The rules for maintaining a cash register and working with cash have been changed from the end of 2022 and from the beginning of 2022. We talk about the changes that have entered the life of an accountant and manager since 01/10/2021. Our experts have prepared for you an interesting review of what’s new from 2021 on cash registers in terms of capital discipline, taking into account the Law of July 13, 2020 No. 208-FZ with amendments to the Federal Law “On combating the legalization (laundering) of criminal proceeds” No. 115-FZ.

Innovations in cash discipline

Cash discipline is the procedure for working with cash established by the Bank of Russia. It was established by Bank of Russia Directive No. 3210-U dated March 11, 2014 “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses” (hereinafter referred to as Directive No. 3210-U).

This document has been amended several times. The last one at the beginning of 2022 was 10/05/2020.

This procedure can be briefly summarized in 4 points, compliance with which is mandatory:

- The issuance of cash and its receipt at the cash desk must be carried out through incoming and outgoing cash orders. All orders at the end of the day must be entered into the cash book (clause 4.1 and clause 4.6 of Instructions No. 3210-U;

- compliance with the cash limit. Funds in excess of the established limit must be deposited in the bank. The exception is days of payment of salaries and days of receipt of revenue on weekends and holidays . Please note that small and micro businesses may not hand over cash to the bank, but leave it for safekeeping in their company. This allows you to do clause 2 of Instructions No. 3210-U;

- proceeds received in cash can only be spent on issuing wages or money on account , paying for goods , works and services. But the cash that was withdrawn from the bank account can be spent on any permitted purposes;

- cash payment limit under one agreement between legal entities and/or individual entrepreneurs is 100,000 rubles.

Receipt cash orders

In the journal of cash receipt orders of PKO, you can see the already created transactions:

And create a new one (when creating, you must specify the type of operation):

Let's say we register the receipt of cash payment from a client (based on a sale). First, we indicate the cashier, the payer and the amount:

On the second tab, fill in the basis for the payment (original sales document or agreement with the counterparty); if we receive an advance from the buyer, then leave the field empty:

In the selection list we see one line, the contract with the buyer is used as the settlement object, we leave it:

We select the VAT rate and the DDS item, the amount of mutual settlements will be filled in automatically after recording the PKO:

On the third tab, fill in the details for creating a printed form of the PKO:

Let's print out the PKO:

We have looked at the far from most effective method of creating a receipt order - it is much easier to process the receipt of payment from clients by entering based on - you need to select a specific sales transaction in the list and click Process receipt

:

The receipt will be filled in automatically:

In this case, the object of calculation is the implementation document:

Responsibility for failure to comply with cash discipline

If you are negligent in following the procedure for handling cash, you will face administrative liability - in accordance with Art. 15.1 Code of Administrative Offenses of the Russian Federation.

It is worth noting that inspectors can only prosecute a violator within 2 months from the date of the offense. That is, if a company did not deposit cash proceeds to the bank and exceeded the established limit on November 1, 2022, after January 1, 2021, it can no longer be punished for this offense.

Remember that the amounts of administrative fines are quite serious:

- for company officials - a fine of 4000-5000 rubles ;

- per company – 40,000-50,000 rubles per violation.

Expenditure cash orders (RKO)

For RKO, the program has a separate document journal:

Similar to the previous type of documents, there are also two bookmarks here:

When creating cash settlement, you should fill in the type of operation - select Payment to supplier

:

First of all, indicate the cash register and the recipient:

Next, we will indicate the object of settlement (those documents/contracts that we pay for). If it is an advance payment, leave the field blank.

In this case, I will show you how to pay for several settlement objects with one order:

In the window that appears, the program independently determines the operation suitable for payment (the oldest debt):

However, if necessary, the user can select paid documents independently:

As a result, the tabular part of the order is filled in . Payment explanation

:

Now fill in the information for correct printing of RKO:

In the RKO journal, the second tab is empty, despite the fact that both orders to the supplier and purchase documents for which there have been no payments have been completed:

The reason is that only the values of documents Request for spending funds

(we will look at it in the next lessons).

Changes from January 10, 2022

As of January 10, 2021, changes regarding the transfer or debiting of money came into force. Moreover, regardless of the currency of transfer. For transfers in foreign currency, equivalent amounts in rubles will be considered.

So, from 2022, under the control of banks and Rosfinmonitoring:

- transfers, write-offs or credits that exceed 600,000 rubles;

- postal transfers and advances for communication services (for cellular accounts) - more than 100,000 rubles.

These changes were introduced in order to improve mandatory control by Federal Law No. 208-FZ of July 13, 2020, which amended Federal Law No. 115-FZ “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism.” The beginning of its action is 10.01.2021.

The new Law of July 13, 2020 No. 208-FZ provides some relaxations . So, now they are not subject to control :

- money transfers on behalf of the client, carried out by non-credit organizations;

- exchange of banknotes of one denomination for the exchange of banknotes of another denomination;

- acquisition of securities by citizens in cash;

- obtaining property on lease.

Also, from January 10, 2022, withdrawals from or deposits of cash in the amount of 600,000 rubles or more are subject to mandatory control , regardless of the nature of the business activity. But the receipt of money from the account of an anonymous owner from abroad or the transfer of money to an anonymous owner abroad will not be controlled.

the following will be subject to mandatory control starting from 2022 :

- operations for crediting money to an account or deposit, debiting money from an account or deposit of a foreign corporation without forming a legal entity that is not yet 3 months old ;

- crediting or debiting money by such in. corporations, when they have not carried out similar operations since the date of registration.

As was said, postal transfers and advances for communication services from 100,000 rubles from 2022 are classified as transactions subject to mandatory control.

Also, starting from 2022, it is mandatory to control transactions with cash or non-cash funds for real estate in the amount of 3 million rubles or more (previously - only transactions for which the transfer of ownership was registered).

The new rule regarding cash returned to the cash desk by accountants directly concerns accountants and cashiers : such money cannot be issued again from the cash register without circulation through a current account. That is, cash received from an accountable person must first be deposited into the account, and then withdrawn again if it needs to be disposed of further.

Retail sales of goods

Regulatory regulation

Retail trade is a type of trading activity associated with the acquisition and sale of goods for use for personal, family, household and other purposes not related to business activities (clause 3 of article 2 of the Federal Law of December 28, 2009 N 381-FZ) . The conclusion of a retail purchase and sale agreement is carried out at the time of issuance of a check or other document confirming payment by the buyer (Article 493 of the Civil Code of the Russian Federation).

Sales are recognized as the transfer of ownership of goods on a reimbursable basis (Article 39 of the Tax Code of the Russian Federation). For the purpose of calculating income tax, organizations engaged in retail trade take into account income and expenses associated with acquisitions and sales.

Income:

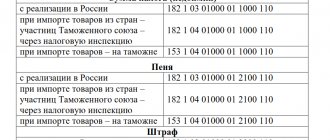

- In the accounting system, revenue from the sale of goods is classified as income from ordinary activities. It is reflected in the credit of account 90.01.1 “Revenue from activities with the main taxation system” (clause 5 of PBU 9/99, working chart of accounts 1C).

- In NU, income is revenue from sales excluding VAT (Clause 1, Article 248 of the Tax Code of the Russian Federation).

Expenses:

- In accounting, this is the actual cost of goods sold (clauses 5, 9 of PBU 10/99). Valuation of goods in retail trade can be carried out: at the cost of acquisition (without using account 42 “Trade margin”);

- at sales price (using account 42 “Trade margin”).

The chosen method must be fixed in the Accounting Policy.

- In NU, the amount of expenses that reduce sales income includes direct expenses associated with the purchase of goods. They are written off as goods are sold. Direct expenses may include (Article 320 of the Tax Code of the Russian Federation): the contractual cost of purchased goods;

- transportation costs for purchasing goods to our warehouse.

The composition of direct expenses must be fixed in the Accounting Policy.

In NU, the valuation of goods in trade (retail and wholesale) is always carried out at the cost of their acquisition (without using account 42 “Trade margin” in NU).

VAT

Retail sales of goods are subject to VAT (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

If payment is made by an individual in cash at the cash desk, then an invoice is not issued; it is enough to issue the buyer a cash receipt (clause 7 of Article 168 of the Tax Code of the Russian Federation).

In the Sales Book, the seller during a retail sale registers any primary document, which can be a cash receipt, summary certificate or other document. Such a document is registered with the transaction type code “Sale of goods, works, services to VAT non-payers, receipt of advances” (Letter of the Ministry of Finance of the Russian Federation dated October 9, 2014 N 03-07-11/50894).

To register VAT accrued on retail sales in the Sales Book , the program draws up the document Summary Certificate on Retail Sales, which is intended to generate summary data on retail sales subject to VAT for a calendar month (quarter) and register them in the sales book (clause 1 , clause 3 of the Rules for maintaining a sales book, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137). When posting this document, the entry is reflected in the Sales Book with the transaction type code “” in column 3 of the Sales Book the number and date of the document Summary of retail sales , and not Z-report . PDF

Accounting in 1C

During the day, when selling goods at retail through ATT, cash register receipts are issued. At the end of the shift, the cash register is closed and a detailed report is generated on goods sold at retail, broken down by their name, quantity and selling price.

A detailed report on goods sold is generated using the document Retail Sales Report, transaction type Retail store in the Sales – Retail Sales Reports section.

The header of the document states:

- Warehouse is a retail outlet, selected from the Warehouses directory, type Retail store . PDF

On the Products , the products sold from the Nomenclature directory are indicated.

- The accounting account is filled in automatically in the document, depending on the settings in the Item Accounting . If necessary, it can be changed manually.

Find out more about setting up item accounting accounts

In our example, accounting for goods in retail is carried out at purchase price, therefore, Accounting Account - 41.02 “Goods in retail trade (at purchase price)”.

- VAT account - 90.03 “Value added tax”.

- Expense account - 90.02.1 “Cost of sales for activities with the main tax system.”

- Income account - 90.01.1 “Revenue from activities with the main tax system.”

- Subconto is a product group related to retail trade, selected from the Product Groups directory.

It is very important to indicate the Nomenclature Group correctly, since filling out the income tax return depends on this.

Read more Setting up accounting policies in NU

Postings according to the document

The document generates transactions:

- Dt 90.02.1 Kt 41.02 - write-off of the cost of goods using the Average (the write-off method is specified in the accounting policy). PDF

- Dt 50.01 Kt 90.01.1 - revenue from retail sales of goods; in accounting accounting including VAT;

- in NU excluding VAT;

Sales Book report can be generated from the Reports – Sales Book section. PDF

Documenting

The organization must approve the forms of primary documents, including the cashier-operator report form. In 1C, a Cashier-Operator Certificate-report in the KM-6 form is used.

The form can be printed by clicking the Print button - Help cashier report (KM-6). PDF

Income tax return

In the income tax return, the amount of proceeds from the sale of goods is reflected as income from sales:

Sheet 02 Appendix No. 1:

- p.010 “Proceeds from sales - total”, including: p. 012 “...revenue from the sale of purchased goods.” PDF

The cost of goods sold is reflected in direct expenses:

Sheet 02 Appendix No. 2:

- p. 020 “Direct expenses of taxpayers...” including: p. 030 “... cost of purchased goods sold.” PDF

Results

The beginning of 2022 brought not only hopes for the future, but also changes in the organization and control of monetary transactions.

Full control over cash transactions has been established all cash transactions in the amount of RUB 600,000. and more (until 2021 - only operations that are not caused by economic activities).

The list of operations subject to mandatory control has been added. For example, these are lease payments in the amount of 600,000 rubles. and more.