07.11.2021

Application for tax refund due to overpayment: official form and sample. The document is drawn up when receiving tax deductions, overpayment of tax as a result of an error, tax refund when applying tax benefits.

In many cases, you have the right to return the amount of tax from the budget. Get "real" money. There are many options. For example, you received a property deduction when purchasing a home. Then you can return the amount of income tax that was withheld from you at work. Another variant. You paid transport tax. Although they had benefits according to it. The amount of tax you paid for the last three years can be refunded. Either way, you will need to apply for a tax refund. It indicates the reason for the return, as well as your bank details to which the tax authorities will transfer the money.

Here you will find the official return application form in Excel format, which you can download, fill out and print, as well as recommendations for filling it out (with a sample form) and sending it to the tax office.

You can view tax refund application forms when receiving deductions using the following links:

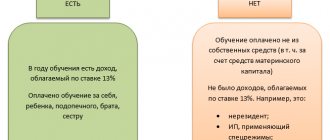

- social deduction for education

- social deduction for treatment

- property deduction when purchasing an apartment (room, land, residential building)

Attention! Refunds of overpaid income taxes are carried out on the basis of a tax return (form 3-NDFL) in which a property, social or investment deduction is claimed. Since 2020, the text of the return application is included directly in the declaration. This is an annex to Section 1 of the declaration. Therefore, starting from 2022 and later, you do not need to fill out such an application. This only needs to be done for tax returns for 2022 and earlier.

Covering letter for the 3-NDFL declaration

The 3-NDFL declaration itself is a statement from the taxpayer.

NOTE! We will submit the declaration for 2022 using a new form.

The Tax Code does not provide for additional statements when filing a report. But it is not forbidden to attach a covering letter to the declaration, which is drawn up in free form. It is recommended to indicate:

- name of the inspection to which the report is submitted;

- applicant's details (full name, address, tax identification number);

- the period for which the declaration is submitted;

- register of documents confirming income or expenses;

- date;

- signature with transcript.

Such a cover letter can be drawn up when submitting the report in person, through an authorized representative, or when sending by mail. When submitting the 3-NDFL report personally or through a representative, you should make 2 copies of the letter and on one of them you should receive a stamp with a mark of acceptance by the tax authority.

When sending a report by mail, a cover letter must be included in the mailing list and receive a postage stamp on it.

To learn about when you should submit your income report for last year, read the material “What are the deadlines for submitting the 3-NDFL tax return?” .

And when submitting a declaration via the Internet, there is no need to issue a cover letter. All attached documents will be recorded electronically.

We draw up and submit to the Federal Tax Service an application for a refund of the overpayment

First, fill out the title page of the form.

The top 2 lines of the form indicate the TIN, KPP and page number (001). In the example given, the application is drawn up from an organization, which means we enter 10 digits in the TIN field, and 9 digits in the KPP field: respectively, the data of Vympel LLC.

Then in the line “Application number” we put its number (if it is the first, then it is “1”) for this year. Next to it we write the code of the tax authority to which we are addressing it.

Next are lines to indicate the full name of the organization (full name of the individual), in our example this is the limited liability company “Vympel”.

In the “Taxpayer Status” line, select the appropriate unambiguous code from those proposed in the form. All empty cells in the form fields must be filled in with dashes.

In the line “Based on the article” you should indicate the number of the article in the Tax Code of the Russian Federation, which serves as the basis for the upcoming return of the overpaid payment. When returning overpaid tax or contribution, this is Art. 78 of the Tax Code of the Russian Federation, when returning state duty - Art. 333.40 of the Tax Code of the Russian Federation, the tax office erroneously collected it - Art. 79 of the Tax Code of the Russian Federation, you reimburse VAT - Art. 176 of the Tax Code of the Russian Federation, etc.

In our example, this is Art. 78 of the Tax Code, since a refund of overpaid income tax is required.

Below, in two cells located one below the other, we indicate information about what kind of overpayment and for what type of payment, and select the appropriate unambiguous codes for these fields from those proposed in the form. For example, “1” is overpaid, and “1” is tax.

In the “in amount” line, we write down in numbers the amount of the requested tax overpayment, for example, 5,350 rubles. The line “Tax (settlement) period” is filled in with the following codes for the first two cells:

“MS” - if the payment is monthly;

“KV” - if quarterly;

“PL” - if overpayment for half a year;

"GD" - if annual.

After the point, the selected and specified reporting period is specified, i.e. the serial number of the month, quarter or half-year is entered, and for the annual payment we put “00” here.

The year in which the overpayment occurred is indicated after the next dot in four empty cells.

In our example: “GD.00.2018”.

Next to it you should indicate the OKTMO code, which can be clarified on the official website of the Federal Tax Service.

To fill out an application for a refund of overpaid tax, organizations can take the region code (OKTMO) from the submitted tax return (in the example, this is a profit declaration), and an individual can indicate the region where this tax was paid: if we are talking about property tax, OKTMO is taken according to the location of this property, transport tax - at the place where the owner of the car is registered, personal income tax - from a certificate of income from work.

In the line below - “Budget classification code” - fill in the 20-digit BCC of the overpaid payment. In our example, this is the KBK of income tax to the federal budget.

Next, we write down the number of pages and attachments in the submitted application. Remember that we cross out all empty cells in the fields of the form.

At the bottom left of the title page of the form, a part of the page is provided to reflect information about the applicant (payer/his representative): full name, phone number, signature and date. If the application is submitted by a representative, you must indicate the details of the document confirming his authority and attach a copy of it to the application.

Find out if you are subject to mandatory audit

according to your situation and get advice from an auditor.

Request a call

Request a call

What to attach to the application for filing 3-NDFL and where to download its sample

Depending on the purpose of filing 3-NDFL, the list of documents may differ. If a declaration is submitted to receive, for example, a social deduction, then the applications may be as follows:

- contract for the provision of medical services (copy);

- training contract (copy);

- certificate from the medical institution for tax authorities on the cost of services provided (original);

- license of a medical institution or educational organization (copy);

- birth certificate of the child, if the deduction is claimed for his education or treatment (copy);

- other supporting documents.

Read more about the documents required to receive a deduction for treatment here.

See also “Documents for tax deduction when purchasing an apartment.”

During a desk audit, tax authorities have the right to request additional documents, which should be accompanied by a separate inventory.

As noted above, the cover letter is drawn up in free form. On our website you can see an example of this document.

Read about one of the tax deductions in the publication “Property tax deduction when buying an apartment (nuances)” .

On what form?

In 2022, an application form for 3-NDFL is in force when purchasing an apartment, which was approved by order of the Tax Service of Russia dated March 3, 2015 No. ММВ-7-8/90 (Appendix No. 8). Moreover, the last time it was adjusted was by order of the Federal Tax Service dated August 23, 2016 No. ММВ-7-8/454.

You can download the personal income tax application when purchasing an apartment on our website using the following direct link.

Please note that this form contains the details of the individual at the bank where the tax will be refunded. Including BIC and correspondent account. They must be filled out. This conclusion follows from the explanations of the Federal Tax Service dated April 25, 2016 No. BS-3-11/1859.

Tax refund application

In addition to the cover letter for the declaration, an application for a tax refund may also be submitted in connection with the right to deductions or in connection with excessively withheld personal income tax.

Starting with the declaration for 2022, it is possible to apply for a personal income tax refund in two ways:

- directly as part of 3-NDFL, it is given in the Appendix to Section. 1 declaration;

If you want to see the line-by-line algorithm for filling out such an application, get free trial access and go to K+.

- separately from the declaration, in this case the form from Appendix 8 to the order of the Federal Tax Service of the Russian Federation dated February 14, 2017 No. ММВ-7-8 / [email protected] , which, starting from October 23, 2021, is valid as amended by the Federal Tax Service order dated August 17, 2021 No. ED- 7-8/ [email protected] You can download it for free by clicking on the picture below

A sample prepared by ConsultantPlus experts will help you fill out the form correctly. You can watch it for free by signing up for a trial access:

Overpayment of personal income tax: what to do?

According to paragraph 1 of Art.

231 of the Tax Code of the Russian Federation, personal income tax amounts excessively withheld from the taxpayer’s income must be returned by the tax agent. Within 10 working days from the date of discovery of the overpayment, the employer is obliged to inform the employee that the amount of personal income tax was excessively withheld, as well as the amount of the amount itself (clause 6 of article 6.1, paragraph 2 of clause 1 of article 231 of the Tax Code of the Russian Federation). The message is drawn up in any form, since tax legislation does not provide for specific methods for its preparation, and is sent to the taxpayer.

A sample message about over-withheld personal income tax can be downloaded from the link below.

The procedure for sending such a message must be previously agreed with the recipient (letter of the Ministry of Finance of Russia dated May 16, 2011 No. 03-04-06/6-112, clause 1).

A ready-made solution from ConsultantPlus will help you reflect the return of excessively withheld personal income tax in 6-NDFL, 2-NDFL and accounting. Get free trial access to the system and proceed to the material.

Results

Tax legislation does not provide for a special application form for filing a 3-NDFL declaration, but you can prepare a cover letter with a list of documents confirming income or expenses. Officially, the form is established for filing an application for a tax refund on a declaration.

Sources: Order of the Federal Tax Service of Russia dated February 14, 2017 N ММВ-7-8/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

If the company does not have the money to return the overpayment of personal income tax to the employee

If a company does not have enough money to return an overpayment of personal income tax to an employee, it must, within 10 days from the date of receiving an application from the employee for a refund of the overpayment, submit to the tax office its application for a refund of the tax that was excessively transferred to the budget. The company has the right to return excessively withheld personal income tax from the employee at its own expense.

Money from the Federal Tax Service will not arrive quickly in the company’s bank account. And while you wait, repayment deadlines may pass and you'll owe interest.

So, a person should not delay the return of money: for each calendar day of delay, interest will have to be charged in the amount of the Central Bank refinancing rate that was in effect on the days the return deadline was missed.

Application for obtaining a TIN

Any citizen, future or current taxpayer, must be registered with the Federal Tax Service. Registration is carried out within five days after submitting the application.

There is a convenient service on the Federal Tax Service website that allows you to register with the tax authority without leaving your home.

But if for some reason it is more convenient for you to work with paper documents, to obtain a TIN (including a repeated one), you need to fill out form No. 2-2-Accounting, approved by order of the Federal Tax Service of Russia dated August 11, 2011 No. YAK-7-6/

How to submit

The Tax Code allows you to apply for a personal income tax refund when purchasing an apartment in different ways:

- through the individual’s personal account on the official website of the Federal Tax Service www.nalog.ru;

- by post with a description of the contents;

- via the Internet with an enhanced qualified signature;

- personally or with the help of an authorized representative by proxy.

In our opinion, it is most convenient to submit this application through your personal account. You just need to enter the account details to which the personal income tax will be returned. And the system itself will generate a statement.

Also see “Register of documents for 3-NDFL”.