I went on vacation to visit my parents in the village. The time has come to submit income reports to the tax office, but it is not possible to go to the city for this, and things are not as good with the Internet as we would like. The only option is to send documents by mail. In this article I will describe in detail the process of sending and generating reports. At the same time I will answer questions like:

- Basic options for filing income reports;

- Requirements for an official declaration;

- Sending tax by mail;

- Rules for compiling an inventory;

- Violation of delivery deadlines.

What is the difference between submitting reports: in person, by mail, via the Internet?

Most reports can be submitted to regulatory authorities in person, online or by mail.

Submitting reports in person on magnetic media to the Federal Tax Service

Direct submission of a report to the inspector at the Federal Tax Service is possible only for entities with a small staff of up to 25 people. The report is submitted in two copies on paper. You may need to attach an electronic file on a flash drive. The main advantage of this method is that the taxpayer immediately knows whether the report has been compiled correctly or not.

The Federal Tax Service will tell him, if necessary, what needs to be corrected. But on the days of quarterly and annual reporting, large queues form at the tax office, in which a representative of an enterprise or individual entrepreneur will have to spend more than one hour. In addition, the inspector will refuse to accept the report if he finds any errors.

Attention! Therefore, it is better to submit the statement directly not on the last reporting day, since there is a risk of simply not submitting it. If the head of the organization or entrepreneur cannot submit the report in person, it is necessary to issue a power of attorney for the representative.

Submitting reports by mail

Submitting reports by mail is a good alternative:

- Reports can be sent from any post office.

- Even if you are in the tax queue for submitting reports and you do not have time to defend it, you can submit it even on the last day.

- There is no subscription fee for an electronic digital signature or other special programs required for electronic reporting.

Only enterprises with a small number of employees can also send a declaration by mail. The report in the amount of one copy must be placed in an envelope, and there is no need to attach additional media with its electronic form. You will definitely need to fill out an inventory of the investment.

This report will be accepted by the regulatory authority, even if there is an error in it. In this regard, it will require further adjustment and clarification. But the company or individual entrepreneur will find out about this later. If the tax return is not submitted by mail by a director or entrepreneur, a power of attorney will only be required for registered items.

Attention! For large companies with more than 25 employees, the statement cannot be sent by mail to the tax office, since the law stipulates that reporting must be submitted via the Internet.

Submitting reports via the Internet

Today, submitting a tax report via the Internet is the most popular method of sending. Moreover, this will be a more profitable alternative to mail if you have to submit a lot of reports. In this case, the declaration is transmitted only in electronic form. This method is available to every enterprise or individual entrepreneur, but provided that they have an electronic digital signature.

Briefly about the main thing

- Reporting can be sent using different methods - in person, through online portals and by mail.

- The appearance of the declaration depends on whether it is a paper version or electronic.

- When sending a report via mail, you can use one of three options - regular mail, certified letter or registered mail.

- In any case, when sending the declaration by mail, an inventory must be attached. This investment is also compiled according to established rules.

- When sending reports by mail, you must comply with the sending deadlines. This will avoid fines.

What are the deadlines for accepting reports when sending them by mail?

The legislation establishes that the date of sending the report by mail is the date indicated in the receipt for the postal item or the day marked on the inventory of the attachment.

No later than the next day from the date the report is received by the tax authority by mail, it must be registered by an official using a specialized program. If there is no automatic registration of reports, then it is recorded in a special journal in which it is assigned an incoming number.

Features of the reporting direction for TKS

Taxpayers whose average number of employees for the previous calendar year exceeds 100 people send tax returns to the tax authority in established formats in electronic form, unless a different procedure for submitting information classified as state secret is provided for by law (paragraph 2, paragraph 3, art. 80 of the Tax Code of the Russian Federation).

The Federal Tax Service does not have the right to refuse to accept a tax return in electronic form on the grounds that the average number of employees of the organization is less than 100 people. Thus, “small” companies can submit reports either on paper or electronically. The organization independently decides on the method of submitting the tax return to the tax authority.

Please note that when transmitting tax reporting via TCS, it is necessary to be guided by the Methodological Recommendations for organizing electronic document management when submitting tax returns (calculations) electronically via telecommunication channels, approved by Order of the Federal Tax Service of Russia dated November 2, 2009 No. MM-7-6/ [ email protected] Reason - paragraph 1 of the order of the Federal Tax Service of Russia dated November 17, 2010 No. ММВ-7-6/ [email protected]

Submission date and supporting document

When transmitting a tax return via telecommunication channels, the day of its submission is considered to be the date of its dispatch, recorded in the confirmation of a specialized telecommunications operator. This is provided for by the Procedure for submitting a tax return in electronic form via telecommunication channels, approved by order of the Ministry of Taxes of Russia dated April 2, 2002 No. BG-3-32/169.

The tax authority does not have the right to refuse to accept a tax return submitted by an organization in the established form and format. And upon receipt of reports on the TCS, he is obliged to transfer the receipt to the organization in electronic form.

The end result of receiving tax returns and individually informing taxpayers about its results is:

- registration of a tax return (calculation) in the information resource of the Federal Tax Service of Russia;

- sending to the taxpayer (his representative) a receipt for acceptance of the tax return in the form of an electronic document signed with the digital signature of an authorized representative of the Federal Tax Service of Russia inspection.

The form of the receipt for acceptance of the declaration in electronic form is given in the order of the Federal Tax Service of Russia dated February 25, 2009 No. MM-7-6/ [email protected]

The official responsible for receiving tax reporting in electronic form according to the TKS, no later than the next working day after the day of its receipt, forms:

- notification that the tax return (calculation) has not been accepted, indicating the reason;

- or a receipt for accepting a tax return (calculation).

Thus, the moment of submission of the declaration is considered to be the date indicated in the confirmation of the specialized telecom operator. The document confirming the receipt of a tax return in electronic form under the TKS is the receipt of acceptance (letter of the Ministry of Finance of Russia dated April 29, 2011 No. 03-02-08/49).

Reporting format

Electronic tax reporting formats are approved by the Federal Tax Service of Russia in agreement with the Ministry of Finance of Russia (Clause 7, Article 80 of the Tax Code of the Russian Federation).

A tax return will not be accepted if it is not submitted in the prescribed format. This is indicated in subparagraph 3 of paragraph 133 of the Administrative Regulations of the Federal Tax Service, approved by Order of the Ministry of Finance of Russia dated January 18, 2008 No. 9n.

Therefore, a tax return not filed in the prescribed format may be considered unfiled.

In case of failure to submit a declaration within 10 days after the expiration of the established period, the Federal Tax Service may decide to suspend the organization’s operations on its bank accounts (clause 3 of Article 76 of the Tax Code of the Russian Federation).

What letter should I use to send reports to the tax office?

The subject himself can choose how to send reports to the tax office by mail. The only obligatory condition is that the letter with the reporting must have an inventory of the attachments.

Thus, the following options are available to the taxpayer:

- Regular mail is the cheapest postal service. You will only need to pay for the envelope and its weight. An inventory of the attachment is drawn up independently on company letterhead, but usually the postal worker refuses to put a stamp on it. Due to the fact that the letter is not registered, if it is lost, it will be impossible to prove the fact of sending.

- Registered shipping is a low-cost option for registered shipping. When submitting it, the employee is given a receipt confirming acceptance of the envelope for forwarding, which will be proof of submission of the report if the letter is lost. But the accountant must draw up the inventory himself, and the postal worker does not stamp it. Thus, the fact of sending and the date can be proven using a receipt. If it is lost, then it will be difficult to confirm the date and fact of departure. You can attach a receipt receipt to the letter.

- A valuable letter with a description of the attachment is also a registered item. However, the sender can assign a “price” to it, which will be paid in case of loss. In this regard, the post office draws up an inventory of the attachment on its own letterhead and puts a stamp on it. With this type of shipment, the inventory can serve as confirmation of the date and fact of sending the declaration to the tax office. If necessary, return receipt can also be used here.

Important! When sending reports to the tax office via mail, it is best to do this in a valuable letter with a list of attachments! Otherwise, the letter may simply be lost. In this case, an inventory with a postal stamp describes the contents of the envelope.

Inventory of attachment

If the declaration is sent by mail, there must be a special inventory of the attachment. This is stated in paragraphs 1 and 3 of paragraph 4 of Art. 80 NK!

There are several rules for how to correctly compose an inventory:

- Information must be entered on letterhead.

- At the top is written the full name of the company or the name of the entrepreneur, as well as checkpoint codes, INN, OGRN, official bank details and legal address.

- In the middle part the name of the paper is written, that is, Inventory of the Attachment.

- Next, the list contains all declarations and documents enclosed in the registered letter.

- After the list, responsible and management persons put their signatures.

This type of inventory is suitable for enterprises. If the declaration is submitted by an individual, you can use standard forms drawn up in Form 107. You can obtain a sample of such a form at the post office itself.

The paper with the inventory must be prepared in two copies. One is placed in the envelope with the declaration. The second sender keeps it for himself. It must be accompanied by a receipt that the letter has been sent and a special notification with a postmark has been issued.

What if the tax office receives the letter after the deadline for submitting reports?

If the report is sent by mail, then according to the provisions of the Tax Code, the date of its submission is the date of dispatch. In this case, this period is valid until 24:00 of the day on which the deadline for filing the declaration is set.

If a report is received after the established date, the tax inspectorate may impose fines, but such an action is unlawful. The same position is shared by the arbitration court, which considered that if the letter was sent on time, but was delayed due to the fault of the postal service, the taxpayer is not responsible for this.

Attention! However, if the fine was still imposed incorrectly, you will have to defend your case only through litigation.

Results

If the tax authorities have asked you for documents, you can submit them on paper or electronically. Paper copies must be certified by the signature of the manager and sewn in a certain way, and can be brought to the tax office in person (or through a representative) or sent by registered mail.

When transferring documents electronically, you need to take into account the requirements of the order of the Federal Tax Service of Russia dated February 17, 2011 No. ММВ-7-2/ [email protected]

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated February 17, 2011 No. ММВ-7-2/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

List of attachments when sending the 3-NDFL declaration by mail

When you send your income tax return by mail, please include this inventory. Make an inventory of the investment in two copies. Send one copy along with the documents to the tax office. Keep the other one with a postmark on it.

Determine the date of filing the declaration by the postmark. The declaration is considered submitted on time if it is sent before 24 hours of the last day established for its submission (clause 8 of article 6.1 of the Tax Code of the Russian Federation). Submit an application addressed to the head of the tax office.

Methods for submitting a VAT return

The VAT return is submitted through electronic document management (EDF) operators via telecommunications channels (clause 5 of Article 174 of the Tax Code of the Russian Federation).

In paragraph 3 of Art. 80 of the Tax Code of the Russian Federation provides the basic requirements that the EDF operator must meet. This must be a Russian organization that meets the requirements of the Federal Tax Service of Russia (paragraph 2, 3, subparagraph “a”, paragraph 6, article 10, part 3, article 24 of Law No. 134-FZ).

IMPORTANT! From the report for the 3rd quarter of 2022, the VAT declaration must be completed in a new form, as amended by the Federal Tax Service order No. ED-7-3 dated March 26, 2021 / [email protected] The changes are related to the introduction of a goods traceability system.

You will find a line-by-line algorithm with examples of filling out all twelve sections of the report in ConsultantPlus. Trial access to the system can be obtained for free.

The use of the electronic form for filing returns must be observed not only by VAT taxpayers, but also by tax agents and persons who have obligations to the budget under clause 5 of Art. 173 of the Tax Code of the Russian Federation (paragraph 1, clause 5, article 174 of the Tax Code of the Russian Federation).

An exception to the method of submitting a VAT return is made only for tax agents who are not taxpayers or are exempt from fulfilling the duties of a VAT taxpayer (paragraph 2, clause 5, article 174 of the Tax Code of the Russian Federation).

Important! Tip from ConsultantPlus If you are a tax agent, you can submit a VAT return on paper only if the following conditions are simultaneously met... Read more about the conditions under which a tax agent can report on paper, read in K+. Access is free.

Violation of reporting method

If the reporting person files the return incorrectly or fails to provide required documents, he or she will face tax liability. Here are the main penalties:

- 200 rubles for violating reporting deadlines.

- 200 rubles for a missing additional document.

- From 300 to 500 rubles for late submission of a report on an official tax application.

To avoid such penalties, it is necessary to track the sending of reports using the stamp issued by the post office.

The declaration will be considered sent on time if it was sent by mail 24 hours before the due deadline!

If problems arise related to violation of deadlines and a fine issued, you can go to court. If the taxpayer is sure that he did not violate the deadlines, he will need to present a postal receipt. If it indicates the date of dispatch, at least one day before the due date, the fine will be automatically removed.

It turns out a similar receipt without problems. If a valuable or registered letter is sent, it must be registered and a special receipt is issued. In addition, when issuing a valuable letter, the postal employee takes a receipt from the addressee that the letter has been received.

How to create a postal inventory?

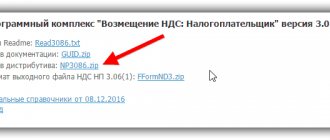

In our service NDFLka.ru you can not only fill out the 3-NDFL declaration, but also create a postal inventory. This is very convenient, because all you have to do is put the finished inventory in an envelope and take the documents to the post office. In order for the postal inventory to be generated, at the end of filling out the declaration in the NDFlka program, namely, in the “Results” section, you need to select the method of sending documents: “Through the post office.” Please look at the picture:

Types and formats of electronic documents

Documents that participate in electronic document flow between tax authorities and taxpayers can be formalized or informal.

Formalized are documents with an xml extension that are created in a format approved by the Federal Tax Service.

For example: explanations for the VAT return are sent to the Federal Tax Service according to the format approved by Federal Tax Service order No. ММВ-7-15 dated December 16, 2016/ [email protected]

Unformalized are any documents for which the format is not approved. Such documents can be sent to the Federal Tax Service in scanned images in a user-friendly format: pdf, jpg, png, etc.

For example: in this form, you can attach a scanned image of an agreement with a counterparty or a payment order to formalized explanations.

In this case, the inventory that accompanies non-formalized documents is sent according to the approved format: KND 1184002 (Federal Tax Service order No. ММВ-7-6/ [email protected] ).

As a rule, working with electronic formats does not require much effort from the taxpayer. He simply fills out ready-made templates in the EDF operator service , and the smart service will always tell you step by step how to correctly fill out a particular document or create a container with files for sending scanned images.

Exchange documents with the tax service through the Online Sprinter service. It is easy and convenient to work in it. And if you have any questions, our support is available 24/7. Use the service for free for a whole month and appreciate its benefits.