Why is this necessary?

According to Russian legislation, all taxpayers are required to pay fiscal fees to the state budget on time and in full.

Otherwise, the company or individual entrepreneur will be punished with rubles: fines and penalties. And especially large tax crimes face criminal liability. To avoid problems, tax authorities strongly recommend systematically monitoring the current state of mutual settlements with the budget. Officials remind that even a minor error in a payment order can lead to disastrous consequences.

For example, the budget classification code in the payment slip is incorrectly indicated, and the funds will not reach their intended destination. Consequently, the tax will not be considered paid, and inspectors will apply penalties. Let us remind you that the punishment for late payment of obligations is not only fines. Representatives of the Federal Tax Service have the right:

- independently write off money from the taxpayer’s current account;

- freeze the company's current accounts;

- suspend the activities of an organization or entrepreneur;

- initiate legal proceedings.

Systematic control of mutual settlements will help avoid such consequences. Carrying out a check is quite simple: just submit an application for reconciliation with the tax office at the nearest territorial branch of the Federal Tax Service. But there are other ways.

Accounting balance

The account balance will be the indicator under consideration. The difference between debit and credit will be the balance of the following types:

- Debit balance . Formed in a situation where the debit is greater than the credit. Displayed in the balance sheet asset.

- Credit balance . Formed in a situation where credit exceeds debit. Records the status of the sources through which funds are received. Displayed on the passive.

The difference between debit and credit (that is, between income and expense) can be zero. In this case, the account will be closed. In some cases, accounting has accounts that have both debit and credit balances.

When considering accounting for the reporting period, the following can be noted:

- Opening balance . Another name for it is incoming. This is the account balance. Calculated at the beginning of the reporting time. The calculation is made based on those transactions that were performed by the enterprise before the time in question.

- Debit and credit turnover . For calculations, only those operations that were performed at the time in question are taken.

- Balance for the period . It represents the total result of the enterprise’s actions during the reporting period.

- Closing balance . The second name is outgoing. Represents the balance available in accounts at the end of the month or other reporting time.

The reflection of the balance depends on its type. Calculations must be made regularly. This is important for tracking dynamics.

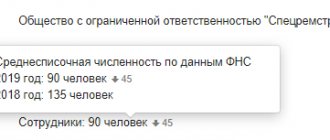

The rules for reconciliation with the Federal Tax Service have changed

The Federal Tax Service of Russia sent a letter dated 03/09/2021 No. AB-4-19/2990 to the territorial tax authorities, which updated the temporary procedure for joint reconciliation of calculations for taxes, fees, insurance premiums, penalties, and fines. The reconciliation procedure sent by letter dated April 16, 2020 No. AB-4-19/ [email protected] has become invalid.

According to the new rules, the largest taxpayers are no longer required to conduct quarterly reconciliations with the Federal Tax Service on their calculations. As before, the tax office must carry out a reconciliation at the taxpayer’s request. The new deadline is 5 days from the date of receipt of the application. It has been established that reconciliation of calculations is carried out by the tax authority without fail in the following cases:

- at the initiative of the taxpayer when submitting an application for a statement of reconciliation of calculations;

- in other cases established by legislation on taxes and fees.

The maximum period for reconciliation of calculations has not changed - it is 3 years.

Additionally, the letter contains the following forms:

- notifications of refusal to accept an application for reconciliation of settlements with the budget;

- notifications of refusal to reconcile settlements with the budget.

The rules were updated and the article became irrelevant. But we'll fix that soon.

If you need up-to-date instructions and documents right now, go to ConsultantPlus. Using our link, get free access for 2 days and find everything you need.

Act of reconciliation of settlements with the Federal Tax Service from 1C

Anyone who has ever checked with the Federal Tax Service knows that the Reconciliation Report is a multi-page and difficult to read document. But users of the 1C-Reporting service have the opportunity to receive a Statement of Reconciliation of Settlements with the Federal Tax Service in a compact and visual form.

To receive a TKS reconciliation report from the 1C: Accounting 8 program (rev. 3.0), you need to send a request to the tax authority through the 1C-Reporting service. In the Reconciliations section, click on the Request Reconciliation button and select the Calculation Reconciliation Act command (Fig. 1).

Rice. 1. Request for a statement of reconciliation of settlements with the Federal Tax Service

This opens the form Request for reconciliation: Statement of reconciliation of calculations, which is filled out as follows:

- in the From field, by default, the organization specified in the program as the main one is substituted;

- The default response format is set to an xml document. The functionality of the program allows you to process information received from the Federal Tax Service in xml format and generate a Settlements Reconciliation Report in a compact and visual form (Fig. 2). If you need to request a reconciliation report in a different format, you must follow the hyperlink to the format selection form and set the switch to another format (.pdf, .xls or .rtf);

- in the To field, indicate the tax authority from which the reconciliation is requested. The tax authority is selected from the directory of the same name. If an organization is registered with only one tax authority, then it is entered into the request form by default;

- In the Mutual settlements as of field, you should indicate the date as of which the reconciliation is being carried out, and in the For a year field, the reconciliation period. The date specified in the Mutual settlements as of field must be in the period of the year of reconciliation;

- By default, reconciliation is requested for all taxes. In the Reconciliation Report request, you can make a selective reconciliation for one or more taxes (KBK). To do this, follow the hyperlink Check by: All taxes and select the required taxes for reconciliation using the selection window.

Rice. 2. Visual form of the reconciliation report in “1C: Accounting 8”

To send a request for a Reconciliation Report, click the Send button. The request status will be set to Sent. You can track the status of your shipment from the Reconciliations list. When a response is received from the tax authority, the status of the sent request in the Status column will change to Ready (see Figure 1). Using the Open hyperlink, you can open the Statement of Reconciliation with the Federal Tax Service, which will be presented in a visual form and can be placed on one page (see Fig. 2).

At the same time, a visual Reconciliation Report with the Federal Tax Service allows you to obtain a detailed breakdown for each type of tax. To do this, double-click on the corresponding numbers.

If the request for reconciliation indicated KBK (taxes) for which the taxpayer has no movement, the response from the tax authority will come in the form of a Notification of Refusal.

| 1C:ITS For information on generating a statement of reconciliation of settlements with the Federal Tax Service from “1C: Accounting 8”, see the manual for using the “1C-Reporting” service in the “Reporting” section. |

How to reconcile with the tax office

There are three ways to request information from the Federal Tax Service for reconciliation:

- By contacting in person or through a trusted representative. To do this, you will have to visit the nearest territorial branch of the Federal Tax Service. But a verbal request is not enough. It is necessary to prepare a special application for a reconciliation report with the tax office (a sample is presented below) and submit it to the inspector.

IMPORTANT!

If the application is submitted by an authorized representative of the taxpayer, then a copy of the power of attorney on the basis of which the authorized representative is acting will have to be attached to the application form. The original power of attorney will also need to be provided to the Federal Tax Service inspector.

- Send a request through the taxpayer’s personal account in the unified service of the Tax Service. But this procedure is available only to registered users. To register for the online service, you will need to contact the Federal Tax Service. It is also possible to register on the inspection website using an account on the State Services portal.

- Send a request for a reconciliation report with the tax office (download a sample form below) electronically via secure communication channels. In this case, the response from the Federal Tax Service will come in electronic form via TKS.

Now we will determine which forms of request for reconciliation with the tax office (sample) need to be prepared.

Application in person

Officials did not approve a unified application form. Therefore, you have the right to contact the Federal Tax Service in any form. Please provide required details:

- Full name of the organization or full name. individual entrepreneur.

- INN, KPP, OGRN, addresses and contact numbers.

- List of taxes, contributions, fees that require reconciliation.

- The time period (year, quarter, month, any other period) for which the audit is carried out.

- Method of obtaining a reconciliation report with the tax office (sample below): by mail or in person.

- FULL NAME. and the position of the employee responsible for reconciling the calculations.

Please note that if the taxpayer prefers to receive the reconciliation report by mail, then it is necessary to indicate the address for sending. Otherwise, the Federal Tax Service will send a letter to the legal address of the company.

Example for reconciliation with the tax office, application (sample)

The application will be reviewed and a paper document will be sent to the applicant within 5 days. And in two copies.

When the inspection refuses to carry out a reconciliation

The inspection may refuse to conduct a reconciliation if:

- you applied to the Federal Tax Service at a different place of registration;

- you indicated the BCC for taxes that you do not pay;

- if the application for reconciliation does not contain the name of the organization (full name of the entrepreneur), its INN/KPP, or the signature of the manager (IP);

- if the application is submitted through a representative not authorized to do so by order or power of attorney.

Power of attorney to represent the interests of the company in relations with the Federal Tax Service

Read more…

If at least one of these grounds applies, the tax authorities will send you a letter of refusal to carry out a reconciliation within 5 days from the date of receipt of the application for reconciliation. And they will justify its reason.

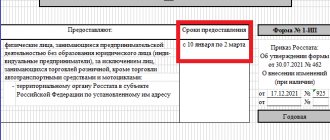

Electronic appeal

If the taxpayer decides to obtain information via the Internet, he will have to fill out a special form. The unified form was approved by Order of the Federal Tax Service of Russia No. ММВ-7-6/ [email protected] dated June 13, 2013, KND 116101.

Form

The request indicates similar information: the name and registration codes of the taxpayer, his address. This information is entered into the unified form automatically.

IMPORTANT!

An act received electronically cannot be returned to the Federal Tax Service with references to disagreements. If the company does not agree with the data specified in the control document, it will have to contact the inspectorate again.

We carry out reconciliation

So, we have determined how to obtain a tax reconciliation report. The document has a unified form KND 1160070. The form is approved by Order of the Federal Tax Service of Russia No. ММВ-7-17 / [email protected] dated 12/16/2016. The structure of the form is a title page and two sections.

The title page contains the taxpayer's registration information. The types of fiscal payments and the period for which the verification document was generated are also specified. Sections No. 1 and No. 2 are filled out separately for each type of tax, fee or contribution.

Check the information with accounting and tax records. After the reconciliation, the taxpayer is obliged to report the results to the Federal Tax Service. If there are no disagreements, then an o is made in the act, and one copy is returned to the inspection.

Tax reconciliation with the tax office, sample completed report

Launching a tax reconciliation program

After installation, you need to launch the program using the corresponding shortcut on the desktop or go to the “Start - All Programs” tab. Recently installed ones will be highlighted or placed at the beginning of the list (much depends on the version of the operating system; for example, in Windows 7, new components are highlighted in light brown).

Before checking with the Federal Tax Service, you need to configure the details. The procedure is as follows:

1. Add a taxpayer. In the window that appears, select the appropriate status and click “OK”.

2. Enter information about the organization in the window that opens: name (full and short), OGRN, address from the constituent documents. You will also need to provide information about the Federal Tax Service, chief accountant, manager, etc.

To save the filled information, click the “Apply” button. After completing the remaining fields - “OK”.

If there is disagreement

If there are disagreements, then you need to act like this:

- In column 4 of the first section, against the information with which you do not agree, indicate the amounts according to the accounting records of the enterprise (entrepreneur).

- On the last page of the first section, put o.

- Submit this copy to the Federal Inspectorate.

Based on the act of disagreement, inspectors initiate a check of the specified data using information systems. Then the payer will be asked to provide the Federal Tax Service with documents confirming your accounting data. For example, copies of payment orders for payment of contributions.

If a mistake was made by the inspector, it will be corrected. The Federal Tax Service will send a special notification. If disagreements arose due to your error, for example, an incorrect KBK in the payment slip or an incorrect calculation in the declaration, then the inspector will send a letter indicating the mistake made by the taxpayer.

The company is obliged to correct its own mistakes. For example, submit an adjustment declaration, pay an additional fee, or write an application to offset the overpayment amounts. After the disagreements are resolved, the inspector and the taxpayer sign the act (“Agreed, no disagreements”).