What characteristics of furniture are considered for write-off?

When we talk about furniture, we mostly think about office furniture. Although this could also be the setting of retail or industrial premises, as well as catering premises.

General points for which furniture may be considered unsuitable for further use are:

- Partial or complete loss of basic mechanical functions:

- damage to legs, back, armrests, walls;

- deformation of the chair seat or work surface of the table;

- breakdown of mechanisms (for example, adjusting the height or tilt of the back of an office chair).

- Fatal appearance defects:

- indelible stains;

- noticeable defects in upholstery or painting (varnishing);

- Changes in color or durability of the upholstery (for example, as a result of exposure to sunlight).

NOTE! The furnishings of an office or restaurant hall are often the “face” of the owner company, so the role of appearance defects in determining the reasons for the write-off of a table or chair can be no less important than the loss of operational characteristics.

Reasons and formulations

A common reason why furniture in an organization is scrapped is usually because chairs, tables and other interior furnishings lose much of their useful features. As a result, their further exploitation becomes impossible. However, when drawing up documents for write-off, more specific characteristics and wording are required.

Considering the issue of writing off furniture further, let us turn to the rationale for these actions:

- Write-off due to breakdown or wear and tear. At the same time, financial and labor costs for repairs, elimination of breakdowns, and replacement of spare parts are close to the cost of a similar product on the market or even exceed it. It is clear that in such conditions it is more profitable to write off a piece of furniture and, possibly, dispose of the usable spare parts remaining after liquidation (for example, from an office chair).

- Write-off due to “obsolescence”, when property becomes obsolete when more modern models of similar property appear on the market, with more efficient performance characteristics. In relation to furniture, we can talk about the desire of management to find a new design solution for an office or workspace and complement the new design with appropriate furniture.

Here are the formulations that can be used when drawing up a write-off act in a particular case. Note that defects related to physical wear and tear (clause 1) can be divided into defects that prevent further operation and defects in appearance.

Appearance defects:

- abrasions, faded areas, other color defects;

- defects in external coatings: mechanical damage to the upholstery, tears, damage to the paint layer of the surface;

- indelible stains.

Mechanical defects and damage:

- changes in the original shape of the product, surface deformations;

- breakdowns of mechanical parts of furniture that make this product unsuitable for use (mechanisms of office chairs, cabinets);

- breakdowns and loss of individual parts and main structures that impede further operation (handles, drawers, walls).

Operation with them present is impossible.

Important! All of the above reasons must be indicated in detail in the write-off act.

Examples of wording in the act:

- destruction of the varnish layer, the appearance of light spots on the varnish layer due to thermal, chemical effects of household chemical products;

- swelling of wooden parts and chipboard parts;

- corrosion of metal parts and components;

- loosening and unsticking of joints of furniture parts, appearance of cracks and gaps in joints due to their wear;

- mold damage to upholstery, facing materials, furniture flooring;

- formation of cracks, swelling, delamination on parts and components of the product, etc.

If you want to purchase new furniture and replace old furniture that does not have obvious defects, you can refer in the act to government decree No. 720 dated June 16, 1997. This document contains a list of durable goods that over time may pose a threat to the consumer. The manufacturer is obliged to set a service life for them. After the specified period, the products must be written off.

The list contains not only the names of upholstered and office furniture, but also various plumbing fixtures, including furniture (sets) for sanitary purposes.

The reason can be formulated as follows: “Written off due to the expired service life established by the manufacturer. According to Decree No. 720 of 06/16/97, it poses a potential threat to the health of workers and the environment. A technical passport indicating the service life is attached to the act.”

If the furniture is damaged

Furniture that is used in commercial premises, be it restaurants, hotels, offices, shops, factories, becomes unusable much earlier and more often than what happens with structures at home.

During intensive use, individual units may break down, become irreversibly dirty, tear, scratch, or fade. Data that such property has become unfit for use is recorded when compiling inventory papers or discovering similar facts.

The documentation shows the types of damage, for example:

- breakdown of the frame part, including legs, tabletops, seats, walls, armrests, doors;

- breakdown of the main functioning mechanisms that facilitated the operation of structures;

- deformation of individual elements as a result of excessive heating, high humidity, and wetness;

- wear of the upholstery as a result of the influence of the temporary factor;

- defects associated with facing furniture surfaces.

All these damages imply the need to write off and note these aspects in the act. There is one condition: the costs of restoration exceed the costs of purchasing new units . Information about how much repair work will cost can be obtained from organizations that specialize in this type of service.

Writing off chairs: nuances of the procedure

The main reasons for the write-off of office chairs are the reduction or loss of the main part of the operational characteristics of the item, which allows the chair to be used safely and effectively in the future. The basic criterion for determining the feasibility of write-off is the repairability of the piece of furniture. You should get rid of an office chair if it has the following defects:

- broken legs, back, armrests;

- deformed seat;

- non-functioning height or backrest adjustments;

- absence or non-functional condition of rollers, cracks on the crosspiece;

- dirt that cannot be washed off with ordinary detergents or chemical solutions for removing stains;

- violation of the integrity and aesthetic appearance of the upholstery.

It is important to remember that the loss of visual appeal of furniture is also considered a serious defect, since the office environment affects the image of the company. If the cost of repairing or reupholstering an office chair is higher than its residual depreciation value, it is much more reasonable to write off the chairs and replace the chair with a new one. However, the decision on replacement must be made by the inventory commission

If the furniture is suitable, but tired

The desire to change the environment is normal and natural not only for households, but also for entrepreneurs.

In this case, write-off occurs not because the furniture has lost its properties, but due to a change in the design concept of the object or the transition of the business to a new status with a higher level of prestige.

In such situations, they are guided by the service life of the furniture, which is established in the technical passport for it.

The write-off of office furniture due to the expiration of its service life, which was indicated in the technical documentation by the manufacturer, assumes the fact that it poses a threat and poses a danger to workers and other property. This process is carried out in accordance with the norms of the Government of the Russian Federation No. 720.

Causal factors are determined in a similar way . If, in the case of a breakdown, the write-off is carried out according to an amount comparable to the costs of repairs, then in this situation it is necessary to act according to the service life.

Service life and characteristics

Furniture in an enterprise means not only classic office “new things”, but also everything that has a similar design - furnishings for retail premises, workshops, warehouses, catering establishments.

To write off furniture structures, several characteristics are taken into account. The following are the general points:

- loss of functionality (breakage, deformation);

- external defects (dirt, cracks, scratches, fading);

- desire for renewal (purchase of more status furniture, reorganization of the enterprise).

The service life of furniture depends on the manufacturer, type and variety and is determined at the factory. Furniture manufacturers have an obligation to establish this parameter in accordance with Decree of the Government of the Russian Federation of June 16, 1997 No. 720.

Sample defect report

There is no established template according to which the write-off procedure is carried out, so the enterprise has the opportunity to independently develop and approve it. The completed act must contain the following information :

- the name of the furniture structures that are being written off;

- total quantity (in units);

- identification codes and signs;

- the results of the inspection by a commission including senior employees of the organization;

- causative factors (breakage, deformation, defects);

- general conclusion;

- signatures belonging to responsible parties.

If we look at a specific example of a document, we can note that it includes several points :

- “Hat” , which indicates the word “I approve”, the name of the general director, and the date of compilation. Then it is signed with the word “Act” in the center, and the title of the document from a new line in the middle is “write-off of furniture, inventory, equipment.” All members of the commission are listed below, it is indicated that they examined certain pieces of furniture and found them to be written off on certain grounds.

- The basic part, represented by the table . The first column displays the name of the structures to be decommissioned. The second indicates the inventory number, then the unit of measurement, quantity. The last column is the general technical condition and causal factors.

- The final part begins below the table and includes the immediate conclusion, information about the group members, and results.

Disposal of office chairs

FOR LEGAL ENTITIES AND STATE GOVERNMENTS TO INSTITUTIONS

- Computers and office equipment

- Electronic equipment

- Medical equipment

- Household appliances and equipment

- Audio and video equipment

- Power tools

- Petrol tools and petroleum equipment

- Cash register equipment

- Sport equipment

- View full list

CONDITION REPORTS AND DEFECTIVE REPORTS FROM 200₽

A criterion for the comfort of a workplace in any office, in addition to the technical characteristics of the room itself, is the availability and quality of office furniture. Indeed, if an employee spends most of the day at his desk, his performance and efficiency directly depend on how comfortable and reliable his chair is. However, furniture, like any other piece of furniture, deteriorates over time. ALAR LLC has been actively cooperating with large enterprises and small companies in Moscow and the Moscow region since 2006, providing services for the recycling and write-off of office furniture.

Reasons for different types

The reasons for write-off largely depend on the type of furniture. Let's look at the most common of them.

Office chairs and armchairs

Among the reasons causing the need to write off office chairs and chairs, the following points :

- damage to the leg, back, armrest;

- seat deformation;

- faded upholstery;

- scratches and holes in the upholstery material;

- loss of aesthetic properties of wood.

- breakdown of fittings (mechanical parts);

- the formation of noticeable gaps due to weakening or unsticking of tenon elements;

- warping of doors, insert shelves;

- breakdown of fittings;

- darkening of varnish;

- darkening of wood;

- destruction of the structure of the material due to the appearance of stains (during exposure to chemicals), aging, fading;

- corrosion;

- damage to the facing material by mold

Carpet

Despite the fact that carpet is not technically furniture, it is subject to write-off according to the same principle as other structures discussed earlier. Reasons include discoloration, formation of bald spots, spots, and holes.

Curtains

More often than not, curtains are susceptible to fading due to exposure to sunlight . But other defects may also form, such as the appearance of spots and holes.

Cushioned furniture

upholstered furniture is also subject to write-off . Such procedures are carried out in hotels, sanatoriums, and boarding houses. Structures located in public areas quickly deteriorate due to active use and negligence of visitors and staff.

The reasons for write-off measures include wear of the upholstery, sagging springs, cracks and chips.

Of course, an unaesthetic interior can easily ruin the organization’s reputation and reduce the flow of clients. In this regard, write-offs must be carried out in a timely and competent manner .

How and when is upholstered furniture written off?

In addition to typical office furniture, upholstered furniture can also be written off. Boarding houses, sanatoriums, hotels of state or private subordination are familiar with this procedure.

As a result of careless or intensive use, negligence in relation to furniture, chairs and sofas that are placed in the halls, guest areas and other common areas of such institutions become unusable. The reasons for the write-off of upholstered furniture manifest themselves in the form of wear and tear of the upholstery, sagging springs, cracks and chips on wooden elements.

It is clear that an unaesthetic interior can easily spoil the reputation of an establishment, as a result of which the influx of customers may decrease. Therefore, it is advisable to promptly engage in inventory and write-off of damaged items, and systematically update inventory.

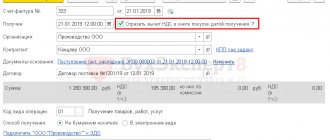

Reflection in accounting with postings

In the classical reflection, office furniture items appear as inventories. So, the receipt of furniture is reflected through the following business records :

- Dt 08 Kt 60 – capitalization;

- Dt 19 Kt 60 – VAT amount;

- Dt 60 Kt 51 – payment to suppliers.

If we talk about the write-off procedure, it is reflected through the following entries :

- Dt 91 Kt 01 – residual price;

- Dt 02 Kt 01 – registration of wear and tear;

- Dt 10 Kt 99 – capitalization of MC in the process of liquidation;

- Dt 91 Kt 99 – receipts received from disposal;

- Dt 99 Kt 91 – losses.

Thus, there are many causal factors for writing off furniture; in any case, it is necessary to act in accordance with the law and accounting rules.

The registration of the act of writing off goods is in this instruction.

How to write off

Any operation involving the movement of inventory items must be documented. Furniture is no exception. When writing off furniture, the following documents must be prepared:

- Act on write-off of an object (as inventory or fixed assets).

- Write-off order.

You can download the forms for such an act from our article “Sample act for writing off computer equipment” (despite the fact that this publication is devoted to writing off computer equipment, it will also be useful. Forms for write-off acts may be useful for registering the write-off of furniture in accounting).

The decision to write off furniture is made by the head of the enterprise. This is preceded by the preparation of a write-off act.

The act is filled out by a special commission, which is appointed by order of the head. The commission may be permanent or appointed for a specific write-off of any objects.

Often the write-off of furniture is preceded by an inventory. During this process, members of the inventory commission must indicate property defects in the inventory sheet. This way you can kill two birds with one stone: carry out an inventory and rid the office of worn-out furniture.

Let's look at what furniture defects there are.