When filling out an application on form P21001, an individual entrepreneur must indicate what areas of business he will be engaged in. To do this, codes of the types of activities of an individual entrepreneur are entered into sheet A of the application for registration of individual entrepreneurs.

Codes are digital designations of types of activities; they are selected from the OKVED classifier. For example, if an individual entrepreneur opens a beauty salon, then its OKVED codes will be:

- 96.02 Provision of services by hairdressing and beauty salons;

- 96.04 Sports and recreational activities;

- 96.09 Provision of other personal services not included in other categories.

If, in the course of his activities, an entrepreneur decides to engage in areas of business that were not immediately indicated in the application for registration of an individual entrepreneur, then it is necessary to add OKVED codes. Suppose that a small store selling professional cosmetics will be organized in a beauty salon, in this case it is necessary to inform the tax office about adding OKVED codes for individual entrepreneurs.

We have developed step-by-step instructions for you on how to add OKVED codes for individual entrepreneurs in 2022. With its help, you can independently add new types of individual entrepreneur activities or exclude those that you no longer plan to engage in. Let us consider in detail step by step how an individual entrepreneur can add new OKVED codes in 2022.

Activities and taxes

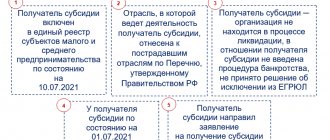

The choice of OKVED also affects what taxes and at what rates the entrepreneur will have to pay. The Russian tax system has 5 tax regimes, 4 of which are preferential and intended for small businesses. For the application of each of them, different conditions have been introduced, for example, the maximum number of employees, the maximum annual income. This choice directly depends on the type of activity. These tax regimes are:

- Basic system (OSNO). An entrepreneur can use it for any activity. You will have to pay tax on income minus expenses at a rate of 13%, as well as VAT at a rate of up to 20%, which is often unprofitable.

- Simplified system (STS). You can choose one of two options - pay 6% on all income or 15% on the difference between income and expenses. The types of activities of individual entrepreneurs under the simplified taxation system can be almost any, although there are still minor restrictions (clause 3 of Article 346.12 of the Tax Code of the Russian Federation). The simplified tax system cannot be used in the production of excisable goods, extraction and sale of minerals, with the exception of common ones. This system is also not used in financial activities - banking, insurance, investment, pawnshop, microcredit. But we have already said that for individual entrepreneurs all this activity is prohibited in any case.

- Patent system (PSN). The tax does not depend on the amount of income, but on the type of activity. The cost of a patent is calculated at a rate of 6% of the potential income of an individual entrepreneur in the chosen field. PSN is introduced by the municipal authorities of the constituent entity of the Russian Federation, so it is necessary to take into account the peculiarities of regional legislation. Starting from 2022, the authorities of the constituent entities will also approve the list of activities for which the patent system is suitable. Their indicative list, as well as the list of activities prohibited on the PSN, are given in Article 346.43 of the Tax Code of the Russian Federation.

- Unified Agricultural Tax (USAT). Applicable only to agricultural producers. These are organizations and individual entrepreneurs that are engaged in livestock farming, crop production, as well as industrial processing of agricultural products. The details of the activities for which the unified agricultural tax can be applied are given in Article 346.2 of the Tax Code of the Russian Federation. The tax rate is 6% of the difference between income and expenses, but in addition to this, VAT must be paid from 2022.

- Professional income tax (PIT). The newest regime, which can be applied by individual entrepreneurs on an equal basis with self-employed persons. It is prohibited to engage in wholesale and retail trade (except for the sale of goods manufactured independently), including the sale of excisable and marked goods, the extraction and sale of minerals, and the carrying out of intermediary activities under contracts of agency, commission or agency agreement.

So, the possibility of applying preferential tax regimes and the cost of a patent directly depend on the type of activity. In addition, for individual entrepreneurs using the simplified tax system and special tax system, regional authorities can introduce “tax holidays” - reducing the tax rate to zero. Again, the ability to take advantage of the benefit depends on the type of activity. Vacations are allowed only for entrepreneurs in the production, scientific and social spheres, as well as in the sphere of consumer services.

Free tax consultation

How to choose activities

To obtain the status of an individual entrepreneur, you need to contact the Tax Service with an application in form P21001 and a package of papers (it differs depending on the situation). This statement, on page 4 of sheet A, indicates the types of activities that the individual entrepreneur will engage in.

The document does not indicate names, but codes specified in the All-Russian Classifier. They are called OKVED (short for the full name of this list).

The main type of activity is indicated at the top of page 4. It is assumed that the individual entrepreneur will mostly deal with this. Additional types are listed below. This does not mean that income from additional OKVEDs should not exceed income from the main one. The division is considered conditional.

The selected OKVEDs must correspond to the areas in which the entrepreneur will operate. For example, wholesale trade does not allow the transfer of goods to retail and vice versa. It is recommended that the individual entrepreneur immediately indicate those types of activities that will indirectly relate to his direction in order to avoid possible contradictions.

.

Sample form No. P21001:

Download form No. P21001 (sample/form)

Responsibility provided for conducting activities not in accordance with OKVED

Regulatory documents do not establish what responsibility an entrepreneur bears in the case of conducting business in types of activities that are not registered in the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities.

There is a possibility of being held liable

in accordance with Art.

14.25 of the Code of Administrative Offenses of the Russian Federation for “...failure to submit, or untimely submission, or submission of false information about a legal entity or an individual entrepreneur” you may be given a warning or a fine of up to 5,000 rubles

.

According to Art. 5 (5) of Law No. 129-FZ of 08.08.01, changes should be made

in the relevant documents

within three days

after the start of activities under the new code.

How to add a new activity

An individual entrepreneur has the right to engage in those types of activities that are open to him. Therefore, it is recommended to immediately enter them when registering an individual entrepreneur.

If a person receives a one-time profit from an activity that is not open to him, then nothing bad will happen. This is permitted by law. For example, an individual entrepreneur will purchase and sell a consignment of goods, whereas, in accordance with the Unified State Register of Enterprises, he is only engaged in the provision of accounting services. But if such activities are carried out regularly, then a new OKVED will have to be added.

You can do this in the following order:

- Get an extract from the Unified State Register of Individual Entrepreneurs and clarify which OKVEDs are already open. You can do this online (absolutely free) at.

- Select which activities to add. It is recommended to indicate those areas that are indirectly related to the planned activity. For example, wholesale trade (46.1) and retail trade in non-specialized stores (47.1).

- Prepare an application in form P24001. The general requirements for document execution are exactly the same as when submitting an application P21001. Only block letters, black or blue, etc. are used.

- Submit an application to the Federal Tax Service (in person, through a representative, through the taxpayer’s account if you have an electronic signature, by mail).

- Receive a new extract from the Unified State Register of Individual Entrepreneurs with the changes made.

There are no restrictions on the number of OKVED documents, so you can enter any.

How many codes can you choose?

Sometimes the question arises, how many codes to choose? The answer is simple - as many as the types of activities you are going to engage in in the near future . In principle, there are no restrictions, although reasonable limits should not be exceeded.

When selecting several OKVEDs, one must be indicated as the main one , and all the others will be additional. It is important to choose the main OKVED code correctly, since the rate of insurance premiums for injuries that the entrepreneur-employer will pay for his employees to the Social Insurance Fund will depend on this. The greater the risk associated with the main activity, the higher the contribution rate will be.

What is OKVED?

OKVED is an all-Russian classifier of economic activity. Activities are coded with six numbers. Also in the code you can distinguish a subgroup, group, subclass and class.

47.

Class. Retail trade, except trade in motor vehicles and motorcycles 47.2 Subclass. Retail trade of food products, drinks and tobacco products in specialized stores 47.24. Group. Retail trade in bread and bakery products and confectionery in specialized stores 47.24.21 Type. Retail trade of flour confectionery products in specialized stores

In 2022, the edition of the classifier is in effect - OKVED-2 (NACE rev. 2).

Are you registering a business?

Prepare documents automatically!

Do you want to save time and be sure that you fill it out correctly? Generate a notification automatically in our service. It's free and takes 15 minutes.

Documents for IPDocuments for LLC

Documents for IPDocuments for LLC

Activity classifier

Every future individual entrepreneur knows what type of business he will engage in. But during registration you need to inform the Tax Service about this. To do this, the entrepreneur must select a specific activity included in the All-Russian Classifier of Types of Economic Activities. This classifier was approved by order of Rosstandart dated January 31, 2014 No. 14-st and is officially called OK 029-2014 (NACE Rev. 2). But for simplicity, it is usually called OKVED or OKVED-2, since its second edition is now in effect.

From OKVED you need to select the main type of activity of the individual entrepreneur, and, if necessary, several additional ones. These codes must be entered into the application for registration of an entrepreneur in the form P21001, approved by Order of the Federal Tax Service dated August 31, 2020 No. ED-7-14 / [email protected] and which entered into force on November 25, 2022.

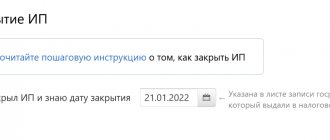

The law does not in any way limit individual entrepreneurs in choosing areas of activity based on their number. It is not at all necessary to deal with everything that is selected at once, so you can indicate OKVED codes in anticipation of the future. But there is also no need to select unnecessary codes. Subsequently, the types of activities can be expanded or replaced by submitting form P24001 to the Federal Tax Service. This must be done within 3 days after the individual entrepreneur began engaging in new activities.

Indication of OKVED codes when registering LLCs and individual entrepreneurs

OKVED codes are selected and indicated in the same way in applications for LLC and. For LLCs, they also need to be indicated in the Articles of Association.

When choosing an OKVED code for an individual entrepreneur, the legislative level does not establish a mandatory indication of all types of activities during registration. An individual entrepreneur can conduct various types of activities, although only the main one is registered. In such a situation, a business loan may be refused if the code does not correspond to the activity; problems may also arise when obtaining a license and when switching to preferential tax regimes.

Too many numbers?

Selecting OKVED from the list is more convenient and reliable

- Generate all documents for registration using our service.

- Just select your activities.

- The program itself will insert them into the application and the Charter.

- All that remains is to print it out.

Documents for IPDocuments for LLC

Documents for IPDocuments for LLC

Minimum and maximum number of codes

How many codes an entrepreneur can enter into the Unified State Register of Legal Entities - the laws are silent about this. This allows a businessman to specify an unlimited number of such codes. But the registration authority rarely enters more than fifty codes into the relevant register for one individual entrepreneur. The fact is that the controlling authority considers a large number of them to be an unfair act. If an organization operates in one direction of the economy, from two to twenty OKVED codes are sufficient for it.

The registration authority rarely enters more than fifty codes into the relevant register for one individual entrepreneur.

The minimum number of codes is one. If a company reports that it has not chosen the type of activity, this will be regarded as providing false information.