Is it true that retained earnings are net profits?

Retained earnings are truly net profits that (as the name suggests) were not distributed (divided) among the participants/shareholders of the company.

Net profit is considered to be that part of income from sales and non-sales operations that remains after paying taxes. The decision on how to distribute this income rests solely with the owners. Traditionally, the issue of retained earnings is put on the agenda of the annual meeting of the company's owners. The adopted decision is documented in minutes, which are drawn up following the results of the general meeting of participants/shareholders.

For information on how such a document is drawn up, read the article “Decision on payment of dividends to an LLC - sample and order.”

The main ways of spending retained earnings are considered to be in the following directions:

- to pay dividends to participants/shareholders;

- repayment of past losses;

- replenishment (creation) of reserve capital;

- other goals formulated by the owners.

For information about the accounting entries accompanying the accrual, payment and receipt of dividends, read the material “Accounting entries for the payment of dividends”.

Is retained earnings an asset or a liability?

Retained earnings on the balance sheet are, of course, a liability. The value of this indicator indicates the company’s actual debt to its owners, since ideally this profit should be distributed among the participants and invested in the further development of the business.

In fact, the company cannot dispose of retained earnings without the owners making a decision. The loss reflected in line 1370 is also on the passive side of the balance sheet, only this is a negative value, so the number is placed in parentheses.

“How to read a balance sheet (a practical example)?” will help you better understand balance sheet analysis. .

Retained earnings must be reflected on the balance sheet. ConsultantPlus experts explained in detail how to do this correctly. To do everything right, get trial access to the system and go to the Tax Guide. It's free.

Retained earnings and uncovered losses - what are they?

As mentioned above, retained earnings are the final income received by the company from its business activities, remaining after the transfer of income taxes and not yet divided (not directed to other purposes) by its owners.

Example 1

Voskhod LLC in 20XX received a profit in the amount of 800,000 rubles and paid income tax in the amount of 160,000 rubles. In line 1370 in the balance sheet liability for the year 20XX, Voskhod LLC should reflect 640,000 rubles. This is retained earnings.

The value in line 1370 of the balance sheet may be equal to that indicated in line 2400 of the financial results report if the company had no profits not distributed by the owners at the beginning of the year and no interim dividends were paid during the year.

What can retained earnings from previous years be used for? The answer to this question is in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Our article “Deciphering the lines of the balance sheet (1230, etc.)” .

As for the uncovered loss, this is the excess of the company's expenses over income at the end of the year.

Example 2

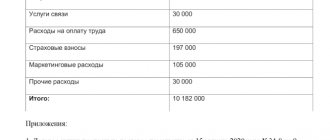

In 20XX, Parus-Trade LLC received revenue from the provision of services and other non-operating income. Their total amount was 400,000 rubles.

The costs associated with conducting the main activity (transportation) are equal to 380,000 rubles. Other company expenses (not taken into account for tax purposes) amounted to another 58,000 rubles. Profit tax was assessed in the amount of RUB 4,000. Parus-Trade LLC has no reserve capital.

This means that at the end of 20XX, after the reformation of the balance sheet, an entry of 42,000 rubles will appear in line 1370 in parentheses. (400,000 – 380,000 – 4,000 – 58,000).

An uncovered loss occurs when the company receives an actual loss and there are no financing reserves. The value entered in the liability side of the balance sheet in parentheses will reduce the total for section 3 of the balance sheet.

Among the main reasons for receiving an uncovered loss are:

- obtaining an actual negative financial result from the company’s activities due to the excess of costs over income;

- changes in accounting policies that had an impact on the financial condition of the company (this is directly stated in paragraph 16 of PBU 1/2008, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n);

- errors found in the current year, made in previous years, which affected the financial result (subclause 1, clause 9 of PBU 22/2010, approved by order of the Ministry of Finance of Russia dated June 28, 2010 No. 63n).

Read more about PBU 1/2008 in the material “ PBU 1/2008 “Accounting policies of the organization” (nuances)” .

Line 1370 “Retained earnings (uncovered loss)”: how to fill out

First of all, it is necessary to understand several points that are directly related to entering information in line 1370:

- The amount of the enterprise's net profit for the reporting period should be reflected according to the CT account. 99 “Profits and losses” in accounting, and the amount of net loss - according to Dt account. 99.

- If, after approval of the financial statements for the current period, significant errors from the previous period were identified, they must be corrected. Corrections are made by making entries in the relevant accounting accounts in the current reporting period. Account 84 is corresponding. That is, if the company corrected significant flaws in 2014 or earlier periods by making entries in the financial statements in 2015, despite the fact that the 2014 financial statements had already been approved, the indicator on line 1370 of the balance sheet for the reporting period of 2015 containing corrective entries should be formed taking into account the correctional entry.

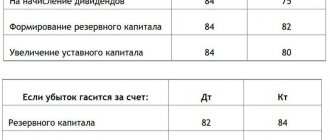

- The accountant must reflect the accrual of dividends according to Dt account. 84 in correspondence with account. 70 and count. 75, sub-account 75-2. This applies to both interim dividends and year-end dividends. If dividends are declared but not claimed, and their statute of limitations has expired, a reverse entry is made for their amount.

- By the final turnover of December, the amount of retained earnings should be taken into account according to the CT account. 84, the amount of uncovered loss - according to Dt account. 84. The amount of net profit or loss of the reporting period should be written off to the account. 84.

Important! The distribution of profit at the end of the period is an event after the reporting date, which indicates that after the reporting date conditions have arisen in which the enterprise carries out its business activities. In the reporting period for which profit should be distributed, no entries are made in accounting (neither in analytical nor in synthetic accounting). But in the next period, the accountant will already make an entry to properly reflect the event. This means that information on the account. 84 “Retained earnings (uncovered loss)” in the reporting period will be formed taking into account the decision made in the reporting year on the distribution of profits identified based on the results of the previous year.

Using the resulting retained earnings to modernize and improve the company's production will not lead to either a change in the indicator of line 1370 or changes in the balance of account 84. Let's find out why. The fact is that the formation in accounting of information about the purposes for which funds of retained earnings will be directed is carried out through the organization of analytical accounting for accounts. 84. In it, money from retained earnings that has not yet been used, and which it was decided to use to subsidize the modernization of production and any other events for the purchase or creation of new assets, can be divided. Costs incurred by an enterprise must be recognized in the reporting period in which they occurred, regardless of:

- time of their formation;

- presence/absence of a source of funds (various funds).

When preparing interim reporting, information from accounts 84 and 99 is used to fill out line 1370 for the reporting period. If the value that needs to be entered on line 1370 appears with a minus sign, it should be placed in parentheses to avoid confusion.

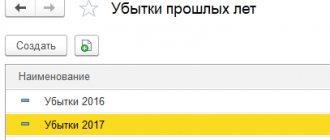

How retained earnings from previous years are displayed

Retained earnings from previous years are accumulated in account 84. The credit balance of this account is transferred to balance sheet line 1370.

Typically, there should be no movement in the debit of the account during the year, since the distribution of profits traditionally occurs at the end of the year after the annual meeting of the company's owners. But there is also a special case when debit 84 needs to be used during the year. To make sure that you did not miss this very transaction, get free access to ConsultantPlus and go to the Typical Situation.

For information on how data on retained earnings is generated for reflection in the balance sheet (final and interim), read the article “Procedure for compiling a balance sheet (example).”

Retained earnings of the reporting year

The credit balance at the end of the year according to accounting account 99 is net profit. But in addition to the financial result, this account also reflects some other indicators. You can learn which ones and how not to make mistakes when making transactions from the Typical Situation from K+, having received trial access to the system.

When reforming the balance sheet, it is written off to accounting account 84 (Dt 99 Kt 84) and constitutes retained earnings at the end of the reporting year.

Read about the reformation procedure in the material “How and when to reform the balance sheet?”.

In order to separate the indicators of retained earnings of the current (reporting) year from last year’s, some accountants allocate separate lines 1372 and 1372 in the balance sheet, which respectively reflect the retained earnings of the reporting period and previous years.

The use of retained earnings is the prerogative of the company's owners. And highlighting this financial indicator for different years in the balance sheet is primarily convenient for them. But it is worth keeping in mind that the retained earnings of the past year cannot be fully distributed without taking into account the company’s previous operating results.

IMPORTANT! It must not be allowed that the value of the company’s net assets, after transferring retained earnings of the reporting year for the payment of dividends, becomes less than the size of the company’s authorized capital even if there is a reserve fund. The caution applies to cases where uncovered losses were recorded in previous years. The decision to cover last year's losses from retained earnings of the reporting year is made exclusively by the owners of the company.

But retained earnings for previous years can be distributed by the participants/shareholders of the company not only at the end of the year, but at any time. The main thing is to hold a thematic meeting of all company owners and approve the appropriate decision.

Does an LLC have the right to make incentive payments to employees from retained earnings and how to formalize this, and are they taken into account when calculating the average salary? The answer to this question was prepared by labor inspector in the Nizhny Novgorod region V.I. Neklyudov. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

Line 1370, annual and interim reporting (balance sheet formula)

On page 1370, enterprise accountants reflect the amount of retained earnings or uncovered losses. The formulas by which the values to be entered in the line can be found differ depending on whether we are talking about interim or annual reporting.

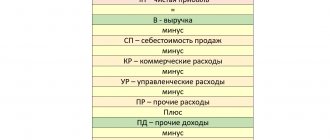

Balance sheet formula for filling out line 1370 for annual reporting:

Balance sheet formula for calculating the value of line 1370 for interim reporting:

To fill in line 1370, you can use the formula

if the following statements are true for the enterprise under study:

- at the beginning of the reporting period there is no retained profit (uncovered loss) from previous periods;

- During the current period, there were no disposals of previously overvalued fixed assets;

- There have been no distributions of interim dividends during the current year.

This is explained by the fact that the amount of retained earnings of the reporting period is equal to the amount of net profit of the reporting period (profit after deduction of tax payments). And the amount of the uncovered loss of the reporting period is the same as the amount of the net loss of the reporting period (loss after taxes). So, if the company does not have retained earnings or uncovered losses from previous periods, and no distribution of interim dividends was made during the reporting period, the indicator on line 1370 will be the same as the value on line 2400 (form No. 2).

Retained earnings: calculation formula

According to general accounting data, retained earnings are a company's net profit after taxes that can be distributed to the company's owners.

Based on global financial practice, retained earnings (hereinafter referred to as RR) are calculated using the following formula:

NPk = NPn + PE – Div,

Where:

NPk - NP at the end of the reporting year;

NPn - NP at the beginning of the reporting period;

PE - net profit remaining after accrual of income tax;

Div - dividends paid in the reporting year based on the NP of previous years.

If you do not have the NP value, then to calculate the NP you can use the following scheme:

- first calculate profit before tax (to determine it, calculate operating profit, which is defined as the difference between operating income and operating expenses);

- then subtract depreciation and interest costs from operating profit;

- Subtract tax from the resulting profit value.

To find out whether it is possible to see the amount of operating profit in the accounting statements, read the article “Which line is operating profit reflected in the balance sheet?”

Report on this indicator

To calculate retained earnings in the balance sheet of an enterprise, first of all you should pay attention to correspondent accounts and accounting entries that are made on account 84.

It must be remembered that in the balance sheet of the enterprise, the account of retained earnings corresponds with the above accounts. This means that accounting entries in this account can be carried out by transferring money from the enterprise according to settlement transactions with partners, stakeholders, personnel, increasing or decreasing all types of capital of the enterprise.

Since there is no accurate information about changes in the balance sheet of retained earnings, how to calculate this indicator, companies can make a decision on their own. For example, prepare a separate report called “Statement of Retained Earnings.” The purpose of this report is to describe changes in retained earnings for a given reporting period. This report has been prepared in accordance with applicable accounting standards such as GAAP, IND AS or IFRS.

This report reconciles beginning and ending retained earnings for the period. This report uses information such as net income for the current accounting period, opening balance of retained earnings, dividends distributed in the current period, etc.

The income statement may be published as a separate report or supplemented by a balance sheet or income statement.

Indicators for investors

When analyzing the financial condition of a company, investors pay attention to the use of retained earnings. If NP accumulates and is not put into circulation, this state of affairs should seem to suit investors, since they can count on significant dividends.

However, without investment in its activities, the company stops growing, and its income not only does not increase, but may also decrease (due to a drop in competitiveness, high wear and tear of equipment, and for other reasons related to the lack of investment). So a company that accumulates profits but does not invest in its activities cannot be attractive.

At the same time, a company that does not make a profit and does not pay dividends cannot interest investors at all.

The ideal option for investors is a company that invests the funds remaining after paying dividends in its development. Although the owners may decide not to pay dividends and direct the entire volume of NP into circulation.

Results

There is a separate line in the balance sheet to reflect retained earnings (profit remaining after the amount of income tax or net profit has been withdrawn from it). The figure entered into it corresponds to the amount of the entire net profit accumulated over the years of the company’s activity. During the reporting year, the value of retained earnings in accounting relating to this year can be seen in a separate accounting account. Dividends are paid out of net profit.

Sources: Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Capitalization of retained earnings

The company may also capitalize its retained earnings by issuing bonus shares. The remainder of retained earnings can be distributed as dividends or carried forward as retained earnings into the next accounting cycle. How to calculate the nominal price of bonus shares that need to be issued in order to capitalize retained earnings on the balance sheet? It's simple - you need to divide the amount of retained earnings subject to capitalization by the number of shares, resulting in the nominal price of the share.