If you discover an error in the financial statements and correct it, how to submit the corrected balance sheet

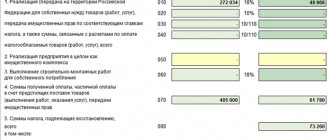

If an organization simultaneously carries out transactions taxable and not subject to VAT, it is obliged to carry out separate

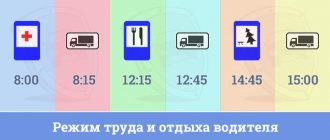

Good afternoon, dear reader. This article will focus on work and rest schedules.

Project “Direct payments to the Social Insurance Fund” in 2020 The pilot project of the Social Insurance Fund has now been introduced

General rules for deducting VAT on fixed assets The amount of VAT paid by the enterprise when purchasing objects

In what situations can the Federal Tax Service request materials under Article 93.1 of the Tax Code of the Russian Federation? Until 04/01/2020

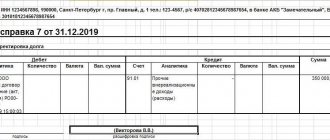

How and why to use This process must be reflected in the accounting journal. Tolling

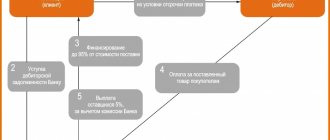

What functions does the letter perform? A letter of deferred payment sent to the supplier: Is an acknowledgment of the existence of

Introduction Today you can easily find on the Internet and even in specialized magazines

March 25, 2022 President of Russia V.V. Putin as part of his address to citizens