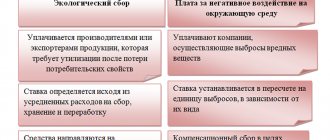

Environmental tax: who should pay, when and how much? The Ministry of Finance published draft amendments to the Tax Code of the Russian Federation,

Typical mistakes If we talk about typical mistakes when abbreviating, these include:

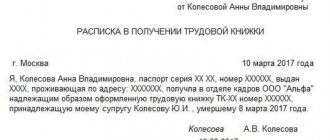

From the moment of registration of an LLC, a sole executive body, the director, acts on its behalf. Formally

Property transferred free of charge is considered to be property that the recipient is not obliged to pay for or return (clause

Not only an individual entrepreneur or a legal entity, but also an ordinary citizen can become a supplier of a trading company

Classification of sick leave codes and their decoding In the structure of the sick leave (certificate of incapacity for work, approved

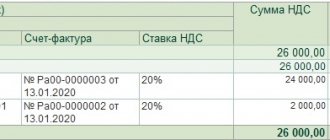

Regulatory framework Order of the Federal Tax Service of the Russian Federation dated September 23, 2019 N ММВ-7-3/ [email protected] “On approval of the tax return form

From the beginning of 2022 for all persons working under employment contracts to the Pension Fund

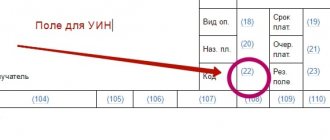

In what cases should the UIN be indicated? The UIN in 2022 must be indicated only in payment documents.

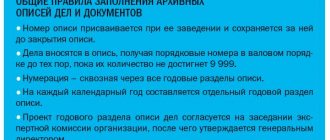

Why keep accounting documents Any accountant knows that every document executed in a company or