When working in the 1C 8.3 Accounting program, input errors are not that rare. Of course, the human factor does not always play a role, but it also plays a big role.

Let's assume that the program reflects the fact of purchase or sale of a product. After some time, it turns out that the data entered was incorrect. The reasons are not important to us. The main thing to understand is that making changes to previously completed documents is not always correct. This can lead to disastrous consequences and break the logic of the data. That's right - make an adjustment in 1C for the previous period using the relevant documents.

Downward Acquisition Adjustment: Regulatory Regulations

An adjustment invoice issued by the seller to the buyer when the cost of shipped goods (work performed, services rendered), transferred property rights changes downwards (including in the event of a decrease in price (tariff) and (or) a decrease in the quantity (volume) of goods shipped ( work performed, services provided), transferred property rights), is a document that serves as the basis for the seller to accept tax amounts for deduction (clause 1 of Article 169 of the Tax Code of the Russian Federation).

An adjustment invoice is issued no later than 5 calendar days from the date of drawing up documents (additional agreement, other primary document) confirming the consent (fact of notification) of the buyer to change the cost of shipped goods (work, services, property rights) (clause 3 of Article 168 Tax Code of the Russian Federation).

According to paragraph 8 of Article 169 of the Tax Code of the Russian Federation, the form of the adjustment invoice and the procedure for filling it out, as well as the forms and procedure for maintaining purchase books and sales books are established by the Government of the Russian Federation.

The Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax” approved the form of the adjustment invoice and the procedure for filling it out (Appendix No. 2 to the Decree).

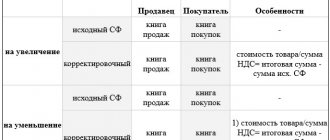

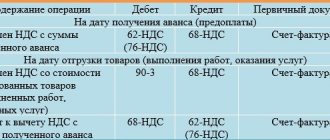

Upon receipt from the supplier of an adjustment invoice to reduce the cost of goods, the buyer:

- performs VAT restoration on the difference between tax amounts calculated on the basis of the cost of goods shipped (work performed, services rendered) and transferred property rights before and after such a reduction. VAT restoration is carried out by the buyer in the tax period in which the earliest of the following dates falls: the date of receipt of primary documents for changes in the cost of goods (work, services, property rights) or the date of receipt of an adjustment invoice (clause 4, clause 3, article 170 Tax Code of the Russian Federation);

- records the adjustment invoice in the sales ledger.

At the same time, it should be taken into account that if, until the receipt of the adjustment invoice, the amount of input VAT was not claimed for deduction (i.e., the received invoice for purchased goods (work, services, property rights) was not registered in the purchase book), then the application to deduct the amount of tax taking into account the adjustment made (i.e., registration of the received invoice in the purchase book for the reduced (adjusted) amount of VAT) does not contradict current legislation. Obviously, in this case, the received adjustment invoice for the reduction in value will not be recorded in the sales book.

The Ministry of Finance of Russia recommended using a similar approach to registering invoices to buyers in case of short delivery of goods (letters of the Ministry of Finance of Russia dated May 12, 2012 No. 03-07-09/48, dated February 10, 2012 No. 03-07-09/05).

| 1C:ITS For more information on how a buyer can register invoices when the value of goods is reduced, see the answers from O.S. Duminskaya, Advisor to the State Civil Service of the Russian Federation, 2nd class of the Value Added Tax Department of the Department of Taxation of Legal Entities of the Federal Tax Service of Russia, in the section “Consultations on Legislation”. Note With the indicated answers O.S. Duminskaya (Federal Tax Service of Russia) can be found in the article “The Federal Tax Service used examples to tell how to correctly make entries in the purchase book and the sales book.” |

Change the type of transaction if you made a mistake in it, and not the entire receipt or sales document

The form of the document and the transactions that are generated when posting the document depend on the selected type of operation. What should you do if you made a mistake with the type of operation, and even processed the document?

Select the document in the list and open the context menu with the right mouse button, select the “Change operation type” command.

In the “Document Form” window that opens, select the required type of operation.

A document will open in which the form corresponds to the new type of operation. We check the document for the presence of all the necessary data, after which we process and close it. Let's see: the postings correspond to the new type of operation.

Downward adjustment in the current period in “1C: Accounting 8” (rev. 3.0)

Let's consider an example of how the 1C:Accounting 8 version 3.0 program reflects downward adjustments to acquisitions in the current tax period if input VAT is not accepted for deduction.

Example

Organization LLC "Style" carrying out operations subject to and exempt from VAT:

In addition, in the fourth quarter of 2022, the organization LLC "Style":

The sequence of operations is given in the table. |

Setting up accounting policies

Due to the fact that the organization maintains separate accounting of the submitted VAT amounts when carrying out operations for the sale of goods (works, services), both subject to VAT and exempt from taxation, it is necessary to make appropriate accounting policy settings.

On the VAT tab of the Accounting Policy form (section Main - subsection Settings - Taxes and reports), you should set the checkbox Separate accounting of incoming VAT by accounting methods is maintained.

After making the settings in the tabular part of the documents of the accounting system Receipt (act, invoice), it will be possible to display information about the selected method of accounting for input VAT, which can take the following values:

- Accepted for deduction;

- Included in the price;

- Blocked until confirmation 0%;

- Distributed.

Receipt of goods

Receipt of goods from the seller (operations 2.1 “Accounting for received goods”, 2.2 “Accounting for input VAT”) is registered in the program using the document Receipt (act, invoice) with the transaction type Goods (invoice) (section Purchases - subsection Purchases), fig. 1.

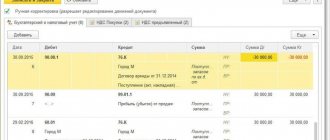

Rice. 1. Reflection in the accounting of goods received

Since the purchased goods are intended for resale, i.e., for carrying out a transaction subject to VAT, the value Accepted for deduction is indicated in the VAT accounting method field in the tabular part of the document.

After posting the document, the following accounting entries are entered into the accounting register:

Debit 41.01 Credit 60.01 - for the cost of goods purchased;

Debit 19.03 Credit 60.01 - for the amount of VAT presented by the seller on purchased goods. In this case, account 19.03 indicates the third sub-account, reflecting the method of accounting for VAT - Accepted for deduction.

An entry with the type of movement Receipt and the event Presented by VAT by the supplier is made in the VAT accumulation register. At the same time, a record is entered with the type of movement Arrival in the accumulation register Separate accounting of VAT. The recording is made to be able to use data on purchased goods in the event of a change in the purpose of their use.

To register a received invoice (operation 2.3 “Registration of a received invoice”), you must enter the number and date of the incoming invoice in the fields Invoice No. and from the document Receipt (act, invoice) (Fig. 1), respectively, and click the button Register. In this case, the document Invoice received will be automatically created (Fig. 2), and a hyperlink to the created invoice will appear in the form of the basis document.

Rice. 2. Invoice received for receipt of goods

The fields of the Invoice document received will be filled in automatically based on information from the Receipt document (act, invoice).

Besides:

- in the Received field the date of registration of the Receipt document (act, invoice) will be entered, which, if necessary, should be replaced with the date of actual receipt of the invoice. If an agreement has been concluded with the seller on the exchange of invoices in electronic form, then the date of sending the electronic invoice file by the EDF operator, indicated in its confirmation, will be entered in the field;

- in the line Base documents there will be a hyperlink to the corresponding receipt document;

- in the Transaction Type Code field the value 01 will be reflected, which corresponds to the acquisition of goods (work, services), property rights in accordance with the Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected]

Since the organization maintains separate accounting, in the Invoice received document there is no line with the value Reflect VAT deduction in the purchase book by the date of receipt, i.e. there is no possibility of a simplified application for deduction of input VAT.

An application to deduct the amount of input VAT is made using the routine operation Generating purchase ledger entries (section Operations - subsection Closing the period - Regular VAT operations).

As a result of posting the document Invoice received, a registration entry is made in the Register of Invoices. Despite the fact that since 01/01/2015, taxpayers who are not intermediaries (forwarders, developers) do not keep a log of received and issued invoices, register entries in the Invoice Log are used to store the necessary information about the received invoice.

Adjusting the cost of purchased goods

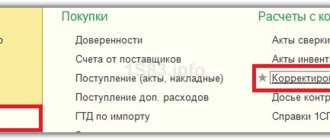

To reflect operations 3.1 “Adjustment of the cost of goods received”, 3.2 “Adjustment of input VAT”, it is necessary to create a document Adjustment of receipts with the operation type Adjustment as agreed by the parties.

This document can be created based on the document Receipt (act, invoice) (Fig. 1) by clicking the Create based on button. On the Main tab you must specify (Fig. 3):

- in the Document No. and from fields - the number and date of the document serving as the basis for adjusting the cost of purchased goods;

- in the Reflect adjustment field - the value In all accounting sections, since the adjustment is made to the cost indicators.

On the Products tab, you should indicate the adjusted indicators in the line after the change (see Fig. 3). After posting the document Adjustment of receipts, the following accounting entries are entered into the accounting register:

Debit 19.03 Credit 60.01 - REVERSE for the difference in the amount of input VAT;

Debit 41.01 Credit 60.01 - REVERSE for the difference in the cost of purchased goods.

Since before the adjustment, the amount of input VAT was not declared for deduction (the routine operation of Generating purchase ledger entries was not performed), an entry with the type of movement Receipt is made in the VAT register presented to adjust downward the amount of VAT presented by the supplier.

At the same time, a similar adjusting entry with the type of movement Receipt is also entered into the accumulation register Separate accounting for VAT.

To register the received adjustment invoice (operation 3.3 “Registration of the received adjustment invoice”), it is necessary in the Corr. invoice No. and from the Receipt Adjustment document (see Fig. 3), enter the number and date of the incoming adjustment invoice, respectively, and click the Register button.

Rice. 3. Adjustment of the cost of received goods

In this case, the document Adjustment invoice received will be automatically created, and a hyperlink to the created invoice will appear in the form of the basis document.

The fields in the document Adjustment invoice received will be filled in automatically based on information from the document Adjustment of receipts.

Besides:

- in the Received field the date of registration of the Receipt Adjustment document will be entered, which, if necessary, should be replaced with the date of actual receipt of the adjustment invoice. If an agreement has been concluded with the seller on the exchange of invoices in electronic form, then the date of sending the electronic invoice file by the EDF operator, indicated in its confirmation, will be entered in the field;

- in the line Basis documents there will be a hyperlink to the corresponding document for adjusting the receipt;

- in the Operation type code field the value 18 will be reflected, which corresponds to the receipt of an adjustment invoice due to a decrease in the cost of shipped goods, including in the event of a decrease in prices (tariffs) of shipped goods (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ).

As a result of posting the document Adjustment Invoice received, an entry will be made in the information register Invoice Journal for storing the necessary information about the received invoice.

Acceptance of completed work

To perform operations 4.1 “Accounting for completed work”, 4.2 “Accounting for input VAT”, you need to create a document Receipt (act, invoice) with the document type Services (act) (section Purchases - subsection Purchases), fig. 4.

Rice. 4. Reflection in accounting of work performed

Since the service for repairing office premises relates to the entire activity of the organization, the amount of VAT claimed by the contractor must be distributed. To do this, in the document Receipt (act, invoice) in the Accounts column of the tabular section, set the VAT accounting method to Distributed.

As a result of posting the document Receipt (act, invoice) the following accounting entries will be entered into the accounting register:

Debit 26 Credit 60.01 - for the cost of repair work performed, amounting to RUB 100,000.00;

Debit 19.04 Credit 60.01 - for the amount of VAT presented by the contractor and amounting to RUB 20,000.00. In this case, account 19.04 will have a third sub-account, reflecting the method of accounting for VAT - Distributed.

Entries with the type of movement Receipt with the event Presented by VAT by the Supplier and with the type of movement Expense with the event VAT are subject to distribution to the amount of VAT presented by the contractor and subject to distribution are entered into the VAT register submitted.

At the same time, for the tax amount written off in the VAT register, an entry is made in the Separate VAT accounting register with the type of movement Receipt.

To register an invoice received from a contractor (operation 4.3 “Registration of a received invoice”), you must enter the number and date of the incoming invoice in the fields Invoice No. and from the document Receipt (act, invoice) (see Fig. 4). invoices and click the Register button. In this case, the document Invoice received will be automatically created (Fig. 5), and a hyperlink to the created invoice will appear in the form of the basis document.

Rice. 5. Invoice received for work performed

As a result of posting the document Invoice received, an entry will be made in the information register Invoice Journal to store the necessary information about the received invoice.

Adjustment of the cost of work performed

To reflect operations 5.1 “Adjustment of the cost of work performed”, 5.2 “Adjustment of input VAT”, it is necessary to create a document Adjustment of receipts with the transaction type Adjustment by agreement of the parties.

This document can be created based on the document Receipt (act, invoice) (Fig. 4) by clicking the Create based on button.

On the Main tab you must specify (Fig. 6):

- in the Document No. and from fields - the number and date of the document serving as the basis for adjusting the cost of work performed;

- in the Reflect adjustment field - the value In all accounting sections, since the adjustment is made to the cost indicators.

Rice. 6. Adjustment of the cost of work performed

On the Services tab, you should indicate the adjusted indicators in the line after the change.

After posting the document Adjustment of receipts, the following accounting entries are entered into the accounting register:

Debit 19.04 Credit 60.01 - REVERSE for the difference in the amount of input VAT;

Debit 26 Credit 60.01 - REVERSE for the difference in the cost of work performed.

According to clause 4.1 of Article 170 of the Tax Code of the Russian Federation, the proportion for the distribution of input VAT is determined based on the cost of goods shipped (work performed, services rendered) and transferred property rights for the tax period.

Since the adjustment to the cost of contract work was made before the end of the current tax period (before performing the routine operations Distribution of VAT and Creation of purchase ledger entries), an entry with the type of movement Receipt is made in the accumulation register Separate VAT accounting to reflect the decrease in the cost of work performed and the amount of input VAT.

To register the received adjustment invoice (operation 5.3 “Registration of the received adjustment invoice”), it is necessary in the Corr. invoice No. and from the Receipt Adjustment document (see Fig. 6), enter the number and date of the incoming adjustment invoice, respectively, and click the Register button. In this case, the document Adjustment invoice received will be automatically created, and a hyperlink to the created invoice will appear in the form of the basis document.

Combine several invoices issued to the buyer in one invoice or act

First we make changes to the document, then fill out the tabular part. Any other order is an error. Therefore, go to the document “Sales of goods” and click on the “Change” button.

The “Edit Product Table” window will open on the screen. Click the “Add from document” button in it.

In the list that appears, select “Invoice to buyer” and go to invoices issued to a specific counterparty.

After selecting the required accounts, click “OK”, and the data will automatically appear in the tabular part of the invoice.