What are direct payments?

This is a payment scheme in which insured persons (employees) receive almost all benefits directly from the Social Insurance Fund. Employers act as intermediaries - they submit documents to social insurance for the assignment and calculation of benefits.

The Social Insurance Fund pays directly to employees:

- sick leave for illness or injury, starting from the 4th day of incapacity for work;

- sick leave due to an accident at work and (or) occupational disease;

- maternity benefits;

- a one-time benefit for women when registering in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance;

- leave for an employee injured at work (in addition to the annual paid one).

Since 2022, direct payments have been valid throughout Russia; the credit system has been abolished for everyone. If, for example, you pay an employee’s sick leave in full, you will not be able to reimburse such expenses from social insurance. It will not be possible to reduce the accrued insurance premiums on them.

Types of services

| Social Insurance Fund |

| Providing disabled people with technical means of rehabilitation and (or) services and certain categories of citizens from among veterans with prosthetics (except dentures), prosthetic and orthopedic products, as well as payment of compensation for technical means of rehabilitation independently acquired by disabled people (veterans prosthetics (except dentures), prosthetic and orthopedic products) and (or) paid services and annual monetary compensation for the expenses of disabled people for the maintenance and veterinary care of guide dogs |

| Establishing a discount to the insurance tariff for compulsory social insurance against industrial accidents and occupational diseases |

| State service to confirm the main type of economic activity of the insurer for compulsory social insurance against industrial accidents and occupational diseases - a legal entity, as well as types of economic activity of the insurer's divisions, which are independent classification units |

| State service for the appointment and payment of a one-time benefit to women registered with medical organizations in the early stages of pregnancy, if it is impossible for the insurer to pay it |

| Assignment and payment of temporary disability benefits to insured persons in case of impossibility of payment by the policyholder |

| State service for registering policyholders and deregistering policyholders - individuals obligated to pay insurance premiums in connection with the conclusion of a civil contract |

| Assignment and payment of a one-time benefit to women registered with medical organizations in the early stages of pregnancy, if it is impossible for the insurer to pay it |

| State service for the appointment and payment of a one-time benefit to insured persons upon the birth of a child in the event that it is impossible for the insurer to pay it |

| Making a decision on financial support for preventive measures to reduce occupational injuries and occupational diseases of workers and sanatorium and resort treatment for workers engaged in work with harmful and (or) hazardous production factors |

| State service for registration and deregistration of persons who voluntarily entered into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity |

| Registration and deregistration of policyholders - individuals who have entered into an employment contract with an employee |

| Assignment of security for compulsory social insurance against industrial accidents and occupational diseases in the form of one-time and (or) monthly insurance payments to the insured or to persons entitled to receive insurance payments in the event of his death |

| Acceptance of documents serving as the basis for the calculation and payment (transfer) of insurance premiums, as well as documents confirming the correctness of calculation and timely payment (transfer) of insurance premiums |

| Assignment and payment to insured persons of a monthly child care benefit in the event that it is impossible for the policyholder to pay it |

| State service for registration and deregistration of policyholders - legal entities at the location of separate divisions |

| State service for accepting calculations for accrued and paid insurance premiums for compulsory social insurance against accidents at work and occupational diseases, as well as for the costs of paying insurance coverage (form 4-FSS) |

| State service for the appointment and payment of temporary disability benefits to insured persons in the event that it is impossible for the policyholder to pay it |

| State service of provision by the Social Insurance Fund of the Russian Federation to citizens entitled to receive state social assistance in the form of a set of social services, state service of providing, in the presence of medical indications, vouchers for sanatorium-resort treatment carried out for the purpose of preventing major diseases, and free intercity travel transport to and from the treatment site |

| State service for the appointment and payment of monthly child care benefits to insured persons in the event that it is impossible for the insurer to pay it |

| State service for registration and deregistration of policyholders - individuals who have entered into an employment contract with an employee |

| Assignment and payment of maternity benefits to insured persons in case of impossibility of payment by the policyholder |

| State service for accepting documents serving as the basis for the calculation and payment (transfer) of insurance premiums, as well as documents confirming the correctness of calculation and timely payment (transfer) of insurance premiums |

| Non-electronic |

| Provision by the Social Insurance Fund of the Russian Federation to citizens entitled to receive state social assistance in the form of a set of social services, state services for providing, in the presence of medical indications, vouchers for sanatorium treatment carried out for the purpose of preventing major diseases, and free travel on intercity transport to place of treatment and back |

| State service for assigning security for compulsory social insurance against industrial accidents and occupational diseases in the form of one-time and (or) monthly insurance payments to the insured or to persons entitled to receive insurance payments in the event of his death |

| State service for the purpose of providing security for compulsory social insurance against industrial accidents and occupational diseases in the form of payment of additional expenses associated with the medical, social and professional rehabilitation of the insured in the presence of direct consequences of the insured event |

| Registration of policyholders and deregistration of policyholders - individuals obligated to pay insurance premiums in connection with the conclusion of a civil contract |

| State service for establishing a discount to the insurance tariff for compulsory social insurance against industrial accidents and occupational diseases |

| State service for making decisions on financial support for preventive measures to reduce occupational injuries and occupational diseases of workers and sanatorium and resort treatment for workers engaged in work with harmful and (or) hazardous production factors |

| Acceptance of calculations for accrued and paid insurance premiums for compulsory social insurance against accidents at work and occupational diseases, as well as for expenses for payment of insurance coverage (form 4-FSS) |

| Purpose of provision for compulsory social insurance against industrial accidents and occupational diseases in the form of payment of additional expenses associated with medical, social and professional rehabilitation of the insured in the presence of direct consequences of the insured event |

| Registration and deregistration of persons who voluntarily entered into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity |

| Assignment and payment to insured persons of a one-time benefit at the birth of a child in the event that it is impossible for the policyholder to pay it |

| Providing additional insurance guarantees to certain categories of medical workers |

| and so on. |

What benefits does the employer pay?

Organizations and individual entrepreneurs continue to accrue and pay at their own expense:

- the first 3 days of sick leave in case of illness or injury of an employee;

- funeral benefit;

- 4 additional days off to care for disabled children.

As before, employers can reimburse their expenses for funeral benefits paid and additional days off. To do this, you need to contact the FSS with an application and supporting documents. Within 10 working days, social insurance will make a decision on reimbursement of expenses to the policyholder. Then, within two more working days, the money will be transferred to the employer’s bank account.

sick pay for the first three days .

How can an employee get paid for sick leave?

The employee submits the certificate of incapacity for work to his employer. If an electronic sick leave is issued, its number is reported. Depending on the situation, the employee will be required to provide certificates from other places of work, details for transferring money, etc.

The certificate of incapacity for work must be submitted no later than six months from the date of its closure. If you miss the deadlines, you will no longer be able to send sick leave to the Social Insurance Fund through your employer. The employee will have to independently contact social insurance with an application. The benefit will be paid if the deadlines are missed for valid reasons.

For the first three days of illness, the employer must calculate the benefit. There are 10 calendar days for this. The due date for payment of this part of the sick leave is the day closest to the payment of benefits after the calculation of benefits, established for the payment of wages (including advance payments).

For the remaining days of sick leave, money will be received from social insurance after:

- the employer will send documents to the Social Insurance Fund for calculating benefits - no later than 5 calendar days from the date of their receipt from the employee;

- Social insurance will check the documents within 10 days and make a decision on granting benefits.

The money will be transferred to the employee using the details he provided to the employer. This could be a bank account (not necessarily a salary account), a Mir card, or an address for a postal transfer.

From July 1, 2022, benefits related to maternity can only be received on cards of the Mir payment system.

Does the calculation of benefits change with direct payments?

The procedure for calculating sick leave has not changed due to the transition to direct payments.

But from January 1, 2021, a new minimum wage is in effect - 12,792 rubles, that is, the minimum benefits have increased.

As in 2022, sick leave for a full month of incapacity should not be lower than the federal minimum wage, regardless of the length of insurance coverage and the employee’s actual earnings.

When calculating benefits for the first 3 days of illness:

- calculate the benefit taking into account the employee’s insurance record in the usual manner;

- calculate the benefit based on the new minimum wage, taking into account the regional coefficient;

- compare the calculation results, select the largest value and multiply by 3 days of incapacity.

The minimum wage amount is taken on the date of opening the certificate of incapacity for work.

The free “My Business” service will help you calculate employee salaries and benefits quickly and without errors.

Relation to a special area for employees

In the Employee's , using the Insurance , you can now indicate the relationship to a special zone. This information affects the calculation of benefits.

The sign of relation to a special zone falls into the Information about the insured person .

Previously, the relationship to the special zone was filled out in the Register of direct payments to the Social Insurance Fund .

Starting from 2022, it is planned to abolish the Registers , so the relation to the special zone will now be transmitted as part of the Information about the insured person .

See an excerpt from the ZUP Supporting Seminar for December 2021

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Minimum wage from 01.01.2022 (ZUP 3.1.18.336/3.1.20.96) In the releases of 3UP 3.1.18.336/3.1.20.96, the minimum wage value for 2022 has been updated….

- EDMS with the FSS: receiving notifications from the FSS about the provision of missing information (ZUP 3.1.14.265 / 3.1.15.96) Starting from ZUP 3.1.14.265 / 3.1.15.96 in ZUP 3 in ...

- Changes in SZV-STAZH and SZV-KORR (ZUP 3.1.18.336/3.1.20.96) From December 12, 2021, the procedure for filling out reports on experience has been changed -...

- Calculation of personal income tax at the rates of clause 1.1 of Art. 224 of the Tax Code of the Russian Federation (ZUP 3.1.18.336/3.1.20.96) The calculation of personal income tax has been implemented at the rate provided for in clause 1.1 of Art. 224…

How to transfer information to the Social Insurance Fund for the assignment and payment of benefits

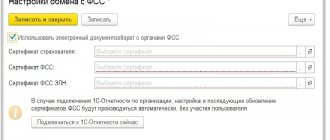

If the average number of employees for the last year is more than 25 people, an electronic register must be submitted to the Social Insurance Fund - a special form with information for the assignment and payment of benefits. You will need an electronic signature and an accounting program or service with the ability to exchange information with social insurance.

The online accounting system “My Business” has already set up an exchange with the Social Insurance Fund. You can create and send registers of sick leave directly from the service.

For different insured events there are three forms of the register; they are given in the FSS order No. 579 dated November 24, 2017:

- for temporary disability benefits, maternity benefits, when registering in the early stages of pregnancy - in Appendix No. 1;

- for benefits at the birth of a child - in Appendix No. 3;

- for child care benefits - in Appendix No. 5.

The register must be sent within five calendar days, counting from the date of receipt of sick leave from the employee.

If the average number of employees for the past year was 25 people or less , the employer can choose how to transfer information for sick leave payments to the Social Insurance Fund.

- Electronic register.

- In paper form. An inventory according to the form from Appendix No. 2 to FSS order No. 578 dated November 24, 2017 is attached to the set of documents for granting benefits.

FSS messages about changes in ENL

The ability to receive messages about the opening/closing of electronic tax records was implemented before - EDMS with FSS (1C ZUP 3.1.14.97). But it only worked for some organizations that participated in the exchange experiment with the FSS. Also, to receive notifications about the status of the electronic safety net, the consent of employees was required. Starting from 2022, employee consent and additional agreements with the Fund are no longer required to receive notifications about the opening and closing of the electronic social network.

To work with notifications about the status of the electronic tax record, a form is provided for the Message from the Social Insurance Fund about changes in the electronic tax record (Personnel - Benefits). You can download notifications by clicking the Receive from FSS .

How to proceed with direct payments to the Social Insurance Fund

Procedure for payment of benefits from the Social Insurance Fund from January 1, 2021.

- The employer receives from the employee documents for assigning and calculating benefits: a certificate of incapacity for work - a paper form or electronic sick leave number, a child’s birth certificate, certificates from other places of work, etc.

- No later than the fifth calendar day, he transfers to the FSS a package of documents with an inventory or sends information using an electronic register.

- The FSS checks for errors. If something is wrong with the documents, he sends a notice to the employer within five working days - by mail or via electronic communication channels. Corrections must also be made within five days.

- When the FSS receives all the necessary information, it will make a decision on the assignment and payment of benefits within 10 calendar days.

- If the decision is positive, the money will be transferred to the employee’s account within 10 calendar days from the moment social insurance receives all documents.

- If a payment is denied to an employee, the Social Insurance Fund will receive a decision within two working days.

From 01/01/2021, the employee provides information for calculating benefits when hiring. When an insured event occurs, he only needs to bring the missing documents (clause 2 of the Regulations, approved by Government Decree No. 2375 of December 30, 2020).

Direct payments to the Social Insurance Fund in Moscow in 2022: step-by-step instructions

The preparatory stage is carried out by the policyholder himself. What is recommended to start with:

- inform your employees that the transition to direct payments to the Moscow Social Insurance Fund is beginning; the 2022 procedure will no longer apply;

- warn employees receiving benefits about the need to provide bank account information or card details to which the Fund will be able to transfer funds;

- collect applications from persons on parental leave and receiving monthly benefits for children under 1.5 years of age for the assignment and payment of benefits - the employer, having stopped payment from 01/01/2021, must within 5 days from the date of receipt of the application transfer him and all the documents he has (copies of birth certificates, etc.) to the Social Insurance Fund for the purpose of direct payments;

- check the software and the presence of a valid digital signature - most special communication operators already have ready-made solutions for connection; if the company does not have access, it is necessary to purchase or modify programs that allow the creation of electronic registers;

- check the possibility of working with the Moscow Social Insurance Fund: connect direct payments on the official website.

If the number of employees in the previous reporting period was more than 25 people, all information is transmitted to the Social Insurance Fund in electronic form; with a smaller number, it is possible to receive documents on paper.

How to receive child care payments from 01/01/2021

In order for employees to continue receiving benefits, they must send to the Social Insurance Fund:

- package of documents for accrual and payment (or electronic register);

- information on the calculation of benefits at the time of parental leave for a child up to 1.5 years old.

You do not need to submit this information monthly. The amount of benefits assigned before 01/01/2021 does not change. The Social Insurance Fund transfers money from the 1st to the 15th of the month following the month for which the child care benefit was accrued.