Report writing rules

This report has a unified standard form recommended for use. The form can be expanded and supplemented based on the needs of the enterprise. The document contains:

- Company details,

- detailed information on the movement of three types of capital:

- additional,

- reserve,

- statutory,

- data on the share of the company's own shares,

- adjustments caused by changes in the company's accounting policies,

- information on changes in the amount of retained income and uncovered losses of the organization, etc.

Also, the report must be signed by the head of the company indicating the date of its preparation.

When filling out the form, special attention should be paid to the following points: information on changes in capital must be entered both for the last reporting period and for the two previous ones.

In addition, when drawing up a report, we must not forget that subtracted or negative values are entered in parentheses, and the units of measurement can be either millions or thousands of rubles.

Today, a report can be created and submitted to the Federal Tax Service in electronic or paper form.

You cannot make mistakes in this document, so after filling it out you need to check it very carefully and, if some inaccuracy or oversight does occur, it is better to fill out a new form.

Characteristics of the first part of the report

Section I of the third form contains information on all changes in the elements of the enterprise’s equity capital for the period under review. It includes: authorized, additional, reserve capital, as well as data on retained earnings (uncovered losses), shares purchased from the owners of the enterprise.

In each part, relevant indicators are indicated that can be compared with data from previous years. If the company has not changed its accounting policies, then the values will coincide with those included in the reports for the past 2 years. In case of changes, it is necessary to make adjustments to the data and indicate the reasons for the discrepancy in the explanatory note to the report.

Example of filling out a statement of changes in capital

We draw up the “header” of the document

First, the report indicates the year for which it was compiled (i.e. reporting period ). Next, enter the full name of the organization and the following data:

- date of registration,

- OKPO code (All-Russian Classifier of Enterprises and Organizations),

- TIN,

- type of economic activity (required in the form of an OKVED code and decoding).

Below is the organizational and legal status and form of ownership , and next to it are the OKOPF (All-Russian Classifier of Organizational and Legal Forms) and OKFS (All-Russian Classifier of Forms of Ownership) codes. The last line of the document header indicates OKEI (All-Russian Classifier of Units of Measurement) codes: i.e. thousands or millions of rubles used in the report.

Completing Section 1 of the Statement of Changes in Capital

The first part includes information:

- on the movement of three types of capital of the company: additional, reserve and authorized,

- information about shares owned by the company and acquired from holders,

- as well as income (undistributed) and losses (uncovered).

If the organization has existed for a long time, then data must be entered for the previous three years, but if the company was opened recently, then only for the last reporting period.

Under the code values, the reasons that contributed to the change in capital are written in the lines, and in columns 3 to 8 - its articles.

Line 3100 shows the balance of the accounting accounts. accounting from 80 to 84 (inclusive). Data from three years ago is recorded here.

Further, in lines 3200 to 3240, information for the previous year is shown in the same way. After this, the necessary information is entered into line 3210 (below is the distribution of all financial and economic actions that led to an increase in capital in the previous year).

Column 3 shows the increase in the authorized capital , in particular, cells 3210 - the full size of the increase, and cells from 3211 to 3216 reflect the channels through which it occurred (in accordance with the 80th accounting account).

Column 4 shows the price of acquired shares for joint stock companies or, for limited liability companies, parts in the authorized capital of the enterprise

Column 5 is information about the increase in additional capital (source: accounting account 83), and column 6 is information about reserve capital (from accounting account 82).

Column 7 contains information about the increase in profit or loss , compiled from net profit (loss), which remained after transferring taxes and creating reserve capital (based on the values of the 84th accounting account).

Column 8 summarizes the data for all rows in the section in question.

Next come row cells from 3220 to 3227.

- Line 3220 shows the values for the reduction of capital for all indicators of economic activity.

- Lines from 3221 to 3227 broadcast debit turnover according to accounting. accounts 80-84 (inclusive) and are filled in completely identical to the ones above.

Code values of lines 3230 and 3240 show changes in the financial parameters of two types of capital: reserve and additional.

Line 3200 reflects the full value of the company's capital as of the closing day of the year preceding the reporting period, compiled as a credit balance (according to accounting accounts 80-84 (inclusive)).

Then the data for the reporting year is recorded and, in the same way as for the previous year, lines from 3310 to 3340 are filled in. Information about the increase and decrease of capital is given here, the final annual value of capital is entered in line 3300.

Completing Section 2 of the Statement of Changes in Capital

The second part of the report shows corrected values and adjustments for the amounts of profits, losses and other indicators that arose as a result of changes in accounting policies.

Thus, if there were no changes in this part in the company’s work, and no errors were identified in previous periods of the report, then this section can be left blank.

If they were, then briefly about how to fill them out:

- in the third column enter the total cost of capital of the organization as of the end of the three-year period;

- line 3400 records the amount compiled before the changes,

- line 3500 - already corrected values;

- Below are lines that detail all the changes that have occurred.

How to fill out for 2022?

The report on changes in capital consists of a title (introductory) part containing general information about the enterprise itself, and a tabular (main) part directly reflecting the indicators of this reporting form.

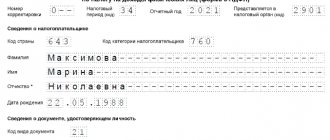

The title section includes the following information:

- Name of the reporting form.

- Reporting period (a specific year is indicated - in this case, 2020).

- Name of the legal entity, its type of activity according to OKVED 2 and details (codes).

- Date of filing of financial statements.

- Unit of measurement of all indicators: thousand rubles. (code 384).

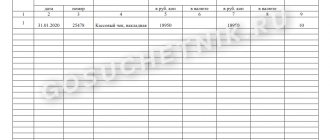

An example of filling out the title part of a statement of changes in capital:

The procedure for filling out the tabular part

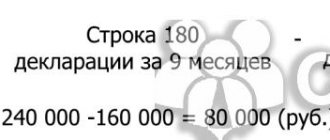

The indicators in the tabular section of the report compiled by the organization for 2022 are reflected for the reporting annual period (that is, 2020) and for the previous annual period (that is, 2019).

Comparison of indicators for different years contributes to an in-depth study of all the factors determining the dynamics of capital.

The tabular (main) section actually consists of three parts:

- Movement of capital (the dynamics of capital are reflected here in the context of all its components for the reporting and previous annual periods).

- Adjustments to the report for the previous period due to the correction of detected errors and changes in accounting policies.

- The amounts of an organization's net assets, calculated separately at the end of the reporting year (that is, 2022), at the end of the previous year (2019) and at the end of the year immediately preceding the previous one (2018). For all these cases, the end of the year is considered to be a specific day - December 31.

The table below shows the general procedure for reflecting changes in the organization's capital for 2022.

| Column name | What is reflected? |

| Authorized capital (column 3) | To fill out, information from account 80 is used. A change in this indicator can be caused by an adjustment in the number of shares (their additional issue or reduction in the number), a change in the nominal price of shares (its increase or decrease), or the reorganization of a legal entity. |

| Own shares purchased from their shareholders (column 4) | For filling out, information from account 81 is used. This indicator is negative (its balance is reflected in characteristic brackets). The reasons for its possible change are the same as for the authorized capital. |

| Additional capital (column 5) | The information is taken from account 83. The reasons for its probable dynamics are the same as for the authorized capital, as well as the revaluation of assets and the presence of income/expenses leading to an increase or decrease in capital. |

| Reserve capital (column 6) | The line is filled in based on the indicators of account 82. The reason for its change is the reorganization of the company. |

| Retained earnings or uncovered loss (column 7) | Account 84 information is used to fill out. This indicator may change for a particular year for the following reasons - receipt of net profit (loss), payment of dividends to shareholders, reorganization of a legal entity, revaluation of its assets, dynamics of the nominal price of its shares (increase, decrease), as well as reduction the number of its shares and the presence of income/expenses for this legal entity that directly lead to an increase/decrease in its capital. |

An example of filling out the table part:

and an example of filling out for 2022

.

.

Net assets

In Sect. 3 of the report provides information on the size of the company’s net assets as of December 31:

- reporting year;

- previous (last) year;

- the year preceding the previous one (the year before last).

Net assets are determined by subtracting the amount of its liabilities from the sum of all assets of the company (with the exception of certain indicators of assets and liabilities).

In other words, net assets are the value of the enterprise’s current and non-current assets, secured by its own funds.

In addition to filling out the statement of changes in capital, the amount of net assets is also needed:

- to control the size of the authorized capital;

- to determine the estimated share price.

Who writes the report and when?

IMPORTANT!

Based on Order of the Ministry of Finance No. 66n dated July 2, 2010, Form 6 of the report on the intended use of funds (OKUD 0710006) is no longer provided. Instead of the outdated one, use the OKUD form 0710003.

The very phrase “target funds” (TS) misleads many accountants. Does this include, for example, a loan from the founder for a specific purpose (for example, the purchase of equipment)?

Before filling out the report, let's understand the concepts. There is no precise definition of CA in the law. In practice, however, experts are guided by the provisions of Article 251 of the Tax Code of the Russian Federation, which allocates revenue from the budget:

- financing (clause 14, clause 1, article 251 of the Tax Code of the Russian Federation);

- receipts (clause 2 of article 251 of the Tax Code of the Russian Federation).

We can conclude that those organizations that report to the state are those that receive money or property from the budget free of charge and irrevocably for specific purposes.

Private kindergartens and schools are not budgetary organizations. They are subject to all the rules characteristic of ordinary commercial firms. Consequently, a report on the use of targeted funds for private kindergartens is provided by them in the usual manner when receiving budget revenues (for example, a grant).

IMPORTANT!

It is not possible to adjust financial statements, including those according to OKUD 0710003, after they have been signed. If an organization violates this rule, it will be fined from 5,000 to 10,000 rubles (Part 1 of Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

Column 3 “Authorized capital”

Here show changes in the authorized capital for the reporting and previous years.

If the company’s capital increased or decreased, then indicate the sources of the increase (reasons for the decrease) in the line-by-line transcripts.

Take the data for filling out this column from the accounting registers under account 80 “Authorized capital”.

Having shown the amount of the authorized capital, in the following lines “Increase in capital” reflect the amount of its increase.

Decipher the sources through which the authorized capital increased.

For this purpose, the report contains the following lines:

- “Additional issue of shares”;

- “Increase in the par value of shares”;

- "Reorganization of a legal entity."

The increase in the authorized capital is reflected in the credit of account 80 “Authorized capital”.

Line 3210 indicates its credit turnover for the past year. If during the last year the authorized capital decreased, then reflect the amount of the decrease in the lines “Decrease in capital”.

At the same time, it is necessary to disclose why such a decrease occurred.

For this purpose, the report contains the following lines:

- “Reduction in the par value of shares”;

- “Reducing the number of shares”;

- "Reorganization of a legal entity."

A decrease in the authorized capital is reflected in the debit of account 80 “Authorized capital”.

Line 3220 indicates its debit turnover for the past year. On line 3200, indicate the credit balance of account 80 at the end of last year.

Reflect the growth of the authorized capital in the reporting year in the same order as for the previous year.

- 3314 “Additional issue of shares”;

- 3315 “Increase in the par value of shares”;

- 3316 “Reorganization of a legal entity.”

In the form, indicate the credit turnover of account 80 “Authorized capital” for the reporting period.

If during the reporting year the company’s authorized capital decreased, fill in the lines in the “Decrease in Capital” section with the explanation:

- 3324 “Reduction in the par value of shares”;

- 3325 “Reduction in the number of shares”;

- 3326 “Reorganization of a legal entity.”

In the form, indicate the debit turnover of account 80 “Authorized capital” for the reporting period.

Reflect the amount of the authorized capital at the end of the reporting year on line 3300. This includes the credit balance of account 80 “Authorized capital” as of the end of the year.

Who needs to fill out and submit balance sheet supplements?

Form No. 3 “Report on changes in capital” is an appendix to the annual financial statements. It is rented out by all legal entities operating in Russia and belonging to the sphere of medium and large businesses, whose structure consists of their own shares and authorized shares of the owners. Those enterprises that:

- use a simplified method of accounting;

- belong to the public sector (non-profit organizations);

- deal with issues of lending and insurance.

Representatives of small businesses do not prepare such a report either.

Due in 2022

Form No. 3 is submitted no later than 3 months after the end of the calendar year. Therefore, for the current reporting period (2021), the deadline for submitting the document is March 31, 2022.

Where to submit

Form No. 3 according to OKUD 0710023 is submitted by enterprises to the attached address of the territorial tax office. Rosstat also receives it.

The preparation of a statement of changes in capital is sometimes required for the owners of the company or higher structures. In this case, the terms for its provision are set individually or upon request.

In what form to serve

The statement of changes in capital may be provided on paper or as an electronic file. Form No. 3 is sent directly to regulatory authorities or through an operator via specialized communication channels.

Financial statements for 2022 for filing in 2022 :

- Sample of filling out the balance sheet of an enterprise

- Income statement

- Cash flow statement

- Report on insurance premiums (DAM)

- Simplified accounting reporting

- Certificate 2-NDFL (on income and tax amounts of an individual)