Losses incurred during the tax period can be written off as a reduction in the tax base in subsequent years. But today it is impossible to automatically transfer them to 1C: such a mechanism has not yet been implemented.

Let’s figure out how to reflect losses in 1C so that they correctly reduce the “profitable” base in the future and are automatically included in the declaration (we will consider the option if the organization does not apply PBU 18/02).

Find out how to transfer losses if an organization works with PBU 18/02

Legislation: procedure for transferring losses from previous years

The Tax Code of the Russian Federation allows the profit base to be reduced by the amount of losses received in previous tax periods.

Carrying forward losses to the future is possible both based on the results of the reporting period (1st quarter, 1st half of the year, 9 months) and based on the results of tax periods (Letters of the Ministry of Finance of the Russian Federation dated 03.08.2012 N 03-03-06/1/382, dated 16.01.2013 N 03-03-06/2/3).

From 01/01/2017 to 31/12/2021, the income tax base for the current reporting (tax) period can be reduced by losses from previous years by no more than 50% (clause 2.1 of Article 283 of the Tax Code of the Russian Federation).

The taxpayers listed below, who have a special status and apply special tax rates in accordance with the Tax Code of the Russian Federation, can write off the loss without taking into account this limitation - in full:

- residents of a technology-innovative special economic zone, as well as resident organizations of tourist and recreational special economic zones, united by a decision of the Government of the Russian Federation into a cluster (clause 1.2 of Article 284 of the Tax Code of the Russian Federation);

- participants in regional investment projects (clause 1.5, clause 1.5-1 of Article 284 of the Tax Code of the Russian Federation);

- participants of the free economic zone (clause 1.7 of article 284 of the Tax Code of the Russian Federation);

- residents of territories of rapid socio-economic development (clause 1.8 of Article 284 of the Tax Code of the Russian Federation);

- residents of the free port of Vladivostok (clause 1.8 of Article 284 of the Tax Code of the Russian Federation);

- participants of the special economic zone in the Magadan region (clause 1.10 of article 284 of the Tax Code of the Russian Federation);

- participants in special investment contracts (clause 1.14 of article 284 of the Tax Code of the Russian Federation);

- residents of a special economic zone in the Kaliningrad region (clause 6 and clause 7 of Article 288.1 of the Tax Code of the Russian Federation).

There is no time limit on the transfer: it is carried out until the loss received for all previous years is completely written off. If losses are received in more than one tax period, transfer them in the order in which they were incurred (clause 3 of Article 283 of the Tax Code of the Russian Federation).

As long as the transfer is in progress, it is necessary to store primary documents confirming the occurrence of the loss (clause 4 of Article 283 of the Tax Code of the Russian Federation). After the transfer is completed, keep them for another 5 years (clause 8, clause 1, article 23 of the Tax Code of the Russian Federation). More details in: The storage period for tax documents has been increased.

How long to keep primary documents confirming a loss?

Primary documents confirming the amount of the loss are stored for the entire period of transfer of the loss plus another 5 years after the end of the year in which the loss was completely written off (subclause 8, clause 1, article 23, clause 4, article 283 of the Tax Code of the Russian Federation). It is necessary to keep documents confirming losses even when the correctness of the calculation of the amount of the loss was confirmed by an on-site tax audit.

Moreover, if during the audit the tax authorities did not request documents confirming losses from previous years, the company must submit these documents independently during such an audit (see Resolution of the Federal Antimonopoly Service of the Volga District dated March 29, 2011 in case No. A49-4451/2010).

Keep all primary documents for the calendar year in which the company incurred a loss. These are invoices, acts of work performed, acts of services rendered, invoices, statements, acceptance acts, cash and sales receipts, etc.

Reorganization of the company does not cancel the right to carry forward losses. The successor company may, in accordance with the generally established procedure, transfer to the future losses incurred before the reorganization (clause 5 of Article 283 of the Tax Code of the Russian Federation).

Read in the berator “Practical Encyclopedia of an Accountant”

Carrying forward losses during reorganization

The Tax Code of the Russian Federation establishes that the successor company will not be able to take into account the losses received by the reorganized organization if, during the audit, the tax authorities establish that the main purpose of the reorganization was precisely the accounting of losses (clause 5 of Article 283 of the Tax Code of the Russian Federation).

Step-by-step instruction

Based on the results of 2022, the Organization received a loss of 520,000 rubles in tax accounting. She decided that this loss would reduce the tax profit of subsequent years.

In the 1st quarter of 2022, NU received a profit of 800,000 rubles.

The organization does not apply PBU 18/02.

Step-by-step instructions for creating a PDF example

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Reporting tax period | |||||||

| Closing the tax period | |||||||

| 31th of December | 99.01.1 | 90.09 | 520 000 | 520 000 | 520 000 | Determination of financial results | Closing the month - Closing accounts 90.91 |

| 84.02 | 99.01.1 | 520 000 | Attribution of a loss of the current period to a loss subject to coverage | Closing the month - Balance sheet reformation | |||

| Carry forward of loss to future periods | |||||||

| 31th of December | 97.21 | 99.01.1 | — | 520 000 | 520 000 | Carry forward of loss to future periods | Manual entry - Operation |

| Next tax period | |||||||

| Write-off of losses from previous years | |||||||

| January 31 | 99.01.1 | 97.21 | 400 000 | 400 000 | Write-off of losses from previous years | Closing the month - Writing off losses from previous years | |

Reflection of loss in accounting statements

In the declaration, losses for past years are confirmed in accordance with the provisions of Art. 315 NK. The tax is calculated with an increasing total - from the beginning of the reporting year for all periods of filing papers and paying taxes. Next, you need to make notes in Appendix No. 4 of the second sheet of the declaration:

- Line 140 indicates the amount of income tax received, which is payable, but can be reduced by the amount of the loss (in whole or in part)

- Line 010 records the remaining part of the loss, which could not be transferred to subsequent time intervals, and it fell at the start of the subsequent tax payment periods

The intolerable loss is formed during the previous 10 years.

The amount from line 010 is additionally recorded in lines 040-130 - a corresponding entry is made based on the year in which a certain part of the loss occurred. The number indicated in line 140 is duplicated with the value in line 100 of the second sheet.

The amount of loss by which the tax array will be reduced is recorded in line 150. In the current payment period, it should not exceed the value in line 140. It is also transferred to line 110.

If, when viewing the accounting and accounting records, a profit is revealed, and the figures in both statements are equal, then calculating and reflecting the amount of the tax burden in the accounting documents will not be a problem. If the financial results differ in them, then PBU 18/02 must be applied. This can happen in the future, resulting in a deductible difference in the tax and reporting periods.

If you find a loss at the end of the year, watch the video:

So, when a loss appears in an accounting or accounting system, you need to use PBU 18/02 to reflect it. This provision regulates the accounting of permanent and temporary differences that record different results of activities reflected in the reporting. The entries used are determined based on the period of discovery of the error over the past years and which type of activity it was formed from - main or indirect. Plus you will need to enter the appropriate values into your tax return.

Top

Write your question in the form below

Algorithm for transferring losses received during the year

The loss is carried forward on December 31 after the procedure for closing the tax period in which it was received.

In 1C, the loss of the previous year is transferred in the following sequence:

- re-processing of documents for December;

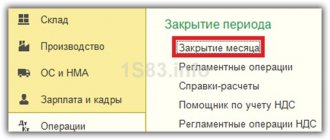

- Closing the month , including the routine operation Balance Reformation ;

- operation ;

- repeated Closing of the month .

Let's consider the procedure for preparing and conducting documents related to the transfer of losses to NU.

Determination of loss to be carried forward

Loss in accounting registers (AU)

To determine the amount of loss, you need to check the financial result and fill out an income tax return.

The loss carryforward can be determined in different ways:

- Generate a report Account Analysis 99.01.1 (Reports—Account Analysis). Account turnover 99.01.1 according to tax records will show the amount of loss to be carried forward to future tax periods.

To display tax accounting data in Account Analysis : PDF

- in the report form, click the Show settings ;

- in the report settings form on the tab Indicators check the box NU (tax accounting data); After that, click on the button Form you can create a report.

- The same amount can be seen in the postings of the routine operation Balance Reformation in the Month Closing procedure in December (Operations – Month Closing).

In the Analysis of account 99.01.1, the loss received in the tax period is transferred to Dt 84.02 by the regulatory operation Balance sheet reformation .

Loss in income tax return

In the annual declaration, the loss received at the end of the tax period is reflected in:

- Sheet 02 page 060 “Total profit (loss).”

The loss indicated in the declaration must correspond to the amount of the loss according to tax accounting (the balance in the debit of account 99.01.1 in NU before the reformation).

Determination of loss at the end of the year

Throughout the calendar year, the company uses entries to record the following transactions:

- Score 90 reflects profitability

- Account 91 – expenses incurred

To summarize the financial results of the company, it is necessary to close both of these accounts. For the past year, those economic activities whose account 90 is less than the amount in account 91 are considered unprofitable - i.e. expenses exceeded income.

The Tax Code itself does not contain an exact list of documents that confirm the write-off of losses for early years. This is usually evidenced by primary documentation:

- invoices

- accounts

- statements

Therefore, all accounting documents are suitable. The exceptions are:

- accounting cards

- tax registers

Company losses in trading on video:

Taxpayers are not required to justify losses (Article 252 of the Tax Code). To recognize expenses when calculating tax, two conditions must be present:

- Economic feasibility of this circumstance

- Confirmation of losses in company documentation

The amount of income tax to be paid in the coming reporting periods depends on whether losses are recorded correctly in accounting. In accounting it is calculated at the end of the period. To determine it, it is necessary to compare the costs incurred with the amount of cash receipts received. The final result is calculated from the sum of the results for all types of activities carried out by the enterprise, and other receipts and disposals.

Carry forward of loss to future periods

The transfer of losses to subsequent periods must be carried out at the end of each year (December 31), if, as a result of its results, a loss was formed in NU.

To date, the transfer of current losses to deferred expenses in 1C is not automated: this operation at the end of the year must be completed manually.

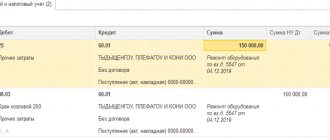

Reflect the transfer of losses received in the expired tax period in the document Transaction entered manually, transaction type Transaction (Transactions – Transactions entered manually...):

- Dt 97.21 “Other deferred expenses” subconto LOSS 2020 ;

- Kt 99.01.1 “Profits and losses from activities with the main taxation system” subconto Profit (loss) from sales .

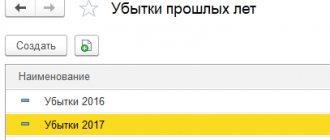

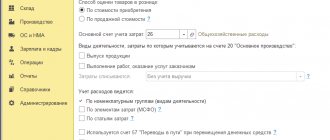

Subconto LOSS 2020 for account 97.21 is an element of the directory Deferred Expenses (Directories - Deferred Expenses), it is configured as follows:

- Type for NU - Losses of previous years ;

- Amount - loss carried forward to future tax periods;

- Recognition of expenses - In a special manner ;

- Write-off period from - 01/01/2021 ; by - not limited.

In a manually entered Transaction :

- the amount for carrying forward losses from previous years is reflected only in tax accounting ;

- out subdivisions .

Don't forget to re-close December! (Transactions – Month Closing)

See Closing the tax period

Check the result of loss transfer in the report Turnover balance sheet for account 97.21 (Reports – Turnover balance sheet for account):

- indicate the period - by 31.12.2020;

- Click the Show settings on the Indicators NU checkbox .

Reflection of losses in accounting

To correctly reflect all financial results, it is necessary to use special account 99 (Order of the Ministry of Finance of the Russian Federation No. 94). During the year, periods are gradually closed, after which interim reports are drawn up. As a result, a short-term reduction in the current tax base may be established.

It is possible to determine exactly how much the tax burden is allowed to be reduced only at the end of the year, when the final size of the tax base is established. To reflect losses in accounting records, the entries described in Table 1 are made.

| Debit | Credit | The essence of wiring |

| 90.9 | 99 | Reflects the profit received from all normal types of company activity |

| 91.9 | 99 | Shows “cons” for other, non-core activities |

| 99 | 90.9 | Demonstrates losses across the entire list of main types of economic activity |

| 99 | 91.9 | Fixes the resulting loss for other activities |

To transfer losses to other periods, you will need to close account 99. For this purpose, use the posting Dt 94 Kt 99.

Important! All results of the enterprise’s activity in subaccounts of accounts 90 and 91 are reflected throughout the year. Therefore, the resulting values will increase in ascending order.

An exception is the balance sheet reform carried out at the end of the reporting year. In this case, they are reset using the entries:

- Dt 90.1 Kt 90.9

- Dt 90.9 Kt 90.2 (90.3)

In account 91, the reformation is carried out in a similar way. Therefore, the loss accumulated at the end of the interim reporting periods remains untouched - all financial results are simply reflected in account 99.

Write-off of losses from previous years

If in the next tax period a profit is generated in NU, it will automatically be reduced by part of the loss of the previous period (or its entire amount, depending on the size of the profit).

Every month until the loss is written off completely, Write-off of losses from previous years will appear Month Closing .

Postings according to the document

The document generates the posting:

- Dt 99.01.1 Kt 97.21 - losses of previous years are written off as a decrease in the profit of the current period.

Control

Check the write-off calculation using the Help report - calculation of write-off of losses from previous years . It is generated by clicking the Help-calculation in the Month Closing or by clicking the link Write-off of losses from previous years - Write-off of losses from previous years. PDF

The report shows:

- the maximum amount of profit by which losses from previous years can be reduced: 800,000 * 50% = 400,000 rubles.

- unwritten balance: 520,000 - 400,000 = 120,000 rubles.

In the footnote of the report Help - calculation of write-off of losses of previous years there is a reminder: “In reporting (tax) periods from January 1, 2022 to December 31, 2022, the tax base for the current reporting (tax) period ... cannot be reduced by the amount of losses received in previous tax periods, by more than 50 percent" (clause 2.1 of Article 283 of the Tax Code of the Russian Federation)."

Accounting for losses

Cost transfers are carried out using various methods. It all depends on the policy of a particular enterprise. In particular, the transfer can be performed in the following ways:

- Carrying out the procedure in each reporting year.

- Carrying out with the allowance of time breaks.

Regardless of the chosen method, the period during which the tax base is reduced due to losses cannot be more than 10 years. If expenses have not been written off during this time, they acquire the status of outstanding. The rule in question is stipulated by paragraph 3 of paragraph 2 of Article 283 of the Tax Code of the Russian Federation.

IMPORTANT! When determining income tax, losses identified at the end of the reporting period are not carried forward to the next period. The rationale for this rule is contained in paragraph 7 of Article 274 of the Tax Code of the Russian Federation. During the period, the tax base is calculated on an accrual basis. The loss that arises at the end of the reporting period is recognized as an interim total.

Let's summarize. Transfer to the next year is carried out only in relation to losses arising as a result of the tax period (a year). Expenses for reporting periods (month or quarter) cannot be transferred.

Reflection of losses of previous years in the income tax return

In the “profitable” declaration, the written-off loss of previous years is reflected in:

- Sheet 02, page 110 “The amount of loss or part of a loss that reduces the tax base for the reporting (tax) period (page 150 of Appendix No. 4 to Sheet 02)”; PDF

- Appendix No. 4 to Sheet 02, page 150 “The amount of loss or part of a loss that reduces the tax base for the reporting (tax) period - total.” PDF

The unwritten balance is reflected in:

- Appendix No. 4 to Sheet 02, page 160 “The balance of the uncarried loss at the end of the tax period - total.” PDF

Reducing the tax base using an example

The easiest way to understand the principle of reducing the tax base is through specific examples.

Example No. 1

The Orion company makes payments every quarter. According to the results of 2016, the structure showed a loss of 40 thousand rubles. At the beginning of 2022, the company received an income of 10 thousand rubles. The taxable base amounted to an amount similar to the amount of expenses, the transfer of which is carried out to the 1st quarter of 2022. The accounting department is obliged to register the following data in Appendix 4 to sheet 02 of the declaration:

- The amount of expenses for past reporting periods is 40 thousand rubles.

- The amount of the taxable base for the first quarter of 2022 is 10 thousand rubles.

- The amount of expense by which the current operating base is reduced is 10 thousand rubles.

- The balance of expenses from previous periods, which have not yet been transferred, is 30 thousand rubles.

According to calculations, for the first quarter of 2022, the company takes into account part of the losses from previous periods, equal to 10 thousand rubles.

IMPORTANT! Expenses identified in more than a single tax period must be transferred in a certain order. In particular, the transfer is carried out according to the order of receipt of losses. Expenses are recorded in the database after the amounts for the past have been covered. This rule is stipulated by Article 283 of the Tax Code of the Russian Federation.

Example No. 2

Based on the results of 2015-2016, OJSC "People's Media" identified expenses. In 2015 they amounted to 200 thousand rubles, in 2016 – 50 thousand rubles. Based on the results of 2022, the OJSC showed a profit of 150 thousand rubles. When calculating accruals for 2022, the base may be reduced in the amount of 150 thousand rubles.

IMPORTANT! The amount must be reflected in accounting as a lump sum. The considered rule is specified in the relevant Instructions. Accounting is carried out in the following periods, and therefore deductible time differences appear in accounting. All of this leads to the creation of a deferred tax asset.

How to transfer a loss if its write-off needs to be postponed or interrupted

What to do in 1C if an organization does not want to reduce the tax base for losses from previous years in the current tax period?

Carrying forward losses to the future is a right, not an obligation, of the taxpayer. It can be applied in the current tax period in relation to all losses starting from 2007 (Clause 16, Article 13 of the Federal Law of November 30, 2016 N 401-FZ). This can be done intermittently, observing only the order of transfer (clause 3 of Article 283 of the Tax Code of the Russian Federation). There is no transfer time limit.

If the Organization has 100% confidence that it will never exercise the right to carry forward, then the Transfer of Loss to Future Periods operation does not need to be done in 1C.

But situations are different: perhaps in the future the management of the organization will change its mind. Therefore, we recommend that you complete this operation, but without specifying the start date of the write-off - then the loss of previous years will not be written off in tax accounting without the command of an accountant.

Let's look at the BPO analytics settings if you need to defer the write-off of losses to NU.

Fill out the reference book element Deferred Expenses in the usual manner.

In the Write-off period , set the start date of the next tax period. This is necessary to correctly fill out Appendix No. 4 to Sheet 02 of the income tax return.

Postpone the write-off of the loss by skipping the routine operation Write-off of losses from previous years in the Month Closing procedure.

Later, when you decide to reduce the tax base by the amount of the loss, begin to carry out this regulatory operation.

In the same way, you should stop doing it when writing off losses needs to be interrupted.

Observe the order (clause 3 of Article 283 of the Tax Code of the Russian Federation): it is impossible to allow a loss of a later tax period to be written off before the one that occurred earlier.

We take into account the features of paying off last year’s losses

Losses must be confirmed with primary documentation (letter of the Ministry of Finance of the Russian Federation dated January 19, 2018 No. 03-03-06/1/2598). Such papers must be stored during the entire period of repayment of losses incurred (clause 4 of Article 283 of the Tax Code of the Russian Federation).

If the primary document was lost, but the amount of losses is confirmed by a tax audit report, then it is unlikely to be transferred to the future (letter of the Ministry of Finance dated May 25, 2012 No. 03-03-06/1/278, resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 24, 2012 No. 3546 /12 in case No. A40-9620/11-140-41, AS of the Central District dated 05/22/2013 in case No. A14-10046/2012 (by the decision of the Supreme Arbitration Court of the Russian Federation dated 08/09/2013 No. VAS-10478/13, the transfer of case No. A14 was refused -10046/2012 to the Presidium of the Supreme Arbitration Court of the Russian Federation for review of this resolution in the order of supervision)).

If a taxpayer suffered losses using the simplified tax system or unified agricultural tax, and then switched to OSNO, then he has no right to take into account losses under the new regime (clause 5 of article 346.6, clause 7 of article 346.18 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated September 25, 2009 No. 03-03-06/1/617).

If a negative result is obtained in the reporting period, then the basis for calculating profit is equal to 0 (clause 8 of Article 274 of the Tax Code of the Russian Federation). Accordingly, there is no tax.

If a company applies the simplified tax system of 15%, then upon receiving a loss it must calculate and pay the minimum tax, which is 1% of the income received. In this case, the resulting loss can be taken into account in expenses over the next 10 years (clause 6 of Article 346.18 of the Tax Code of the Russian Federation).

When applying the unified agricultural tax, the resulting loss can also be taken into account in expenses over the next 10 years (clause 5 of article 346.6 of the Tax Code of the Russian Federation).