From the moment of registration of an LLC, a sole executive body, the director, acts on its behalf. Formally, this is the most important figure who bears administrative and criminal responsibility for the actions of the company. This situation provokes some founders to hire a person to whom all the property risks of the business can be transferred. Who is a nominee director, and is it worth transferring management of the organization to him? Find out about it in our publication.

Free consultation on business registration

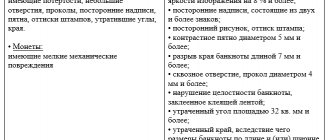

Signs of a nominee director of an LLC

A nominee, also known as a fictitious or fictitious director, is a person who knows in advance that he will not be able to manage the company. Actually, this is not hidden in sentences like “Working as a nominee director.” The nominee is only required to have a decent appearance and, occasionally, to be present at meetings with partners or in government agencies.

Those who place such proposals assure that the nominal leader does not face liability under the law. At the first problems with government agencies, you just need to “surrender” the person who actually ran the organization.

This opportunity is indeed provided by Article 61.11 of the Insolvency Law, but in practice it is not so easy to use. The true owners of the LLC will do everything possible to ensure that at least part of the subsidiary liability is assigned to the nominee. Therefore, it is no coincidence that the search query “nominee director responsibility” is so popular.

The Federal Tax Service has long and persistently fought against fictitious directors, entering them into registers:

- disqualified persons;

- mass leaders;

- directors of companies excluded from the Unified State Register of Legal Entities with debts to the budget.

If, when checking application P11001, it turns out that the future manager is in one of the registers, the LLC registration will be denied.

The Federal Tax Service also includes the lack of a permanent place of work and professional education, low income, and age no older than 25–30 years as suspicious signs pointing to a nominal leader.

As an additional control measure, the Federal Tax Service may invite the person nominated by the director for a conversation. The goal is to find out the true motives of the person whose information will be entered in the Unified State Register of Legal Entities.

Questions asked may include:

- Do you have an idea of what the created organization will do?

- whether you have sufficient leadership experience and relevant education;

- what is your relationship with the founders;

- do you confirm that you will personally manage the financial and economic activities of the LLC;

- Do you suspect that you may be used as a nominee director;

- Do you realize that you bear subsidiary liability for the debts of the legal entity being created?

Some inspections also require that the future manager be registered in the same locality where the LLC is registered. Otherwise, according to tax officials, he will not have a real opportunity to manage the organization. However, such a requirement contradicts the law “On registration of individual entrepreneurs and legal entities” and cannot be a reason for refusing to create a company.

But in addition to the features of the nominal value that can be identified at the stage of registering a limited liability company, there are those that appear already when doing business:

- the manager does not appear in person at the tax office or comes with a lawyer;

- during a conversation with the inspector, it turns out that the director is not aware of the economic activities of his LLC;

- the manager cannot explain the tax and accounting data;

- repeated absence of a manager at his place of registration or legal address, inability to contact him by telephone.

In what cases might a nominee (fictitious) director be needed?

Typically, hiring a person to serve as a nominee director can be done:

- to ensure anonymity of transactions;

- to hide the participation of the main manager in the management of the company from third parties;

- to manage a company whose official owner resides in another state;

- to replenish the company’s charter with a certain number of people;

- in order to prevent the results of legal restrictions in cases of transactions between close associates.

When ordering a classic offshore company LLC with a nominee director, you should take into account that if there is a fictitious manager in the company, you will not be able to open bank accounts in certain countries, and, in addition, it is necessary to ensure the protection of your rights in the event that the nominee director decides to take advantage of the position and encroach on ownership of the company.

Why does a company need a nominee director?

It’s worth saying right away that it doesn’t make much sense for the founders to resort to such a management option as a nominee director. The real owner of the business, as the person controlling the debtor, will also be jointly and severally liable for the insolvency of the company.

But besides the desire to avoid possible responsibility, work as a nominee director can be offered by the founders in the following situations:

- the actual owner or manager of the business cannot or does not want to officially manage the organization (for example, he has the status of a civil servant or a disqualified person);

- several different enterprises are headed by the same person, which is a sign of the interdependence of these taxpayers and increases tax risks;

- the actual manager already manages another organization, and at the same time cannot or does not want to obtain the consent of its owners for parallel work for hire in the new LLC;

- it is necessary to split the business into several small firms in order to maintain tax benefits;

- to simulate competition when participating in tenders and government procurement, a director is needed.

Officially, there is no such thing as working as a nominee director, so the law does not establish responsibility for this. However, this situation carries risks for both parties.

What are the risks for a business beneficiary when working with a nominee manager?

Criminal liability is provided for in paragraphs 1 and 2 of Article 173.1 of the Criminal Code of the Russian Federation

“Illegal formation (creation, reorganization) of a legal entity”: for registering a company with a dummy manager or appointing him as a director, you can receive various punishments, starting with a fine from 100 thousand rubles to 300 thousand rubles and ending with imprisonment for up to 3 years.

Paragraph 2 of this article is much more serious, because it assumes that the same crime was committed by a group of people. That is, not one person created a company through a dummy director, but two or more. For this, the court can fine you in the amount of 300 thousand rubles to 500 thousand rubles or send you to a colony for a maximum of 5 years.

Legal protection of business managers and owners

We have our own methodology for comprehensive protection of top managers, founders and beneficiaries of a business. They minimize the risk of tax, criminal and subsidiary liability.

Find out more

This article is also distinguished by the fact that it is considered a crime of medium gravity (because the maximum imprisonment is up to 5 years), and other articles for fraud with nominal directors are crimes of minor gravity.

Vicarious liability of a shadow business owner with a nominee director

. As you have already read above, real business owners are more “interesting” to tax and law enforcement agencies than a nominal director. If it is proven that the nominee followed the instructions of the beneficiary, then the beneficiary will pay off the company’s debts at his own expense (if there are grounds for subsidiary liability, of course).

There are also other risks of working with a nominee, for example, when a “nominee” director can come to the bank and transfer money from the account, or sell a stake in the company to third parties, etc. We advise our clients on all such risks and provide effective ways to control such a situation.

Risks when appointing a nominee director

Of course, if the founders agree to transfer management of the company to a nominee, they are trying to protect themselves. The organization where they really plan to do business will invite not a person from the street, but a relative, friend, other trusted or dependent person.

The problem is that friendly and family ties may not stand the test if the nominee director faces property or criminal liability. In addition, the likelihood of personal disagreements between the founders and such a “friendly” figure should not be underestimated.

In most cases, the real owners of the company who receive profits from it (the so-called beneficiaries) do not give all the control levers to the nominee. To protect against possible uncoordinated actions of a fictitious manager, the following measures are applied:

- restrictions on access to the current account, cash register, seal, LLC documents;

- execution of a general power of attorney for management of another person;

- the need for written approval of business transactions with the beneficiary;

- restrictions in the charter allowing certain transactions to be carried out only with their approval by the company’s participants;

- appointment to important positions of people who can control the actions of the leader;

- a resignation letter or agreement to terminate the employment contract signed in advance by the nominal manager without a date;

- other methods of influence, including criminal ones.

Despite this, the risks of appointing a nominee to a management position for the LLC itself still exist.

- A nominee director is not limited in his powers as a sole executive body given to him by law. Even if a general power of attorney has been issued to another person, he has the right to sign documents and enter into transactions unless restrictions are expressly established on them in the charter. Theoretically, he can act as he pleases in his own personal interests or in the interests of third parties who are not the owners of the business.

- In order to avoid possible liability, some denominations deliberately distort their signature (after having first certified the real signature by a notary). In this case, the LLC documents may be invalidated due to the fact that they were signed by an “unidentified person.” This threatens not only a breakdown in relations with partners, but also problems with government agencies. For example, if the Federal Tax Service considers that the declaration was not signed by the manager, it will be considered unsubmitted. And for this you can block the LLC’s current account.

- A nominee director can gather dirt on business owners by secretly recording conversations with them or bringing in witnesses to prove that he was acting at the direction of another person. Later this information can be used against the founders.

- A fictitious manager can declare to the Federal Tax Service that he was included in the Unified State Register of Legal Entities without consent or knowledge. For this, form P34001 is used. Because of this, an entry will be made in the register about false information about the organization, which will significantly complicate its activities, up to and including exclusion from the Unified State Register of Legal Entities.

- In the event of bankruptcy of an LLC, the nominee director may be partially or completely relieved of liability. To do this, he must help the arbitration court identify the person who actually controlled the business, or discover hidden property that can be used to satisfy the claims of creditors. Of course, for the founders the consequences of such cooperation between the director and the court will only be negative.

Responsibility to the founders

If the director is a nominee and carries out the instructions of the beneficiaries, this will not exempt him from the claims of the founders in the event of causing losses to the corporation.

Even the execution of the decision of the general meeting does not relieve the manager from liability for losses incurred by the company (clause 16 of the Review of Judicial Practice, approved by the Supreme Court of the Russian Federation on December 25, 2019).

Read more in the article “Collection of damages from the director of a company as a corporate dispute.”

Responsibility of the nominee director

Working as a nominee director is not a dream job at all. Possible consequences include not only serious administrative liability, but also criminal prosecution. Let's talk about this in more detail.

Nominee director - civil liability

If, under the leadership of a nominee director, the LLC caused damage to the budget or other creditors, then it will have to be compensated in full. As a rule, such subsidiary liability arises when a company is brought to bankruptcy.

The manager will be found guilty if he:

- did not comply with the principles of good faith and reasonableness when performing official duties, which is why the company lost property with which it was possible to satisfy the claims of creditors;

- made obviously unprofitable transactions;

- did not file an application for bankruptcy of the LLC on time if there were signs of bankruptcy;

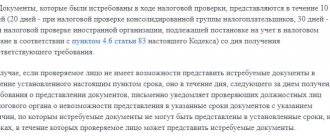

- during the bankruptcy procedure, did not transfer the documentation of the debtor organization to the manager or provided false information, which makes it impossible to identify the controlling persons.

Let us remind you that the nominee is not allowed to actually manage the company, so he really may not be aware of the frauds that are carried out on his behalf. But in order to be freed from subsidiary liability, he must be able to prove that he is not guilty of such actions, and this is not at all easy to do.

In addition, the company participants who hired him for this post can demand compensation from the manager for damages (Article 44 of the Law “On LLC” and 277 of the Labor Code of the Russian Federation). And this is not only real damage, but also lost profits.

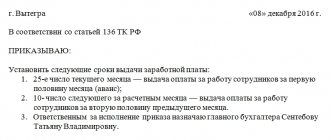

Nominee director - administrative responsibility

We must not forget that the manager is responsible for all actions of the organization in civil, tax, labor and other legal relations. Numerous fines for possible violations are imposed not only on the LLC itself, but also on the director.

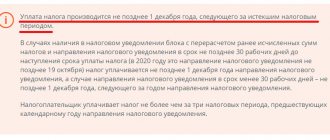

There is also special administrative liability for deliberate bankruptcy under Article 14.12 of the Code of Administrative Offenses of the Russian Federation - a fine of up to 10,000 rubles or disqualification for a period of six months to three years.

Nominee director - criminal liability

The main criminal liability for a denomination is provided for in Articles 173.1 and 173.2 of the Criminal Code of the Russian Federation. In particular, they are talking about providing the body that carries out state registration of legal entities and individual entrepreneurs with information about figureheads.

And a fictitious manager who had no real intention of managing a limited liability company is such a person. In this case, the nominee director faces a fine of up to 500 thousand rubles, correctional labor or imprisonment for up to five years. And although the majority of sentences under such articles do not lead to actual imprisonment, the person will have a criminal record.

Criminal liability for a nominee director may also arise during the period of operation of the organization. Having no real opportunity to manage, he nevertheless must comply with the requirements established by law.

And if, for example, an organization headed by a fictitious manager does not pay wages to employees, he will bear responsibility under Article 145.1 of the Criminal Code of the Russian Federation. Here are a few more articles of the Criminal Code under which nominal managers can be prosecuted:

- violation of labor safety rules, resulting through negligence in causing death or serious harm to human health (Article 143);

- evasion of taxes and fees from an organization (Article 199);

- malicious evasion of repayment of accounts payable (Article 177);

- evasion of customs duties levied on the organization (Article 194 of the Criminal Code).

Free consultation on opening an LLC

If you still have questions about creating an LLC, leave a request for a free consultation on business registration. During business hours, specialists from your region will call you back and answer your questions in detail, taking into account regional specifics.

Pound dashing

However, the Zits-chairman of the “12 Chairs” endured hardships at least for money, but here... But first things first. In April 2022, the bank and a certain LLC entered into a loan agreement for 130 million rubles. The documents stated that the general director of the company, Vasily Shapkin (ed. - last name has been changed), spoke on behalf of the borrower. He was also the guarantor for the loan (the loan was also secured by the pledge of goods in the company’s turnover). In June 2022, the company entered into another loan agreement on the same terms, but this time for 70 million rubles. In October, the bank demanded that the company repay the loan ahead of schedule, pay interest and penalties. But the company did not repay the debt.

note

Persons who are not aware that a legal entity has been created based on their documents are not subject to criminal liability. That is, law enforcement officers need to prove the intent to create a company as a dummy

Then the bank filed a lawsuit. Mr. Shapkin, who was a co-defendant, in the first instance referred to the fact that he had never been a director of any LLC and had not signed either a loan agreement or a guarantee agreement. Moreover, being a group II disabled person, during the period of concluding the contracts he could not even move independently.

How can you determine that a company has a nominee director?

When conducting regular raids to check company addresses, tax inspectors may discover suspicious facts. Companies are required by law to report their office address to the tax office. In case of violation, the director will also be checked, and determining his fictitious status is not difficult.

Law enforcement agencies also do not need to use complex schemes to identify violators. To do this, it is enough to enter the Unified State Register of Legal Entities and discover indirect evidence of a violation. These include:

- Specifying the mass registration address. This is most typical for shell companies, which means that the likelihood of a nominal leader in such a company will be high.

- An individual is registered simultaneously in several companies. This will indicate a violation, especially if the companies are located in different localities, and the companies have completely different types of activities.

- Inability to locate the nominee. This may be revealed when visiting representatives of the authorities of the registration address.

Is it possible to avoid responsibility?

Often the denominations know what they are getting into, but in some cases a person can be registered using lost or stolen documents.

To protect yourself, you must immediately file a police report after losing or stealing your passport or other documents.

This measure will help you secure yourself and, if necessary, prove your non-involvement in the illegal actions of a legal entity.

If you have become a victim of scammers who secretly found out your passport details or forced you to participate in this by blackmail, you must submit a letter of resignation in writing addressed to the founder as quickly as possible, and also contact the police.

For persons who knowingly become nominals, there are also ways to avoid criminal liability, for example, to fully compensate for the damage caused and repent of the crime committed.

In addition, liability may not arise due to the expiration of the statute of limitations for the crime, the illness or age of the offender, or other circumstances that the court considers valid.

Why does an LLC hire a nominee manager?

So, we have found out who a nominee director is, now let’s figure out why the founders appoint him. First of all, this is the removal of responsibility for the activities of the LLC.

After all, Article 53.1 of the Civil Code of the Russian Federation indicates that the manager is liable if he acted in bad faith or unreasonably, including if his actions (inaction) did not correspond to the usual conditions of civil turnover or normal business risk.

And the nominal leader, by definition, will act both dishonestly and unreasonably, because he does not have the necessary knowledge and experience for this. Therefore, it is easy to use him in various kinds of schemes, for participation in which he will be personally responsible.

But the role of the nominal is not always sharply negative. The company may actually need such a director in the following cases:

- when splitting up a business;

- to divide family assets;

- to eliminate the sign of interdependence of several enterprises that were previously managed by one person;

- to participate in tenders when it is necessary to simulate competition;

- in order not to obtain consent from the owners of another company, which the director is already managing.

In such situations, the founders do not intend to “frame up” the nominal leader; on the contrary, they will do everything possible to hide this fact. Then such a necessary person will often appear in the office, more or less understand the direction of the business, and know that it is necessary to answer questions from the Federal Tax Service and government agencies.

However, the powers of the nominee will still not correspond to the powers of the real director, because he is simply not allowed to be in real leadership.

Free accounting services from 1C

Concept and terms.

First, let's define the basic concepts.

The concept of “nominee manager” in the context of the characteristics given in one norm of the law can be formulated as follows:

“nominee manager” is a person who, when performing the functions of the relevant management body (general director, director, president, chairman, etc.), does not actually have a decisive influence on the activities of the legal entity (based on clause 9 of article 61.11 of the Federal Law dated October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)”.

Those. the main feature is “for appearance” and does not have an actual impact on the activities of the legal entity.

Another concept that is directly provided for by law and is important for assessing the behavior of figureheads from the point of view of the Criminal Code is “dummy”.

Under dummies we mean persons who are founders (participants) of a legal entity or management bodies of a legal entity and, by misleading or without their knowledge, data about them was entered into the unified state register of legal entities, as well as persons who are management bodies of a legal entity, which do not have the goal of managing a legal entity (note to Article 173.1 of the Criminal Code of the Russian Federation). The meanings of the concepts do not coincide; the second has more features than the first. Each of the concepts is formulated and intended for use for the purposes of the laws containing them: the first when bringing to vicarious liability, the second to criminal liability.

The relationship of concepts, if we talk about nominal leaders, in my opinion, can be expressed as follows:

every “figurehead” who is a manager is a “figurehead”, but not every “figurehead” is a “figurehead”. I base this opinion on the characteristic of a figurehead “ there is no goal of managing a legal entity”, I believe that “realization of the goal of management » in practice, i.e. “actual management” can sometimes occur “without actually exerting a decisive influence on the activities of the legal entity.”

For example, in a limited liability company that has one participant who delves deeply into the activities of the company and constantly gives “valuable” instructions to the director.

For practical application, judging by the text of one resolution of the Plenum of the Supreme Court of the Russian Federation, the concept of “nominal leader” was simplified a little, instead of the cumbersome “did not actually have a decisive influence on the activities of a legal entity,” they limited themselves to a brief one:

“a manager who is formally part of the bodies of a legal entity, but does not exercise actual management (hereinafter referred to as the nominal manager)” (clause 6 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 21, 2017 No. 53 “On some issues related to the involvement of persons controlling the debtor to liability in bankruptcy").

The tax authorities also proceed from this formulation; it is convenient for them because it easily allows them to draw a conclusion about the status of the manager based on the nature of the legal entity’s activities (and attach the appropriate label!).

If a legal entity “suddenly” does not conduct income-generating activities, submits “zero reports,” and, moreover, does not pay taxes, then its manager can also easily be considered a “nominee.” Without bothering to find out or prove that “he dances to someone else’s tune”, carries out someone else’s will, but simply based on such initial data they can conclude that “he is formally a member of the governing bodies” and “does not exercise actual control.”

Along with the term “nominee director”, even more often, the term “nominee director” is used in judicial practice with a similar meaning. In less official usage, other terms are used, for example, “nominal”, its derivative “gnome”, also “drop”, “cosmonaut”, “deer”.

The well-known term “sic chairman,” in my opinion, is used little, more to explain the meaning to those who do not understand other terms than designations when communicating. Or because “sit” (and this is the meaning given by the prefix “sitz” in German) is no longer the main task, other reasons for use prevail or against the backdrop of a general simplification of speech, plus “there are terms that are shorter and more modern.” For example, those nominal leaders who are “ready to go to the end in all types of responsibility” are now sometimes called “tankers.”