Why was it necessary to introduce regional coefficients at all? Russia, as a state, has a very vast territory. Citizens of our country living in different regions sometimes find themselves in very different conditions. In some areas, for climatic reasons, the cost of living is much higher, while working and living conditions are much more complex and involve additional stress on people’s health. It would be unfair to evaluate labor equally given such differences in the original “rules of the game.” We need a certain state mechanism that would relatively equalize the rights of all workers of the Russian Federation. Its role in labor law is intended to be fulfilled by the district coefficient (RK).

What kind of legal norm is this, what monetary categories it applies to, how it is documented and how to calculate it correctly, we will consider in this article.

For more than five years, the Supreme Court of the Russian Federation has not been able to decide on the question of how the three provisions of the Labor Code of the Russian Federation are consistent with each other. Because of this, even prosecutors cannot understand where the rights of workers end, which should be protected. the RF Armed Forces lost the meaning of the regional coefficient ?

Regional coefficients in the Labor Code

The Labor Code of the Russian Federation defines the regional coefficient as a mechanism for equalizing workers' incomes through an increasing financial indicator that indexes payments in regions with special climatic conditions and equivalent ones.

This method of government support for working citizens operates at the government and local level.

The Labor Code of the Russian Federation and other legislative acts prescribe this norm in the following provisions:

- Art. 316 of the Labor Code says that regional indexing coefficients are set directly by the Government of the Russian Federation, which does not exclude the possibility of additional “additions” from local budgets;

- Art. 146, art. 148 Labor Codes decipher in detail the concept of RK as a state-guaranteed supplement to various types of payments for working citizens;

- the territories in which the fixed RK will be relevant are given in Resolution of the Ministry of Labor dated September 11, 1995 No. 49;

- Art. 10 of Federal Law N 4520-1 of February 19, 1993 covers in detail the “northern” allowances.

Question: Is the regional coefficient applied to the wages of employees of separate divisions in Novosibirsk and Khabarovsk and are they provided with additional vacation days if the organization is located in Moscow? View answer

How is the coefficient calculated?

The general formula for calculating the coefficient looks like this:

Here are some examples of calculations:

Ivanov I.I. employed at a mining enterprise in the Khabarovsk Territory, in the Vyazemsky district. His salary is 30,000 rubles. His salary includes an incentive payment for intensity and achievement of high performance in the amount of 6,000 rubles. Also this month he had a seasonal part-time job, for which he received 15,000 rubles.

His actual salary will be:

30,000 + 6,000 + 15,000 = 51,000 rubles.

The regional coefficient for the Vyazemsky district of the Khabarovsk Territory is 1.3.

The salary of Ivanova I.I. will be:

51 000 × 1,3 = 66 300.

In the arms of Ivanov I.I. will receive:

66,300 – 13% (personal income tax) = 57,681 rubles.

Another example of how to calculate the regional wage coefficient:

Petrov P.P. works in Norilsk. Petrov’s salary this month is 45,000 rubles. He also worked the night shift and on holidays and went on sick leave for 2 days.

His monthly salary will be:

- salary - 45,000;

- sick leave (2 days) - 3000;

- night - 2800;

- holidays - 4000;

- the regional coefficient for the Krasnoyarsk Territory, including for the city of Norilsk, is 1.8.

The regional index is calculated on actual wages, that is, on salary and additional payments to it. In our case:

45 000 + 2800 + 4000 = 51 800.

Here's how to calculate your salary based on the northern and regional coefficient: 51,800 × 1.80 = 93,240 rubles.

Actual income of Petrov P.P. per month: 93,240 + 3000 = 96,240 – 13% (income tax) = 83,728.80 rubles.

Who can qualify for regional surcharges?

Funds, taking into account the regional coefficient, will be received as government-guaranteed payments by employees living and working in the regions provided for by law, regardless of the form of ownership of the organization. Features of the region that determine the purpose of the Republic of Kazakhstan:

- dependence on transport;

- existing infrastructure;

- environmental conditions;

- climate;

- sphere of operation of the enterprise.

IMPORTANT! The regional coefficient applies to all employees working on the basis of an employment contract, without exception, from the very first working day - subject to the essential condition of their permanent residence or employment in the specified territories.

Areas with a status requiring financial equalization include the following territories of the Russian Federation:

- the southern part of the East Siberian region;

- Far East;

- The Far North and regions similar in status to it.

Question: An organization located in the Far North pays bonuses for anniversaries in the organization and for a professional holiday. The payment of bonuses is specified in the collective agreement. Are regional coefficients and northern allowances applied to these premiums? View answer

Benefits and guarantees

In addition to the increased salary, thanks to different coefficients and accruals, residents working in the Far North have government benefits:

- Additional leave, which is paid by the employer - 24 days for the most severe regions and 16 for milder ones.

- Compensation for transport to the holiday destination and back, because due to the significant distance from other regions, transport tickets can be very expensive.

- If there is a medical certificate, the employee can travel free of charge to another city where the necessary examination or treatment will be carried out.

- Shorter work week.

- Parents can take additional paid days off for the period when the child enters school. In addition, every month parents have the right to take one day off at their own expense.

- Housing subsidies.

- Such workers retire earlier: with maximum work experience, men will retire at 55, and women at 50.

It is very difficult to live and work in such harsh conditions, so the state is trying to do everything possible to improve the lives of its citizens in such difficult conditions.

Significant salary increases and various benefits can make life in such difficult places more pleasant.

You can learn more about regional coefficients from the video:

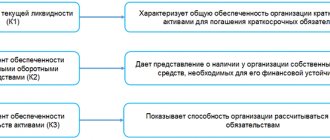

Payments indexed by the Republic of Kazakhstan

The law provides a list of financial income that is subject to the obligation to apply the district allowance:

- the minimum amount of labor remuneration and, accordingly, all payments “tied” to the minimum wage;

- salary, tariff rate, wages themselves - the entire amount received by the employee;

- all additional payments to labor remuneration - compensation, bonuses, allowances for length of service, for qualifications, for military or commercial secrets, etc.;

- surcharge “for harmfulness”;

- compensation for temporary disability;

- remuneration for seasonal workers, part-time workers, flexible or part-time workers;

- pension accruals;

- other funds paid on the basis of an employment or collective agreement.

NOTE! Pensioners will receive increased amounts only as long as they live in “special” territories; moving will necessarily remove the regional indexation of pensions.

What payments are affected by the regional coefficient?

The regional coefficient affects the following payments:

- Minimum wage and all payments using it

- Wages (salary and other income from work)

- Additional payment to wages (bonuses, allowances, additional payments for qualifications, for length of service, compensation)

- Additional pay for work in hazardous conditions (after a special assessment of working conditions)

- Sick leave payment for temporary disability

- Payment for seasonal workers, part-time workers, employees on a flexible schedule or part-time schedule

- Pension payments

- Other transfers received by an employee on the basis of an employment or collective agreement

Indexation of the above payments is valid as long as the person lives in this region. When you change your place of residence, the regional coefficient also changes.

If the regional coefficient affects the employee’s pay. It must be written into the employment contract as an essential condition.

These payments are not covered by the Republic of Kazakhstan

For logical reasons, the coefficient does not apply to the following cash accruals in favor of employees:

- payment of vacation pay - when calculating them, a rate is used that already takes into account the Republic of Kazakhstan;

- individual financial assistance provided - if this payment is irregular and the procedure for its calculation is not specified in the collective agreement or special regulations of the enterprise;

- irregular bonuses;

- travel funds if the employee does not travel to an area that also belongs to “special” regions;

- allowances for work in the Far North and similar regions - the Republic of Kazakhstan and the “northern” surcharge are different indicators, they should not be mixed, although they increase the same payments.

Question: The organization has declared downtime due to reasons beyond the control of the parties to the employment contract. Should the employer charge a regional coefficient in the Far North to pay for such downtime? View answer

How coefficients are used (example)

Let's assume that a citizen lives and works in the Tyumen region, respectively, the regional coefficient is 1.15. If the salary is 45,000 rubles, and the regular bonus is 15,000 rubles. Then the salary is calculated according to the formula: (salary + bonus) × regional coefficient = (45,000 + 15,000) × 1.15 = 69,000 rubles.

If a bonus of 15,000 rubles was received, in the form of a one-time bonus or financial assistance (from an organization) in connection with the birth of a baby. Then the regional coefficient would apply only to salary. The salary would be: salary × regional coefficient + financial assistance = 45,000 × 1.15 + 15,000 = 66,750 rubles.

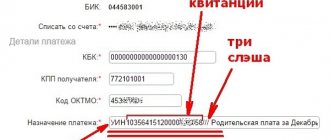

How to calculate payments taking into account the Republic of Kazakhstan

The district coefficient increases the size of the financial payment by a certain percentage. The accounting department calculates payments according to the usual scheme valid for the entire country, and then multiplies the resulting figures by its regional coefficient.

If an employer finds it difficult to determine the size of this indicator, he should contact the regional Labor Inspectorate, which has all the information on this issue, because compliance with this legislative norm is mandatory for all entrepreneurs. On their official website and other information resources you can see a table containing a list of “special” regions of the Russian Federation with the corresponding financial ratios.

What code is used in the 2-NDFL certificate to indicate the percentage premium and regional coefficient accrued to bonuses for production results?

Responsibility of the employer for non-accrual of the Ural coefficient

If an employer ignores its obligation to calculate the Ural coefficient on wages, it faces administrative penalties for violating labor laws.

Penalties are as follows: (click to expand)

- 1,000 – 5,000 rubles – per official;

- 1,000 – 5,000 rubles – for entrepreneurs;

- 30,000 – 50,000 rubles or administrative suspension of activities for up to 90 days – per organization.

Table of regional coefficients for wages by constituent entities of the Russian Federation

| № | Name of the subject of the Russian Federation | RK size |

| 1 | Republic of Adygea | |

| 2 | Altai Republic: | |

| throughout the territory | 1,4 | |

| Kosh-Agachsky, Ulagansky districts | 1,4 | |

| 3 | Republic of Bashkortostan: | |

| throughout the territory | 1,15 | |

| 4 | The Republic of Buryatia: | |

| throughout the territory | 1,2 | |

| Barguzinsky, Kurumkansky, Okinsky districts | 1,3 | |

| 5 | Bauntovsky, Muisky, Severobaikalsky districts, Severobaikalsk | 1,7 |

| 6 | The Republic of Dagestan: | |

| for settlements located at an altitude of 2000 to 3000 meters above sea level | 1,2 | |

| for settlements located at an altitude of 1500 to 2000 meters above sea level | 1,15 | |

| 7 | The Republic of Ingushetia | |

| 8 | Kabardino-Balkarian Republic | |

| 9 | Republic of Kalmykia: | |

| on the territory of the Kalmyk Autonomous Soviet Socialist Republic, bounded from the north and west by the border line with the Astrakhan region through the village. Chompot, s. Severny, village Tsagan-Nur, p. Burugsun - 10 km, east of the village. Kugulty, further to the southern border of the Priozerny district with. Shatta-UlanErge, p. Iki-Burul, village. Southern, from the south along the border of the Kalmyk Autonomous Soviet Socialist Republic with the Stavropol Territory and the Dagestan Autonomous Soviet Socialist Republic to the Caspian Sea; at the state farms “Razdolny”, “Severny”, named after. Chkalova, “Novy”, “Yalmata”, “Ulan-Erginsky”, “Red Putilovets”, “Khomutnikovsky” | 1,3 | |

| on the territory of Yustinsky, Malo-Derbetovsky and Priozerny districts, limited on the west by a line from Lake Barmannak, state farm named after. Chapaeva, s. Dede-Lamon - s. Burgsun and from the south the territory where a coefficient of 1.3 is provided; on the territory of Priozerny, Tselinny, Yashkul and Iki-Burul districts, limited from the west and north-west by a line 10 km east of Kegulta village. Bor-Nur, p. Djendik, village Buratinsky, p. The giant from the south and southeast borders the Iki-Burulsky district with the Stavropol Territory, from the north and east - the territory where the coefficient is 1.3; on state farms “Buratinsky”, “Priozerny”, “Baga-Burulsky”, “Manych” | 1,2 | |

| on the territory of the Kalmyk Autonomous Soviet Socialist Republic, with the exception of the territory where coefficients of 1.3 and 1.2 are provided, the city of Elista and the territories west of Lake Manych and ManychGudilo; in the state farms “Arshan-Zelmensky”, “Obilny”, “Ergeninsky”, “Sadovy”, “Troitsky”, “Balkovsky”, “Zapadny”, “Leninsky”, “Voznesenovsky” | 1,1 | |

| in settlements provided with drinking water and water for domestic needs, as well as in regional centers, the coefficients decrease respectively from 1.3 to 1.2, from 1.2 to 1.1 | ||

| 10 | Karachay-Cherkess Republic | |

| 11 | Republic of Karelia: | |

| Kondopoga, Pitkyaranta, Prionezhsky, Pryazhinsky, Suoyarvsky, Lakhdenpokhsky, Olonetsky districts, the cities of Petrozavodsk, Sortavala | 1,15 | |

| Medvezhyegorsky, Muezersky, Pudozhsky, Segezhsky districts | 1,3 | |

| The city of Segezha and the settlements subordinate to its Administration | ||

| Belomorsky, Kalevalsky, Kemsky, Loukhsky districts, Kostomuksha | 1,4 | |

| The city of Kem and the settlements subordinate to its Administration | ||

| 12 | Komi Republic: | |

| Knyazhnogorsky, Kortkorossky, Sysolsky, Syktyvdinsky, Priluzsky, Ust-Vymsky, Ust-Kulomsky, Koygorodsky districts, Syktyvkar | 1,2 | |

| Pechora, Sosnogorsk, Izhemsky, Ust-Tsilemsky, Troitsko-Pechorsky, Udora districts | 1,3 | |

| the cities of Ukhta and populated areas subordinate to its Administration, Pechora and populated areas subordinate to its Administration, Sosnogorsk and populated areas subordinate to its Administration, Vuktyl and populated areas subordinate to its Administration | ||

| Vuktyl district, Vuktyl city | 1,4 | |

| Usinsky district, Inta cities, Usinsk | 1,5 | |

| 13 | Vorkuta | 1,6 |

| 14 | Mari El Republic | |

| 15 | The Republic of Mordovia | |

| 16 | The Republic of Sakha (Yakutia): | |

| areas located up to the Arctic Circle, south of 65 degrees. northern latitude: Aldansky, Amginsky, Verkhnevilyuysky, Vilyuysky, Gorny, Kobyaisky, Leninsky, Lensky, MeginoKangalassky, Neryungrinsky, Namsky, Mirninsky, Olekminsky, Ordzhonikidze, Suntarsky, Tattinsky, Tomponsky, Ust-Aldansky, Ust-Maysky, Churapchinsky, Yakutsky | 1,7 | |

| areas located beyond the Arctic Circle, not lower than 65° northern latitude: Abyisky, Allaikhovsky, Anabarsky, Bulunsky, Verkhnekolymsky, Verkhoyansky, Zhigansky, Mirninsky (territory of the Aikhalsky and Udachny City Council), Momsky, Nizhnekolymsky, Oymyakonsky, Oleneksky, Srednekolymsky, Ust- Yansky, Eveno-Bytantaysky | 2 | |

| areas where enterprises and construction sites of the diamond mining industry are located, at the Aikhal and Udachnaya deposits, the Deputatsky and Kular mines | 2 | |

| 17 | Republic of North Ossetia Alania | |

| 18 | Republic of Tatarstan | |

| 19 | Tyva Republic: | |

| throughout the territory | 1,4 | |

| Mongun-Taiginsky, Tozhinsky, Kyzylsky (territory of Shynaan Rural Administration) districts | 1,5 | |

| 20 | Udmurt republic | |

| throughout the territory | 1,15 | |

| 21 | The Republic of Khakassia: | |

| throughout the territory | 1,3 | |

| 22 | Chechen Republic | |

| 23 | Chuvash Republic - Chuvashia | |

| 24 | Altai region: | |

| throughout the territory | 1,15 | |

| Aleysky, Baevsky, Blagoveshchensky, Burlinsky, Volchikhinsky, Egorievsky, Zavyalovsky, Klyuchevsky, Kulundinsky, Mamontovsky, Mikhailovsky, German, Novichikhinsky, Pankrushikhinsky, Pospelikhinsky, Rodinsky, Romanovsky, Rubtsovsky, Slavgorodsky, Suetsky, Tabunsky, Uglovsky, Khabarovsky, Shipunovsky districts, cities regional subordination Aleysk, Slavgorod, Yarovoye | 1,25 | |

| 25 | Krasnodar region | |

| 26 | Krasnoyarsk region: | |

| throughout the territory | 1,3 | |

| Kezhemsky district | 1,6 | |

| Turukhansky (north of the Lower Tunguska and Turukhan rivers) region, areas located north of the Arctic Circle (with the exception of the city of Norilsk and settlements subordinate to its Administration), the city of Igarka and settlements subordinate to its Administration | ||

| Norilsk and settlements subordinate to its Administration | 1,8 | |

| 27 | Primorsky Krai: | |

| throughout the territory | 1,2 | |

| settlements of the Taezhny and Ternisty mines in the Krasnoarmeysky district | 1,4 | |

| 28 | Stavropol region | |

| 29 | Khabarovsk region: | |

| Khabarovsk, Bikinsky, Vyazemsky, named after Lazo, Nanaisky districts, Khabarovsk | 1,3 | |

| Ayano-Maysky, Tuguro-Chumikansky, Nikolaevsky, named after Polina Osipenko, Komsomolsky, Sovetsko-Gavansky, Vaninsky, Solnechny, Amursky, Verkhnebureinsky, Ulchsky districts, Komsomolsk-on-Amur | 1,5 | |

| Okhotsk region | 1,7 | |

| 30 | Amur region: | |

| Arkharinsky, Belogorsky, Blagoveshchensky, Bureya, Zavitinsky, Ivanovsky, Konstantinovsky, Mazanovsky, Mikhailovsky, Oktyabrsky, Romnensky, Svobodnensky, Seryshevsky, Tambov districts, the cities of Blagoveshchensk, Belogorsk, Raichikhinsk, Svobodny | 1,3 | |

| Magdachinsky, Shimanovsky districts, Shimanovsk | 1,4 | |

| Skovorodinsky district | 1,5 | |

| Zeya, Selemdzhinsky, Tynda districts, cities of Zeya, Tynda | 1,7 | |

| 31 | Arhangelsk region: | |

| throughout the territory | 1,2 | |

| Leshukovsky, Pinezhsky districts | 1,4 | |

| Mezensky, Solovetsky districts, Severodvinsk and settlements subordinate to its Administration | ||

| 32 | Astrakhan region: | |

| the regional coefficient is applied to the wages of employees of enterprises and organizations located in desert and waterless areas in the “black lands”, “Kizlyar pastures”, in part of the Limansky district | 1,1 | |

| the regional coefficient is applied to the wages of workers for work in desert and waterless areas engaged in water construction and construction of facilities on state farms and other agricultural enterprises in the Astrakhan region | 1,35 | |

| the regional coefficient is applied to wages for work in desert and waterless areas: workers engaged in geological exploration, drilling wells, construction and operation of Astrakhan gas condensate field facilities, including workers of auxiliary enterprises, construction industry bases, as well as employees of the USSR Ministry of Internal Affairs employed on this construction; employees of enterprises and organizations serving the construction and operation of the Astrakhan gas condensate field; workers and employees of enterprises, organizations, institutions located in populated areas in the eight-kilometer sanitary protection zone of the Astrakhan gas complex for the period until the latter are resettled from this territory | ||

| 33 | Belgorod region | |

| 34 | Bryansk region | |

| 35 | Vladimir region | |

| 36 | Volgograd region | |

| 37 | Vologda Region: | |

| Babaevsky, Vologda, Gryazovets, Kaduysky, Mezhdurechensky, Sokolsky, Ustyuzhensky, Chagodoshchensky, Cherepovets, Sheksninsky districts, Vologda | 1,15 | |

| Cherepovets with the territory subordinate to the city Council of People's Deputies | 1,25 | |

| 38 | Voronezh region | |

| 39 | Ivanovo region | |

| 40 | Irkutsk region: | |

| throughout the entire territory (with the exception of the city of Angarsk, the city of Cheremkhovo and the Cheremkhovo district, the city of Tulun and the Tulunsky district and employees of the Eastern Railway, for which decisions of the regional executive committee and resolutions of the Head of Administration were adopted) | 1,3 | |

| Bratsky district, Bratsk | 1,4 | |

| Ust-Ilimsky, Nizhneilimsky districts, Ust-Ilimsk | 1,6 | |

| Ust-Kutsky district | 1,7 | |

| 41 | Kaliningrad region | |

| 42 | Kaluga region | |

| 43 | Kamchatka region: | |

| throughout the territory | 1,8 | |

| Commander Islands | 2 | |

| 44 | Kemerovo region: | |

| throughout the territory | 1,3 | |

| 45 | Kirov region: | |

| Afanasyevsky, Belokholunitsky, Bogorodsky, Verkhnekamsky, Darovsky, Zuevsky, Kirovo-Chepetsky, Kamensky, Luzsky, Murashinsky, Omutninsky, Nagorsky, Oparinsky, Podosinovsky, Slobodskoy, Uninsky, Felensky, Khalturinsky, Yuryansky districts, Kirov with the territory subordinate to the city Council of People's Deputies | 1,15 | |

| 46 | Kostroma region: | |

| Buysky, Galichsky, Soligalichsky, Chukhlomsky, Sudaisky, Neysky, Manturovsky, Kologrivsky, Mezhevsky, Sharinsky, Ponazyrevsky, Vokhomsky, Pyshchugsky, Pavinsky, Parfenyevsky districts (the regional coefficient is applied to the wages of employees of logging, timber floating, timber transshipment enterprises, organizations and chemical forestry enterprises) | 1,15 | |

| 47 | Kurgan region: | |

| throughout the territory | 1,15 | |

| 48 | Kursk region | |

| 49 | Leningrad region | |

| 50 | Lipetsk region | |

| 51 | Magadan Region: | |

| throughout the territory | 1,7 | |

| 52 | Moscow region | |

| 53 | Murmansk region: | |

| throughout the territory | 1,5 | |

| village Fog | 1,7 | |

| Murmansk-140 | 1,8 | |

| 54 | Nizhny Novgorod Region | |

| 55 | Novgorod region | |

| 56 | Novosibirsk region: | |

| throughout the territory | 1,25 | |

| 57 | Omsk region: | |

| throughout the territory | 1,15 | |

| 58 | Orenburg region: | |

| throughout the territory | 1,15 | |

| 59 | Oryol Region | |

| 60 | Penza region | |

| 61 | Perm region: | |

| throughout the territory | 1,15 | |

| Krasnovishersky, Cherdynsky districts | 1,2 | |

| 62 | Pskov region | |

| 63 | Rostov region: | |

| Zavetinsky, Remontnensky districts; Dubovsky, Zimovnikovsky, Orlovsky, Proletarsky districts, bounded from the west by the line of the Salsk - Volgograd railway, from the north by the border with the Volgograd region, from the east, northeast and south - by the border with the Republic of Kalmykia (in the regional centers of the village of Dubovskoye, the village of Zimovniki, the village . Orlovsky and Proletarsk, the coefficient does not apply) | 1,1 | |

| 64 | Ryazan Oblast | |

| 65 | Samara Region | |

| 66 | Saratov region | |

| 67 | Sakhalin region: | |

| Aleksandrovsk-Sakhalinsky, Anivsky, Dolinsky, Korsakovsky, Makarovsky, Nevelsky, Poronaisky, Smirnykhovsky, Tomarinsky, Tymovsky, Uglegorsky, Kholmsky districts, Yuzhno-Sakhalinsk | 1,6 | |

| Nogliki, Okha districts | 1,8 | |

| Kuril, North Kuril and South Kuril regions | 2 | |

| 68 | Sverdlovsk region: | |

| throughout the territory | 1,15 | |

| Garinsky, Taborinsky districts, in territories under the Administrative subordination of Ivdelsky, Karpinsky, Krasnoturinsky and Severouralsky city councils (including cities) | 1,2 | |

| 69 | Smolensk region | |

| 70 | Tambov Region | |

| 71 | Tver region | |

| 72 | Tomsk region: | |

| Bakcharsky, Krivosheinsky, Molchanovsky, Teguldetsky districts | 1,3 | |

| Alexandrovsky, Verkhneketsky, Kargasoksky, Kolpashevo, Parabelsky, Chainsky districts, cities of Kedrovy, Kolpashevo, Strezhevoy | 1,5 | |

| The regional coefficient is applied to the wages of employees of enterprises and organizations engaged in the oil and gas industry, in geological and topographic-geodetic work, as well as employees of construction, construction and installation and specialized departments, auxiliary production, transport, farms and organizations serving oil and gas production enterprises, offices drilling, construction of oil and gas industry facilities, geological and topographic-geodetic work in the Tomsk region north of 60° north latitude | 1,7 | |

| 73 | Tula region | |

| 74 | Tyumen region: | |

| throughout the territory | 1,15 | |

| Uvatsky district | 1,5 | |

| Tobolsk, Vagai districts, Tobolsk (only for public sector employees) | 1,217 | |

| 75 | Ulyanovsk region | |

| 76 | Chelyabinsk region: | |

| throughout the territory | 1,15 | |

| 77 | Transbaikal region: | |

| throughout the territory | 1,4 | |

| Tungokochensky, Chernyshevsky, Tungiro-Olekminsky, Mogochinsky districts | 1,5 | |

| Kalarsky district | 1,7 | |

| 78 | Yaroslavl region | |

| 79 | Moscow | |

| 80 | Saint Petersburg | |

| 81 | Jewish Autonomous Region: | |

| throughout the territory | 1,3 | |

| 82 | Aginsky Buryat Autonomous Okrug: | |

| throughout the territory | 1,4 | |

| 83 | Komi-Permyak Autonomous Okrug: | |

| throughout the territory | 1,15 | |

| Gaininsky district | 1,2 | |

| Kochevsky, Kosinsky districts | 1,2 | |

| 84 | Koryak Autonomous Okrug: | |

| throughout the territory | 1,6 | |

| throughout the entire territory (the regional coefficient is applied to the wages of employees of construction and repair organizations) | 1,8 | |

| throughout the entire territory (the regional coefficient is applied to the wages of forestry workers) | 2 | |

| 85 | Nenets Autonomous Okrug: | |

| throughout the territory | 1,8 | |

| 86 | Taimyr (Dolgano-Nenets) Autonomous Okrug: | |

| throughout the territory | 1,8 | |

| 87 | Ust-Ordynsky Buryat Autonomous Okrug: | |

| throughout the territory | 1,3 | |

| 88 | Khanty-Mansiysk Autonomous Okrug - Ugra: | |

| throughout the territory | 1,7 | |

| 89 | Chukotka Autonomous Okrug: | |

| throughout the territory | 2 | |

| 90 | Evenki Autonomous Okrug: | |

| Baykitsky, Tungusko-Chunsky districts | 1,5 | |

| Ilimpiysky district | 1,6 | |

| 91 | Yamalo-Nenets Autonomous Okrug: | |

| north of the Arctic Circle (66° 33.3′ north latitude): | 1,8 | |

| Salekhard, Aksarkovsky village council of the Priuralsky district | ||

| Labytnangi city, village. Sidorovsk of the Krasnoselkupsky district, Nydinsky and Yamburgsky village councils of the Nydymsky district, Baydaratsky, Beloyarsky and Kharsaimsky village councils of the Priuralsky district, Samburgsky village council of the Purovsky district, Tazovsky, Yamalsky districts | ||

| south of the Arctic Circle (66° 33.3′ north latitude): Gubkinsky, Muravlenko, Nadym, Novy Urengoy, Noyabrsk, Krasnoselkupsky district (except for the village of Sidorovsk), Nadymsky district (except Nydinsky and Yamburg village councils), Zelenoyarsky and Katravozhsky village councils of the Priuralsky district, Purovsky district (with the exception of Samburgsky village council), Shuryshkarsky district | 1,7 |

FILES

Historical reference

The regional coefficient appeared in 1964 and was aimed at people working in gas and oil production. The main recipients of this bonus were employees and residents of the Khanty-Mansiysk and Yamalo-Nenets Autonomous Okrugs. Nowadays, the list of regions has expanded. Now they receive a regional coefficient in the Altai Territory, Krasnoyarsk Territory, and northern regions. But you shouldn’t think that the sum of this coefficient is the same everywhere. It is calculated for each region individually. Let's look at how the regional coefficient is calculated in the Altai Territory.

Northerners get more

Allowances for labor in the North have the same function and mechanism of action as the Republic of Kazakhstan. But these indicators are somewhat different. The Far North stands apart from a number of regions with a special financial status, distinguished by special climatic conditions. This is how legal norms that were adopted back in Soviet times and remained virtually unchanged are interpreted.

“Northern bonus” is an additional payment of a constant percentage to the salary part of the salary, carried out for work in certain regions of the Russian Federation, characterized by harsh climatic conditions (the Far North and similar areas). Its size is the same for all territories included in this list:

- 10% for the first six months of work;

- every 6 months there is a 10% increase up to the established limit of 80%, and in some areas - up to 100%;

- territories equated to the Far North allow you to increase the bonus by 10% only after a year of work and do this once a year with an increase of up to 50% (in some regions up to 30%);

- special standards are relevant for young specialists (up to 30 years of age) - they receive a double increase (20%) at an accelerated rate, starting from the first working day, if they have lived in the given region for 5 or more years before starting work.

Features of northern payments for different categories of workers

Payment according to the northern coefficient will be slightly different for employees performing work in different modes:

- Part-time workers , if their additional work is carried out in the northern region, have every right to an appropriate bonus (Article 285 of the Labor Code of the Russian Federation).

- Seasonal workers, shift workers, conscripts who temporarily arrive to work in such regions will also receive an allowance in accordance with Art. 302 Labor Code of the Russian Federation.

- Specialists who perform home work and work remotely will receive indexed pay if they permanently reside in the specified area, which is reflected in the employment contract.

- “Travelers,” or employees whose jobs involve a lot of movement, will receive additional funds based on where they travel rather than the location of their organization's headquarters.

Accrual procedure and recalculation

The regional coefficient is always calculated based on the conditions and how much time the employee spent in areas with a northern coefficient. This is all carefully checked and recorded exactly according to working hours.

If he works there constantly, then the coefficient will be calculated on all his earnings; if he travels to such regions periodically, then only the part that was earned in this region will be increased.

There are other conditions for which the employee will receive bonuses:

- Work experience, title and class in the specialty;

- Employees who were allowed access to information constituting state secrets;

- By length of service;

- For successful annual work;

- For working in a complex schedule: at night, daily, or combining several professions at once.

The increase in salary is also influenced by the age of the employee: for young people under 30 years old, the possibility of accelerated calculation of the bonus is provided:

- In regions 1 and 2 groups (that is, with a maximum increase of 100 and 80%), from the very beginning of work they will receive 20% of their salary. Every six months, the premium will increase by another 20%, but you will have to wait a whole year for the last 20% before the maximum rate.

- In regions with a 50 and 30% bonus, the employee will initially receive a 10% bonus, and every six months the bonus will increase by another 10%.

For people over 30 years old, a slightly different scheme is used:

- For areas of groups 1 and 2, accruals will increase by 10% every 6 months until it reaches a maximum of 100% for the first group of regions and 80% for the second.

- For Group 3 localities, charges will increase by 10% each year until charges reach 50%.

- For group 4, for the first year the premium will be 10%, then for every 2 years 10% will be added until it increases to a maximum of 30%.

The northern coefficient is not included in the minimum wage.

Northern payments

There are people all over the country who work in the North. Therefore, it is worth explaining what the northern allowance is and who is entitled to it.

The first thing I would like to note is that such an increase is considered an additional payment of the same percentage of the salary. It is awarded only for work in certain territories of Russia, which have a very harsh climate.

What is the northern allowance:

- After getting a job and after six months, ten percent is accrued.

- Every six months another ten percent is added. Thus, wages can increase up to an upper threshold of eighty percent, and in some places - up to one hundred.

- Territories that are considered the Far North allow you to add this ten percent only after a year of work. Also, once a year you can increase the interest to fifty.

- Young specialists who have not yet turned thirty years old receive a double bonus, that is, twenty percent. They are entitled to receive this additional payment starting from the first day of work. But there is one condition: before starting work, the period of residence in the region should not be less than five years.

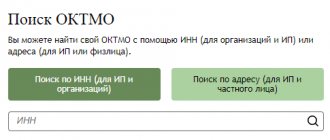

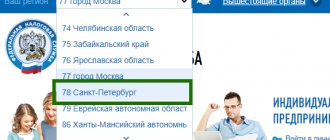

How to find out your coefficient

The easiest way is to go to the State Services website. This is done as follows:

- First you need to register.

- Then enter your office.

- Find the “Additions” section and click on it.

- In this section, mark the desired region.

- Click on the “Get service” button.

It is important to remember that all information is provided free of charge. If you need a certificate about the regional coefficient, you will have to wait for six days.

When it is not possible to use the site, you can find out all the necessary information from the Pension Fund. And about what the regional coefficient is in the Altai Territory in 2022, too.

This article discusses everything related to the regional coefficient, its meaning, the basis for calculation, and so on. It is important that all this was analyzed using the example of the Altai Territory, because usually this region remains on the sidelines. If you have any doubts about whether the coefficient is valid or not, you can look at the very detailed table in the article. In case of serious problems, it is best to contact the nearest branch of the Pension Fund or, as mentioned above, obtain information on the official State Services portal.

Altai Territory coefficient

As can be seen from the table, in most administrative entities the regional coefficient in the Altai Territory in 2022 is set at twenty-five percent. These are areas such as Aleysky, Shipunovsky, Bayevsky, Khabarovsky, Blagoveshchensky, Uglovsky, Burlinsky, Tabunsky, Volchikhinsky, Suetsky, Egoryevsky, Slavgorodsky, Zavyalovsky, Rubtsovsky, Klyuchevsky, Romanovsky, Kulundinsky, Rodinsky, Mamontovsky, Pospelikhinsky, Mikhailovsky, Pankrushikhinsky, German , Novichikhinsky. Cities where the coefficient was increased are Yarovoe, Aleysk, Slavgorod.

All other cities and regions did not change their fifteen percent coefficient. For example, the regional coefficient of the Altai Territory in the Soloneshensky district has not changed at all and is still equal to fifteen percent.

Payment nuances

Payment also depends on the working hours of employees:

- Shift workers and conscripts who work in the regions for periods of time can also count on additional pay, just like everyone else.

- Business travelers, as well as employees whose work involves frequent travel, are also entitled to additional payment. And it will depend on the location of the business trip, and not on where the company’s main office is located.

- People who combine work can also receive additional payment, but only if the second job is located in a territory that falls under the requirements.

- Employees who work from home or remotely receive additional payment only if they live in a certain area, and this is specified in the contract.

How is the size of the regional coefficient determined?

This indicator is calculated in the range from 1.1 to 2. The highest of the coefficients is for residents and workers of Chukotka, Yakutia, as well as for those people who work at enterprises in the Arctic Ocean. They get two extra salaries.

The majority of those living in the north of Russia, in its European part, are content with coefficients ranging from 1.15 to 1.4. The salary increase corresponds to fifteen and forty percent.

In order to correctly calculate the size of the regional coefficient in the Altai Territory, the Far Eastern Region, the Krasnodar Territory and other regions of our country, all factors that influence the life, health and work of people are added up. These include weather conditions, the state of transport links, the environmental situation, and the level of danger of the work. These indicators were approved back in 2011 and have not changed until now.