How and why to use it

This process must be reflected in the accounting journal.

Customer-supplied materials and raw materials will be accounted for as fixed assets. Upon transfer, a report is drawn up that includes the main data on the materials. The serial code of raw materials, grade and brand is indicated. It is necessary to indicate which part is suitable for further work. You can use the M-15 waybill form, which is only recommended. To get a good filling result, you can use books and articles on accounting. It is recommended to familiarize yourself with the sample. Appendix No. __ to the Contract Agreement dated “__” ________ 20__ No. _______

REPORT on the use of materials

_____________ "__" ________ 20__ Limited Liability Company "______________________" represented by __________________________________, acting___ on the basis of ____________________, hereinafter referred to as the "Contractor", compiled this report on the use of materials (hereinafter referred to as the Report) transferred by the Limited Liability Company " _____________________" (hereinafter referred to as the Customer) to perform work under the contract dated "__" ________ ____, No. ________ (hereinafter referred to as the Agreement), that:

1. In pursuance of clause ___ of the Contract, the Customer transferred, and the Contractor accepted, materials to perform the work. 2. In the period from “__”________ 20__ to “__”________ 20__, the materials transferred by the Customer were used by the Contractor when performing the work, namely:

| No. | Name of type of work | Name of materials used | Material unit | Price per unit of measurement, rub. | Materials transferred by the customer | Materials actually used by the contractor | ||

| Quantity (volume) | Amount, rub. | Quantity (volume) | Amount, rub. | |||||

The total cost of materials used was ___________ (_________________) rubles. 3. We hereby confirm that there are no unspent materials, no returnable waste, and no fact of excess consumption of materials during the performance of work has been established. 4. This Report is drawn up in 2 (two) copies, one each for the Contractor and the Customer. 5. Attachments to the Report: — ___________________________________ (copies of documents confirming the actual use of materials).

| On behalf of the Contractor | On behalf of the Customer | ||

| (signature) | (FULL NAME.) | (signature) | (FULL NAME.) |

Why do you need an invoice? M-15

The M-15 invoice form is most often used to document operations for the transfer of materials between company divisions, if they are geographically remote from each other.

It is also used when carrying out business transactions involving the transfer of customer-supplied raw materials for processing or when transferring property under agency agreements. There is no prohibition on the use of M-15 to process shipments to the buyer. However, for the last operation, a consignment note of the TORG-12 form is traditionally used. Read about the design of TORG-12 in the article “Unified form TORG-12 - form and sample” .

Note! From 01/01/2021, FSBU 5/2019 “Reserves”, approved. by order of the Ministry of Finance dated November 15, 2019 No. 180n. In this regard, the Methodological Instructions for accounting for inventories and protective clothing have lost their force.

Invoice M-15 is one of the unified forms approved by the State Statistics Committee of Russia (Resolution No. 71a dated October 30, 1997), the mandatory use of which has been canceled since 2013. Instead, it is possible to use another document of similar content, drawn up in accordance with the requirements for the primary document.

Read more about the requirements for the primary document in the material “Primary document: requirements for the form and the consequences of violating it .

Is a report on toll materials required?

When it comes to customer-supplied materials, it is understood that a contract has been concluded between the parties (Article 702 of the Civil Code of the Russian Federation). Accordingly, the party who received the materials supplied for the work is called the contractor.

Civil law requires that the contractor use the materials provided by the customer economically and prudently, and after completing the work, submit a report on the materials used. The remainder of the supplied raw materials must be returned to the customer. By agreement of the parties, the cost of the contractor’s work may be reduced by the cost of materials remaining with the contractor (clause 1 of Article 713 of the Civil Code of the Russian Federation).

Obviously, a report on toll materials is one of the most important documents that are drawn up when executing a contract with toll raw materials. The report will ensure reliable accounting and control of raw materials supplied by the contractor and the customer, and determine the cost of work under the contract. In addition, the amount of materials consumed by the contractor from the customer will be included in the cost of work performed or manufactured products, and therefore, without drawing up reports, it will not be possible to correctly determine, for example, the cost of construction.

At the same time, there is no single form for reporting on the use of customer-supplied materials (sample). How to draw up such a report is up to the parties to decide for themselves. In this case, the form of the report on tolling materials (sample) is fixed in the contract.

The report should clearly indicate how much and what kind of material was consumed during the reporting period and how much was left.

Below is an example of a report on the use of supplied materials in construction.

Prev. / Next

What is the report?

Sometimes the terms of the contract provide for the transfer to the contractor of raw materials belonging to the customer - for processing, processing or use in contract work. These are customer-supplied materials. The Contractor does not pay the cost of such resources and uses them exclusively for the purpose described in the agreement of the parties.

After producing goods, performing work or providing services, the contractor reports on both the fulfilled obligations and the resources used. He generates a report on the customer's consumed materials - customer-supplied materials, and returns the unused remaining raw materials to the client.

IMPORTANT!

The contractor indicates in the reporting the quantity and cost of the raw materials received and actually consumed and necessarily records the remaining balances. During the execution of contract work and until the transfer of the remaining resources to the customer, he bears full responsibility for these assets.

Methodological manual for PC "GRAND-Smeta" version 7

- 1. Working with the regulatory framework 1.1 How to open a regulatory framework?

- 1.2 How to choose the right regulatory framework?

- 1.3 How to open a collection of prices?

- 1.4 How can I view pricing information in the collection?

- 1.5 How to open the technical part of the collection of regulatory framework?

- 1.6 How to find a price in the regulatory framework?

- 1.7 How to add a new regulatory framework to the GRAND-Smeta PC?

- 2.1 Formation of a database of estimates as part of the program 2.1.1 How to create a new local estimate?

- 2.2.1 How to add a price from the regulatory framework to the estimate?

- 2.3.1 How to choose a coefficient for the price from the technical part?

- 2.4.1 How to see the general list of resources according to the estimate?

- 2.5.1 How to calculate the amount of work in an estimate item using a formula?

- 2.6.1 How can I see how estimate items are linked to types of work?

- 2.7.1 How to add an allowance for tightness to the estimate?

- 2.8.1 How to apply individual indexes to individual budget items?

- 2.9.1 How can you enter the value of limited costs not as a percentage, but as a coefficient, or as a monetary amount?

- 2.10.1 How to manually select an arbitrary group of estimate items (including using flags, bookmarks, color filling)?

- 2.11.1 How to understand the reason why budget items are highlighted in red?

- 2.12.1 How to recalculate estimates from one TEP database to the TEP base of another region?

- 2.13.1 Why do you need a custom collection?

- 3.1 How to enter or change current resource prices in the estimate?

- 4.1 How to create a new act?

- 5.3 How to generate several output documents at once?

- 6.1 How to create a new object estimate (summary estimate calculation)?

- 7.1 Initial settings for local estimates

- 8.1 Settings for ranking

- 9.1 Regulatory framework for design and survey work 9.1.1 Selection of regulatory framework

- 9.2.1 Document appearance

- 9.3.1 Adding coefficients from the technical part

Accounting for customer-supplied materials in 1C Enterprise 8.2 (8.2.19.83)

AnitaAnn, look. All documents in the “production” block of the BP 3.0 configuration (the entire list) are designed for both the supplier and the processor. Your situation is that you are a mediator. You can record accounting entries in several different ways. Let me draw your attention to the fact that the previously mentioned document “Transfer of goods” with the type of operation “transfer of raw materials for processing” is more correct to reflect the entries in the accounting of the supplier. You can, of course, consider yourself a giver when transferring the MPZ to the processor. However..., it is better to use this document to reflect your materials in the seller’s records. You have someone else’s materials from the customer (supplier). And you are a processor in relation to the seller (your customer).

Quote (AnitaAnn): Based on your answer, I would like to know what document should I then use to report on the use of customer-supplied materials received from the subcontractor? I assume that this is the document “Receipt from Processing”, accounting account K 003.02 (Materials transferred to production). Am I not including the expense account? Are there other options for reflecting this operation? Thank you. The document “Receipts from Processing” can and conveniently reflect the operations of receipt by the supplier in his accounting of what the processor (you, the subcontractor) did for him. And copy your materials to them. Again in relation to documents and their printed forms. It's all about how much emphasis you are going to put on the documents. If it is important for you to reflect the “Report on Consumed Materials,” then there is only one document that is convenient to reflect the write-off of customer materials in the processor’s accounting and receive a printed form of the report on consumed materials you need. This is the implementation of processing services. And, by the way, it is more convenient for them to write off customer-supplied materials (Kt 003.02). In general, if we take as a basis the reflection of business operations specifically in the processor’s accounting, then the set of documents may look like this. 1. Receipt of materials for processing - from the customer, Dt 003.01 2. Request-invoice - transfer of customer materials to production, D003.02 K003.01, there is a special tab in the document. 3. If the processor needs to collect its costs, then a number of independent documents are entered (salaries, write-off of its own other materials, receipt of subcontractor services, etc.). I note that the receipt of services can be reflected even with a simple “Receipt (only services and input VAT). In short, the processor’s accounting accumulates costs on account 20.01. 4. The output of products, works or services is reflected by the processor in the document “Production Report for the Shift”. If you do not previously reflect the transfer of your materials in the Request-invoice, then they can also be written off here (automatically if the specification is filled out). On the first tab they reflect “products”, but not necessarily with accounting account 43. Here it is proposed to indicate in the processor’s accounting in the “accounting account” field - account 20.02 - Production of products from customer-supplied raw materials. Well, other bookmarks need to be filled out. When carried out, one of the postings will be D20.02 K20.01 - at the planned cost of production.

Such costs will be written off later when services are sold, D90.02.1 K20.02. 5. Now we move on to the document that completes the transfer of completed work, services, and products in the processor’s accounting. This is the one mentioned - “Sales of processing services”. We sell them the work, service, and products issued by the shift report. There is also a “customer materials” tab. After filling out and posting, we will receive approximate postings. D 62.01 K90.01.1 D90.03. K68.02. D90.02.1 K20.02

The use of customer-supplied raw materials in processing requires the organization of its accounting, both on the part of the recipient of the raw material and on the giving side. To carry out the relevant operations, all necessary documents can be taken from the “Production” section.

The toll processing scheme provides for a whole list of sequential actions, observance of the order of which is a prerequisite for the correct reflection of the results of work in the 1C program. The list of required documents can be presented in tabular form.

Tolling transaction: we prepare accounting documents

Relationship diagram

A tolling transaction usually looks like this: the toller provides the processor with raw materials, which he refines (processes) or from which he produces finished products (hereinafter referred to as products). The peculiarity of this relationship is that the seller owns both the raw materials and the final product. The processor only processes <1>:

Transfer of raw materials for processing

The supplier prepares a delivery note (commodity or commodity-transport, depending on the method of transportation). Cost indicators can be reflected in it based on the accounting prices of customer-supplied raw materials, collateral or others - determined by the terms of the processing agreement. But, as a rule, the dealer uses discount prices, i.e. those for which raw materials are listed in his accounting <2>.

The VAT amounts are not indicated in the invoice, since the transfer of raw materials to the processor is not recognized as subject to this tax (there is no fact of sale) <3>.

Receipt of products upon completion of the production cycle

Having processed the supplied raw materials and manufactured the final product from them, the processor performed work for the customer. This means that for the cost of such work, determined in the contract, he draws up a corresponding work acceptance certificate or other similar document. In addition, for the turnover of the sale, the processor creates and issues an ESCHF to the supplier - if he is a VAT payer for the work performed by the customer <4>.

The manufactured products are transferred to the seller using a consignment note (commodity or commodity-transport). The processor has the right to reflect cost indicators in it at prices calculated based on the cost of used raw materials per unit of manufactured product. But only if a different procedure for determining the cost of manufactured products is not specified in the processing agreement. For example, in the contract the parties may agree that the supplier forms the price of the finished product made from the raw materials supplied by the supplier and brings it to the attention of the processor. In this case, the processor uses exactly this price.

In addition to manufactured products, the processor can return to the supplier the remains of unused raw materials and returnable waste belonging to it. If all these assets are transferred at the same time, then all information can be included in one invoice. Returned raw materials are indicated in the invoice based on the prices at which they were received by the processor. Waste is usually recorded at the prices agreed upon in the treatment contract. But if they are not there, then you can take as a basis the cost of raw materials supplied by the customer, declared by the customer when transferring for processing <5>.

The VAT amounts are not indicated in the invoice, since the transfer of products to the seller and the return of unused raw materials and waste are not recognized as subject to VAT (there is no fact of sale of these assets) <6>.

NOTE If a processor produces excisable products from raw materials supplied by customers, then it is he who is recognized as the payer of excise taxes, despite the fact that the owner of these products is the customer. The processor presents the calculated amount of excise taxes to the seller. This can be done, for example, in an invoice for the transfer of finished products to the seller or in another PUD <7>.

In addition to the invoice and act, the processor provides the seller with a report on the consumption of raw materials <8>. The report form is not established, so the processor develops it independently (the parties can also fix the form in the processing agreement). The report usually indicates the name of the received raw material, its quantity, consumption rates, actual quantity consumed, residues after processing, waste (if any). The corresponding cost indicators can also be reflected.

If products, remaining raw materials, waste are transferred to pay for processing

Quite often, by agreement of the parties, the supplier does not transfer money to pay for the work, but transfers manufactured products, unused materials, and waste belonging to him as offset <9>. In this case, the seller sells the assets, and the processor acquires them.

So, when, in payment for work, the supplier leaves with the processor part of the products or waste belonging to him, for this part the processor first draws up a delivery note for the supplier so that he can accept the assets for accounting. The seller issues a bill of lading to the processor for the sale of the specified assets at the agreed prices. After which the processor enters them on the balance sheet as its own assets.

offset the balance of unused raw materials as payment for the work , then, we believe, the supplier simply issues an invoice for sale and the processor accepts the raw materials for balance <10>.

In the invoices for the sale of products, raw materials, and returnable waste, the seller allocates VAT, if, of course, he is a payer of this tax. In addition, he issues ESHF <11> to the processor.

Provided raw materials in 1C from the processor

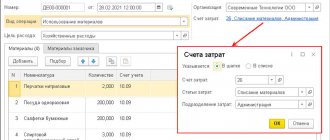

| №№ | Operation | Document | Document transaction type | Postings |

| 11 | Capitalization of customer-supplied materials | “Receipt (Acts, invoices)” (in the old version “Receipt of goods, | Dt 003.01 Kt - | |

| 22 | Transfer of customer-supplied raw materials to production | "Demand-invoice" | Dt 003.02 Kt003.01 | |

| 33 | Transfer of customer-supplied raw materials to production | "Production report for the shift" | Dt 20.02 Kt 20.01 | |

| 44 | Transfer of products to the customer | "Transfer of goods" | Transfer of products to the customer | No postings |

| 55 | Sales of processing services, write-off of customer-supplied materials. | “Sales of processing services” | Dt 62.01 Kt90.01 Dt 90.02 Kt20.02 Dt 90.03 Kt68.02 Dt - Kt 003.02 | |

| 66 | Return of remaining customer-supplied raw materials | "Return of goods to supplier" | From recycling | Dt - Kt 003.01 |

The service implementation document achieves the solution of several problems simultaneously. Below are presented both the features of its structure and those formed by the wiring system. As for determining the cost of customer-supplied materials, in essence the procedure does not differ from a similar operation when working with your own materials.

It is necessary to take into account that the posting of customer-supplied materials involves the selection of contracts that have the “With the buyer” type.

Creating a document “Sales of processing services” involves entering in the “Price” column the cost of services established by the materials processing company. The column “Planned price” reflects data on the planned cost of the processing service in question.

The completed document “Sales of processing services” has the following appearance:

After posting the document, the system will create the following set of transactions:

How does the tolling scheme work?

A tolling scheme of work is an organization of the production process when the customer transfers his raw materials to another organization for processing in order to obtain products with specified qualities. In this case, both the raw materials and the finished product remain the property of the customer, and the organization performing the work simply fulfills the terms of the contract, providing its facilities and labor for the agreed remuneration.

REFERENCE! If any waste or surplus remains as a result of the processing of raw materials, these also belong to the customer, unless the contract provides for their provision as part of the payment.

The supplier is the owner of the raw materials and the customer of the production processing. Raw materials owned by the supplier, transferred by him for subsequent actions, can be:

- produced by the dealer himself;

- purchased from any sources;

- received under the terms of any transaction.

Question: How can a customer take into account the costs of raw materials during third-party toll processing in tax accounting? View answer

The legislative justification for such a cooperation scheme is clause 156 of the Methodological Instructions for Accounting for Inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Question: What amounts are included in the VAT tax base for the sale of services for the production of goods from customer-supplied raw materials (clause 5 of Article 154 of the Tax Code of the Russian Federation)? View answer

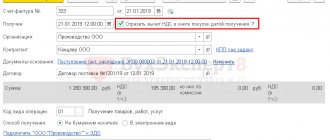

Accounting for raw materials supplied by the customer in 1C

| №№ | Operation | Document | Document transaction type | Postings |

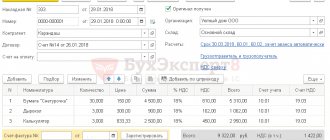

| 11 | Transfer of materials for recycling | "Transfer of goods" | "Transfer of raw materials for processing" | Dt 10.07 Kt 10.01 |

| 22 | Return of materials and products from processing: 2.1- write-off of materials; 2.2 — receipt of finished products; 2.3 — return of remaining materials; 2.4 - accounting for processing services; 2.5 - VAT accounting; 2.6 - invoice; | "Receipt from processing" | Dt 20.01 Kt10.07 Dt 43 Kt 20.01 Dt 10.01 Kt10.07 Dt 20.01 Kt60.01 Dt 19.04 Kt60.01 Dt 68.02 Kt19.04 |

It should be noted that in the process of transferring customer-supplied raw materials to production, its write-off is carried out on the basis of the average cost of this material. In this case, when drawing up a document, the option of the contract “With the supplier” is selected.

The document received from processing is characterized by the following structural features:

- Products made from obtained raw materials;

- Recycling service;

- Materials used in processing;

- Returnable materials, that is, returned to owners in their original form;

- Returnable packaging;

- Cost account.

The completed document has the following appearance:

After it is completed, the program will independently create the necessary set of transactions

It must be noted that the 1C program provides all the possibilities for correct accounting of transactions with customer-supplied raw materials. The only condition is the correct sequence of actions performed.

Accounting under tolling scheme

The customer recycles the materials, while retaining ownership of them. Therefore, they are stored on the seller’s balance sheet, but their dynamics must be reflected in the “Materials Accepted for Processing” account specially provided for this purpose. In accounting, it is not customary to mix accounts to reflect materials in-house and third-party production.

The Ministry of Finance recommends recording transactions with customer-supplied raw materials on synthetic account 003 for material assets, using additional sub-accounts, such as “Materials and raw materials in warehouse”, “Materials and raw materials in processing”. When raw materials are used for production, these materials are “transferred” from one subaccount to another.

Such materials cannot be written off - this is a violation, since they continue to be the documented property of the seller. Write-off will automatically put the finished product in the category of not produced, but resold, which will significantly increase the tax expenses of the seller.

The Contractor keeps records of products made from customer-supplied raw materials in off-balance sheet account 002 “Inventory assets accepted for safekeeping.” Upon completion of processing, he issues an invoice to the seller. At the same time, the cost of raw materials for the contractor does not affect taxation in any way, because it belongs to the supplier. The tax is paid only on the provision of services, and the base is the amount for processing: the contractor’s income includes the remuneration for the work specified in the contract.