Clarifies the rules for disclosure of information about related parties in force since January 1, 2008.

How work books “multiply” If an employee started working before 2022 and for him

Individual entrepreneurs usually choose preferential tax regimes. This allows them to optimize costs and serve

I went on vacation to visit my parents in the village. The time has come to submit income reports to

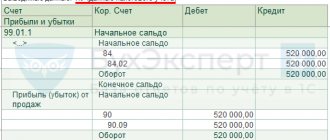

Losses incurred during the tax period can be written off as a reduction in the tax base in subsequent years.

Deadlines for submitting 6-NDFL reports The legislation defines the exact deadlines when it is necessary to submit 6-NDFL reports in

When filling out an application on form P21001, an individual entrepreneur must indicate which areas of business he

Assets listed on the balance sheet of an enterprise and used in production processes have a limited service life.

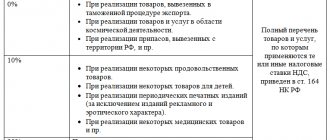

VAT rate for exports There are several points of view that explain the appearance of a 0% VAT rate.

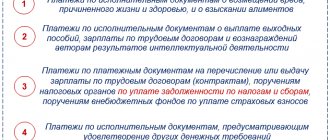

What does priority mean? The priority of payment is a number from 1 to 5, which, in fact,