What does severance compensation mean?

When talking about compensation for leave upon dismissal, we usually mean its most general case, which applies to absolutely all employees.

This is compensation upon dismissal in the form of vacation pay due for vacation not used during the period of work. Every employee has the right to annual paid leave, and at the time of dismissal, part of it (and sometimes even several years of leave) may be unused. Art. 127 of the Labor Code of the Russian Federation obliges to pay this part in case of dismissal, no matter what its actual duration turns out to be. The reason for termination of the employment contract does not matter when calculating compensation upon dismissal. How to calculate days of compensation upon dismissal? The duration of standard annual leave is 28 calendar days (Article 115 of the Tax Code of the Russian Federation). However, for some categories of workers it is extended (Articles 116–119, Article 348.10 of the Labor Code of the Russian Federation). Vacation pay upon dismissal is calculated based on the length of vacation that is due to a particular person, taking into account the extension, if any. Holidays do not include holidays.

The beginning of the year to which the annual leave will relate is determined individually by each employer for each specific employee - from the first day of his employment for this job (clause 1 of the Rules on regular and additional leaves, approved by the People's Commissar of the USSR on April 30, 1930 No. 169), and the end may be shifted if, during the calendar year calculated from the starting date, the employee experienced periods that were not included in this length of service (Article 121 of the Labor Code of the Russian Federation).

Calculation of compensation for dismissal in 2022 is also carried out for persons signed under a fixed-term (up to 2 months) employment contract (Article 291 of the Labor Code of the Russian Federation) or for part-time work (Article 93 of the Labor Code of the Russian Federation). For a fixed-term contract, vacation pay is calculated based on the fact that each month worked corresponds to 2 working days of vacation.

There is no need to accrue compensation for unused vacation upon dismissal to employees:

- drawn up under a GPC agreement (Article 11 of the Labor Code of the Russian Federation);

- those who worked less than half a month (clause 35 of the Rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169).

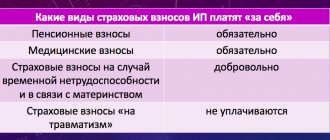

The accrued compensation upon dismissal is subject to insurance premiums, personal income tax and is paid along with other amounts due to the employee on the last day of his work activity (Article 140 of the Labor Code of the Russian Federation).

ConsultantPlus experts have made an analytical selection on legal disputes with employees regarding the payment of dismissal compensation. Get trial access to the system and find out court decisions on the most common questions.

Read about whether it is possible to receive vacation pay compensation without resorting to dismissal.

Calculation deadlines that apply when dismissing an employee in different situations

Sometimes staff quit while on vacation, sick leave, etc. Such situations often lead to an incorrect interpretation of labor legislation. Let's look at several typical cases that arise in the practice of accounting services.

How to calculate an employee if dismissal occurs after going on vacation

If an employee has written an application for leave with subsequent termination of the contract, the accounting department is obliged to calculate and pay him the salary on the last day of work (i.e. before the leave). On the same day, the personnel officer introduces the employee to the dismissal order. makes an appropriate entry in the work book and gives it to the employee.

Calculation upon dismissal on a day off: terms

If the date of dismissal falls on a weekend, payouts must be paid on the first working day following the non-working day. This follows from the provisions of Article 14 of the Labor Code of the Russian Federation.

Payment of settlement pay on a day off from the administration upon dismissal of a shift worker: deadlines

If the dismissed person works on a shift schedule and his last working day falls on the administrative staff’s day off, it is convenient for the cashier (accountant) to pay him his paycheck on a working day. Otherwise, they need to be called to work on days off, which is fraught with additional costs for paying the cashier and accountant.

This is also important to know:

Termination of an employment contract at the initiative of the employee, procedure, deadlines, grounds for challenging it in court

In addition, the called employees must obtain written consent to work on days off.

Taxes upon dismissal of personnel: terms and procedure

When calculating a resigning employee, you need to keep in mind that all payments included in the payroll (salary, bonus, compensation for unspent vacation, etc.) are subject to personal income tax. However, personal income tax is not withheld from an employee’s severance pay calculated in accordance with the requirements of the Labor Code of the Russian Federation. Tax must be collected only on amounts exceeding mandatory payments.

If the payment of an employee’s salary upon dismissal occurred on a weekday, the deadline for transferring personal income tax is no later than the next working day. If the payment is made on a weekend, personal income tax is transferred on the next working day.

Formula for calculating compensation in 2022

How to correctly calculate vacation compensation upon dismissal? In 2022, a formula is used for this, according to which the amount of compensation upon dismissal is equal to:

KNO = SDZ × NDO,

Where:

KNO - compensation for vacation upon dismissal, if the vacation was not used;

SDZ - average daily earnings;

NDO - the number of unused vacation days.

When calculating compensation upon dismissal, the amount of average daily earnings Art. 139 of the Labor Code of the Russian Federation prescribes to determine it as follows:

SDZ = WIP / 12 / 29.3,

Where:

WIP - wages accrued for the estimated period of time (12 months before the month of dismissal);

12 - number of months in the billing period;

29.3 - the average number of calendar days per 1 month of the billing period.

However, not all income paid by the employer and, accordingly, not all periods during which the employee works for the employer can be taken into account when determining the average daily earnings (clause 5 of the Government of the Russian Federation Resolution No. 922 dated December 24, 2007). In particular, it does not include accruals for periods of vacations, sick leave, and business trips.

In this case, the working time taken into account to calculate the average daily earnings will be the sum of the number of days corresponding to months worked in full, the number of days in each of which will be taken as 29.3, and the amount of calendar days of work for incomplete months (clause 10 resolution No. 922).

The procedure for accounting for bonuses related to wages in the calculation depends on the period for which they are paid (clause 15 of Resolution No. 922).

For more information on how to take bonuses into account when calculating compensation, read the article “Are bonuses taken into account when calculating vacation pay?”

In addition, with regard to income for the billing period (12 months), the following situations are possible:

- The income occurred only in the month of dismissal. Then the average daily earnings will be calculated for this month alone, dividing the salary accrued in it by the average number of calendar days calculated for this month (clause 7 of Resolution No. 922). The last value will be calculated from the number 29.3 in proportion to the share of calendar days corresponding to the time of work in the month of dismissal in the total number of days in the same month (clause 10 of Resolution No. 922).

- There was no income in the billing period. Then the period for calculating the average daily earnings is shifted to the previous period of the same duration (clause 6 of Resolution No. 922). And if there is no income there, then the average daily earnings will be calculated from the salary or tariff rate (clause 8 of Resolution No. 922).

For more information about calculating vacation pay in the absence of income in the billing period, read the material “Calculating the number of vacation days in 2022 - 2022 - an example.”

Methodology for calculating average daily earnings for payment of severance pay

The payment of additional funds upon dismissal (severance pay) is regulated by Art. 178 Labor Code of the Russian Federation. This money is not accrued in all cases of employee departure, but only when the reason for dismissal, recorded in the work book and order, is one of the following:

- health inadequacy of the position;

- exit of an employee who previously held the position from which the person being dismissed is leaving;

- conscription of an employee to military or alternative service;

- refusal to move to work in another area.

In these situations, upon leaving, the employee is entitled to funds in the amount of their average earnings for 2 weeks.

If an employee is forced to leave due to:

- liquidation or reorganization of the company;

- reduction in numbers or staff,

then he is entitled to a compensation payment in the amount of average monthly earnings.

IN ADDITION: in all of the above cases, the employee is retained his average monthly earnings for the first time after losing his job (no more than 2, in some cases - 3 months from the date of dismissal, this amount also includes severance pay).

Calculation procedure

- The billing period for which the total income is determined is 12 months.

- If the length of service of the dismissed employee is less than a year, the calculation period is considered to be the time from the date of hiring to the first day of the last working month.

- It is necessary to take into account the number of days actually worked during this period.

When the last calendar year is fully worked, the calculation formula is applied:

Zwed.-days = (∑12 months / 12) / Day/month Wed.

Where:

- Zwed.-days – average daily earnings;

- ∑12 months – the employee’s total income for 12 months;

- Day/month Wed. – the average length of the month, recorded as 29.3 days.

When a billing period is not fully worked out, the formula is applied:

Zwed.-days = ∑Nmonth. / (N-1) + Days of non-weekly months

Where:

- Nmonth – number of full months worked;

- Day.week.month. – the number of days actually worked in an incomplete month.

Calculation example

Employee Rosomakhin V.M. worked for the company from April 18, 2015 with a salary of 20 thousand rubles/month. In the last year, based on the results of his work, he was awarded a bonus in the amount of 5 thousand rubles. Resigned due to staff reduction on 04/18/2017. Paid vacation days have been used in full. Over the past year, he has been on sick leave for a total of 20 days.

Let's calculate the average daily earnings for the compensation due to him. The funds received during this time amounted to 20,000 x 12 + 5,000 = 245,000 rubles. We apply the formula:

Average daily earnings Rosomakhina V.M. = 245,000 / 12 / 29.3 = 696.8 rubles.

When calculating compensation, funds paid for 20 days of temporary disability will need to be subtracted from the amount received.

Leave compensation upon dismissal: calculation

The number of days of unused vacation is determined based on the fact that a full year of experience giving the right to it corresponds to 28 calendar days, and each full month corresponds to 2.33 calendar days. When the last month of service turns out to be incomplete, then, when calculating compensation upon dismissal, it is taken into account as full if the number of days of work in it exceeds half a month, and is not taken into account when the period worked in it is less than half a month (clause 35 of the Rules on regular and additional holidays approved by the USSR People's Commissariat of Labor on April 30, 1930 No. 169).

There are situations in which it becomes mandatory to pay compensation for leave upon dismissal for a full year, although in reality it turns out to be not fully worked out (clause 28 of the Rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169). These are cases when the employee worked:

- more than 11 months and they have all entered the length of service that grants the right to leave;

- from 5.5 to 11 months, but is forced to resign due to reduction in numbers, due to enlistment in military service, assignment to study or other work, or due to revealed unsuitability for work.

The law does not require rounding the number of vacation days determined by calculation when calculating compensation upon dismissal. Therefore, when calculating leave compensation upon dismissal, you can use a number that has decimal places, or you can reflect in the accounting policy a provision on rounding it to a whole number. When deciding how compensation for leave upon dismissal is calculated, you should keep in mind that rounding should always be done in favor of the employee (letter of the Ministry of Health and Social Development of the Russian Federation dated December 7, 2005 No. 4334-17).

Let's consider calculating compensation for unused vacation step by step.

What operations are performed during calculation

Employees can quit for various reasons: from their own desire to staff reduction. However, payment of wages upon dismissal is carried out regardless of under which article of the Labor Code of the Russian Federation the employment contract was terminated.

The responsibility for calculating the amounts lies with the accountant, but every employee can check whether everything has been done correctly. To carry out this operation, it is necessary to request a payslip on the day of dismissal and carefully study the accruals reflected in it. After you receive the document in your hands, you can proceed to a detailed analysis of payments.

The final payment upon dismissal usually includes:

- salary for the last month of work;

- monthly bonus (if it is provided for in the employment contract);

- payment for additional work time (overtime, night, holidays, etc.);

- compensation for missed vacation.

Some enterprises have a collective agreement under which a resigning employee may be entitled to various compensation payments, especially if the contract is terminated at the initiative of the administration. This can be a one-time severance pay in a fixed amount or a percentage of the employee’s salary.

An example of calculating compensation for unused vacation

Employee Fedorov V.A. hired at Solnyshko LLC on December 3, 2020, and left on May 25, 2022.

Fedorov was on vacation in July 2022 (28 cal. days). The employee did not have any periods not included in the vacation period. The calculation period for calculating compensation is 12 months preceding the month of dismissal, i.e. from May 2022 to April 2022. During this period, the employee earned 632,400 rubles.

Step 1 - calculate the length of service:

- from 03.12.2020 to 02.12.2021 - 12 months;

- from 12/03/2021 to 05/02/2022 - 5 months;

- from 05/03/2022 to 05/25/2022 - 22 days, which exceeds half a month, which means a full month is taken into account.

Total experience is 18 months

Step 2 - determine the number of vacation days from the start of work. 18 months x 2.33 = 42 days.

Step 3 - determine the number of days of unused vacation.

42 days - 28 days used = 14 days

Step 4 - calculate average daily earnings (ADE).

- the number of fully worked months in the billing period is 11;

- in incompletely worked August it is equal to 2.84 (29.3 / 31 days x (31 days - 28 days));

- SDZ is equal to 1,945 rubles. (RUB 632,400 / (29.3 x 11 months + 2.84 days)).

Step 5 - determine the amount of compensation for vacation.

RUB 1,945 x 14 days = 27,230 rub. When paying compensation, personal income tax must be withheld from it. Thus, Fedorov will receive 23,691 rubles. (RUB 27,230 - 13%).

What to do if payments are delayed upon dismissal, employer's responsibility

If the employer does not pay the employee in a timely manner, the dismissed person must seek help from the competent authorities. The complaint can be addressed to:

- to the labor inspectorate;

- to the prosecutor's office;

- to the district (city) court at the place of legal address of the offending organization.

The application must indicate a violation of the employee’s rights, formulate a demand for the former employer, consisting of full payment of obligations and payment of penalties for all days of delay in settlement amounts.

The following must be attached to the application:

- a copy of the work book;

- a copy of the dismissal order;

- pay slips, certificates 2-NDFL and 182-for the last 2 years;

- copies of cash receipts or payment orders for salary payments.

The labor inspectorate and the court, as a rule, side with the employee, obliging the employer to fully pay off the obligations and pay off any accrued penalties.

Special situations for accrual and payment

Difficulties in determining the amount of vacation compensation upon dismissal may arise in the following situations:

- In the period for which the right to leave is determined, there are time intervals that are not included in the length of service. In this case, the beginning of the year following the one that includes such intervals is shifted by the corresponding number of calendar days. And vacations at your own expense are shifted to the beginning of the next year only if their total duration for the year exceeds 14 calendar days (Article 121 of the Labor Code of the Russian Federation) and the shift occurs by the difference between the actual number of days of vacation without pay for the year and 14 calendar days days.

- The employee quits before the end of the year for which he has already taken a full vacation. In this situation, upon dismissal, that part of the vacation pay is withheld from him, which corresponds to the overpaid part of the vacation (clause 2 of the Rules on regular and additional vacations, approved by the People's Commissar of the USSR on April 30, 1930 No. 169). However, if the dismissal occurs on grounds that give the right to payment of vacation pay in full, then compensation payments upon dismissal attributable to the overpaid part of the vacation are not considered unnecessary.

For information on how to calculate vacation pay attributable to the overpaid part of the vacation, read the article “Deduction for unworked vacation days upon dismissal .

If an employee goes on vacation with subsequent dismissal, the calculation of compensation and its payment must be made on the last working day. On this working day preceding the vacation with subsequent dismissal, the employee must receive a final payment, work book and other documents necessary for further employment (letter of the Federal Service for Labor and Employment dated December 24, 2007 No. 5277-6-1).

Basic rules and calculus formula

In order to correctly terminate a dismissal, an organization must comply not only with legislative regulations under the Labor Code, but also with the basic rules of settlement procedures. The calculation of wages upon dismissal at one's own request includes not only the salary for the time actually worked, but also all payments established by the employment contract: compensation allowances, premiums, bonuses, etc. Also, the employee has the right to receive payments for length of service, for harmful working conditions, compensation for work in difficult climatic conditions or a “northern” allowance.

After the head of the institution has reviewed and signed the resignation letter, the HR department submits an order to the accounting department to process compensation payments. The accountant, in turn, calculates the employee, charging him all the amounts required by law.

First of all, it is necessary to calculate the number of days worked by the employee directly in the month of dismissal. The calculation of the last salary must include not only the salary, but also all additional payments due - compensation, incentives, bonuses, etc. The calculation is carried out in proportion to the actual time worked.

Next, you need to calculate unused vacation. In accordance with accepted standards, each employee should be provided with 2.33 days of rest for the month actually worked: 28 days. / 12 months = 2.33. Pedagogical, medical workers and civil servants are entitled to an annual vacation period of 56 days.

Unused vacation compensated to the resigning employee is determined by multiplying the number of vacation days that are provided for each month worked and the total number of months worked for the employer. From the result of this work, it is necessary to subtract the already completed period of required rest.

If the resigning employee worked less than half a month, he is excluded from the calculation. If half a month or a longer period has actually been worked, then this period is taken into account when paying in full.

If an employee of a budgetary educational institution (for example, a teacher) decides to resign without taking his last vacation in full, then the number of days subject to compensation is 56.

The compensation itself is calculated using the formula:

Calculation of the required compensation is made from the moment a specific employee is hired. Average daily earnings are calculated strictly according to the law, that is, the accountant calculates only those payments that are taken into account for the value of SDZ. They include salary, bonuses, various additional payments, compensation, allowances and rewards.

An accountant, when calculating an employee who resigns of his own free will, has the right to use the following formula, compiled according to the general rule:

The regional coefficient varies depending on the area in which the employer operates. The regional coefficient is determined by current legislative norms.

There are situations when an employee has booked vacation time in advance and then decided to resign. In such cases, a debt is formed to the employer for vacation pay. It is important to remember that the organization has the right to withhold funds in the amount of up to 20% of wages. The resigning employee transfers the balance of the previously paid advance to the cashier himself.

Is it possible to check online?

It is possible to check the manual calculation of compensation upon dismissal via the Internet. To do this, you will need to enter into the appropriate program all the information it requests, taking into account the features described above. The program will process the entered data and issue the estimated amount of compensation.

If you doubt your calculations, use the Ready Solution from ConsultantPlus. Get trial access to the system and learn for free how to calculate and pay compensation for unused vacation upon dismissal of an employee.

Calculation note upon dismissal: goals and design

The calculation note reflects the procedure for calculating the average daily earnings used to calculate severance pay. It does not have a regulated form; in most organizations, accountants use the T-61 form because of its clarity and convenience. The document is internal; the employee can receive it only upon a written request outlining the reasons for the request.

Purposes of receiving a note-calculation:

- control over the procedure for calculating payment amounts;

- confirmation of income at a new job (for negotiations with a potential employer);

- confirmation of the fact of illegal settlement in litigation.

Appearance and content

The T-61 calculation note contains the front and back sides.

On the front side there is information about the employee:

- Full name, position, personnel number;

- article of the Labor Code of the Russian Federation, according to the norms of which the order was issued;

- information about the date and number of the order on the basis of which the calculation is made;

- number of vacation days to be paid (or used in advance).

On the reverse side, in fact, is the calculation itself:

- monthly earnings are shown;

- the number of days of the billing period is indicated;

- average daily earnings calculated;

- the amount of vacation pay (compensation upon dismissal), the personal income tax withheld from it and the amount to be paid were calculated.

The document is endorsed by the accountant who made the calculations for the dismissed person.

Results

Payment of compensation for unused vacation upon dismissal of an employee is mandatory for the employer. Its calculation must be done taking into account all the features of determining the average daily earnings and the number of days of unused vacation. Excessive vacation pay paid in advance is subject to withholding. The calculation can be checked via the Internet.

Sources:

- Tax Code of the Russian Federation

- Labor Code

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Required documents

The following documents serve as grounds for dismissal:

- an employee’s application for dismissal (if he terminates the contract voluntarily) or notice of termination of the employment contract;

- severance agreement.

To understand how to correctly pay settlements upon dismissal of an employee, let’s look at the list of documents that an accountant will need for this. It includes:

- dismissal order form T-8 or T-8a;

- note-calculation - form T-51;

- work record book of the dismissed person;

- personal card in form T-2.

How to determine average daily earnings if there were no accruals

It happens that an employee did not have any payments for a period. Then the SDZ is calculated as follows:

- If the employee did not work at all, or the entire period consisted of excluded days, then the value of the SDZ is calculated using information on wages for the previous year.

- If the employee did not carry out work either in the current or in previous periods, the SDZ is calculated based on the actual appearances at work during the month when it became necessary to find out the SDZ.

- If an employee has not worked a single day, the tariff rate approved for his position is taken.

Calculation basis

Please note that not all types of accruals are taken into account when calculating the average. You cannot include social payments, all types of financial assistance, certain categories of compensation in favor of the employee (compensation for the cost of food, travel, rest, vouchers, travel to vacation spots, travel expenses, etc.).

In the base for calculating the average salary, include all types of accruals that are provided for by the regulations on remuneration in the organization. For example, include:

- official salary;

- incentive bonuses;

- bonuses;

- additional payments for overtime, night work;

- payments for combining positions;

- territorial and district allowances;

- other types of payments within the framework of remuneration for labor provided for by the current system of remuneration.

How is the average salary calculated? To do this, you need to divide the calculation base by the number of days in the calculation period. It is worth noting that, for example, for vacation pay the procedure is somewhat different from the generally established one.

General calculation formula:

If you need to calculate average earnings, an online calculator will help you do this easily.

Calculation parameters

The numbers that are taken into account when calculating the average salary of an employee are both fixed and constant values, namely:

- the period for which the calculation is made (legally determined for each case);

- the amount of all types of employee income for this period (with the exception of deductions provided for by law);

- the average number of calendar days in a month is a fixed indicator equal to 29.3 (as regulated by Federal Law No. 55 of April 2, 2014).

Legislative norms

Labor law and Government Decrees of the Russian Federation require that managers and accountants, when calculating compensation and other payments upon dismissal, be guided by the provisions given:

- Art. 139 of the Labor Code of the Russian Federation - it regulates the procedure for calculating dismissal payments;

- provision approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 - it discusses in detail the calculation methodology relating to the determination of average earnings for the accounting period in all legally valid situations.

If you haven't been paid

If on the last day of work the employer did not make the payments due to the employee upon dismissal at his own request (in cash or by bank card - it does not matter), there are several ways to restore justice:

- contact your employer directly with an application for a final settlement (“In accordance with Article 140 of the Labor Code of the Russian Federation, I ask you to make a final settlement with me on “__”_______ 2020 in connection with dismissal of one’s own free will. The day of dismissal should be considered “__”_______ 2022 G."). You must bring two copies of the application, give one to the employer, and get a mark on the second that the application has been received. If the manager refuses to accept the application, give it to the secretary under the incoming number or send it by mail;

- file a complaint with the State Labor Inspectorate. Remember that the complaint review period is 30 days, and prepare your application as quickly as possible. It will be accepted through the inspection reception (under the incoming number), through an electronic service or by post. In the complaint, indicate your full name, address and telephone number, details of the employing organization, describe in detail the essence of the complaint, what measures were taken, what is the amount of the required payments. If you have supporting documents (work book, applications, orders for employment and termination of the contract, a copy of the letter to the employer, etc.), attach them. The inspector will conduct an inspection, and you will receive a reasoned response based on its results. If violations are detected, the employer will be ordered to make payments and pay a fine;

- write to the prosecutor's office at the location of the employer. The procedure for applying is the same as for the labor inspectorate. Since government bodies often conduct joint inspections, it is permissible, without wasting time, to write statements to both the State Tax Inspectorate and the prosecutor’s office. The prosecutor's office also has the right to issue an order to the employer to pay the withheld funds, but cannot force him to do so. This is the prerogative of the district (city) court;

- go to court with a statement of claim or an application for a court order. The ability to go to court if an employee’s rights are violated has limitations: you can do this within three months from the date of violation of your rights - from the last day of work. Therefore, simultaneous appeal to three authorities at once is most effective: the labor inspectorate, the prosecutor's office and the court. This is not prohibited by law, but comprehensive checks and a subpoena encourage the employer to make a decision in your favor and charge a settlement upon dismissal of your own free will with subsequent payment.

- Svetlana Chernykh (Kuznetsova)

2020-09-21 17:19:16Hello, please tell me how I will be calculated if I went on vacation from September 21 for 12 days, and decided to resign of my own free will on September 22. Vacation pay has already been paid for 12 days