Explanation of the abbreviation SOUT The term “special assessment” appeared several years ago. It is used along with others:

Why is this necessary? According to Russian legislation, all taxpayers are required to pay their taxes in a timely manner and in full.

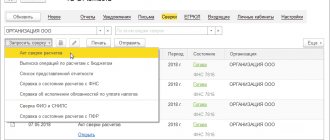

We recently held a webinar on Clerk where we talked about tax risks for companies.

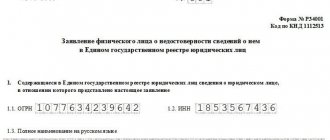

Reasons for making changes to the register Every organization, from time to time, undergoes various transformations.

What we pay for Membership fees are calculated and paid in accordance with Federal Law No.

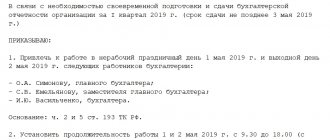

An order to work on a day off is an integral part of the work process if employees are involved

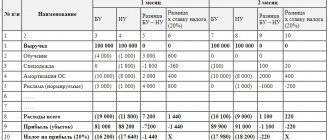

Which accounting accounts are involved in the postings? All tax calculation transactions are displayed by credit

In what situations is this possible? There are several most common reasons for closing an individual entrepreneur: an independent decision

What does severance compensation mean? When talking about severance compensation, we usually mean the most

Until December 31, 2022, employees had the opportunity to submit an application to the employer for a transfer