Authorized capital - postings in 1C 8.3: example and step-by-step instructions

Let's look at how to form authorized capital and transactions in 1C 8.3, using an example.

On April 10, a decision was made to create the Limited Liability Company "GRANTMEBEL". Shares in the authorized capital are distributed as follows:

- 10% - LLC "AZBUKA COMFORT";

- 90% - Lyubov Andreevna Trofimova.

On April 22, the registration of the Company was confirmed by an extract from the Unified State Register of Legal Entities.

On April 27, the receipt of contributions to the management company is reflected in the bank statement.

Authorized capital in 1C 8.3 - step-by-step instructions

Formation of authorized capital - postings in 1C 8.3

Postings in 1C 8.3 on the formation of the authorized capital after registration of the company are reflected for each participant as of the date of registration of the company.

Enter the first document that begins accounting for the new organization Formation of authorized capital in the Operations .

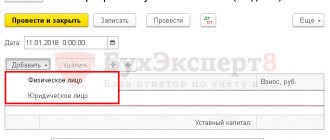

The list of founders is stored in two directories - Individuals and Counterparties. Click the Add to indicate who the founder is - an individual or a legal entity.

If an individual is listed only in the Counterparties , for example, as an Individual Entrepreneur , enter him in the Individual Entrepreneurs and, when selecting a founder, select him from this directory.

Print the list of LLC participants using the button List of founders . When paying for the authorized capital in cash, you do not need to edit anything before printing. If payment for a share in the authorized capital is made by property contribution, click on the Edit and manually correct the information in the Form of payment .

Authorized capital - postings in 1C 8.3

Familiarize yourself with the regulatory part of the formation of authorized capital - Topic 4.1. Registration of the LLC course Accounting and tax accounting in 1C: Accounting 8 ed. 3 from A to Z

Contribution of authorized capital 1C: Accounting 8.3

Configuration:

1c accounting

Configuration version:

3.0.54.20

Publication date:

18.12.2017

Views:

44998

When registering an LLC, the founders have the obligation to make a contribution to the authorized capital. This is the very first operation that is performed in the program, but it is precisely this that creates great difficulties for the 1C: Accounting user. The contribution may be made in money, securities, other things or property rights or other rights with a monetary value. Let's consider the contribution to the authorized capital by the founders using cash. And if you do not have enough funds to contribute the authorized capital, then you can choose a suitable loan at GidKredita.ru and calculate your monthly payment.

In the 1C: Accounting 8.3 program there are 2 options for how you can do this: 1) the document “Formation of authorized capital” 2) through “Operations entered manually”

Let's consider option 1. Document “Formation of authorized capital” Menu - Operations - Formation of authorized capital

Click the Create button. In the window that opens, fill in the Date, use the add button to create or select from the list the one who will contribute the authorized capital. (Organization or individual) Next is the Carry out button. Document Posted and transactions generated. To view them, press the Dt/Kt button.

To view a printed form of the document, click the List of Founders button. The printed form looks like:

This document created the founder’s debt, which he can repay either by depositing money into the cash register or into a current account. Let's consider the option of depositing authorized capital into a current account. Go to the section Bank and cash desk - Bank statements - Receipts

The document Receipt to the current account opens. We fill out the document. Type of operation: Other receipts. The Payer line indicates the LLC member who makes the contribution. Settlement account 75.01 (Settlements on deposits in the authorized (share) capital). Fill in the line: Purpose of payment. Conduct

The Dt/Kt button opens a window with generated transactions.

Post and close To check whether there is any debt on contributions to the authorized capital, we will use the Turnover Balance Sheet for account 75.01. section Reports - Account balance sheet

Set the period and score to 75.01. Click the Generate button.

The balance sheet shows that all transactions were reflected correctly and the investor has no debt in the authorized capital. So, we have considered reflecting the contribution to the authorized capital in 1C: Accounting through the document “Formation of the authorized capital.” Next, we will consider option 2: through “Operations entered manually.” section Operations - Operations entered manually

book Create - select Operation

We indicate the date in the document, click the Add button and register the transactions. By posting Dt 75.01 Kt 80.09 we form the debt of the founder for the contribution to the authorized capital. The decrease in this debt will be reflected under loan 75.01. Repayment of this debt with the help of funds, by depositing them into the current account will be in account 51. This is reflected in the second line. book Add and indicate postings Dt 51 Kt 75.01

Record and close.

As can be seen from the manual, the contribution of the authorized capital is a very simple operation that can be entered in any of the ways and does not require any special knowledge of the user.

Comments ()

You must be logged in to post a comment.

Payment of authorized capital - postings in 1C 8.3

Contribution to the authorized capital - postings in 1C 8.3

Contributions to the authorized capital can be made either in money or other property. The minimum authorized capital (RUB 10,000) is paid only in cash. Depending on the type of contribution, the required 1C document is selected. The diagram shows the main standard payment documents for management companies.

In our example, the contribution to the management company was made by non-cash payment to the account. Enter the document Receipt to the current account in the Bank Statements (section Bank and Cash ).

When selecting founders, select an LLC participant from the directory Individuals or Counterparties - depending on who he is: an individual or a legal entity.

If you fill out the Cash Flow Report in the Income Item , select the item with the Type of Flow - Receipts of cash deposits from owners (participants) .

Posting authorized capital - payment in money in 1C 8.3

The second statement is prepared in the same way.

Familiarize yourself with the regulatory regulation in accounting for payment of authorized capital - Topic 6.1: Receipt of payment for shares in the authorized capital of the course Accounting and Tax Accounting in 1C: Accounting 8th ed. 3 from A to Z

We have formed the authorized capital in 1C 8.3 - now we can move on to registering other business transactions.

Authorized capital in 1C 8.3. Instructions for working with wiring and formation

Content:

1. Formation of the authorized capital of the organization

2. Change of authorized capital

3. Payment of dividends to founders

In configuration 1C: Enterprise Accounting 3.0 (3.0.73.54), operations for accounting for authorized capital in 1C are partially automated; there is a document “Formation of authorized capital” and “Accrual of dividends”.

Formation of the authorized capital of the organization

In accounting, the formation of the authorized capital of an organization is reflected by the following entries:

Debit 75 Credit 80

In BP 3.0, the Founders subconto is a composite subconto. The value type of this subaccount can be selected both from the Counterparties directory and from the Individuals directory.

Menu: Operations – Subsection “Accounting” – “Formation of authorized capital”

The header of the document indicates the date and organization under which the business transaction is registered.

The tabular section contains a list of founders and the amount of contribution of each of them to the authorized capital. The founders are selected respectively from the “Counterparties” directory or the “Individuals” directory.

Let's look at the movements of this document:

Account 75.01 records the receivables of the founders for contributions to the organization.

Next, the founders’ contribution to the authorized capital in the form of cash or non-cash funds should be reflected directly.

Debit 50 Credit 75.01

In the case of a cash contribution, you must enter the document Cash Receipt with the transaction type “Other Receipt”.

We set the loan account to “75.01” and indicate the corresponding founder.

Non-cash contributions are processed in the same way:

Menu: Bank and cash desk - subsection "Bank" - Bank statements - button "Receipt"

. In the document we indicate the type of transaction “Other receipt”, the settlement account “75.01” and the corresponding founder.

Also, the contribution to the authorized capital made by the founders can be made by property: fixed assets, materials, goods, intangible assets.

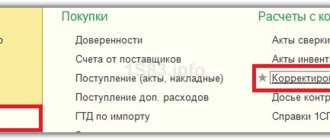

For these types of operations, you can use standard documents: Receipt of fixed assets, Receipt (acts, invoices)

, indicating the account for settlements with the supplier: 75.01.

In this case, you will have to manually adjust the posting to account 75.01, since the Founders subaccount is not filled in. Or reflect these operations using the document “Operations entered manually”

.

Change of authorized capital

If the founders make additional investments or new persons are accepted among the founders, it is important to record changes in the authorized capital. This is reflected in the accounting records as described above.

Debit 75.01 Credit 80

IMPORTANT! When filling out the document “Formation of authorized capital”

in this case, it is necessary to enter into the tabular section not only data about the new founder and the amount of his contribution (or the amount of investment of any founder), but also to reflect the existing founders and the corresponding amounts of contributions, as if “re-forming” the authorized capital.

Another option for increasing the authorized capital is to use part of retained earnings. The amount of increase in the size of the share of each founder is calculated based on the percentage of the authorized capital owned by this founder. In the accounting records for each of the founders, the entry is recorded: Dt 84 Kt 80. Or Dt 83 (additional capital) Kt 84, if the founders decide to write off additional capital to increase the authorized capital.

When the founder withdraws from the capital of the organization, he is entitled to return the share that he contributed.

Debit 80 Credit 75.01

And then pay this share in the form of cash (expenditure cash order) or non-cash payment (Write-off from the current account), or in another form.

If the net assets of an enterprise are less than the amount of the authorized capital, then by law the authorized capital must be reduced to the amount of net assets. The percentage of the share of each founder remains unchanged, the amount of reduction in the size of the share of each founder is calculated in proportion to the contribution to the authorized capital.

Debit 80 Credit 84

Payment of dividends to founders

The founders can decide to pay dividends to the founders if the organization has a net profit at the end of the year. In the 1C: Enterprise Accounting program, you can use the document “Accrual of dividends”.

Menu: Operations – subsection “Accounting”.

The document is drawn up for each founder. If the founder is an individual, then personal income tax should be withheld from him, if a legal entity - corporate income tax.

Working with document postings:

Debit 84.01 Credit 75.02

Debit 75.02 Credit 68.01

Specialist

Tatiana Fedorova.