Entrepreneurs under the simplified system report only once a year, unlike other tax regimes, where reporting is usually quarterly. When filling out the simplified tax system declaration, it usually does not cause any special problems, since it does not require complex calculations or clarification of individual coefficients.

In this article, we will use examples to understand how to fill out a declaration under the simplified tax system for 2022 in different versions: “Income”, “Income minus expenses” and zero, in the absence of activity.

We draw the attention of those entrepreneurs who have submitted a notification to the simplified tax system, but do not work within the framework of this regime. You, like other simplifiers, must report on this form! Until you are deregistered as a payer of the simplified tax system, you are considered a simplifier, and the Federal Tax Service is waiting for an annual declaration from you. If you know for sure that you will not work on a simplified basis, submit an application using Form 26.2-8. Only after this you can no longer report under the simplified tax system.

Declaration form for simplified tax system

Let's start with the declaration form itself. The form on which individual entrepreneurs must report was approved by Order of the Federal Tax Service of Russia dated February 26, 2016 N ММВ-7-3/ [email protected] The same form was in force under the simplified tax system in 2022. New reporting was not accepted in 2022.

The main reason why entrepreneurs began reporting on this form was the addition of a section on payment of trade tax. So far, the trade tax is paid only in Moscow, but it may well be extended throughout the Russian Federation. The trade tax reduces the calculated advance payments and the annual flat tax, so the amounts paid are reflected in the declaration.

The entire declaration form for the simplified regime consists of 8 pages, but payers of the simplified tax system Income and simplified tax system Income minus expenses fill out different pages. For example, if an individual entrepreneur at a simplified rate of 6% does not pay a trade tax and has not received targeted financing, then his completed annual declaration will consist of only 3 pages.

What information is included in the declaration under the simplified tax system?

A tax return under the simplified tax system for individual entrepreneurs must include the following information:

- the amount of annual income;

- amounts of permitted and documented expenses (only for simplification with the object “Income minus expenses”);

- presence or absence of employees;

- tax rate applied by the simplified tax rate (from 15% for the simplified tax system Income minus expenses to 0% if the entrepreneur works within the framework of tax holidays);

- the amount of insurance premiums paid by individual entrepreneurs for themselves and for their employees (for the simplified tax system Income minus expenses, they are included in the total amount of expenses).

Individual entrepreneurs must reflect all this data during the year in the KUDiR accounting book. If you kept a book, recording all income and expenses, then based on this data you can easily draw up your declaration.

Important: KUDiR is not submitted to the Federal Tax Service, but it is a mandatory tax register. At any time, the tax office may request a book of income and expenses for verification. If it is discovered that the KUDiR data and the completed declaration do not match, the entrepreneur may be fined up to 40 thousand rubles.

Now, using specific examples, let’s look at how to fill out a declaration for 2022 for individual entrepreneurs on different taxation objects of the simplified system.

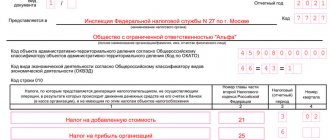

Title page

Here you fill in the details of the individual entrepreneur/LLC and the tax authority.

If you have a non-standard situation, a list of codes for filling out the title page is in the ninth section of the “Procedure for filling out the declaration.”

What to include in the title page fields of a standard annual report:

| Field name | What information to enter |

| TIN | TIN of an entrepreneur or organization. |

| checkpoint | Organizations enter their checkpoints, entrepreneurs put dashes. |

| Correction number | “0 — -” if this is the first version of the declaration, “001” if the first adjustment, etc. |

| Taxable period | "34" for annual declaration. |

| Reporting year | “2018” if the report is for 2022. |

| Provided to the tax authority (code) | The Federal Tax Service code where the individual entrepreneur or LLC is registered, for example, “1651”. |

| Location code | “120” for entrepreneurs, “210” for organizations. |

| Code of type of economic activity according to OKVED | The code of the main activity indicated in the registration documents, for example, “36.13”. |

| Reorganization form, liquidation (code) | In general, do not fill in, put a dash. This field is intended only for companies undergoing reorganization or liquidation. |

| TIN/KPP of the reorganized organization | In general, they don’t fill it out either. |

| Contact phone number | Telephone number of an individual entrepreneur or organization. |

In the lower left block, enter code “1” if you submit the declaration yourself, and “2” if through a representative. Please enter your full name below. the head of the organization, if you have an LLC. Individual entrepreneurs put dashes in this field.

This is what a completed title page for an individual entrepreneur looks like:

Filling out the simplified tax system income tax return for 2022

Example 1.

Individual entrepreneur Volkov S.P. received income in the amount of 1,387,600 rubles in 2022. An individual entrepreneur does not have employees, which allows him to take into account the entire amount of contributions paid for himself to reduce tax payments. With such income, Volkov must pay 32,385 rubles for himself plus 1% on the excess income of 300,000 rubles. We count: 32,385 + (1,387,600 – 300,000) * 1%) = 43,261 rubles.

The entrepreneur could pay an additional 1% contribution in 2019 (the deadline for payment of this payment is July 1 of the year following the reporting year). But the individual entrepreneur decided not to delay paying the additional contribution, so he transferred it in the reporting year.

We will summarize the amounts of income received and insurance premiums paid for each quarter in a table.

| Period | Income received, rub. | Paid fees, rub. |

| First quarter | 432 000 | 12 000 |

| Second quarter | 318 000 | 8 000 |

| Third quarter | 270 000 | 10 000 |

| Fourth quarter | 367 600 | 13 261 |

The individual entrepreneur applied the usual tax rate of 6%. And since expenses for the simplified tax system are not taken into account, all income received is taxed. Let's see what advance payments the entrepreneur made each quarter.

For the 1st quarter - 432,000 * 6% = 25,920 rubles, from which insurance premiums paid can be deducted (this right is given by Article 346.21 of the Tax Code of the Russian Federation). That is, you only need to pay 25,920 – 12,000 = 13,920 rubles to the budget, which was done no later than April 25.

For the 2nd quarter - 318,000 * 6% = 19,080 rubles, subtracting the 8,000 rubles of contributions paid, we find that the advance payment due is only 11,080 rubles. The deadline for transfer is July 25.

For the 3rd quarter - 270,000 * 6% = 16,200 minus 10,000 paid contributions, an additional 6,200 rubles remain to be paid (no later than October 25).

For income received in the 4th quarter, advance payments are not paid; they are taken into account only when calculating the annual tax.

Typically, entrepreneurs, for themselves, take into account their income quarterly, but for tax accounting within the framework of the simplified tax system, a different procedure is used - incrementally from the beginning of the year. This is what it looks like.

| Reporting period | Income | Calculated tax | Paid fees |

| First quarter | 432 000 | 25 920 | 12 000 |

| Half year | 750 000 | 45 000 | 20 000 |

| Nine month | 1 020 000 | 61 200 | 30 000 |

| Year | 1 387 600 | 83 256 | 43 261 |

So, if our entrepreneur did not have the right to reduce the accrued tax by the amount of contributions paid, then he would have to pay 83,256 + 43,261 = 126,517 rubles to the budget.

But in fact, he will pay only 43,261 rubles in insurance premiums and (83,256 - 43,261) 39,995 rubles in tax payments. Taking into account the advances paid (13,920 + 11,080 + 6,200), the balance of the annual tax for individual entrepreneur Volkov will be only 8,795 rubles, which will be reflected in the declaration itself.

The completed declaration, as we said above, consists of only 3 pages: title page, sections 1.1 and 2.1.1.

Responsibility for violations during declaration

Violation of tax discipline entails certain fines and sanctions, which are reflected in the tax legislation of the Russian Federation. Types of fiscal offenses and financial liability for them are as follows:

- If you are late in filing your return, tax authorities have the right to block the taxpayer’s business bank account. This is done within ten days after the expiration of the deadline set for submitting a tax calculation. Conclusion: if in the first ten days of May the Federal Tax Service does not receive a calculation-declaration from an individual entrepreneur, such a sanction may be applied to him. Despite the fact that the block is removed from the account quite quickly - the next day, the procedure is extremely unpleasant.

- At the same time, controllers can impose a fine on individual entrepreneurs for missing declaration deadlines - 5% of the amount of the unpaid tax fee. The maximum percentage is 30%, but the fine will be at least 1,000 rubles. As mentioned above, if no business work was carried out, it is mandatory to provide a zero calculation or pay a penalty fee of 1,000 rubles.

- If the rules for accounting for the tax base, as well as profits and business expenses are violated, the following liability may arise: 10,000 ₽ - in case of incorrect tax declaration in one reporting period;

- 30,000 ₽ - for violations committed during two or more tax periods;

- 20% of the amount of the underpaid fee, but not less than forty thousand rubles, if as a result of the calculation the tax base of the individual entrepreneur was underestimated.

Failure to comply with tax accounting requirements is considered to be the absence of primary documentation or incorrect maintenance of the tax register (KUDiR).

If an entrepreneur fails to make a timely payment of the advance payment, tax or insurance fee, sanctions will be applied to him:

- daily accrual of penalties in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation according to the formula: 1/300 of the rate of the Central Bank of the Russian Federation x amount of debt x number of overdue days (this is enshrined in Article 75 of the Tax Code of the Russian Federation);

- a fine of 20-40% of the tax amount not transferred to the tax authorities.

Filling out the simplified taxation system declaration Income minus expenses for 2022

Now let's see how to fill out a declaration for another taxable object - Income minus expenses.

Example 2.

In this example, we will immediately indicate income and expenses on an accrual basis. Contributions paid by the entrepreneur for himself are included in the total amount of expenses. The contributions themselves do not reduce the calculated tax (this right is only available to the simplified tax system for Income), but at their expense the tax base is reduced, i.e. the amount on which tax is charged at a rate of 15%.

| Reporting period | Income | Expenses | Calculated tax |

| First quarter | 570 000 | 320 000 | 37 500 |

| Half year | 1 210 000 | 730 000 | 72 000 |

| Nine month | 1 590 000 | 919 000 | 100 650 |

| Year | 2 133 000 | 1 309 000 | 123 600 |

As we can see, in 2022 the entrepreneur received income in the amount of 2,133,000 rubles, of which expenses amounted to only 1,309,000 rubles. The tax payable turned out to be quite large (123,600 rubles), plus the insurance premiums paid for yourself must be added to this amount.

Unfortunately, despite numerous court decisions, the Federal Tax Service insists that the additional contribution for individual entrepreneurs on the simplified tax system Income minus expenses is formed on the basis of all income received, excluding expenses. That is, this entrepreneur had to pay insurance premiums in the amount of 32,385 + (2,133,00 – 300,000) * 1%) = 50,715 rubles for 2022.

Sample declaration of the simplified tax system Income minus expenses for 2022 for individual entrepreneurs without employees

It can be assumed that, given the relatively small share of expenses in income received, the chosen tax regime cannot be called optimal. Even under the simplified tax system, income payments to the budget for this individual entrepreneur would be less.

Before choosing a tax system, we recommend that you seek advice from professionals to optimize your tax burden.

Filling out a zero declaration of the simplified tax system for 2022

Example 3.

If a simplifier has not received any income during the year, then his declaration will be zero. At the same time, insurance premiums are not indicated in the declaration, although they must be paid.

The fact is that the declaration reflects only the amount of contributions that reduces the calculated tax. And since there was no income, no tax is charged on it.

Sample zero declaration of the simplified tax system Income for 2022 for individual entrepreneurs

Sample zero declaration of the simplified tax system Income minus expenses for 2022 for individual entrepreneurs

Methods for submitting a tax return to the Federal Tax Service

The final simplified accounting calculation can be submitted to the district inspectorate in several ways:

- You can give the document in person by visiting the Federal Tax Service at the place of registration (in a simplified manner, the report is submitted strictly to the inspectorate at the place of registration of the individual entrepreneur). If a businessman cannot independently approach the tax authorities, this can be done, among other things, with the help of a legal representative of an individual entrepreneur (it is allowed to involve any legally capable individual in this: be it a relative, acquaintance or hired employee). In this case, the representative must have a notarized power of attorney to represent the interests of the declarant. The document must contain a reference to the actions that the authorized person can perform. The recommendation here is to have a flash drive with a calculation downloaded onto it in Excel format. As a rule, tax authorities ask for such a form to be uploaded into the system. The reason is that for several years now all communications with tax authorities and other departments have been actively transferred to electronic document management (EDF). And one more point that should be taken into account here: you need to have 2 copies of the printed declaration with you. One copy is handed over to the inspector, and the second copy is stamped with the visa of the responsible person who accepted the calculation, and it remains with the individual entrepreneur.

- Submit a declaration through the online resource of tax authorities through a special reporting service for individual entrepreneurs or e-document flow operators. In this case, the individual entrepreneur must obtain an enhanced qualification visa, with which the report is signed. In this option, the day of receipt of the declaration is considered to be the moment of sending. All communications with the Federal Tax Service are carried out remotely, which is convenient and efficient.

Electronic document management simplifies doing business for individual entrepreneurs - Sending by Russian Post is another way to present the calculation. In this case, an inventory of the attachment must be drawn up and a registered letter issued for the tax authorities. In this option, the moment of submission of the declaration is recognized as the date indicated on the postmark and on the receipt for payment of the registered item.

The list of attachments of the mail item indicates all documents that are sent to the Federal Tax Service