11/07/2021 Application for tax refund due to overpayment: official form and sample

Accounting is a specific activity of specific structures of any organization, which is aimed at accounting for all

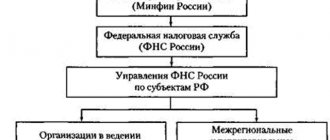

Briefly about the history of the taxation system in Russia The tax system of the Russian Federation began to take shape after the collapse

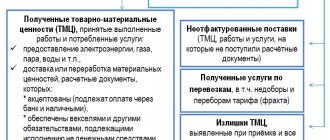

An invoice for payment from a supplier is not a primary document; it does not generate transactions and,

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

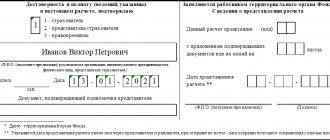

4-FSS is a mandatory quarterly report for all legal entities and individual entrepreneurs who accrue

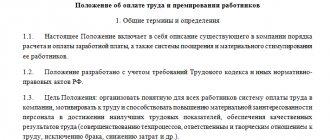

Is it possible not to draw up a wage regulation and can they be punished for this?

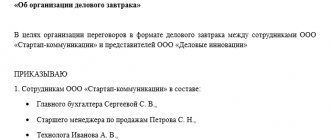

To understand exactly what expenses can be classified as representative expenses, let us turn to clause 2 of Art.

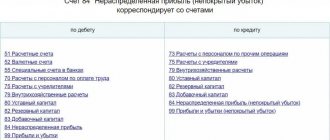

Is it true that retained earnings are net profits? Retained earnings are real

In accordance with paragraph 3 of Article 1 of the Federal Law of August 3, 2018 No. 303-FZ, from January 1