It seems that the company belongs to its founder, but according to the law, he does not have the right to simply withdraw money from his current account and put it in his pocket or spend it non-cash for personal needs. The problem is that the money of the enterprise is not the money of the founder.

The question arises, in what legal ways can company funds be converted into the personal money of its owner, and in what case will it be possible to pay less taxes? It should be understood that the tax office and banks do not like it when legal entities cash out their accounts.

How to legally withdraw funds from an LLC’s current account in 2022? This is what will be discussed in detail below.

But first, let’s understand the term “legal withdrawal of funds.” It implies a transfer or withdrawal of money from a current account, which will not entail the risks of blocking the current account, tax audit and sanctions, including criminal ones. Therefore, all kinds of multi-steps outside the legal framework will not be considered in this article.

Dividends

The founder of a legal entity has the right to receive dividends, which are paid from the organization’s net profit quarterly or once every six months or year. All the main provisions are explained by Article 28 of Law No. 14-FZ of February 8, 1998.

Dividends are subject to personal income tax at a rate of 13%, insurance premiums are not charged on them, which makes this payment more attractive than a salary.

However, if the company operates at a loss and the founder does not receive dividends. In addition, they cannot be paid from the cash desk; the transfer must be made non-cash to the founder’s card from the organization’s current account.

For reference! If the company has more than one founder, it will be necessary to organize an official meeting and sign a protocol on the payment of dividends. The meeting on the results of the previous year is held between March 1 and April 30, it is mandatory.

Employment contract

The company and the founder can enter into an employment contract. You need to pay personal income tax and insurance premiums from your salary, so this option for withdrawing money is the most unfavorable in terms of tax burden. But wages and insurance contributions reduce the single tax on the simplified tax system with the object “income minus expenses” or on the OSNO income tax.

Risks may arise if the founder is only fictitiously on the company's staff or his salary differs significantly from the salaries of other employees or does not correspond to market values.

For reference! Salary is remuneration for work (Article 129 of the Labor Code of the Russian Federation). Therefore, it is allowed to accrue an official salary to the founder only if he has an employment relationship with the company.

Compensation payments

Registration of a founder as a member can bring such side benefits as the possibility of providing him with all kinds of compensation. Some of them are not subject to personal income tax or insurance premiums. Only 13% income tax is charged on some payments.

Examples of compensation:

- for the use of a personal car;

- for the use of cellular communications;

- travel expenses to and from your destination;

- living expenses and many others.

Despite the fact that the current legislation provides for a lot of compensation for employees of the organization, it will not be possible to withdraw millions from a current account in this way. In addition, each payment must be properly documented.

If it turns out that the employment contract with the founder is fictitious, in fact he does not participate in any way in the company’s activities, questions may arise regarding compensation payments.

How and to whom can funds be issued on account?

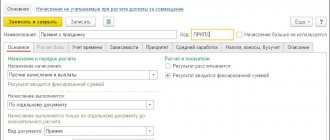

Directive of the Bank of the Russian Federation No. 3210-U dated March 11, 2014. clause 6.3 provides special conditions for the issuance of funds on account:

- money is issued only on the basis of a written application from the employee , which is approved by the manager. Moreover, the application must necessarily indicate the period for which these funds are provided, the amount of the amount to be issued, the manager’s visa and the date of approval. The application must be drawn up by an accountable person;

- on the basis of the specified application, an expenditure cash order is issued , to which the document is attached as confirmation of the targeted release of funds;

- money is given to an employee of an enterprise or entrepreneur . At the same time, Directive No. 3210-U directly states on what basis this employee is recognized as an employee of an organization or individual entrepreneur. For such recognition, there are only two options: the existence of an employment contract with the specified person or the conclusion of a civil agreement with him. Both of these options are enshrined in paragraph 5 of Bank of Russia Directive No. 3210-U. Therefore, you can safely issue funds on account to an employee who is out of state, but with whom an agreement has been concluded . In confirmation of this, there is also a letter from the Bank of the Russian Federation itself No. 29-R-R-6/7859 dated 10/02/14, which directly stipulates that an employee is recognized for the purpose of issuing funds to him on the account of the person with whom the organization has entered into a civil law agreement . For example, a contract. This statement also applies to the entrepreneur’s employees;

- money is recognized as issued on account if its purpose is to pay expenses related to the activities of an organization or entrepreneur ;

- the issuance of funds on account is possible only if the employee has no debt on funds previously received by him on account . Based on Directive No. 3210-U of the Bank of Russia, this debt must be repaid in full at the cash desk or its expenditure in full must be documented - by submitting an advance report and documents from which the intended use of funds results (i.e. for business activities) .

If all the above conditions are met at the same time, then funds from the cash register can be issued on account without fear. Is it possible to give money on account to the head of the company?

How to withdraw money from an LLC through entertainment expenses

Another option for paying the founder’s expenses related to negotiations and business activities of the enterprise is payment of entertainment expenses.

Representative expenses include, in particular, expenses for the official reception and service of representatives of other organizations participating in the negotiations, payment for the services of cafes, restaurants, and even compensation for housing.

To account for them for tax purposes, a limit of 4% of labor costs for the reporting period for which they are paid is provided (clause 2 of Article 264 of the Tax Code of the Russian Federation).

- Personal income tax and insurance premiums are not charged on entertainment expenses if they do not exceed the limits for tax purposes (clause 1 of Article 217 of the Tax Code of the Russian Federation, subclause 2 of clause 1 of Article 422 of the Tax Code of the Russian Federation, subclause 2 of clause 1 of Article 20.2 of Law No. 125-FZ of July 24, 1998 of the year).

- Such expenses must be documented (Article 9 of Law No. 402-FZ, letter of the Federal Tax Service No. GD-4-3/8852 dated May 8, 2014).

Advantageous explanations from officials regarding entertainment expenses include the fact that they are considered expenses for conducting negotiations not only with the actual counterparties of the organization, but also with potential ones, that is, with anyone, if desired. Here it is useful to study the letters of the Ministry of Finance No. 03-03-06/1/49848 dated July 05, 2022 and No. 03-03-06/2/32859 dated June 05, 2015.

Lease of property or other service agreements

If the founder of an organization has personal assets (land, real estate, vehicles, equipment, etc.) that can be used in the commercial activities of the enterprise, he has the right to lease them to the company.

Withdrawal of money will be carried out from the current account to the account of the founder within the framework of the lease agreement. If the founder does not have the status of an individual entrepreneur, then the organization is obliged, as a tax agent, to withhold 13% of each transfer to the founder’s account.

However, in such a situation, it is more profitable and safer to register an individual entrepreneur using the special simplified taxation system or PSN. Otherwise, there is a high probability that the founder’s activities will be recognized as entrepreneurial.

Attention! When renting property, a registered individual entrepreneur will pay for the withdrawal of funds from 1 to 6%, depending on the region of registration of the individual and the tax rate in the constituent entity of the Russian Federation.

At the same time, a company on the simplified tax system with the object “income minus expenses” or on the general regime can receive additional tax benefits in the form of costs that reduce the single tax or profit tax.

The main thing is that in such transactions market prices are used and the transactions are real and not fictitious. Similarly, the company can pay for other services to the founder-individual entrepreneur.

But concluding an agreement with the owner of the company for the management of an LLC (using an individual entrepreneur) is currently considered a transaction with high tax risks; in the vast majority of legal disputes, arbitrators side with the controllers, as a result, participants in such a scheme receive additional taxes and sanctions.

The large sums that the manager receives as remuneration must be justified by the real economic achievements of the organization. If there is no profit because most of the LLC's income goes to pay the management services, this will raise many questions. There is a tax evasion scheme, inspectors believe.

Loan agreement as a method of legal withdrawal of funds

Often, a loan is provided to the founder to withdraw money. Concluding an interest-bearing loan will help eliminate negative tax consequences. This will relieve the founder from the obligation to pay 35% personal income tax on material benefits. Material benefits are calculated based on 2/3 of the refinancing rate of the Central Bank of the Russian Federation.

Also, you should not make non-repayable loans; during the inspection, inspectors can reclassify them as salary or donation. In the first case, the company and the founder face additional assessment of insurance premiums and personal income tax, in the second only personal income tax.

Note! If the founder of the company has registered himself as an individual entrepreneur, then concluding a loan between the LLC and him as an individual entrepreneur can become a problematic transaction.

The court reclassified the interest-bearing loan that the individual entrepreneur received from his own company as dividends and ordered him to pay personal income tax on the entire loan amount (ruling of the Supreme Court in case No. A26-3394/2018 No. 307-ES19-5113 dated April 09, 2022). Therefore, you need to conclude a loan agreement with the founder as an individual, and not with an individual entrepreneur.

Court verdict: when accountable amounts are subject to personal income tax

The Arbitration Court of the North-Western District, in its resolution dated October 15, 2020 No. A66-6506/2019, recognized that the tax inspectorate justifiably assessed additional personal income tax on the amounts of funds issued by the organization as accountable funds to its general director.

Subject of dispute

: for two years, the organization issued daily amounts of money to its general director for reporting. In total, the general director received over 35 million rubles from the organization. At the same time, proper advance reports and primary documents for these amounts were not provided. Based on the results of the audit, the Federal Tax Service came to the conclusion that these funds are the income of the general director. The inspectorate ordered the organization to withhold and transfer previously unpaid personal income tax from the general director’s income, as well as to pay a fine for late payment of tax. Having disagreed with the decision of the Federal Tax Service, the organization went to court.

What were they arguing about?

: 6,114,632 rubles.

Who did win

: tax authorities.

Challenging the actions of the tax authorities in court, the organization pointed out that the funds issued to its employee on account are not the income of this employee, which is subject to personal income tax.

The fact that the employee did not report on the issued funds within the prescribed period only indicates a violation of the procedure for conducting cash transactions, but does not confirm that the accountable funds became the property of the employee.

Consequently, in the opinion of the organization, the Federal Tax Service had no grounds for additional assessment of personal income tax and a fine for this tax.

The cassation court found the organization's arguments untenable and sided with the tax authorities. The judges explained that in the absence of evidence confirming the expenditure of accountable funds, as well as the posting of inventory by the organization, these funds are considered the income of the accountable person. Accordingly, these funds are subject to inclusion in the tax base for personal income tax (Article 210 of the Tax Code of the Russian Federation).

According to the current rules, the accountable person, no later than 3 working days after the expiration date for which he was given cash, must present to the chief accountant an advance report with attached supporting documents (clause 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014).

Documents confirming the material costs of an accountable individual can be sales receipts, invoices with cash receipts attached, or receipts for receipt orders confirming payment for any goods (work, services).

In the controversial case, sums of money were issued without execution of orders and applications for their release on account. The organization was unable to provide documents confirming the acquisition and payment of inventory items from accountable amounts and their posting.

Travel certificates and orders for sending employees on business trips were not attached to the advance reports. No adequate evidence was provided regarding the expenditure of the disputed funds for production needs. Moreover, for a number of advance reports, the organization presented the same primary documents.

In this regard, the court concluded that unspent funds for the needs of the organization and, in fact, unreturned accountable funds remaining at the disposal of the general director are his personal income.

Consequently, this money is subject to inclusion in the tax base for personal income tax, and is also subject to insurance premiums and is subject to inclusion in the base for their calculation.

Therefore, the court concluded, the Federal Tax Service justifiably demanded that the organization withhold and contribute to the budget previously unpaid personal income tax amounts.

Issuance of money on account

This method is not a good idea for withdrawing funds in favor of the founder from a current account. Although many still give large sums of money on account to the founder of the company, if at the same time he is listed as a director.

Tax authorities can again consider a non-closed report as dividends, salary or donation of money, with corresponding tax consequences.

The legality of this approach was confirmed by the judges in the Supreme Court ruling No. 310-ES19-28047 dated February 3, 2022.

Accountability can be viewed rather as an opportunity to pay for non-essential expenses of the founders with the company's money, if it is possible to justify such expenses for business purposes.

For reference! There are no restrictions on the issuance of accountable funds to the founder. But you will have to follow the general rules for issuing and reporting money; in this case, they will be the same as for ordinary employees.

Is it possible to issue money on account?

To the director

It is worth recalling that clause 6.3 and clause 5 of Bank of Russia Directive No. 3210-U stipulate the possibility of issuing funds only to employees of a legal entity who are registered under an employment contract or work under a civil law agreement. However, there is no indication of job restrictions.

As for the director (general director), i.e. the chief manager of the organization, then he, as a rule, works only on the basis of an employment contract (and this can even be a part-time job) and is on the company’s staff. Therefore, he also falls under the category of “organizational employee”. This means that he also has the right to receive money on account.

Video - settlements with accountable persons:

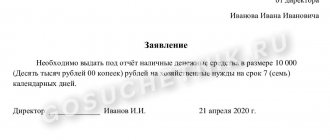

But what about filling out the application? In this case, it is recommended to write an impersonal statement, which does not contain a request for the issuance of funds, but a statement about the need to receive them. For example, like this: “I declare the need to receive 10,000 (ten thousand) rubles for payment…”. In addition, the director of the company is also required to prepare an advance report.

Is it possible to fill out an application in this way if the founder of the organization receives funds for the report?

Founder

If the founder of a legal entity (i.e., its owner) acts as the head of the company or holds another position in it (for example, a simple manager or accountant), then the organization must enter into an employment contract with him and accept him as a staff member.

In fact, for the purposes of Directive No. 3210-U of the Bank of Russia, such a founder becomes an ordinary employee with job responsibilities and an employment contract. This means that you can give him funds on account!

If the founder remains only in the status of owner, then he does not have the right to receive money from the cash register on account . Why? Because the specified person is not a full-time or even freelance employee of the company, but only its owner.

Therefore, funds issued to the specified person from the cash register can be regarded as a loan. This interpretation of the issuance of funds does not contradict the law, but in this case:

- you will have to draw up a loan agreement (not a loan!) with the founder;

- withdraw funds from the current account, since spending cash proceeds to issue loans is prohibited (Instruction of the Bank of the Russian Federation No. 3073-U dated 10/07/13);

- in addition, even if the founder spends these funds on the needs of the enterprise, they will still not be accountable. In this case, then you should draw up, for example, a purchase and sale agreement in order to receive from the founder the assets he acquired for the company.

What if an entrepreneur takes money from the cash register for the needs of his company?

For an entrepreneur

Indeed, if you follow the norm of clause 6.3 and clause 5 of Directive No. 3210-U, then an individual entrepreneur does not have the right to receive funds on account, since he does not have a labor or civil law agreement with himself.

However, Directive No. 3210-U only regulates the procedure for issuing funds on account to employees of the organization and entrepreneur, setting the following restriction for them: only those employees who work under an employment or civil agreement can receive money from the cash register on account.

And at the same time, in Directive No. 3210-U there is no prohibition on the entrepreneur himself receiving funds for the purposes of his activities. Moreover, paragraph 1 of Article 861 of the Civil Code of the Russian Federation directly states that in the case of settlements with the participation of citizens that are not related to their business activities, these settlements can be made in cash without restrictions on the amount.

The opposite follows from this provision: when citizens make cash transactions related to their business activities, restrictions arise on the amount of spending.

In other words, the civil legislation of the Russian Federation allows entrepreneurs to spend cash on their business activities, but within certain limits.

This is also supported by clause 2 of Bank of Russia Directive No. 3073-U dated 10/07/13: an entrepreneur is prohibited from spending cash proceeds other than paying for goods, works and services.

But in order to make such a payment, a number of conditions must be met:

- money for the purpose of entrepreneurial activity must be paid from the funds received by the entrepreneur during the implementation of this activity;

- expenses must have documentary evidence, from which their connection with business activity follows;

- payments must be made within the limit established for cash payments, i.e. no more than 100 thousand rubles within the framework of one contract.

Those. When issuing money to an entrepreneur to pay expenses, the cash receipt order should indicate the targeted nature of the disbursement of funds. For example, like this: “To pay for goods under contract No. 1 dated November 16, 2015 through individual entrepreneur V.V. Ivanova.”

If the entrepreneur has already spent his own funds, it is recommended to give him the funds he spent from the cash register as compensation in order to confirm the cash payment of these expenses. In the expense order you will need to indicate, for example: “repayment of debt for payment through individual entrepreneur V.V. Ivanova. behind …. according to invoice No.... from..."

It is worth noting that an entrepreneur is not required to prepare an advance report.

Withdrawing money to deposit

This method will not make the company’s money the money of its founder, but it can save his funds in the event of blocking the account under Law 115-FZ.

To do this, agreements are drawn up with different banks for placing a deposit from a legal entity with an open date. This trick sometimes saves money by transferring money from a blocked account in another bank to a deposit account.

When a current account is blocked under 115-FZ, the credit institution offers the client to close it and transfer the money to another bank or withdraw it by paying a high commission (10-30% of the amount).

Paying a commission is expensive, and transferring money to a regular account at another bank can lead to a new block, so an alternative solution may be to transfer it to a deposit, but it is important that it is opened in advance. Later, after transferring money to the company’s accounts, it can be withdrawn to the founder using one of the methods listed above in the article.

Thus, it turns out that there are at least eight legal ways to cash out part of the LLC's funds for the needs of the founder. They can be used together, and then the total amount will be quite decent. It is of course more difficult to legally withdraw funds from an LLC’s current account in 2022, and control by the Federal Tax Service has noticeably increased. But there are still some techniques that savvy founders can use.

Is it possible to issue money by bank transfer?

Of course you can. In this case, you can use either a corporate card, which is issued to an organization or an entrepreneur. Or you can simply transfer funds from the current account to the salary card of the accountable person or to the personal card of the entrepreneur himself.

However, in order to avoid troubles such as charging insurance premiums to the accountable amount and adding it to the employee’s income, when transferring funds to the card, it is necessary to indicate in the payment order that these funds are transferred under the report.

By the way, the use of salary cards for transferring accountable amounts to them is confirmed by a joint letter of the Ministry of Finance of the Russian Federation and the Federal Treasury of the Russian Federation No. 02-03-10/37209, 42-7.4-05/5.2-554 dated September 10, 2013.

But to be on the safe side, it is still necessary, for example, in the Regulations on Accountable Funds or in the collective agreement to provide for the possibility of issuing funds against the report to the employee’s salary card.

In addition, after spending the funds issued for reporting, the employee must report on the expenses he made. He must do this in the advance report and no later than 3 days after the end of the period for which funds were issued for the report.

Despite the fact that the advance report and the 3-day period apply only to cash accountable amounts, in order to avoid disagreements with regulatory authorities, the specified requirements should also be observed when spending accountable funds non-cash.