By virtue of the provisions of Art. 19 of the Law on Accounting[1], autonomous institutions are obliged to independently organize and carry out internal control of the facts of economic life. In addition, we would like to remind you that before drawing up annual reporting forms, an inventory of funds, monetary documents and strict reporting document forms is carried out. During the inventory, the completeness, reliability and accuracy of the reflection in accounting and reporting of cash transactions for the period under review must be checked, as well as compliance with legislative and regulatory documents governing cash discipline. In this article we will consider the main issues that should be paid attention not only when conducting a cash inventory, but also when carrying out internal control operations in an institution in terms of checking compliance with cash discipline in the institution.

When checking cash discipline, an institution needs to focus on analyzing the following issues:

- presence of facts of shortages, embezzlement and theft of funds;

- compliance with legal requirements when receiving funds to the institution’s cash desk;

- completeness and timeliness of cash receipts at the cash register, including those received from the bank;

- presence of cases of storage of funds in the cash register in excess of the established cash limit;

- exceeding the maximum amount of cash payments between legal entities;

- the reliability of the documents that are the basis for writing off expenses at the cash desk, the legality of the expenses incurred;

- evidence of cash being used for purposes other than its intended purpose.

It is advisable to check cash discipline using a continuous method for the selected period. Moreover, in our opinion, such a period should be a calendar year. For verification, you need to study the following documents:

- cash book (f. 0504514);

- journal of transactions on the "Cash" account (f. 0504071);

- journal of settlement transactions with accountable persons (f. 0504071);

- cash receipt orders (f. 0310001);

- expense cash orders (f. 0310002);

- journal for registering incoming and outgoing cash documents (f. 0310003);

- statement for the issuance of funds from the cash register for reporting (f. 0504501);

- general ledger (f. 0504072);

- inventory records of cash;

- agreements on full financial responsibility with cashiers;

- payroll statements;

- advance reports (f. 0504505) together with the documents attached to them.

- Next, we will consider in more detail the stages of checking this issue.

Identification of facts of shortages, embezzlement and theft of funds

Any check of cash discipline should begin with an inventory of the cash register, which is carried out in order to identify shortages, waste and theft of funds.

We think that some accountants still remember those times when, when coming to an organization for an inspection, the first thing auditors did was seal the cash register premises. Let us remind you that an inventory of funds stored in the institution’s cash desk must be carried out with the mandatory participation of the chief (senior) accountant and cashier. The cashier presents for verification the latest cash report and documents on transactions of the last day, and also gives a receipt that all incoming and outgoing documents are included in the report and by the time of the inventory in the cash register there are no cash and strict forms that have not been received or written off as expenses. reporting. Note that the procedure for conducting an inventory must be established in the accounting policy of the institution.

If shortages or surpluses are identified during the inventory, measures are taken to establish the reasons for their occurrence.

At the same time, it is necessary to pay attention to the conditions for storing funds:

- Is the safety of funds ensured?

- does the cashier have sample signatures of persons authorized to sign cash documents, as well as a seal (stamp) containing details confirming the cash transaction. Let us remind you that according to clause 4.4 of the Procedure for conducting cash transactions [2], the cashier must be equipped with a seal (stamp) containing details confirming the conduct of a cash transaction, as well as sample signatures of persons authorized to sign cash documents. At the same time, in the case of conducting cash transactions and drawing up cash documents by the manager, sample signatures of persons authorized to sign cash documents are not drawn up;

- whether the established cash storage limit is observed on individual dates.

FAQ

The payment method was confused: instead of “cash” they indicated “non-cash”. What to do?

In FFD 1.05, correct the error with a refund check, in FDF 1.1 and 1.2 - with a correction check. Since the most popular format is still 1.05, we’ll use it as an example. To correct the error, issue a check with the attribute “Return of receipt” with the payment type “Cash”, and then generate a correct check with the attribute “Receipt” and the payment method “Non-cash”. After this, notify the Federal Tax Service about the correction.

The cashier does not allow you to enter additional check details. What should I do?

The additional check detail (1192) has the lowest requirement, that is, it may not be on the check. If it is impossible to indicate the details for technical reasons, this will not be considered a violation (Appendix No. 2 to the order of the Federal Tax Service of Russia dated March 21, 2017 No. ММВ-7-20 / [email protected] List the fiscal characteristics of checks: an erroneous check and a check that cancels it in the accompanying documents.

When returning, instead of the “Return of receipt” attribute, the cashier indicated “Return of expense”. What to do?

- Generate a check for “Expense” with the same data as the erroneous check, and indicate the FPD of the first check. And then create the correct check.

Compliance with the established cash balance limit

Autonomous institutions, like any other organizations, have the right to keep cash in the cash register only within the limits of the cash balance limit established by the administrative document of the institution.

Accumulation of cash in the cash register in excess of the stipulated cash balance limit is allowed on days of payment of wages, scholarships, payments included in accordance with the methodology adopted for filling out federal state statistical observation forms in the wage fund, and social payments, including the day receiving cash from a bank account to make the specified payments, as well as on weekends and non-working holidays if a legal entity conducts cash transactions on these days. In other cases, accumulation of cash in the cash register in excess of the established cash balance limit is not allowed. Let us remind you that the cash balance limit must be calculated by the institution independently. At the same time, the Procedure for conducting cash transactions contains two options for such calculation: based on the volume of cash receipts for goods sold, work performed, services rendered, or based on the volume of their issuance, from which amounts intended for the payment of wages, scholarships and other payments are excluded employees.

If an institution has separate divisions, the cash balance limit is determined taking into account the cash balance limits established for these divisions. A copy of the administrative document establishing a cash balance limit for a separate division is sent to this division in the manner determined by the institution. It is quite easy to check the indicated issue: just pay attention to the balances at the end and beginning of the day in the cash book.

The procedure for conducting cash transactions establishes a deadline for issuing cash for wages, scholarships and other payments - five working days (including the day of receipt of cash for these payments from a bank account). Thus, in excess of the limit established by the institution, you can keep cash only in the amount intended for wages, social security benefits and scholarships, and no more than five working days.

Despite the fact that the institution sets the cash balance limit on its own, failure to comply with the limit continues to be recognized as an administrative offense. Let us remind you that exceeding the established limit of the cash balance at the cash desk of an institution is one of the grossest violations of cash discipline, which, in accordance with Art. 15.1 of the Code of Administrative Offenses of the Russian Federation entails the imposition of an administrative fine:

- for officials - in the amount of 4,000 to 5,000 rubles;

- for legal entities – from 40,000 to 50,000 rubles.

In what case will you not be fined for a mistake?

If the user of the online cash register corrects the violation himself, he may be released from liability (note to Article 14.5 of the Code of Administrative Offenses of the Russian Federation).

The fine can be avoided if two conditions are met:

- The violation was corrected before the Federal Tax Service itself found out about it.

- The Federal Tax Service provided information and documents sufficient to establish the offense.

How to generate a correction check is described in the Methodological Recommendations of the Federal Tax Service of Russia dated 08/06/2018 No. ED-4-20/ [email protected]

Checking the correctness of documents at the cash desk

During the audit, you should pay attention to the following:

1. Filling out all lines and details of cash settlements, cash registers and other documents used in cash transactions, the absence of corrections in them. Thus, according to clause 167 of Instruction No. 157n [3], the cash desk accepts cash from individuals using strict reporting forms approved in the manner prescribed by the legislation of the Russian Federation. In the case of cash acceptance by authorized persons, the latter daily hand over to the institution’s cash desk the funds registered in the document delivery register, accompanied by receipts (copies thereof).

Cash documents must indicate the basis for their execution and list the attached supporting documents (settlement and pay slips, pay slips, statements, invoices, etc.).

Acceptance for accounting of documents documenting transactions with cash or non-cash funds containing corrections is not permitted. Other primary (consolidated) accounting documents containing corrections are accepted for accounting in the case when the corrections are made in agreement with the persons who compiled and (or) signed these documents, which must be confirmed by the signatures of the same persons, indicating the inscription “Corrected believe.” ” (“Corrected”) and the date the correction was made. Making corrections to documents executed electronically after they have been signed is not permitted.

It is also necessary to ensure that all PKOs and RKOs are reflected in the cash book. To do this, you need to compare the entries in the cash book with the data in the cash documents.

2. Availability of required signatures. Let us remind you that cash documents must be signed by the chief accountant or accountant (in their absence, by the manager), as well as by the cashier. In the case of conducting cash transactions and drawing up cash documents by the manager, cash documents are signed by the manager ( clause 4.3 of the Procedure for conducting cash transactions ). However, here it should be taken into account that, by virtue of clause 8 of Instruction No. 157n , documents used to document the facts of economic life with funds are accepted for accounting if the document has the signatures of the head of the institution and the chief accountant or their authorized persons. Thus, in this case, the Procedure for conducting cash transactions contradicts Instruction No. 157n. In order to prevent negative consequences that may arise during the inspection, in our opinion, it is advisable for the institution to be guided by the requirements of the said instructions.

Cash received and issued from the cash register must be recorded in the cash book (f. 0310004). Entries in it must be made for each PKO and RKO.

According to clause 6 of the Procedure for Conducting Cash Operations, the cashier issues cash after identifying the recipient of the cash using a passport or other identification document presented by him in accordance with the requirements of the legislation of the Russian Federation, or using a power of attorney and an identity document presented by the recipient of the cash. Cash issuance is carried out directly to the cash recipient indicated in the cash settlement system (settlement and payment or payroll) or in the power of attorney.

To issue cash to an employee on account of expenses, cash settlement is drawn up in accordance with a written application from the accountable person, drawn up in any form and containing a record of the amount of cash and the period for which the cash is issued, the signature of the manager and the date. In addition, the application must be accompanied by a calculation (justification) of the amount of the advance ( clause 213 of Instruction No. 157n ). The form of this calculation has not been approved; therefore, it can be drawn up in any form.

3. Correspondence between the amount of cash entered in numbers and the amount of cash entered in words.

4. Availability of powers of attorney. Let us remind you that when issuing money by power of attorney, the compliance of the surname, name, patronymic (if any) of the recipient of the cash, registered in the cash register, with the surname, name, patronymic (if any) of the principal indicated in the power of attorney, the correspondence of those entered in the power of attorney and the cash receipt order is checked last name, first name, patronymic (if any) of the authorized person, details of the identity document, data of the identity document presented by the authorized person. In the payroll statement (payroll), before the signature of the person entrusted with receiving cash, the cashier makes an entry: “By power of attorney.” The power of attorney is attached to the cash order (settlement and payment or pay slip).

In the case of issuing cash under a power of attorney issued for several payments or for receiving cash from different legal entities, copies of it are made and certified in the manner established by the legal institution. The original power of attorney (if any) is kept by the cashier and is attached to the cash receipt at the last cash disbursement.

What to do if the correction cannot be signed by the author of the document

Situations can be different, and the employee who compiled the primary document could quit, get sick, or be on vacation or a business trip at the right time. Regulatory documents do not provide for a procedure in this case, so companies can develop the method and procedure by which correction is carried out independently. Persons who have the right to sign primary documents are approved by the head of the company and coordinate this issue with the chief accountant. This list may also include persons who are authorized to sign these documents. For example, corrections can be signed by a person authorized to sign primary documents (

Identification of facts of non-compliance with restrictions on settlements with legal entities

By virtue of clause 6 of Directive No. 3073-U [4], cash payments in the currency of the Russian Federation and foreign currency between participants in cash payments within the framework of one agreement concluded between these persons can be made in an amount not exceeding 100,000 rubles.

or an amount in foreign currency equivalent to RUB 100,000. at the official exchange rate of the Central Bank of the Russian Federation on the date of cash payments. Please note that previously there were no restrictions on cash payments in foreign currency. Cash payments are made in an amount not exceeding the maximum amount of cash payments in the fulfillment of civil obligations provided for in an agreement concluded between participants in cash payments and (or) arising from it and executed both during the validity period of the agreement and after its expiration. actions.

Without taking into account the maximum amount of cash payments, cash received at the cash registers in Russian currency for goods sold, work performed and (or) services provided, as well as received as insurance premiums, is spent for the following purposes:

- for payments to employees included in the wage fund and social payments;

- for issuance to employees for reporting.

How to generate a correction check in the cash register module of Kontur.Market (FFD 1.05): step-by-step instructions

In the upper left corner of the checkout screen, click the menu icon.

Next, you can work in any of two sections: “Information” or “Receipts”. In both tabs you need to select the “Adjustments” tab.

We will describe the creation of adjustments in the “Receipts” section. Going to the “Adjustments” tab, click “Create adjustment”:

Fill in the fields in the window that opens. All items are required except the “Reason” field. The sequence of actions depends on the format of fiscal documents (FDF) that the cash register supports - these are formats 1.05 and 1.1. The updated Market cash module uses only format 1.05.

Checking the intended use of funds

Let us recall that, based on clause 2 of Directive No. 3073-U, autonomous institutions, like other legal entities, have the right to spend cash received in their cash registers in the currency of the Russian Federation for goods sold by them, work performed by them and (or) services provided by them, and also received as insurance premiums exclusively for the following purposes:

- payments to employees included in the wage fund and social payments;

- payment of insurance compensation (insurance amounts) under insurance contracts to individuals who previously paid insurance premiums in cash;

- payment for goods (except for securities), works, services;

- issuing cash to employees on account;

- refund for previously paid in cash and returned goods, uncompleted work, unrendered services;

- issuance of cash when carrying out transactions by a bank payment agent (subagent) in accordance with the requirements of Art. 14 of the Federal Law of June 27, 2011 No. 161-FZ “On the National Payment System” .

Spending cash in the currency of the Russian Federation received at the cash desk of an institution for goods sold, work performed and (or) services provided, as well as received as insurance premiums not for the purposes indicated above, is unlawful.

In addition, it should be noted that cash payments in the currency of the Russian Federation for transactions with securities, under real estate lease agreements, for the issuance (repayment) of loans (interest on loans), for the organization and conduct of gambling are carried out at the expense of cash received in cash desk of a participant in cash payments from his bank account ( clause 2 of Directive No. 3073-U ).

We also note: if, in accordance with the Budget Code, an autonomous institution is assigned the responsibilities of a recipient of budget funds, you need to make sure that there are no facts of their misuse. It is advisable to check this issue in parallel with the study of documents that are the basis for making settlements with accountable persons. During the audit, it is necessary to compare the articles and sub-articles of KOSGU (from 2016 - you should pay attention to the type of expenses) for which the advance was issued with those indicated in the advance reports. In addition, it is necessary to analyze the correctness of attributing actually incurred expenses to certain articles and subarticles of KOSGU (type of expenses).

What does the format of fiscal data have to do with it?

To correct the error correctly, you will have to find out which version of the fiscal data format (FDF) the cash desk uses to draw up documents. In general, in FFD 1.05 errors are corrected by a return check, in FDF 1.1 and 1.2 - by a correction check. And if the cash register was not used in the calculation, then a correction check is needed, and it does not matter in what format the cash register works.

The full list of details of correction checks is given in the Order of the Federal Tax Service dated September 14, 2020 ED-7-20 / [email protected] For FFD 1.05 - in table 27, for FFD 1.1 - in table 65, and for FFD 1.2 - in table 120.

You can see which version of the fiscal data format (FDF) the cash desk uses to generate documents in two ways:

- In the report on the opening of a shift in the “FFD CCP” field: number 2 corresponds to format 1.05, number 3 to format 1.1, number 4 to format 1.2.

- In the personal account of the OFD. To view the FFD in your personal account, in the “Cash Offices” section, upload the list of cash registers into Excel. The format will be indicated in the FFD column opposite the desired cash register:

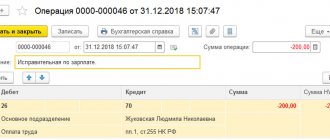

Accounting information

If an error was made in the accounting accounts when recording a business transaction, then an accounting certificate is issued, which will indicate that corrections were made to the entries. The reason for this is that, according to the Law “On Accounting”, the data reflected in the accounting registers is produced on a primary basis. This certificate is necessary in order to correct the data, as well as to confirm that an error was made. The correct data is transferred to the accounting registers based on the certificate.

A certificate is drawn up in free form with the obligatory indication of the details specified in the law.