What does sequence mean?

The order of payment is a number from 1 to 5, which, in fact, means the queue number. This refers to a queue in which debits are made from the taxpayer’s account when there is insufficient funds for all expenditure transactions.

The order of payment is established in accordance with the provisions of Article 855 of the Civil Code . There are 5 priority levels:

- Alimony, writs of execution for compensation for harm to life and health.

- Transfers on writs of execution for arrears of wages and severance pay.

- Current salary. Debts on mandatory payments - taxes and contributions (according to collection orders from tax authorities).

- Other executive documents.

- All other listings are in chronological order.

Note! The order of payments comes into force only when there are insufficient funds in the taxpayer’s account to make all the necessary payments.

Where and what symbols indicate the order of payment

The order of payment is indicated in all types of customer orders. Thus, according to Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds,” the order of payment (21 details number) is indicated in the following types of customer orders:

- In the payment order (See the form in Appendices No. 2 and No. 3 of the Regulations)

- In the collection order (See the form in Appendices No. 4 and No. 5 of the Regulations)

- In the payment request (See the form in Appendices No. 6 and No. 7 of the Regulations)

- In the payment order (See the form in Appendices No. 9 and No. 10 of the Regulations)

21 details number

(field number 21), reflecting the “order of payment” - is indicated in the payment document with only one digit in accordance with the federal law (Civil Code of the Russian Federation) or is not indicated in cases established by the Bank of Russia.

Since December 14, 2013, the order of payments has been set to 5

(from the first to the fifth), and the payment document always contains one of these five queues - the amendment to the Civil Code of the Russian Federation was introduced by Federal Law of December 2, 2013 N 345-FZ.

The same Federal Law abolished the 6th order of payment

.

Payment documents are accepted by banks for execution with the mandatory completion of all details, which includes filling out 21 details, so a payment document without this detail from a client is practically not accepted by the bank for execution.

How are salaries paid?

From the list above it follows that before paying wages for the past month, the employer is obliged to pay off arrears of wages and severance pay. However, it means debt for which there are enforcement documents.

Are you calculating your salary? Find out how to properly pay for non-working days.

What is paid in advance: salary or tax debt?

In the third priority there are wages and arrears of taxes and contributions. The question often arises: which of these should be paid first? In fact, the mentioned payments do not have priority over each other. The fact that they are in the same queue implies the following: the payment will be made in advance, the order for the transfer of which was received by the bank earlier.

If the order to pay wages was made earlier than a collection order was received from the tax authority to write off the debt, then the wages will be paid first, and then the tax debts. If an order from the tax office was received earlier, then this payment will go forward.

Order of payment in a payment order

In the standard payment order form (its form is given in Appendix No. 2 to Bank of Russia Regulation No. 383-P dated June 19, 2012), a special field is allocated to indicate the priority. In the diagram reflecting the numbering of the fields of this document (Appendix No. 3 to Regulation No. 383-P), the field allocated for the queue number is assigned the number 21.

When will current taxes be written off?

Current tax payments will go to the last, fifth place. This same level of priority includes, for example, payment for goods and services, payment of state duties, and so on. There is a chronological order inside the queue, that is, the payment that arrived earlier will go first.

Let us once again draw attention to the fact that in this queue we are not talking about tax debt under writs of execution - it is paid in third place.

Priority in paying taxes to the budget

What order of payment to the budget should I indicate in the payment order when paying taxes? New edition of Art. 855 of the Civil Code of the Russian Federation raised many questions about how to fill out the payment priority field in a payment order when paying taxes and fees to the budget. Which queue should I indicate - 3 or 5?

Payments and fees to regulatory authorities are of an indisputable nature, therefore the 3rd priority is indicated in the “Priority” field. But in case of timely (independent and/or voluntary) payment of taxes and fees, the 5th order of payment is indicated in the payment order.

So, in addition to ordinary business transactions to pay the supplier for purchased goods, works or services, the 5th stage also includes payments for the payment of any taxes, fees, penalties and fines to the budget of the Russian Federation, as well as payments for insurance contributions to the budgets of state extra-budgetary funds .

When else does the order of payment apply?

In addition to being indicated in the payment order, the order of payment is relevant to the insolvency procedure . When a register of creditors' claims against a bankrupt is formed, the sequence of payments is also determined in accordance with the provisions of paragraph 2 of Article 855 of the Civil Code of the Russian Federation.

The essence here is the same, with the only difference that the order of payment applies not only to the funds in the current account, but to all the property of the debtor. External management is introduced at the enterprise, the value of the property is determined and its sale is carried out. After this, debts are paid to creditors in the established order of priority.

Calendar order of payments

Calendar priority is the debiting of funds from the current account of an individual or legal entity in the order of receipt of client orders and other payment documents for debiting.

If several payment documents are included in one priority group, then they will be paid within this group also in the calendar order of receipt of payment documents.

For example, the bank received several payment documents: a payment order for the transfer of wages on September 2, a request from the Federal Tax Service for payment of taxes on September 3, a payment order for the payment of financial assistance on September 5. All payments relate to the third stage. If there are insufficient funds in the client’s current account, the bank will first issue a salary payment, then the tax claim, and finally transfer financial assistance.

The order of debiting funds from the organization's current account

Maintaining an optimal cash balance in a current account is one of the tasks of financial planning in an organization. A lot of money is not very good, it lies like a dead weight and does not work. Little money - even worse, there is nothing to pay the bills. This is where the “fight of payments” begins, when there are more demands for payment from an account than there are funds on it.

How should a bank act in such a situation? Who has more “privileges”? Let's determine the order in which funds are written off from the organization's current account, especially since it has recently undergone significant changes.

What is the order of payment?

The payment sequence is the sequence that the bank uses when writing off money from the client’s accounts based on received orders for which the payment deadline has arrived or is due on the day the bank receives them. The order is determined in the Civil Code.

Orders for debiting from a bank client's account can be of various types - payment orders and demands, collection orders, etc. The order of payment does not depend on the type of order, but is determined only by the availability of money and whether there is enough money to pay for all documents.

The order of payment is indicated on any type of order - detail (field) 21 (Regulations of the Bar of Russia dated June 19, 2012 No. 383-p). Without filling out this field, the document will not be accepted by the bank.

Types of priority of payments

According to the amendments to the Civil Code, from December 14, 2013, five priorities of payments were established: from 1 - the most urgent to 5 - the least urgent. Until this time, six sequences were used.

There are two types of priority for writing off funds (Article 855 of the Civil Code):

1. Calendar priority: if the amount in the current account is sufficient to satisfy all the requirements for it, then the money is written off in the order in which the documents are received.

2. Priority in the sequence established by law: if there is not enough money in the account to satisfy all the demands made on the account.

Priority according to law

So, according to the sequence established by law, the following order of debiting funds from the organization’s current account is applied (clause 2 of Article 855 of the Civil Code):

1st stage: writs of execution to satisfy demands for the collection of alimony, for compensation for harm caused to health and life.

2nd stage: executive documents for the payment of severance pay and wages to persons working under an employment contract, payment of remuneration to the authors of the results of intellectual activity.

3rd stage: payment documents for remuneration of persons working under an employment contract, instructions from tax authorities and authorities monitoring the payment of insurance contributions to write off and transfer debts on taxes, fees, insurance contributions to extra-budgetary funds.

4th stage: writs of execution to satisfy other monetary claims.

5th queue: other payment documents in calendar order.

If there are not enough funds in the account and there are documents that all belong to the same payment priority, then debiting them (within the group) is carried out in calendar order.

Note:

— the order of payment in field 21 is always entered, regardless of whether you have enough money in your current account or not and regardless of what order the document for payment belongs to;

- transfer of payments for taxes, fees, insurance premiums on a voluntary basis refers to the 5th priority of payment.

What else has changed in payment orders for the payment of insurance premiums, see here. Read about OKTMO codes, which have been indicated in payment orders instead of OKATO since 2014, here.

Share your opinion, has the use of the new sequence become more understandable compared to the previously used one? What situations have you encountered with the bank regarding the order of payments?

You might be interested in:

Partial account blocking

If the account is partially blocked (due to failure to comply with the tax payment requirement), you can manage the funds on it in the following order:

| There is more money in the account than the blocked amount | There is less money in the account than the blocked amount |

| You have the right to dispose at your own discretion of money exceeding the blocked amount - you can make any payments, including settlements with counterparties | The order of payments is used - first the bank will make payments according to executive documents of the 1st and 2nd stages (if any), then salary payments (if they arrived before tax collection orders). After this, tax and other payments are possible |

Why do we need a queue?

The priority for bankruptcy of an individual or organization was introduced to determine the priority of different types of claims. The essence of the claim will be visible from the documents submitted by the creditors. A separate priority is provided for claims that arose before filing for bankruptcy and after the initiation of a case in arbitration. In the second case, the queue for current payments is determined.

The order of creditor claims in bankruptcy was introduced for the following purposes:

- to determine the procedure for paying off debts, if such a possibility exists;

- to distinguish between current obligations that arose after the initiation of the case and old debts that caused bankruptcy;

- to avoid disputes between creditors when distributing funds.

The priority of creditors' claims is formed even if the debtor obviously has no property or income. There are situations when, after filing bankruptcy, the debtor has liquid assets that can be sold at auction. In this case, the manager will already have a list of creditors of different priority levels.

The order of priority does not apply to simplified bankruptcy at the MFC. For this procedure, the applicant indicates all obligations that he has to banks, housing and communal services enterprises, individuals and legal entities. Since the MFC does not sell property, the queue of creditors does not matter. It is believed that only those citizens who do not have property file for bankruptcy through the MFC - this was the conclusion made by the bailiffs.

What is the priority of creditors

During the bankruptcy process, creditors have one last chance to recover money from the debtor. If the defaulter does not have property, or its sale does not allow the debt to be fully repaid, creditors will be left with nothing.

The debts will be considered uncollectible, and at the last court hearing they will be written off from the debtor. The right to recover through the courts from bailiffs and collectors is automatically lost.

When conducting a bankruptcy case, the manager forms the bankruptcy estate. It includes cash and property assets that can be foreclosed on. At the expense of the bankruptcy estate, creditors can count on full or partial compensation for the debt.

To participate in the distribution of the bankruptcy estate after the sale, creditors must declare their claims. They submit documents to arbitration, prove the reasons for the occurrence and the amount of the debt. All claims made by creditors are verified by the court.

If the requirement is justified, it is included in the register. Also, all claims are posted in queues, which will be important when distributing funds identified from the debtor or received after sale. The manager is obliged to follow the order of priority in bankruptcy.

Complete blocking of an account is not an absolute ban on access to money

If trouble does happen and the tax authorities have blocked your account, there is no need to panic. The law allows you to continue spending money from a blocked account, taking into account the order of payments established in the Civil Code of the Russian Federation - all payments that are in this queue before tax payments are not blocked (paragraph 2, clause 1, article 76 of the Tax Code of the Russian Federation).

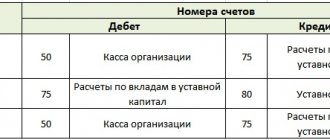

The order of priority of payments according to the Civil Code of the Russian Federation:

It turns out that from a blocked account it is possible to transfer at least wages and taxes - of course, provided that the bank does not have writs of execution and there are enough funds.

Other transfers (to suppliers, customers, etc.) related to queues 4 and 5 are impossible until the tax authorities unblock the account.