What is TZR?

What are transportation and procurement costs? Each organization must answer this question for itself, establishing a list of such expenses in its accounting policies. The following regulations can help in this matter:

- FSBU 5/2019 “Reserves”;

Since 2022, inventory accounting is regulated by the new FSBU 5/2019 “Inventories”, PBU 5/01 has become invalid. Some accounting rules have changed significantly. The changes were explained in detail by ConsultantPlus experts. Get trial access to the system for free and go to the Ready-made solution.

- All-Russian classifier of types of economic activities (approved by order of Rosstandart dated January 31, 2014 No. 14-st) - section “Transportation and storage”.

Find examples of possible components of TZR in this article.

Methods for accounting for goods and materials

How the organization will reflect the costs associated with the purchase of inventories must also be recorded in its accounting policies. You can choose from the following options for accounting for goods and materials:

- Using accounts 15 “Procurement and acquisition of materials” and 16 “Deviation in the cost of material assets.”

- Using a separate subaccount in the inventory accounts 10 “Materials” or 41 “Goods”.

- Directly included in the actual cost of inventories.

- On account 44 “Sales expenses” - only for goods.

The first three methods apply to both the purchase of materials and the purchase of goods. They follow from the requirement of clause 11 of FSBU 5/2019 that delivery and procurement costs are included in the actual cost of inventories. In addition, in the instructions for the Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), the description of the 41st account states that account 15 for goods is used in the same way as for materials. Therefore, we combine the first three methods for all inventories. But the 4th method, by virtue of clause 21 of FSBU 5/2019, is used only for goods during trading activities.

Read about the ways in which TZR are taken into account for taxation in the Ready-made solution from ConsultantPlus. Trial access to the legal system is free.

Let's look at examples of the use of each method of inventory accounting.

Example 1

Cassiopeia LLC produces bearings. Accounting for materials is carried out at planned prices. TZR are included in the deviations of the actual cost from the planned one. In August, Cassiopeia LLC purchased 120 tons of rolled steel at RUB 33,966.10. per ton, total RUB 4,075,932. (incl. VAT 20% - RUB 679,322). RUB 88,474.80 was paid for the delivery of these raw materials. (incl. VAT 20% - RUB 14,745.80). The planned cost of a ton of rolled steel is 27,000 rubles.

| Description | Dt | CT | Amount, rub. |

| The purchase price of rolled steel is reflected | 15 | 60 | 3 396 610 |

| VAT on rolled steel is reflected | 19 | 60 | 679 322 |

| Delivery costs included | 15 | 60 | 73 729 |

| VAT on delivery reflected | 19 | 60 | 14 745,80 |

| Rolled steel was capitalized at the accounting price | 10 | 15 | 3 240 000 (120 × 27 000) |

| The excess of the actual value over the accounting value at the end of the month is written off | 16 | 15 | 230 339 (3 396 610 + 73 729 – 3 240 000) |

Example 2

Orion LLC produces parts for machine tools. Accounting for raw materials is carried out at actual prices; a separate sub-account is provided for TZR. Orion LLC received 170 tons of rolled metal at 68,135.60 rubles, the total amount is 11,583,050.40 rubles, incl. VAT 20% - RUB 1,930,508.40. Delivery costs amounted to RUB 158,643.60, incl. VAT 20% - RUB 26,440.60. The delivery was carried out urgently to prepare a new order. Therefore, the company sent an employee on a business trip, who agreed on additional volumes and entered into an additional agreement with the supplier. Business trip expenses amounted to RUB 37,500.

| Description | Dt | CT | Amount, rub. |

| The purchase price of rolled metal is reflected | 10.1 | 60 | 9 652 542 |

| VAT on rolled metal products is reflected | 19 | 60 | 1 930 508,4 |

| Delivery is reflected in the cost of raw materials in a separate sub-account “TZR for raw materials and materials” | 10.1.1 | 60 | 132 203 |

| VAT on delivery reflected | 19 | 60 | 26 440,60 |

| Business trip expenses are reflected as part of the TZR | 10.1.1 | 60 | 37 500 |

The third accounting method is suitable for those organizations that use few different types of materials. The application of this method is shown in example 3.

Example 3

Malaya Dipper LLC packages one type of honey for retail sale. In August, 1,750 kg of honey were purchased from beekeepers in the amount of 875,000 rubles, excluding VAT. 75,000 rubles were spent on delivery. The salary of the forwarder, who makes the purchase and escorts the cargo, for August turned out to be equal to 67,000 rubles, social contributions on his salary - 20,234 rubles. TZR at Malaya Dipper LLC is recorded in the materials account, directly included in their cost.

| Description | Dt | CT | Amount, rub. |

| The purchase price of honey is reflected | 10.1 | 60 | 875 000 |

| Transport costs reflected | 10.1 | 60 | 75 000 |

| The salary of the forwarder is reflected | 10.1 | 70 | 67 000 |

| Social contributions accrued on the forwarder's salary | 10.1 | 69 | 20 234 |

The fourth method can be chosen by trade organizations, as well as when accounting for goods by non-trade organizations, that is, those that conduct trading activities in addition to other activities (clause 21 of FSBU 5/2019).

Example 4

Ursa Major LLC is a distributor of electronic equipment. In August, 300 televisions of the same brand were purchased for the amount of RUB 1,677,966, incl. VAT 20% - RUB 279,661. Delivery costs amounted to RUB 57,966, incl. VAT 20% - RUB 9,661.

| Description | Dt | CT | Amount, rub. |

| The equipment has been registered | 41 | 60 | 1 398 305 |

| Incoming VAT on equipment is reflected | 19 | 60 | 279 661 |

| Transport costs reflected | 44 | 60 | 48 305 |

| Incoming VAT on delivery is reflected | 19 | 60 | 9 661 |

Methods for writing off TZR

When inventory items are accounted for separately from the cost of inventories themselves (all accounting methods except the third), the question arises of how much they should be written off when using or selling inventories to which these associated costs relate. For accounting purposes, the organization chooses independently the method of distributing goods and materials between used/sold materials/goods and those remaining in the warehouse and enshrines them in the accounting policy.

For the first two methods of accounting for goods and materials, it is advisable to write off in proportion to the accounting cost of materials, using the formulas indicated below.

K = (TZR0 + TZR1) / (MPZ0 + MPZ1) × 100,

TZR2 = K × MPZ2,

Where:

K - percentage of deviation write-off;

ТЗР0 - balance of the deviation amount at the beginning of the month;

TZR1 - amount of deviation for the month;

MPZ0 - balance of materials at the beginning of the month at book value;

MPZ1 - the amount of materials received for the month at book value;

TZR2 - the amount of deviations written off as costs;

MPZ2 - the amount of materials at the accounting price, written off as costs.

For the examples discussed above, we will show the write-off of goods and equipment using this method.

Example 1 (continued)

At the beginning of August, the balance of materials is equal to 880,000 rubles, the balance of deviations is 46,000 rubles. 140 tons of rolled steel were written off for production. The write-off of rolled steel and corresponding fuel and equipment as part of accounting deviations will be reflected in the following entries:

| Description | Dt | CT | Amount, rub. |

| Rolled steel is written off for production at the discount price | 20 | 10 | 3 780 000 (140 × 27 000) |

| The deviation for 140 tons of rolled steel transferred to production was written off | 20 | 16 | 253 260 |

K = (46,000 + 230,339) / (880,000 + 3,240,000) × 100 = 6.7%.

Amount of deviations written off to costs:

TZR2 = 6.7% × 3,780,000 = 253,260 rubles.

For the third method of accounting for material and equipment, their distribution is irrelevant, since these costs are already included in the cost of materials. But with the fourth method of accounting for inventory items (as part of sales expenses), the organization can choose one of the ways to write them off:

- write off completely to cost;

- distribute between goods sold and those remaining in the warehouse.

This choice is given in the instructions for the Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n (rules for using the 44th account). When distributing, you can use, for example, the formulas given in Art. 320 Tax Code of the Russian Federation:

K = (P0 + P1) / (T1 + T2) × 100,

P2 = K × T2,

Where:

K - % of sales expenses that fall on the balance of goods at the end of the month;

P0 - sales expenses related to the balance of goods at the beginning of the month;

P1 - sales expenses of the current month;

T1 - the cost of purchasing goods sold in the current month;

T2 - cost of purchasing goods not sold at the end of the month;

P2 - sales expenses related to the balance of unsold goods at the end of the month;

T2 - the cost of purchasing goods that were not sold at the end of the month.

Example 4 (continued)

The cost of goods sold in August is 1,830,000 rubles. The balance of goods at the beginning of the month totaled 540,000 rubles, on the 44th account the opening balance was 13,400 rubles.

Cost of acquisition of goods not sold as of August 31:

540,000 + 1,398,305 – 1,830,000 = 108,305 rubles.

K = (13,400 + 48,305) / (1,830,000 + 108,305) × 100 = 3.18%.

Selling expenses related to the balance of unsold goods as of August 31:

108,305 × 3.18% = 3,444 rubles.

Selling expenses written off to cost:

13,400 + 48,305 – 3,444 = 58,261 rub.

| Description | Dt | CT | Amount, rub. |

| The cost of goods sold is reflected | 90.2 | 41 | 1 830 000 |

| Transport expenses written off for the month | 90th subaccount “Business expenses” | 44 | 58 261 |

To write off sales expenses, it is advisable to allocate a separate subaccount; this will make it easier to fill out reports.

Registration of sale of goods

Now we formalize the sale of goods and analyze the balance sheet for 41 accounts.

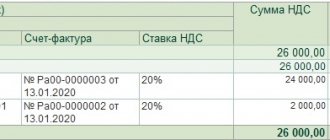

Fig.4

According to the documents in Fig. 1 and Fig. 4, we see that half of the total items received in the current period are written off.

On March 14, 10 m3 of the nomenclature “Beam100*100” and “Beam 150*150” were received. On March 25, 5 m3 of both types of timber were sold.

Results

The choice of method for accounting for inventories depends on the characteristics of the organization, the share of these expenses in the cost of inventories, the amount of inventory balances at the end of the reporting period and other factors. When forming an accounting policy, it is necessary to go through all available methods of accounting and distribution of equipment, since they can significantly affect the financial result of the organization.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Calculation of transportation and procurement costs

It is quite difficult to directly include all material and equipment items in the cost price of a product, since information about their composition and size, accumulated in primary forms, may arrive late not only at the time of receipt of the material materials, but also when they are written off for production, i.e., to the formation of the cost price. Therefore, it is possible to take into account the entire amount of TRP in the cost price only with small turnover of the company and homogeneous operations. For example, if a company produces one type of product, the cost of its transportation will be fully included in the final cost.

If a company incurs costs for the production of several nomenclature items or works in several types of activities, the amount of TRP is calculated according to options, the meaning of which boils down to the separate accounting of these costs during a specific reporting period and their distribution among manufactured products and inventory balances in storerooms proportionally.

Calculation of equipment and materials to be transferred to the accounts where the costs of the MC are recorded is made using the formula:

%rtzr – percentage of distribution of TZR,

TZRn – TZR at the beginning,

TZRot – TZR for the reporting period,

Mk – balance of MC at the end of the period;

Roth – consumption of MC for the reporting period.

The amount of TZR to be written off is calculated by the costs incurred by the calculated percentage. If the TZR does not exceed 10% of the cost of the MC, then their full amount can be written off to cost accounts.