The obligation to pay property tax falls on both companies using OSNO and having real estate on their balance sheet, and on enterprises using special regimes if they are owners of real estate accounted for at cadastral value.

All tax-paying enterprises pay it at the end of the calendar year, i.e. tax period, and transfer advance payments if reporting periods are established by regional legislation (clause 1 of article 379, clause 2 of article 383 of the Tax Code of the Russian Federation). Let us recall the features of reflecting events related to this tax in accounting.

Calculation of corporate property tax

The obligation to pay property tax lies not only with organizations working on OSNO, but also with “simplifiers” and “imputers”, if the latter own real estate, the basis for calculating property tax is the cadastral value (clause 2 of Article 346.11 and clause 4 of Article 346.26 of the Tax Code of the Russian Federation).

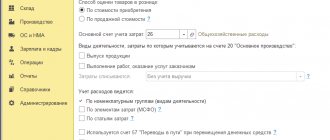

The reflection of transactions for calculating property tax for each taxpayer depends on the provisions of the accounting policy adopted by it. There are 2 options for recording entries in accounting:

- According to PBU 10/99 “Organization expenses”, which does not qualify property taxes as expenses for ordinary activities and, when accruing them, recommends using account 91 “Other expenses”.

- In accordance with the position of the Ministry of Finance of the Russian Federation expressed in letter dated October 5, 2005 No. 07-05-12/10, which classifies property tax as general expenses. Thus, in his opinion, tax accrual reflection is on a par with generally accepted expenses.

Each taxpayer decides independently which method to choose. Fixing one of the possible options in the accounting policy will allow you to avoid disputes with inspectors.

Find out how to correctly calculate property tax in the Typical Situation from ConsultantPlus. Learn the material by getting trial access to the system for free.

Read about the rules for drawing up accounting policies in the article “How to draw up an organization’s accounting policies (2022)?”

Cancellation of movable property tax

Federal Law No. 302-FZ dated 03.08.2018 amended Chapter 30 of the Tax Code of the Russian Federation, according to which it is established that from 01.01.2019 only real estate of organizations is subject to tax (clause 1 of Article 374 of the Tax Code of the Russian Federation). In order to determine the tax base for the tax, as now, the criteria for classifying property as real estate (movable) are extremely important.

What is real estate

Based on paragraph 1 of Article 130 of the Civil Code of the Russian Federation, real estate includes land plots, subsoil plots and everything that is firmly connected to the land, that is, objects whose movement without disproportionate damage to their purpose is impossible, including:

- buildings, structures, unfinished construction projects;

- residential and non-residential premises;

- parts of buildings or structures intended to accommodate vehicles (car spaces), if the boundaries of such premises, parts of buildings or structures are described in the prescribed manner.

Real estate also includes objects subject to state registration: aircraft and sea vessels, inland navigation vessels. The Civil Code of the Russian Federation allows other property to be classified as real estate if it is defined by law (for example, space objects).

According to paragraph 1 of Article 131 of the Civil Code of the Russian Federation and in accordance with Federal Law dated July 13, 2015 No. 218-FZ “On State Registration of Real Estate,” real rights to real estate are subject to state registration in the Unified State Register of Real Estate (USRN). At the same time, the absence of an entry in the Unified State Register of Real Estate is not a basis for exempting property from taxation.

To confirm the existence of grounds for classifying a property as real estate, the Federal Tax Service of Russia recommends that the tax authorities establish the following circumstances (letter dated 08/02/2018 No. BS-4-21/ [email protected] ):

- availability of a record about the object in the Unified State Register of Real Estate;

- in the absence of information in the Unified State Register of Real Estate - the presence of grounds confirming the strong connection of the object with the ground and the impossibility of moving the object without disproportionate damage to its purpose. For example, for capital construction projects, these may be documents of technical accounting or technical inventory of the object as real estate; permits for construction and (or) commissioning; design or other documentation for the creation of an object and (or) its characteristics.

In letter dated 10/01/2018 No. BS-4-21/ [email protected] the Federal Tax Service of Russia also provides criteria for distinguishing property into movable and immovable.

Real estate in "1C: Accounting 8"

In previous versions of the 1C:Accounting 8 program, the attribute of classifying fixed assets (FPE) objects as movable (immovable) property was determined by the value of the Fixed Asset Accounting Group

. The value of this detail is selected from a predefined list and indicated in the fixed asset card.

Thus, objects were automatically classified as real estate objects if in the Fixed assets accounting group

, one of the values was indicated:

- Building;

- Facilities;

- Perennial plantings;

- Land;

- Natural resource management facilities;

- Other objects requiring state registration, classified by Article 130 of the Civil Code of the Russian Federation as real estate.

Accordingly, objects were not classified as real estate if the requisite Fixed assets accounting group

took one of the following values:

- Machinery and equipment (except office equipment);

- Office equipment;

- Vehicles;

- Industrial and household equipment;

- Draft livestock;

- Productive livestock;

- Other types of fixed assets.

At the same time, in practice, situations arose when it was necessary to change the group so that property tax was calculated correctly. For example, structures such as construction cabins (which do not have a strong connection with the land and do not meet the criteria of real estate) had to be indicated in the group Other types of fixed assets. And some vehicles, for example, sea vessels, should have been indicated in the group Other objects requiring state registration, classified as real estate by Article 130 of the Civil Code of the Russian Federation.

Meanwhile, the asset accounting group

is used in the program not only for tax accounting purposes for corporate property tax. When filling out financial statements, the distribution of fixed assets into groups (for example, Buildings, Land, Vehicles, etc.) is also widely used, so it is not always convenient for users to “requalify” fixed assets into other groups.

Starting from version 3.0.66 in 1C:Accounting 8, the sign of real estate is indicated explicitly using the flag of the same name in the fixed asset card (Fig. 1).

Rice. 1. Attribute of real estate in the fixed asset card

When switching to version 3.0.66 in the Fixed Assets directory, flags are set by default for those groups that belonged to real estate in accordance with the previous algorithm (Buildings; Structures; Perennial plantings; Land plots; Natural resources; Other objects requiring state registration, classified by Article 130 of the Civil Code of the Russian Federation as real estate).

When creating a new OS object, the default flag is also set in accordance with the group, after which the user can clear or set the flag depending on the characteristics of the specific property.

Regardless of the flag installed, Land Plots and Natural Resources Objects will still not be recognized as objects of taxation (Clause 4, Article 374 of the Tax Code of the Russian Federation).

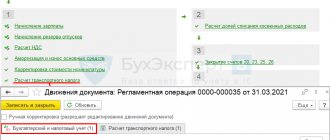

The calculation and accrual of property tax in the program is performed automatically using the regulatory operation for December Calculation of property tax, which is included in the Closing of the month processing. If in the Local Tax Payment Procedure register there are entries indicating that advance payments are being made for property tax, then the Calculation of Property Tax operation is also added to the list of month-closing operations for March, June and September.

If property tax is assessed: posting for organizations

The posting for calculating the property tax of an organization will look like this:

- When assigning costs to other expenses:

Dt 91 Kt 68.

- When charged to expenses for ordinary activities:

- Dt 20 (23, 25, 26) Kt 68, if the activity of the enterprise is not related to trade;

- Dt 44 Kt 68 for trade organizations.

Tax accrual is carried out quarterly, unless the reporting period is canceled by the relevant regional legislation (clause 3 of Article 379 of the Tax Code of the Russian Federation).

ConsultantPlus experts explained how to correctly reflect the payment of tax in accounting. Get trial access to the system and go to the Tax Guide.

Read about the nuances of quarterly tax calculation in the material “Calculating the amount of advance payments for property tax.”

Untimely transfer of an object to account 01 entails additional assessment of property tax

Let's assume that an organization received equipment from a related party in 2022. The equipment was handed over for installation and will subsequently be included in the organization’s fixed assets. From what point is it necessary to charge property tax: immediately after the completion of installation and installation work or after the actual operation of the equipment has begun?

It is known that account 07 “Equipment for installation” reflects the cost of:

– technological, energy and production equipment (including equipment for workshops, pilot plants and laboratories), requiring installation and intended for installation in facilities under construction (reconstruction);

– equipment put into operation only after its parts have been assembled and attached to the foundation or supports, to the floor, interfloor ceilings and other load-bearing structures of buildings and structures, as well as sets of spare parts for such equipment. This equipment includes control and measuring equipment or other devices intended for installation as part of the installed equipment.

The cost of equipment handed over for installation is written off from account 07 to the debit of account 08 “Investments in non-current assets”.

The generated initial cost of fixed assets is transferred from account 08 to the debit of account 01 “Fixed Assets”. Assets recorded as fixed assets (as a general rule) are recognized as subject to taxation on the property of organizations ( clause 1 of Article 374 of the Tax Code of the Russian Federation ). Accordingly, as long as assets are listed in accounts 07 and 08, the organization does not have the obligation to charge this tax.

It is clear that it is beneficial for an enterprise to delay the start of property tax assessment. However, the transfer of property to the OS cannot be carried out solely at the request of the organization. Where does this conclusion come from? First of all, from the wording of clause 4 of PBU 6/01 “Accounting for fixed assets” and clause 20 of the Guidelines for the accounting of fixed assets [1].

For your information

Paragraph 4 of PBU 6/01 lists four conditions, if simultaneously met, the object is accepted for accounting as fixed assets. From the wording of these conditions - the object is intended for use , is capable of bringing economic benefits to the organization - it is clear that we are talking about the potential possibility of use, and not about actual use. In other words, an object must be recognized as part of the operating system when it is ready for use, regardless of whether its actual use has begun or not.

The same conclusion follows from the wording of paragraph 20 of the Guidelines for accounting of fixed assets , according to which, according to the degree of use, fixed assets are divided into:

– in operation;

– in stock (reserve);

- under repair;

– at the stage of completion, additional equipment, reconstruction, modernization and partial liquidation;

- on conservation.

Thus, installed equipment received from a related party must be transferred to the OS at the moment when the object is ready for operation and is in the place and condition in which the organization intends to use it[2]. From this moment on, the asset is subject to property tax.

It should be recognized that this conclusion is known to the overwhelming number of accountants. Nevertheless, they are reluctant to follow it, hoping that during an inspection they will be able to prove that the facility is not ready for operation. However, is it so easy to do? Of course, each case is individual. At the same time, it is possible that it is easier for inspectors to convince the court that the facility has been ready for use for a long time, and perhaps even that it is already in operation, despite the fact that it continues to be listed on account 08.

What arguments will help inspectors prove that the tax base is understated?

Let’s answer this question based on the Resolution of the AS PO dated 04.04.2017 No. F06-19093/2017 in case No. A65-8927/2016 . It states: the object is accepted for accounting as fixed assets and, accordingly, is included in the property tax base after it is brought into a state suitable for use, that is, all costs associated with the acquisition (construction, creation) have been incurred. and bringing it into a state of readiness for operation ( regardless of its commissioning ).

During the audit, the tax authority revealed the untimely acceptance by the organization of 31 objects for accounting as fixed assets.

Analysis of account cards 08 and 07 indicates that the initial cost of these objects includes the costs of delivery, registration, installation and was fully formed by December. Subsequently, the organization did not have any additional expenses for the disputed objects. Consequently, the disputed property during the period specified by the tax authority was brought to a state of readiness and the possibility of its operation, and was capable of bringing economic benefits (income) to the organization.

The organization did not prove that changes were made to the technical documentation and equipment was modernized or other costs were incurred in order to bring the equipment to readiness for operation.

Thus, having identified the fact that costs have ceased to be written off to the debit of account 08, inspectors will be able to prove that the equipment is ready for use.

note

An attempt to artificially create debit turnover (by late reflection of expenses) will also not help to avoid additional tax charges. Inspectors will be able to convince the court, for example, if they present evidence of the use of the OS object (facts of operating costs, production of products or performance of work).

In this case, the arbitrators will reject the argument that the documents were received late, since in this case the accountant is obliged to adjust the original cost, recalculate the amount of previously accrued depreciation and clarify tax obligations. We'll show you how to do it.

Example

The organization hired a contractor to install production equipment. The cost of equipment including delivery is RUB 2,500,000. In accordance with the contract, the price of the work is 1,000,000 rubles, the period for completion is from April 27 to May 31, 2022.

The work acceptance certificate was signed by the parties on June 5, 2017.

In September 2022, the accounting department received a transfer and acceptance certificate, as well as an order for the commissioning of equipment with a useful life of 25 months from 06/06/2017.

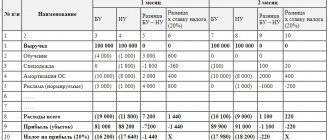

Incorrect option for reflecting transactions:

| Contents of operation | Debit | Credit | Amount, rub. |

| April 2022 | |||

| Equipment for installation was transferred | 08 | 07 | 2 500 000 |

| September 2022 | |||

| Cost of installation work included | 08 | 60 | 1 000 000 |

| The equipment is accounted for as an OS object | 01 | 08 | 3 500 000 |

| October 2022 | |||

| Depreciation accrued for October (RUB 3,500,000 / 25 months) | 20 | 02 | 140 000 |

Result: distortion of accounting (financial) reporting indicators, understatement of the corporate property tax base.

The correct option to reflect transactions:

| Contents of operation | Debit | Credit | Amount, rub. |

| April 2022 | |||

| Equipment for installation was transferred | 08 | 07 | 2 500 000 |

| September 2022 | |||

| Cost of installation work included | 08 | 60 | 1 000 000 |

| The equipment is accounted for as an OS object | 01 | 08 | 3 500 000 |

| Depreciation accrued for July - September (RUB 3,500,000 / 25 months x 3 months) | 20 | 02 | 420 000 |

| Additional property tax was assessed (taking into account the cost of equipment) according to the updated tax return for the first half of the year* | 26 | 68 | 2 750 |

| Property tax penalties have been accrued** | 26 | 68 | 37 |

| Tax amount transferred to the budget | 68 | 51 | 2 750 |

| Penalties listed | 68 | 51 | 37 |

* The average cost of property over 6 months will increase by 500,000 rubles. (RUB 3,500,000 / (6 + 1)). The amount of tax to be paid additionally will be 2,750 rubles. (RUB 500,000 x 2.2% / 4).

** The penalty is accrued from the day following the tax payment established by law until the day of actual payment, that is, the day on which the tax amount is transferred to the budget is not included in the period of delay ( Letter of the Ministry of Finance of Russia dated July 5, 2016 No. 03‑02‑07/ 2/39318 ). Let's assume the period of delay is 45 days. The refinancing rate (key rate) in this period is 9%. Then the amount of the penalty will be 37 rubles. (RUB 2,750 x 9% / 300 x 45 days).

Let us remind you: in order to avoid the accrual of a fine, you must pay the missing amount of tax and the corresponding penalties before submitting an updated declaration to the tax authority ( clause 1, clause 4, article 81 of the Tax Code of the Russian Federation ).

Results

The entry reflecting the accrual of property tax in accounting may be different depending on which of the expenses that arise for the taxpayer this tax relates to in accordance with the accounting policy adopted by him.

The frequency of calculation (quarterly or once at the end of the year) depends on whether reporting periods for this tax are established in the region. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features of tax calculation and payment deadlines

According to Art. 380 of the Tax Code of the Russian Federation, the tax rate is established by regional laws, without exceeding certain limits: for property with an average annual value of 2.2%, and for real estate with a cadastral value - 2%. Regional authorities have the right to set their rates in the specified range, as well as differentiate them by property groups and types of enterprise activities. If a subject of the Russian Federation has not established tax rates, those specified in Art. 380 Tax Code of the Russian Federation.

The deadlines for tax payment are not established by federal legislation, since this right is given to the regions - they themselves decide when enterprises pay it (Article 383 of the Tax Code of the Russian Federation).

From 01/01/2022, a single payment deadline will apply for all regions: the annual tax will be paid before March 1 of the next year, and advance payments will be paid no later than the last day of the month following the reporting period.

In tax accounting, property tax or an advance on it when taxing profits is taken into account on the date of accrual, i.e. on the last day of the reporting or tax period (clause 1 of Article 264 of the Tax Code of the Russian Federation) regardless of the date of payment to the budget.

If the tax is paid by a simplifier using the “Income minus expenses” object, the amounts of tax and advances are recognized as expenses at the time of payment (clause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

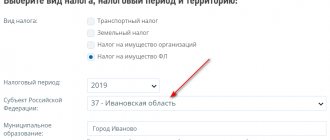

Tax return

A property tax declaration based on the results of the year must be submitted to the tax authority by March 30 of the next year. This means that the Declaration for 2022 had to be sent by March 30, 2018. This year, every quarter it is necessary to present “Tax calculations for advance payment...” for the 1st quarter, half a year and 9 months. A period of 30 days is allocated for provision after the end of the relevant quarter.

By the way, from 2022 in Russia for the first time a single deadline for paying corporate property tax is being introduced - March 1. Read about other changes in the procedure for paying this tax in our review.

Declaration and Calculation refer to regulated reporting documents. They can be found in the “Reports—Regulated Reports” section. In the basic version of the 1C program, it is possible to keep records of only one organization. If you need to make declarations for several companies, then you need to buy the CORP or PROF version.

As an example, let’s consider creating a property tax calculation for the 1st quarter of 2022 and charges for it.

In the Declaration window that appears, the “Fill” button is active, with which the program will fill out the “Calculation” automatically. The Calculation includes a Title Page and three sections. The title page contains the following information about the payer:

- Name;

- checkpoint;

- TIN;

- reporting period;

- tax authority code and other information.

The first Section is “The amount of the advance tax payment subject to payment to the budget according to the tax authority.” It reflects data on OKTMO, budget classification code, and the total tax amount.

For example, an organization purchased two OS objects:

- “Workshop building” – the cost is 12 million rubles. (including VAT 2,160 thousand rubles). The indicated useful life is 20 years - 240 months. They are subject to a preferential rate of 1%.

- “Ice cream production line”, the cost of which is 5 million rubles. (including VAT in the amount of 762.7 thousand rubles). The useful life is indicated at 75 months - 6.5 years.

Section 2 on the first page indicates the residual value of the workshop building as of each first day of the first month of the reporting period.

Line code 030 displays the residual value of the workshop building as of February 1, 2022. It is calculated as the difference between the acquisition cost and VAT: 12 million rubles. – 2,160 thousand rubles. = 9,840 thousand rubles. The residual value is reduced on the following reporting dates by the amount of monthly depreciation charges - this is 41 thousand rubles.

(9840 thousand rubles / 240 months)

In Section 1, in the lower fields of the first page, the average cost for the reporting period, the reduced tax rate for a certain object and the amount of tax assigned to be paid to the budget are indicated.

The average value of property is formed by summing the value of property for each date of the period under study, divided by 4: (9048+9799+9758)/4=7349.3 thousand rubles.

As a result, the tax base is determined, which must be multiplied by the tax rate (1%). It looks like this: 7349.3 x 1% = 73.493 thousand rubles. It should be taken into account that the resulting annual tax amount, which must be divided into 4 quarters, is 18,882. This is reflected in line 180.

In Section 2 on the second page, the assessment of property tax is indicated for the second object - “Ice cream production line” (Fig. 15). At the top of the page the residual value of the equipment as of the reporting dates is indicated.

The lower fields set the tax rate to 1.9%, and also display the total tax amount for the object in question - 14,894 rubles.

In Section 1, line 030, the total tax amount is equal to the tax amount on two pages - 14,894 rubles. + 18,373 rub. = 33,267 rub. Section 2.1 provides data on OS objects.

Section 3 is drawn up in a situation where an organization assesses tax on an object for which the tax base is calculated based on the cadastral value. Using the 1C program, calculating property taxes is quite easy and quick. It is important to carefully enter source data into the system to avoid errors.

If you have questions about calculating property taxes, contact our 1C support specialists, we will be happy to help you!

You can purchase services that help you work as an accountant here.

Do you want to install, configure, modify or update 1C? Leave a request!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Tax base, rates

Chapter 30 of the Tax Code of the Russian Federation indicates the object of taxation and the tax rate. The maximum tax amount is 2.2%. The tax is calculated using the following formula:

Tax = tax base (rub.) x tax rate (%) – amount of advance payments (rub.).

Additionally, Article 381 of the Tax Code of the Russian Federation specifies federal tax benefits. When setting up the 1C program, it is important to check whether changes have been made to legislation at the regional or federal level regarding tax regulation. It is important to regularly update the 1C program so that all legislative innovations are taken into account. You can do this yourself or contact a franchisee company that provides modification services for 1C versions of PROF and CORP. An ITS agreement must be signed with her.

Connect the ITS Support Kit in First Bit. Monthly updates, 24/7 hotline, useful reference books, 1C-Reporting, EDI setup and much more.

Artificial crushing of objects

Let's consider this situation. The purchased set of equipment includes several items, some of which cost less than 40 thousand rubles. Does the organization have the right to recognize each item as an independent object and, accordingly, take into account cheap objects as part of the inventory, writing off their cost as expenses at a time?

This course of action is quite common. It allows you to save on property tax and income tax. However, tax authorities are often able to prove that the equipment should be considered a single whole, that is, one inventory item.

As a rule, technological equipment, including individual types of equipment, is used only as a complex and not separately. It is impossible to exclude certain types of equipment from the technological process, as this will lead to disruption of the technological process and the impossibility of production. Therefore, when qualifying equipment, you can proceed from the following. One OS object occurs if:

- any types of equipment are not intended to perform their functions separately from each other, that is, they are structurally connected;

- certain types of equipment cannot be removed or replaced without disrupting the technological process or completely stopping production.

For example, this approach was applied by the arbitrators of AS PO in the Resolution dated July 1, 2015 No. F06-24858/2015 in case No. A55-5190/2014 . Moreover, the Supreme Court judge did not find any grounds for transferring the case to the Judicial Collegium for review ( 306-KG15-13406 dated 10/07/2015 ).