What is a receipt for PKO

A receipt for a cash receipt order (CRO) is a document confirming the receipt of money, usually within an organization from a depositor. The contributor can be an employee, founder or another company. The receipt is not a separate piece of paper, but a detachable part of the PKO.

The order is considered the primary documentation that is used to record cash transactions. Accepting money and filling out the PQS is regulated by relevant legislative acts.

Organizations and individual entrepreneurs usually use a unified order form, which is provided by the Bank of the Russian Federation.

Document functions

The PKO receipt is provided to the person who deposited a certain amount into the cash register. Thus, the paper confirms that the monetary transaction was completed. It is issued immediately after filling out the PQS. The paper contains the same information as in the order.

A person receives it in the following situations:

- when paying for company services

- when forming a share in the authorized capital of an organization

- when returning the balance of money that was issued for reporting

Receipt documentation acts as confirmation of the transaction at the cash register. The responsible accountant or cashier is responsible for preparing the reports.

When compiling the paper, a unified sample called KO-1 is used.

Receipt is a document of strict accountability

After accepting funds through the cash register, the person who deposited them is given a tear-off receipt.

The PKO form itself is stored at the cash desk of the individual entrepreneur/enterprise. Today, the receipt form must fully comply with the established KO-1 form. Its sample is recommended or purchased in specialized stores.

The main thing is not to violate the filling procedure, since strict requirements are imposed on the cash receipt order, since the order is considered a document of strict accountability!

Is a cash receipt required?

A check and a PKO receipt are different documents that must be drawn up separately from each other. The depositor uses the receipt to conduct his own accounting and reporting. A cash register receipt is a paper that is generated by a cash register. A receipt is created for buyers as confirmation of payment for a specific unit of goods or service, for the receiving party - as confirmation that revenue has been received.

If the depositor is a legal entity, then after depositing funds he is simultaneously issued a check and a receipt. For ordinary individuals who do not conduct business activities, only a check is issued. For persons who contribute to the authorized capital, only a receipt is issued.

Receipt form for receiving money from an individual

- full name of the recipient organization (a mandatory condition is that it belongs to the bodies of the Ministry of Finance of the Russian Federation and the Federal Treasury);

- TIN, KPP contains the name of the government agency and tax office that controls this payment. The names of these bodies are indicated in abbreviated form. In some cases, the TIN is not filled in;

- in the “OKATO code” cell the code of the municipality by which incoming funds are mobilized is indicated. This information is taken from the corresponding classifier;

- name, details, bank identification code, beneficiary account. Column "corr. "account" is not filled out if the service is provided in Russian banks;

- in the “payment name” cell the name of the tax, state duty, fine (for example, a fee for issuing a passport) is indicated;

- Filling out the budget classification is mandatory. Filling out the receipt incorrectly will make it impossible to determine the purpose of the payment. This code consists of 20 characters and is taken from the country’s budget revenue classifier.

Sberbank notification receipt. Form PD-4 is a bank document that is used when legal entities or individuals make payments for state duties, fines, penalties, taxes, as well as other non-cash payments. The receipt form is unified, approved by a special letter in 2007, which was prepared jointly by Sberbank of the Russian Federation and the Ministry of Taxes.

Please note => Studying at a university is included in the work experience

Is it possible to confirm the fact of payment?

The receipt is issued to the other party for record-keeping purposes, so it will likely not be sufficient to prove payment if a dispute arises. In any case, companies or individual entrepreneurs cannot issue their client a receipt instead of a check. If one organization pays another company for goods, it must require a receipt.

In some situations, confirmation of payment may be carried out using a strict reporting form.

About receipts for individual entrepreneurs in the video:

Opened form

- “Details of the payment recipient” - it indicates the name of the payment and enters data related to the payment recipient.

- “Payer details” - here the payer’s last name, first name, patronymic, his address and, if necessary, his personal account number are filled in in detail.

- “Payment” - in the fields of which you need to enter information directly related to this payment: “payment amount”, “payment amount for .

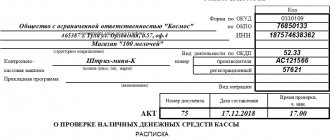

The payment document of form PD-4 is intended for making payments by Clients in cash and consists of two parts - “Notice” and “Receipt”. The payment document is used when accepting payments on cash registers and PTK. To confirm payment acceptance, a KKM or PTK stamp is affixed to the payment document (notice and receipt).

31 Dec 2022 marketur 239

Share this post

- Related Posts

- What payments are due for the first child of a working woman in the Kursk region gubernatorial

- Zemstvo Nurse Program for Nurses 2019

- Increase in prosecutors' salaries in 2021

- In violation of points

Registration procedure

Papers are filled out by an accountant or cashier directly when accepting funds. Registration is carried out as follows:

- Fill out the PKO (left side of the paper). It indicates the document number, company name, date of preparation, amount, basis for contribution and details of the contributor (initials of the person or name of the company, if we are talking about an organization).

- The information is duplicated on the receipt (right side of the paper).

- The accountant's signature and the organization's seal are placed on the PKO and its detachable part.

Registration can be done in writing, by filling out a printed sample, or electronically, by entering data on a computer. After filling out the order electronically, the order is printed and signatures are placed on it.

The filling process is quite simple. Basic information about the organization is entered, the reasons for depositing money and information about the donor are indicated. It is worth noting that before signing an order, you will need to add it to a specialized journal in which all transactions are noted. The procedure does not take much time when using a ready-made sample.

Cash documentation

A receipt for a cash order, or as accountants also call it a receipt order, is considered a strict reporting document that must be filled out in the case when funds in cash are received at the cash desk of an individual entrepreneur or an enterprise, institution or organization of various forms of ownership. The receipt in 2019 can be filled out either on a computer or manually. However, the sample is in one copy.

When filling out a document, any corrections or blots are absolutely unacceptable. Otherwise, you can fill it out again and correctly.

A tear-off receipt for a cash receipt order must be certified by the signature of an authorized person, usually an accountant. The cashier of an individual entrepreneur also puts his signature. The order is certified with a seal in such a way that the main part of it remains on the receipt, which will be torn off, and the smaller part remains on the PKO. When filling out a cash receipt order, a sample of such a document that can be downloaded, the cashier must register it in a special journal of the KO-3 form.

How to receive funds

Reception is accompanied by compliance with the following procedure:

The cashier accepts cash one by one, carefully counting each bill- money is recalculated so that the depositor can see all the manipulations

- The PKO is signed only if the amount specified in the order corresponds to the funds actually received

Acceptance of finance from third-party organizations or from one’s own employees is carried out by order.

The procedure is carried out according to predetermined regulations. You can learn more about the procedure by studying legislative acts and regulatory documents.

If, after recalculation, a shortage of deposited funds is discovered, the cashier offers to deposit the missing portion to the depositor. If an excess is detected, the cashier returns the excess portion. If the depositor refuses to compensate for the shortfall, the procedure is cancelled.

How to create a PKO in 1C, watch the video:

Document numbering

When maintaining accounting records, you need to number the reporting papers correctly. The order is numbered in accordance with the rules adopted by the organization. Numbering may begin again annually or quarterly. There are currently no acts strictly regulating numbering. The main thing is to ensure timely deposit of money into the cash register.

The number of each individual document is entered in the cash book. At the initial stage of the company’s work, it is necessary to decide on the rules for maintaining numbering independently. A common standard is to update the numbering annually. Throughout the year, the count is kept in chronological order.

Is it possible to get a copy

If necessary, it is possible to issue a duplicate of the order and receipt. The duplicate is drawn up as a copy, the appropriate signatures are placed on it and it is indicated that the paper is a duplicate.

Under normal circumstances, the PKO is issued in a single copy. If lost, it is not possible to restore it. If you want to insure against the loss of an important copy of the order, you can create a duplicate. A copy is usually created at the initiative of one of the parties.

The paper is stored in the organization along with other accounting documentation. Orders must be retained for 5 years. After this, they can be sent to the archive.

How to correctly write a receipt for receiving funds

It is recommended to compare the signatures of the parties with the autographs in the passport. If they don't match, the paper will likely become invalid. But this action will be unnecessary if the document is certified by a notary, since notary offices themselves certify the fact that the agreement was signed by these very citizens.

- You need to make sure that the person to whom you are transferring the money has the right to receive it (for example, you rented an apartment from a woman, and her husband comes to collect the money - this is illegal).

- Traditionally, the document is recorded with a blue ballpoint pen (in particular, this facilitates potential examination, since the gel pastes are lubricated).

- Corrections, strikethroughs and other blots are not allowed. In theory, you can write “correction is correct” next to the correction and put the signatures of the parties, but the best solution would be to rewrite the text completely.

- A copy of a note (even certified by a notary) has no legal force. When presented in court, the original is required.

Please note => Conclusion of a specialized organization when recognizing a house as unsafe