An invoice for payment from a supplier is not a primary document; it does not generate transactions and, as a rule, serves only as a basis for payment of funds. This article discusses why it is necessary to issue an Invoice from a supplier in 1C, its purpose and design features.

You will learn:

- document creation options;

- detailed description of each field;

- additional document features.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Purpose of the document

Entering the document Invoice from a supplier allows you to significantly simplify document flow in 1C, as well as analyze the fulfillment of obligations on each side of the transaction.

See also Analysis of payment on an invoice and Analysis of receipt of goods and materials (works, services) on an invoice.

Based on the Invoice from Supplier , the following documents will be automatically filled in:

- document Power of Attorney;

- document Receipt (act, invoice);

- document Payment order;

- document Write-off from current account;

- document Cash withdrawal;

- document Invoice to the buyer.

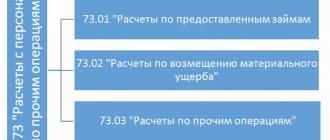

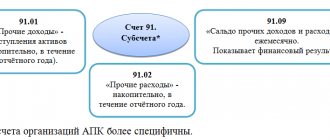

Account 60 in accounting

All transactions related to payments for purchased goods, materials, consumed services or accepted work are reflected in account 60, regardless of the fact of payment. Account 60 is credited according to the supplier's settlement documents, debited for the amount of fulfillment of obligations, that is, payment of bills, including advances and prepayments, in correspondence with cash accounts, etc. In this case, the amounts of advances issued are accounted for separately in a separate sub-account.

For account 60, analytical accounting is maintained for each supplier invoice received, and settlements are made in the order of scheduled payments, that is, for each supplier separately.

Types of settlements on account 60:

Document header

Let's look at the procedure for filling out the header of the document Invoice from supplier .

Account no. from

In these fields, fill in the invoice number and date indicated by the supplier in the issued invoice. PDF

Number

The Number field displays the serial number of the document assigned automatically by the program.

From

In the From , indicate the date of account registration in 1C. The current date is automatically entered, but it can be changed manually.

Counterparty

In the Counterparty , select the name of the supplier who provided the invoice from the Counterparties directory.

Agreement

In the Contract , indicate the basis for settlements with the supplier: contract, invoice, other document. We select the basis from the Contracts directory. In the contract selection form, only those that have Contract Type :

- With supplier.

- With a principal (principal) for sale.

- With a commission agent (agent) for purchase.

If an agreement is not concluded with a new counterparty (for example, the Organization receives only an invoice from a supplier), the program has the opportunity not to specifically create a basis in the Contracts Without agreement from the drop-down list . In the future, this value is indicated by default in other documents. PDF

Bank account

In the Bank account , the bank details of the supplier are indicated to which the payment is transferred. Selected from the Bank Accounts , automatically filled in with the Bank account specified in the Counterparty . PDF

By default, the field is not displayed on the form; you can add it by clicking the More – Edit Form button.

Payment before

In the Payment by , manually specify the date by which payment must be made to the supplier.

Filling out this field allows you to analyze payments to suppliers in terms of payment terms and automatically generate payment orders for payment using the Supplier Payment Assistant.

Payment State

The Payment Status field displays the current invoice payment status. Payment status helps you monitor your invoice payment.

Has the following meanings:

- Not paid - set automatically when creating a document;

- Partially paid;

- Paid;

- Canceled.

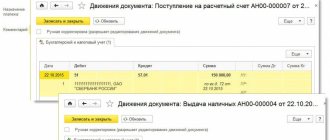

The payment status is changed either manually by the user or automatically.

If, when posting a document for transferring payment to a supplier, you fill out an Invoice for payment , then the Payment Status in the Invoice from Supplier will automatically change to Paid or Partially Paid .

If the Payment Invoice is not completed or there is no way to indicate it, the Payment Status manually.

Organization

In this field, indicate the name of our Organization. The field is displayed if several organizations are registered Organizations The name of the organization that is the Use as primary attribute Organizations . PDF

VAT link

VAT link .

When you click on the VAT the Prices in Document form opens . The procedure for filling it out is as follows:

- Price type —price name selected from the Price Types of the item directory.

If the Price Type is selected, the Price will be filled in automatically in accordance with the price set using the document Setting item prices .

If the Price Type is not selected, the Price is entered from the Prices information register the document nomenclature the Method of filling in prices At purchase prices PDF, i.e. from the previous receipt document or invoice.

For goods and materials and services received for the first time, the price of receipt will not be filled in; set it manually.

Price type field is filled in automatically if the Price type used in calculations under this agreement is filled in the Contract Calculations PDF

- VAT - select one of the options: either VAT in total or VAT on top . The selected option is used for the convenience of indicating VAT in the tabular section.

Currency and Capitalize at rate - these objects become visible if settlements under the contract are made:

- in currency; PDF

- in u. e. PDF

The Currency field indicates the currency in which the agreement was concluded. In the Capitalize at the default rate, the rate for the selected currency is inserted, corresponding to the document date from the information register Exchange rates .

The procedure for writing off receivables and payables on account 60

According to accounting requirements, only true facts must be reflected in accounting data and reporting. If the documents show accounts payable with an expired collection period, then this rule is violated.

You might be interested in:

Account 01 - Fixed assets in accounting: correspondence of accounts, postings

Thus, the company is obliged to write off accounts payable if the collection period established by law has passed.

In addition, a debt that can no longer be repaid is subject to removal if the counterparty has been deregistered and no longer exists as a legal entity.

The law establishes that the period during which the creditor has the right to demand its coverage is set at 3 years. In this case, it is necessary to correctly determine the beginning of this period.

When concluding a supply or service agreement, this document usually indicates the date for repayment of obligations. From the day following it, you need to start counting the statute of limitations.

However, the law provides for the deadline to be reset and counted from the beginning. This happens if the debtor acknowledges the existing debt in writing, makes partial payment, signs a reconciliation report, etc. In this situation, the limitation period must be counted first from this moment.

Attention! However, this cannot be done indefinitely. When a period of 10 years has been reached from the date of its formation, the debt must be written off unconditionally.

The debt write-off process is carried out in the following order:

- Carrying out an inventory of all payments. This procedure must be performed annually in order to compare the accounting data with the actual amounts of debt. During the inventory, it is also checked on what date the last movement on this debt occurred.

- Registration of an inventory report. There is a recommended form of the INV-17 form, but currently the company has the right to use its own forms. It is necessary to include in the act all the debts the company has, and not just the identified overdue ones. The document is drawn up in two copies, one is transferred to the accounting department, and the second remains with the commission.

- Preparation of accounting certificates. The accountant must analyze the executed act and draw up a certificate based on it. It reflects the counterparty for which there is a debt, the reason for the occurrence, the amount of the debt, as well as the day when the statute of limitations expired. Certificates of all expired debts, together with the act, are transferred to the manager for consideration and decision-making.

- Making an order. If the manager decides to write off, then he gives instructions to draw up an order to write off the debt. This document provides instructions to write off debt in accounting and tax accounting, and also appoints responsible persons. Based on the order, the accountant prepares accounting entries.

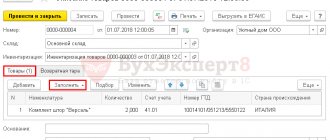

Tabular part of the document

The tabular part of the document consists of several tabs:

- Goods and services;

- Returnable packaging.

On the Goods and Services , display the list of goods, works (services) for which an invoice has been issued.

the Returnable containers if the receipt of goods and materials is planned in returnable containers.

Containers that are not returned to the supplier are accounted for as inventory items and are indicated on the Goods and services .

Enter positions into the table section using the Add or the Selection .

Find out more about the Methods for selecting items.

You can also add a row with completely filled data to the tabular part by copying a row from another tabular part with the same functionality.

Learn more about Filling out a document by copying lines.

Change button to adjust the price for all positions of the document according to the specified algorithm.

Find out more about price changes in the document.

Products and services tab

Goods and Services tab of the tabular part of the Invoice from Supplier .

The tabular part of the Products and Services contains the following columns:

Nomenclature

In the Nomenclature , select the name of inventory items (material assets) or works (services) from the Nomenclature directory.

If an item with the Item Type Service an additional column Contents in the Nomenclature .

In the Contents , describe the name of the service provided. If the value is filled in, this is what will be reflected in the printed forms.

the Contents column automatically displays the full name of the service specified in the Nomenclature , but it can be changed manually.

If the service frequency is specified Nomenclature , the service period will be automatically added in the Contents depending on the date of the document. PDF

An invoice from a supplier for payment for equipment can also be registered in 1C - to do this, in the tabular part of the Invoice from a supplier select Item , whose item type is Equipment (fixed asset objects) or Equipment to be installed .

Study in more detail the execution of the document Receipt of equipment based on an invoice from the supplier.

Quantity

In the Quantity , enter the quantity of goods and materials to be paid.

If you have selected an item with the Item Type Service, Quantity column .

Price

The Price column reflects the price of paid goods and materials, works (services).

The column is filled in:

- manually;

- automatically based on data from the previously entered document Invoice from supplier or Receipt (act, invoice) ;

- automatically according to the price type specified in the Price type via the VAT . PDF

Sum

Amount column is calculated as the product of the Quantity and Price .

% VAT

In the %VAT the VAT rate is displayed . the VAT rate manually, then inventory items will be paid at the specified VAT rate.

VAT

VAT column VAT link VAT field :

- VAT in total;

- VAT on top.

Total

In the Total , the total cost of inventory items is displayed, including VAT.

Additional tabular columns

You can add additional columns to the tabular part of the document by clicking the More – Change Form button:

- Code;

- vendor code.

Code

Code column displays the value of the Code the Nomenclature directory .

It is convenient to use when the Nomenclature contains a large number of similar names.

Code column can be displayed in printed document forms next to the Name .

To do this, select the Code in the Administration – Program Settings – Accounting Options – Printing Items section. PDF

Once the column settings have been completed, the Code will be displayed in printed form:

- An invoice for payment.

vendor code

Article column is convenient to use when the Nomenclature contains a large number of similar items. This column displays the value of the Article number Nomenclature directory element .

The Article column can be displayed in printed forms of documents next to the Name . To do this, you need to set the switch column Article in the section Administration - Program Settings - Accounting Options - Printing Articles. PDF

Once the settings in the column have been completed, the Article will be displayed in printed form:

- An invoice for payment.

Directory of “Counterparties”

This directory stores all the necessary information on organizations or individuals who are either suppliers or buyers. You can open it from the “Directories - Contractors” section.

Fig.1 Opening the “Counterparties” directory

The “Counterparties” directory has a grouping option. The counterparty can be either a legal entity or an individual. You can create a counterparty card from the directory list by clicking the “Create” button.

Fig.2 List of the directory “Counterparties”

For the organization you need to fill out the full name, TIN, KPP. Additionally, you need to indicate contact and banking information, which can be automatically inserted into printed forms of documents: bank account, agreement, contact person, addresses and telephone numbers.

It will be important to fill out accounts for automatic completion in documents using the link “Accounts for settlements with counterparties” in the navigation panel.

Fig.3 Setting up accounting accounts with counterparties

Account data will be inserted into documents for the specified counterparty for any organization, any agreement and for settlements in rubles.

To speed up filling out the counterparty’s data, you can enter the TIN and click “Fill in by TIN” or fill in by name.

Fig.4 Filling in counterparty data

Also, when creating a new counterparty, you can use the automatic completion of details according to the state registers of the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs.

Fig.5 Automatic completion of counterparty details

This functionality will work if the connection to the ITS is configured. From the counterparty card, using the “Agreements” link, you can create an agreement and print it.

Fig.6 Agreement with counterparty

Returnable packaging tab

the Returnable packaging functionality setting . PDF

The tabular part of the Returnable contains the following columns:

Nomenclature

In the Nomenclature , select the name of the returnable container from the Nomenclature directory. If the item type is Service PDF, then this item cannot be selected in the tabular part of the Returnable the Buyer Invoice document .

The nomenclature specified on the Returnable packaging tab is not reflected in the standard printed form, and filling it out is only necessary to automatically fill out a similar tab in the document Receipt (act, invoice) .

Quantity

In the Quantity , indicate the quantity of packaging that is returned to the supplier.

Price

In the Price the price of the deposit for the container is displayed. The column is filled in:

- manually;

- automatically based on data from the previously entered document Invoice from supplier or Receipt (act, invoice) ;

- automatically according to the price type specified in the Price type via the VAT . PDF-13

Sum

Amount column is calculated as the product of the Quantity and Price .

Additional tabular columns

to the tabular part of Returnable packaging using the More – Change form button:

- Code;

- vendor code.

Code

Code column is convenient to use when the Nomenclature contains a large number of similar items. This column displays the value of the Nomenclature directory element code .

vendor code

Article column is convenient to use when the Nomenclature contains a large number of similar items. This column displays the value of the Article number Nomenclature directory element .

Features of accounting and characteristics of accounting

This accounting account belongs to the group of active-passive accounting accounts. This means that both the debit of account 60 and the credit are subject to the ending balance. Now we will give a detailed explanation for beginners in the accounting field of what accounting account 60 looks like for dummies: in the example we use a fictitious one.

Vesna LLC entered into two agreements:

- According to the terms of agreement No. 1, supplies of goods and materials by a third-party company are carried out before payment. Consequently, the receipt of material assets in the accounting of Vesna LLC will be reflected in the credit of accounting account 60 as an arising obligation.

- Under the terms of agreement No. 2, Vesna LLC undertakes to make an advance payment for the ordered services and work. In such a situation, the advance transferred in favor of the supplier or contractor is taken into account as a debit to accounting account 60.

The company is obliged to organize reliable and detailed analytical accounting in the context of each third-party company, entrepreneur and individual. In other words, all suppliers and contractors (account 60) are reflected separately; In addition, it is necessary to provide details on contracts and agreements.

Document footer

Total line

Total column displays the total amount of the document including VAT and the currency of the document.

The VAT (including) column displays the total VAT amount for the document.

A comment

Place any necessary comments in the Comment

Responsible

In the Responsible , the user from the User List who entered the program and registered this document is automatically inserted.

Responsible column is displayed in the document if the Display author of the document in Users and Rights Settings in the Administration – Program Settings – Users and Rights Settings section.

Additional features

Payment Analysis

Thanks to the information contained in the document Invoice from supplier , the accountant will automatically generate a report for the manager, located in the section For the manager – Accounts payable:

- report Invoices not paid to suppliers .

Unpaid invoices can also be monitored in the document journal Invoices from suppliers using the Due Date and Payment .

An overdue Payment Date is highlighted in red. Also, the payment status in the Payment if the goods and materials (works, services) on the invoice from the supplier have been received and not paid or partially paid.

If the invoice is paid, but it is not indicated in the payment document ( Payment status is not automatically changed), change it manually in the Invoices from suppliers using the Change status or directly in the document itself in the Payment status .

BukhExpert8 advises filling out the Invoice for payment in payment documents so that the Payment Status of the Invoice from Supplier document changes automatically.

Depending on the payment, you can also configure conditional formatting of the list.

Receipt analysis

In the document journal Invoices from suppliers, the Receipt column controls the receipt of inventory items (works, services) on the invoice.

The receipt status is displayed only in the Invoices from Suppliers Invoice from Supplier document, the Receipt Status even by clicking the More .

Receipt column is highlighted in red if the invoice has been paid, but inventory items (works, services) have not been shipped or have been partially shipped.

For accounts for which goods and materials, works (services) were received, but not indicated in the receipt documents, change the Receipt Status manually in the Invoices from Suppliers using the Change Status .

If an Invoice from the supplier was issued upon receipt of fixed assets, and the receipt was documented using the document Receipt (act, invoice) type of operation Fixed Assets , then the Receipt Status is also changed only manually, since the program does not automatically track the delivery of fixed assets according to the document Receipt (act, invoice) type of operation Basic facilities .

BukhExpert8 advises filling out the Invoice for payment in the delivery documents so that the Receipt Status of document from the supplier changes automatically.

Depending on the Receipt, you can also configure the conditional formatting of the list.

Test yourself! Take a test on this topic using the link >>

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

What about materials?

In the process of working towards making a profit, business entities are often faced with the need to purchase related materials.

This type of property is of low value and is rarely purchased for the purpose of further resale. Inventory inventories (MPI) are used for production or management needs. The procedure for accounting and movement of materials must be reflected in the accounting policy of the enterprise, which each business entity has the right to form independently, without violating the requirements of current legislation. The rules for using information on materials from 01/01/2021 are regulated by the new FSBU 5/2019 “Reserves”, PBU 5/01 has become invalid.

Some accounting rules for materials have changed significantly since 01/01/2021. The Guide from ConsultantPlus will help you adjust to the new order. If you do not already have access to this legal system, trial access is available for free.

Also, until the end of 2022, on the basis of PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n, equipment whose cost does not exceed 40,000 rubles is included in the inventory.

Important! From 2022, PBU 6/01 “Accounting for fixed assets” will be replaced by two new standards: FSBU 6/2020 “Fixed assets” and FSBU 26/2020 “Capital investments”. One of the changes: organizations will be allowed to independently set a limit on the value of fixed assets, taking into account the materiality of information about such assets (instead of a fixed figure of 40,000 rubles). Objects with a cost below the limit accepted by the company can be recognized as expenses of the period in which they are incurred.

How to independently determine and set a limit on the cost of fixed assets in accounting in accordance with the new Federal Accounting Standards 6/2020 “Fixed Assets”? The answer to this question is in the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial demo access. It's free.

Read about the nuances of accounting for assets whose value is below 100,000 rubles here.