Absolutely any company engaged in economic activity produces goods that are ultimately subject to sale. These are not necessarily material products. We can also talk about the services provided. In order for the organization’s work to be as efficient and coordinated as possible, it is necessary to monitor the release, production and sale of finished products in accounting, which is reflected in it. What it is and how to perform this operation correctly will be discussed in this article.

Concept

To open up the topic, we first need to give a clear definition for GP. In short, this is a completed product that was manufactured at the enterprise as a result of its economic activities. To acquire this status, it must meet all necessary standards, undergo quality control, and be staffed. The final touch is sending the batch to the warehouse for storage. In this case, the premises can be your own or belong to the customer company

After receipt, the products are measured, weighed, and, if necessary, distributed into categories. The results obtained are recorded in documents. The use of cards or cardless method is allowed. The decision on this is made by management.

Types of GP

There are several groups into which it is divided depending on a large number of factors. Read more about classification in this section.

Gross

It is characterized by the fact that it was manufactured by the company for a specific period of time. Expressed in monetary terms. Includes several subspecies: complete, final, and intermediate.

Total turnover

A set of goods from the previous category that were produced by all workshops and departments of the organization. This includes carrying out production work.

Comparable

All products and services produced by the corporation in the current and previous (base) year. In this case, production can be serial or mass. Parties made on an experimental basis are not included in this concept.

Incomparable

The total number of products that were launched for the first time during the current reporting period. Its quantity shows the degree of development and implementation of new technologies, as well as the level of expansion of the product range.

Accounts for accounting of production process

To maintain production records, an accountant will need several separate accounts:

- Account 20 “Main production”. During the reporting period, it accumulates the costs of manufacturing products included in the cost price, namely:

- cost of materials, raw materials;

- remuneration for the labor of workers participating in production;

- payments to various social funds;

- resource costs (water, electricity, etc.).

- Account 23 “Auxiliary production” collects the costs of those production structures that are not directly involved in the production of products, but provide and maintain the functioning of the main purpose. For example, these are the costs of maintaining your own boiler house, power plant, water pumping facilities, etc.

- Account 25 “General production expenses” associated with the use of equipment, machines and mechanisms. It reflects:

- funds for fuel and lubricants;

- depreciation of mechanisms, buildings, structures;

- maintenance costs;

- salaries for repairmen and adjusters;

- equipment testing;

- other similar costs.

- Account 26 “General business expenses” records the areas of expenses that are designed to support the work of the entire enterprise, including management functions and implementation. These include the following types of costs:

- salaries and other payments to management employees;

- business trips;

- funds for equipping and repairing office premises;

- payment for stationery;

- communication and Internet services, etc.

- Account 28 “Manufacturing defects” is the “saddest” of the expense accounts, but, unfortunately, necessary. The cost of all substandard products, if subject to write-off, will be reflected in the debit of this account. If it is nevertheless sold, albeit at a discount, these funds will be used against the loan.

- Account 29 “Servicing industries and farms” shows the share of costs for maintaining activities not directly related to production:

- expenses for operating subsidiary workshops (sewing, repair, etc.);

- payment for internal canteens, buffets;

- costs for auxiliary facilities (baths, laundries, dormitories, etc.);

- departmental kindergartens, sanatoriums.

- Account 96 “Reserves for future expenses” accumulates expenses for the coming periods, including:

- vacation pay for workers;

- long-service benefits for production personnel;

- funds for repairs;

- money for preparatory measures to launch a new line or change seasonal production.

- Account 97 “Future expenses” – used when costs have already been incurred, but will have to be taken into account later. In the production process it reflects:

- exploration costs;

- prepayment for advertising, etc.;

- funds for the expansion of technological lines, new equipment, product range, etc.;

- licensing, certification.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Accounting for finished products in accounting, primary documentation

For the final product, a number of papers must be completed. They are needed for pickup from the warehouse. This list includes:

- certificate of conformity;

- opinion of a hygiene expert;

- a certificate confirming the quality of the products;

- other documents that confirm the correctness of packaging, configuration and other parameters.

Only if the entire package is available, the company receives the right at the legislative level to sell the cargo.

All operations are accompanied by certain certificates, for which their own standards are established.

Receipt of finished products to the warehouse

To successfully carry out this procedure, you must provide an invoice in form MX-18. It displays the following data:

- information about the places from and where the shipments in question are transported;

- a correspondent account opened in one of the banking organizations to display all payments;

- basic information about the product and its properties;

- list of characteristics.

The paper is signed by the responsible persons who deliver and receive the cargo. After that she goes to the accounting department.

Another option is also possible. The described operation can also be performed using another document - the delivery note. Its contents indicate data about the warehouse, workshop where the goods were produced. In addition, basic information about its quantity is included.

In parallel, the corresponding statement and act are applied. They are needed to simplify the operation described here for accounting for manufactured products at the enterprise.

All movements of the GP inside the storage facilities are carefully recorded in special cards in the M-17 form. Another option is in the M-40 book. The accounting department stores data on price indicators.

Shipment from warehouse

The release of batches must be accompanied by documentation. Most often - invoices M-19 and M-15, as well as orders. All listed papers display cargo categories. Invoices and invoices are attached to transport documents. They can be forwarded to accountants no later than 5 days after departure.

The process of transporting orders to the client is carried out with mandatory registration in Form 1-T, as well as a waybill for trucks. The melon certificates indicate the information necessary for forwarders about the type of products and the features of their transportation. To receive the GP in hand, the carrier or the buyer’s representative must provide the appropriate power of attorney.

Accounting for the write-off of finished products for production or for other reasons

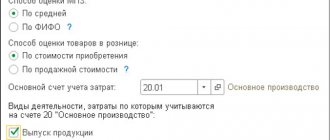

If a product has been sold or has become unusable, it is deregistered in accordance with the company's policy. There are 3 main methods that can guide those in charge.

1. Based on the weighted average cost of batches. This approach is considered the most common because it is suitable for businesses with large amounts of inventory.

2. FIFO. Assumes the disposal of products in chronological order. In other words, at the price of the first arrival, then the second and so on. It has proven itself best when working with perishable GP.

3. At the cost of each specific unit. Managers rarely resort to this method. Basically, when one name cannot replace another. For example, in situations with precious stones and metals.

The write-off is accompanied by primary documentation. These are invoices for the movement of cargo, relevant acts, as well as pick-up cards.

The reasons for the disposal of valuables may be different. The most common:

- Damage due to expired storage period;

- Obsolescence. Most often found in cars and electronic gadgets.

- Theft or accidents.

Often a special commission is convened to carry out write-offs.

Accounting

In accounting, reflect finished products transferred to the warehouse at actual cost (clause 5 of PBU 5/01, clause 203 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n). The actual cost will be equal to the amount of expenses associated with the manufacture of finished products collected in cost accounts (20, 23, 29) (clause 7 of PBU 5/01).

In this case, the balances of finished products in the warehouse (other storage places) at the end (beginning) of the reporting period can be assessed in accounting in one of two ways:

- at actual production cost;

- at standard cost.

Reflect the chosen cost accounting option in the accounting policy for accounting purposes (clause 7 of PBU 1/2008).

This is provided for in paragraph 203 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

If accounting for finished products is carried out at actual cost, make the following entry in accounting:

Debit 43 Credit 20 (23, 29) – finished products are capitalized in the amount of actual costs.

Form the actual cost of manufactured products at the end of the reporting month, when all production costs (direct and indirect) have been determined.

When using the standard cost accounting method, during the month, manufactured products are taken to the warehouse (written off from the warehouse) at accounting prices. The standard cost per unit of finished (shipped) products is established, as a rule, even before the start of its production (sales) for a long period. The use of the standard method of cost calculation is effective in mass production of products, a larger range and a significant number of operations required to manufacture a unit of product (clause 205 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n).

There are two options for calculating costs at standard cost:

- using separate sub-accounts opened for account 43 “Finished products” (Instructions for the chart of accounts);

- using account 40 “Output of products (works, services)” (Instructions for the chart of accounts).

The selected cost calculation option must be fixed in the accounting policy for accounting purposes (clause 7 of PBU 1/2008).

In the first method, reflect the costs of producing finished products using the following entries:

Debit 20 Credit 02 (05, 10, 16, 21, 25, 26, 60, 69, 70, 71) – reflects the actual costs of production of finished products;

Debit 43 subaccount “Normative cost of finished products” Credit 20 – reflects the standard (accounting) cost of finished products;

Debit 90 Credit 43 subaccount “Normative value of finished products” - finished products are written off at standard (accounting) value to the sales account;

Debit 43 subaccount “Deviations from the standard cost of finished products” Credit 20 – reversal. Deviations between the actual cost and the standard (accounting) cost were identified (the actual cost is greater than the standard);

Debit 43 subaccount “Deviations from the standard cost of finished products” Credit 20 – deviations between the actual cost and the standard (accounting) cost were identified (the actual cost is less than the standard);

Debit 90 Credit 43 subaccount “Deviations from the standard cost of finished products” – reversal. The deviation that accounts for sold products has been written off (the actual cost is greater than the standard cost);

Debit 90 Credit 43 subaccount “Deviations from the standard cost of finished products” - the deviation that falls on sold products is written off (the actual cost is less than the standard cost).

In the second method, reflect the costs of producing finished products using the following entries:

Debit 40 Credit 20 – actual expenses for the production of finished products are reflected;

Debit 43 subaccount “Normative cost of finished products” Credit 40 subaccount “Normative cost of finished products” - reflects the standard (accounting) cost of finished products;

Debit 90 Credit 43 subaccount “Normative value of finished products” - finished products are written off at standard (accounting) value to the sales account;

Debit 90 Credit 40 “Standard cost of finished products” - the deviation that falls on sold products is written off (the actual cost is greater than the standard cost);

Debit 90 Credit 40 “Normative cost of finished products” – reversal. The variance that falls on products sold is written off (the actual cost is less than the standard cost).

This procedure is provided for in paragraphs 205 and 206 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, and the Instructions for the chart of accounts.

Finished product accounting scheme

The concept of GP is regulated by Accounting Regulation 5/01. According to the information in this document, the definition includes inventories that are intended for further sale for the purpose of making a profit.

Several methods are used for accounting. Management chooses one of these methods at its discretion. Depending on the decision, the reflection of ITC on the accounts of the enterprise will change. Read more about each in this section.

If finished products are shipped to customers at actual cost

This parameter reflects the totality of all resources that were spent on the production of goods. Including general economic ones. For example, for the maintenance of relevant equipment, the salary of management personnel, and so on. Such accounting of finished products is kept under account 20. It is called “Main production” and includes data on all expenses incurred by the organization during the manufacturing process. Experts recommend using this approach if there is a small volume of products in the warehouse.

This method has another option - calculation based on partial production costs. It differs from the actual one in that general business expenses, such as travel deductions, vacation pay, depreciation and others, are not taken into account. In this way, you can get a complete picture of the “net” costs of producing a unit of goods or batch. This allows for high-quality planning within a limited budget.

At discounted prices

This group includes several subspecies, each of which has its own advantages and disadvantages. Such solutions include:

Operating with the concept of planned cost. It is calculated by determining the difference between actual and accounting. This method shows its effectiveness if large production volumes occur. Accounting entries for finished products and their sales are carried out in account 40, which is called “Manufacture of goods” or 43 (“GP”).

Valuation at wholesale or negotiated prices. It is permissible to use this method only when selling prices are stable. Similar to the first one, since it is based on the difference between types of cost. It is very important to take into account the need to observe the ratio.

At retail price. Similar in nature to the previous two. Quite popular these days.

Accounting for finished products, if they are released, in accounting entries

This approach is also called synthetic. When using it, two accounts come to the rescue, which have already been discussed above.

40. He belongs to the active-passive group. Most often, it is used when it is necessary to collect general data on goods and services produced over a certain period of time. The debit contains the actual cost of products, and the credit contains the planned cost. The first parameter looks like this: Dt 40 Kt 20. If there is an overrun, then it is displayed as follows: Dt 90-2 Kt 40. Otherwise, the following entry takes place: Dt 90-2 Kt 40.

43. It is called "GP". It can be used to immediately account for manufactured goods. In this case, account 40 will not be used. Finished products at accounting prices are accounted for using the posting Dt 43 Kt 20.

Accounting at standard cost

The one below the actual one is used as this indicator. The difference between them is called deviation. It is recorded in one of the two accounts described above: 40 or 43. When using the second, two new sub-accounts must be opened. When writing off, the accounting department calculates the balances in the warehouse as of the end of the reporting year.

For better understanding, an example can be given. Let's imagine a company that produces car radios. At the beginning of February 2012, 10 units of equipment were in storage. The standard cost of each device is 5,000 rubles. As you can see, the VA of the entire product is 50,000 rubles. (5000 x 10). The amount of deviations will be 10,000.

In the second month, 100 devices were produced. Manufacturing costs amounted to 750,000. At the same time, 105 devices were sold. The accountant makes the following entries:

Dt43 sub-account “Finished products according to NS” - Kt20 - 500,000 rub. The difference with the actual one will be -250,000 rubles.

Next, you need to multiply the resources for the production of one radio tape recorder by the number of tape recorders made in February. The result is 5,000 x 105 = 525 thousand. This is how we calculated the cost of sales.

The balance sheet at the end of the reporting period will look like this: 750,000 - 500,000 = 250,000.

Manufacturing costs and selling price

This method can help determine how promising the release of a certain product is. Let's give an example.

Let's say there is a factory for the production of televisions. Every month its capacity is capable of producing 10 units of equipment. Expenses for this period will be:

- materials – 200,000 rubles;

- employee salary – 120,000;

- social contributions – 50,000;

- depreciation – 20,000 rubles;

- utility bills - 5,000.

The total cost of this batch is 395,000. The planned production cost of one device is 39.5 thousand.

Let's assume that the share of overhead costs is 20%. Then PPP is calculated using the formula: 39,500 + 200,000 x 20%: 10. Total – 43,500.

If the market price of this model is 60,000, then the planned profit will be: 60,000 - 43,500 x 100 = 16.5%. Thus, we can say that it makes sense to start the process.

When carrying out this operation, specialized software is often used. This is necessary in order to automate the process and achieve maximum clarity and efficiency. To configure and implement the software, you should contact professionals. For example, in . We develop ready-made solutions for businesses in various areas.

Unfinished production

Tax accounting for the release of finished products is carried out even if it is unfinished. This can be shown on the balance sheet using several methods:

- actual or planned cost;

- direct costs;

- prices for materials and raw materials.

Financial result for the month

This information is useful in the case when manufactured products are sold immediately, and no surplus occurs in the warehouse. Most often this happens when orders are made by appointment. In this case, the operation is carried out as follows:

1. GP falls on account 43;

2. Products sold from there are written off;

3. Current expenses are recorded in account 20.

On the last day of the reporting period, these data are compared with each other.

Conflict of norms

Often in the process of accounting for the release and production of finished products, an inconsistency arises that can mislead an inexperienced entrepreneur. It lies in the contradiction of two regulations: PBU 5/01 and PVBU. They are both orders of the Russian Ministry of Justice. It is not immediately clear which assessment method should be used. However, in the event of a discrepancy, the current legislation of the Russian Federation must give priority to the first document, which states that the FS is determined from the totality of actual costs.

THE CONCEPT OF FINISHED PRODUCTS

Finished products are part of inventories intended for sale (the final result of the production cycle, assets completed by processing (assembly), the technical and quality characteristics of which comply with the terms of the contract or the requirements of other documents, in cases established by law).

In other words, finished products are products and products that have passed all stages of the production process, accepted by the technical control department, and are ready for shipment to the customer. For accounting purposes, products are considered sold after shipment to the buyer or customer.

The production and sale of finished products characterize the activity of the enterprise as a whole and ensuring consumer demand. The fact of selling finished products is the end result of the entire cycle of the enterprise’s activities, which contributes to making a profit.

Accounting data (Financial Results Report, Purchase Book, etc.) are used as sources of information for accounting and analysis of finished products.

The main tasks of accounting and analysis of finished products:

- control over the correct and prompt documentation of finished products;

- control over the stock level of finished products in warehouses;

- prompt identification of surplus finished products in warehouses;

- control over the fulfillment of the terms of supply contracts and timely payment of goods (works, services) by customers;

- assessment of financial results from the sale of finished products;

- control over the execution of the production plan in accordance with customer requests and contracts.

Accounting and analysis of finished products are regulated at the legislative level:

- Federal Law No. 402-FZ dated December 6, 2011 (as amended on May 23, 2016) “On Accounting”;

- Regulations on accounting and financial reporting, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n (as amended on December 24, 2010, as amended on July 8, 2016; hereinafter referred to as Regulation No. 34n);

- Chart of accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n (as amended on November 8, 2010);

- Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008), approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n.