplace by authorized (trusted) representatives of trade unions .

Attention! The Occupational Safety and Health Commissioner may be removed from his position early due to improper performance of his duties. This procedure is also carried out at the general meeting.

Important! The labor safety representative cannot be dismissed without agreement with the labor collective/trade union.