In the 1C Accounting 8.3 program, the calculation of income tax and tax under the simplified tax system is automated, taking into account the trade tax, and the ability to prepare a notice of registration of retail outlets is also implemented. The 1C 8.3 program calculates sales fees for registered retail outlets on a quarterly basis.

Let's look at how to register retail outlets correctly and without errors in the 1C Accounting 8.3 program, calculate the trade fee and reflect it in the income tax return, as well as calculate and charge the trade fee under the simplified tax system.

Payment of trade tax: payers, terms, rate, calculation

Trade tax is a mandatory payment paid by enterprises and individual entrepreneurs engaged in trade in the federal cities of St. Petersburg, Moscow, Sevastopol (Articles 410, 411 of the Tax Code of the Russian Federation).

The trade fee in Moscow was introduced by the Moscow Law of December 17, 2014 No. 62 “On Trade Fee”.

The use of a trade object – real or movable property, such as, for example: buildings, premises, structures is subject to a trade tax; use of a facility where stationary or non-stationary trade is carried out, or a retail outlet.

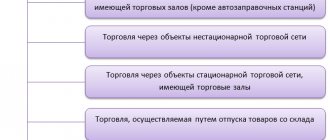

According to clause 2 of Article 413 of the Tax Code of the Russian Federation, the trade fee is established:

Organizations, enterprises and individual entrepreneurs must register with the tax service as a payer of trade tax by submitting the necessary Notification (Letter of the Federal Tax Service dated August 12, 2015 N GD-4-3/14174).

The fee is accrued quarterly (Article 414 of the Tax Code of the Russian Federation). The payer independently calculates the amount of the fee for each object by multiplying the trade fee rate (ST) by the actual value of the physical characteristics of the trade object (FH):

Trading fee = ST*FH

The rate of trade tax (ST) is established by the municipality (clause 1 of Article 415 of the Tax Code of the Russian Federation) depending on:

- different types of trading activities;

- features of the trade object;

- categories of fee payer;

- territory where a particular type of trade is carried out.

The physical characteristic (PC) of an object can be (depending on the specific type of activity):

- sales floor area;

- separate object of trade.

The fee is paid by the 25th day of the month following the reporting period (clause 2 of Article 417 of the Tax Code of the Russian Federation).

Registration of a retail outlet

Registration of a new outlet, as well as making legal changes to an existing outlet, are made in the directory Retail outlets in the section Directories - Taxes - Trade fee - Retail outlets.

The trade tax is provided for in cities of federal significance (Moscow, St. Petersburg and Sevastopol) and is established by the law of the constituent entity of the Russian Federation (Article 411 of the Tax Code of the Russian Federation). As of 2022, the trade tax has been introduced only in Moscow (Moscow Law of December 17, 2014 N 62).

Please pay attention to filling out the fields:

- Outlet type - Store .

- Date of registration - the date of occurrence of the object of taxation (date of commencement of trading activities).

- Address - the address of the location of the retail outlet.

- The area of the sales area is 25 sq. m.

- Registration - At the location of the organization , since in this case the Federal Tax Service Inspectorate at the location of the retail outlet corresponds to the Federal Tax Service Inspectorate at the location of the organization.

- Trading fee for the quarter - 30,000 rubles, the amount of the trading fee payable for the quarter is calculated automatically.

Find out more about Registration of a taxable object

Registration of information about retail outlets in 1C 8.3

Registration of retail outlets for automatic calculation of the trade fee is carried out in the section Directories - Taxes - Trade fee:

You can register a new retail outlet using the “Retail outlets” link:

The “Status” field shows the current state of the outlet:

Using the “History” links you can see changes in the physical indicators of the outlet. For example, the area of retail space, as well as the benefits applied:

The [Deregister] button registers this event in 1C 8.3 for a specific date, and also makes it possible to prepare a notice of deregistration of a retail outlet in form No. TS-2:

The 1C 8.3 Accounting program allows you to check the prepared notification, print it, upload it to a file, or immediately send it to regulatory authorities if the 1C-Reporting service is connected to 1C 8.3:

Reducing income tax by the amount collected

If an individual entrepreneur or organization is registered as a fee payer, then at the end of each quarter in which a taxable object arose, a trade fee must be paid.

The amount of the fee paid allows you to reduce income tax. This opportunity neutralizes the company's costs of paying the fee. It is important that the company has a profit that can be taxed accordingly. If there is no profit, then it will not be possible to reduce it by the amount of the fee paid.

The amount of the fee paid will be fully taken into account as part of the income tax if the amount of tax paid to the local budget on profit (at a rate of 18% of profit) exceeds the amount of the transferred fee.

Income tax is also paid quarterly in the form of advance payments, but the deadline for payment is the 28th of the next month.

Thus, the company first calculates the trade tax (if there is a corresponding taxable object) and pays it up to the 25th day inclusive. After that, a comparison is made of the listed amount and the advance payment on profit (part of the payment, calculated at a rate of 18% and paid to the budget of the Moscow Region), if the latter exceeds the previously paid fee, then the difference is paid until the 28th inclusive.

If the profit tax is less than the fee, then nothing additional is required to be paid to the local budget. In such a situation, due to the obligation to pay a trade tax, the amount of which exceeds the profit tax, the actual tax burden on the entrepreneur increases.

Calculation and accrual of trade tax and its reflection in the income tax return

The income tax can be reduced by the amount of the Trade Tax actually paid before the date of payment of the income tax (Clause 10, Article 286 of the Tax Code of the Russian Federation).

The calculation of the trading fee in 1C 8.3 is carried out quarterly by the regulatory operation “Closing the month. Calculation of trade fee":

Document movements:

Payment of the trade fee in 1C 8.3 is registered using the document “Write-off from a personal account” - operation “Payment of tax”:

Document movements in accounting and postings for trade fees in 1C 8.3:

The calculated and paid trade fee is indicated in Sheet 02:

- pp.265 – 267;

- Appendices No. 5 – pp. 095 – 097;

- Appendices No. 6 – pp. 095 – 097.

In particular, Sheet 02 indicates:

Reflection in Sheet 02 of the trading fee:

Calculation of trade fee

The period for taxation of trade fees is a quarter (Article 414 of the Tax Code of the Russian Federation).

In the accounting system, the accrued amount of the fee is taken into account as part of expenses for ordinary activities (as expenses associated with the sale of goods) and is reflected in the Dt of account 44.01 “Distribution costs in organizations engaged in trading activities” (clause 5 of PBU 10/99, Instructions for use Chart of accounts, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n).

In NU, the amount of trade tax is not taken into account in expenses when determining the tax base for income tax (Clause 19, Article 270 of the Tax Code of the Russian Federation).

The calculation of the trading fee is carried out through the Month Closing procedure - the Calculation of Trading Fee operation in the Operations – Period Closing – Month Closing section.

Postings according to the document

The document generates transactions:

- Dt 44.01 Kt 68.13 - trading fee charged.

You can view the calculation of the trading fee in the Help-calculation of trading fee by clicking the Help calculations – Calculation of trading fee button.

The calculated amount of the fee to be paid to the budget is equal to the amount specified in the Trading fee for the quarter of the directory Retail outlets .

Calculation of sales tax and its reflection in expenses under the simplified tax system with the object “Income minus expenses”

The amount of the trade fee is taken into account when calculating the simplified tax system. When the simplified tax system is used with the object “Income minus expenses,” the amount of the paid trade fee is included in expenses (clause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

The calculation of the trading fee in 1C 8.3 is performed by the regulatory operation “Closing the month. Calculation of trade fee":

Document movements and postings for trade fees:

The transfer of the trade fee is registered by the document “Write-off from a personal account”, type of operation “Payment of tax”:

Document movements in accounting:

In NU, in section I of KUDiR, an expense is recorded for the amount of the paid trade fee:

How to account for trading fees in accounting

This payment applies to local tax. By decision of local authorities, a trade tax can be introduced in any locality. The procedure for introducing and canceling a trade tax on any territory is provided for in Article 410 of the Tax Code of the Russian Federation and part 4 of Article 4 of the Law of November 29, 2014 No. 382-FZ. To the great joy of many companies working on the “buy-sell” principle, at the moment the trading fee is established only in the territory of Moscow by Law No. 62 of December 17, 2014. But that’s for now.

If we consider that almost all organizations engaged in trade are payers of this fee, then many have questions about how this payment is reflected in accounting and tax accounting. So let's find out.

Apparently, having received a huge number of questions addressed to it, the Russian Ministry of Finance issued a letter. According to the letter of the Ministry of Finance of Russia No. 07-01-06/42799 dated July 24, 2015, the trade fee relates to expenses for ordinary activities. This means that the trading fee must be reflected in accounting as the debit of account 44 in correspondence with account 68 for the loan.

Debit 44 / Credit 68 “Trading fee”

By the way, in 1C accounting there is already a subaccount to account 68 for accounting for the trading fee - 68.13 “Trading fee”. If this subaccount has not yet appeared in your program, you need to check the latest update. The program may not have been updated for a long time.

How will the amount of the trading fee affect your company's profit calculation? Yes, none! Clause 19 of Article 270 of the Tax Code of the Russian Federation directly prohibits the inclusion of trade fees in expenses that reduce taxable profit. But don't be upset! Let's take a look at the Tax Code of the Russian Federation. Based on paragraph 10 of Article 286 of the Tax Code of the Russian Federation, the amount of income tax can be reduced by the amount of the trade fee. You can reduce the part of the income tax that is credited to the regional budget. This can be done if the following is done simultaneously:

- the amount of income tax payable to the regional budget must be greater than or equal to the amount of the trade tax. If this is not the case, then during the tax period you can reduce your tax liability by the amount of the trade fee in the next reporting period. But! This can only be done within one tax period! Next year you will no longer be able to make this reduction!

- your company must voluntarily register as a trade tax payer and receive notification of this.

- the trading fee must actually be paid to the budget before you pay income tax (i.e. by the 28th day of the month following the reporting quarter).

The question arises: how to reflect the reduction in income tax by the amount of the trading fee in accounting? There is no such practice yet, but in my opinion, it is convenient to do this by recording using the “red reversal” method using the following posting:

Debit 99 / Credit 68 “Profit tax credited to the budget of a constituent entity of the Russian Federation”

- the amount of the trade fee.

Moreover, this entry is made in accounting in the period in which all the above conditions are met to reduce the income tax by the amount of the trade fee.

EXAMPLE: In the 3rd quarter of 2015, an organization registered as a trade tax payer in Moscow and received a notification. The company paid a trading fee of RUB 40,500.00 by October 28, 2015. At the same time, based on the results of operations for 9 months of 2015, a loss was formed. But in the 4th quarter of 2015, a profit was made and the income tax turned out to be more than the amount of the trading fee. The following entries were made in the accounting: 3rd quarter of 2015 D 44/ K 68 “Trade fee” - 40,500.00 rubles 4th quarter of 2015 D 99/ K 68 “Income tax to the regional budget” - “- 40,500.00 rubles”.

It is not yet known how the data on reducing the income tax by the amount of the trade fee will be reflected in the accounting of the Federal Tax Service. I recommend that after submitting your income tax reports, write a letter to your tax office with a request to offset the amount of the paid trade tax to reduce the income tax in the regional budget.

Alyabyeva Maria Nikolaevna

, for the site "Bukhgalteria.ru"

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe