Fixed assets in budget accounting - 2020-2021: introductory information

In accordance with paragraph 21 of Order No. 157n, the concept of “budget accounting of fixed assets” applies only to certain government organizations.

For example, government institutions, government agencies, extra-budgetary funds. In addition to the unified chart of accounts, a special chart of accounts must be used in budget accounting (Order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n). The remaining government institutions, maintaining accounting and tax accounting of fixed assets in 2020-2021, in addition to the unified chart of accounts, use charts of accounts approved by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n (budgetary institutions) or dated December 23, 2010 No. 183n (autonomous institutions) and other regulations.

For example, FSBU “Fixed assets”, approved. by order of the Ministry of Finance of Russia dated December 31, 2016 No. 257. ConsultantPlus experts explained what institutions should take into account when applying this standard. Get trial demo access to the K+ system and study the review material for free.

Read about the regulatory documents governing accounting in budgetary structures here .

In this article we will refer to Order No. 157n as the basis for budget accounting. From the beginning of 2022, public sector organizations must be guided by the new federal standard “Fixed Assets”, approved. by order of the Ministry of Finance dated December 31, 2016 No. 257n (hereinafter referred to as the Standard). These documents reveal the general principles of accounting for fixed assets, as well as the logic for drawing up transactions.

According to clause 8 of the Standard, in order to classify an asset as a fixed asset, the following criteria must be met:

- Property (with the exception of periodicals that make up the library collection of the subject of accounting) is classified as fixed assets, regardless of its useful life.

- The accounting entity predicts the receipt of economic benefits or useful potential from the use of the asset.

- The initial cost of property as an accounting object can be reliably estimated.

If an asset does not meet at least one of the above criteria, it is recorded in off-balance sheet accounts. Information about such material assets is disclosed in the financial statements.

NOTE! Fixed assets do not include objects classified as inventories in accordance with clause 99 of Order No. 157n. For example, fishing gear, gas-powered saws, etc.

Each inventory item as a unit of accounting for fixed assets must be assigned a number. And an inventory card is created for each object.

To account for fixed assets, a synthetic account 010100000 “Fixed Assets” is provided. The budget accounting account number consists of 26 digits, and only 18–26 digits are used in the accounting of the institution. Depending on the group and type of fixed assets, as well as the essence of their movement, the code in the 22–26 digits changes in the account number.

Below we consider the scheme for generating an accounting account number in a budgetary organization, and also decipher the category codes using an example. A detailed explanation of the categories can also be found in clause 21 of the instructions to the chart of accounts (order No. 157n).

| Account digit number | ||||

| 18 | 19-21 | 22 | 23 | 24-26 |

| Financial support | Accounting object | Accounting object group | Type of accounting object | Type of receipts, disposals of an accounting object |

| Example: account 110118310 “Increase in the value of other fixed assets - real estate of the institution” | ||||

| 1 | 101 | 1 | 8 | 310 |

| 1 - at the expense of the budget | 101—fixed assets | 1—real estate | 8 - other fixed assets | 310 - increase in OS cost |

Read about creating a working chart of accounts in a budget organization here .

Important rules for writing off fixed assets in budgetary organizations

The set of rules for writing off the main balance is quite broad; observing them is not as difficult as it seems at first glance. They are regulated at the level of current legislation. They should also be studied in advance. With minimal experience, it is necessary to consider real life examples in more detail.

To write off, you need solid reasons for this. Here are some objective reasons for this procedure:

- If the OS has lost some important properties, it cannot function properly;

- The OS no longer finds its use due to its destruction or complete loss.

To avoid many difficulties, you need to study all the important points of this process.

You need to consider the following questions in advance:

- Required documentation;

- Creating the required order;

- Step-by-step instructions;

- Documentary reflection by postings.

Accounting for fixed assets upon admission to budgetary institutions

OS are received by institutions at actual cost, which includes (clause 15 of the Standard):

- cost paid to the supplier;

- the cost of construction work when creating the facility;

- the cost of all costs required to create the OS;

- fare;

- amounts for related services;

- customs duties;

- as well as other costs associated with the purchase/creation of the OS.

NOTE! If the fixed asset will be used in budgetary activities, then the amount of input VAT is included in the initial cost.

- The receipt of fixed assets is reflected in the synthetic account 0010600000 “Investments in non-financial assets”. For example, in a budgetary institution, according to order 174n, it has the following groups of accounts: 010610000 “Investments in real estate”;

- 010620000 “Investments in particularly valuable movable property”;

- 010630000 “Investments in other movable property”;

- 010640000 “Investments in financial lease objects”;

- 010660000 “Investments in the rights to use intangible assets”;

- 010690000 “Investments in the grantor’s property.”

In the accounting of fixed assets, to reflect receipts, separate analytical accounts are allocated, in 24–26 digits of which code 310 is used for each type of fixed assets. This code indicates an increase in the cost of the OS.

Let us consider in the table the main entries for accounting for the receipt of fixed assets using the example of a budgetary institution (order 174n).

| Wiring | Description of posting in fixed asset accounting |

| Dt 010600000 “Investments in non-financial assets” Kt 020800000 “Settlements with accountable persons” (020831660), 030200000 “Settlements for accepted obligations” (030231730) | Purchasing an OS |

| Dt 010600000 “Investments in non-financial assets” Kt 030200000 “Settlements for accepted obligations”, 020800000 “Settlements with accountable persons”, 010400000 “Depreciation”, 030300000 “Settlements for payments to budgets”, 010500000 “Inventories” | Creating an OS object yourself |

| Dt 010110310 “Fixed assets - real estate of the institution” Kt 010611310 “Investments in real estate” | Commissioning of the constructed building |

| Dt 010100000 “Fixed assets” (010110310, 010120310, 010130310) Dt 010600000 “Investments in non-financial assets” | Commissioning of purchased, manufactured household goods. OS way |

| Dt 010100000 “Fixed assets” (010110310, 010120310, 010130310) Kt 030404310 “Internal departmental settlements for the acquisition of fixed assets” | The OS object was received from another budget institution that has the same budget resource manager |

| Dt 010100000 “Fixed assets” (010110310, 010120310, 010130310) Kt 040110190 “Income of the current financial year” | Other gratuitous receipts of fixed assets |

For information on how the accounting policy of a budgetary institution is formed, read the material “An example of an accounting policy in a budgetary institution (nuances)” .

Reflection in the accounts of acquisition and receipt of fixed assets

Fixed assets are recorded in accounting registers at their original cost. It includes the costs of purchasing and constructing facilities, consulting services, delivery and other costs required to bring the facility into a state of readiness for operation, taking into account the VAT charged. Accounting in budget accounting accounts is carried out in rubles and kopecks.

Budgetary institutions can, in addition to budget financing, receive income from extra-budgetary sources, including from entrepreneurship, and VAT reimbursement is provided.

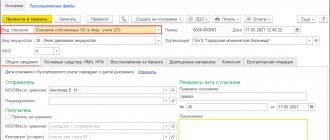

Example. The budgetary institution paid for and purchased equipment worth 236,000 rubles from budget funding. (of which 36,000 rubles are VAT) Delivery costs incurred by the transport organization amounted to 11,800 rubles. (VAT – 1800 rub.). The equipment has been put into operation.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 110631310 | 130231730 | Receiving equipment | 236000,00 | Acceptance and transfer certificate f.No. OS-1 budget. |

| 110631310 | 130222730 | Reflection of equipment delivery costs | 11800,00 | Contract for the provision of transport services |

| 110434310 | 110631410 | Commissioning of equipment | 247800,00 | Inventory card f.No. OS-6 budget. |

Depreciation of fixed assets

Government institutions charge depreciation of fixed assets linearly over their service life. There is also a rule of monthly accruals in the amount of 1/12 of the annual amount. Depreciation charges begin to be reflected in the month following the month the facility is put into operation.

Read about the practical application of the linear method in the article “Linear method of calculating depreciation of fixed assets (example, formula)” .

The useful life is determined based on:

- the expected period of receipt of economic benefits;

- recommendations contained in the manufacturer's documents;

- warranty period for use of the object;

- other methods described in clause 35 of the Standard

When calculating depreciation of fixed assets in budget accounting, the following procedure is applied:

- for an OS object worth over 100,000 rubles. depreciation is accrued in accordance with calculated depreciation rates;

- for an OS object worth up to 10,000 rubles. inclusive, with the exception of library collection objects, depreciation is not accrued, the cost of the object is immediately written off as expenses, then the fixed assets are taken into account in off-balance sheet account 21;

- for a library fund object worth up to 100,000 rubles. inclusive, depreciation is charged in the amount of 100% of the original cost when it is put into operation;

- for another fixed asset costing from 10,000 to 100,000 rubles. inclusive, depreciation is charged in the amount of 100% of the original cost when it is put into operation.”

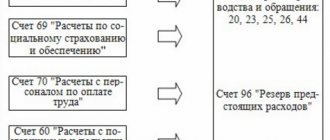

Depreciation is reflected in the synthetic account 010400000 “Depreciation”.

In a budgetary institution, by order 174n, analytical accounts ending in 410 are used to record entries for depreciation charges, which are used in the following transaction: Dt 040120271 “Costs for depreciation of fixed assets and intangible assets”, 010900000 “Costs for the manufacture of finished products, performance of work, services" (010960271, 010970271, 010980271, 010990271) Kt 010400000 "Depreciation" (010410410, 010420410, 010430410, 010440410, 010460410, 0104 90410).

Operations for calculating depreciation on operating lease accounting objects are reflected in the debit of account 040120224 “Expenses for rent for the use of property”, 040120229 “Expenses for rent for the use of land plots and other isolated natural objects”, the corresponding analytical accounts of account 010900000 “Expenses for production of finished products, performance of work, services" (010960224, 010960229, 010970224, 010970229, 010980224, 010980229) and the credit of the corresponding analytical accounts of account 010440000 "Depreciation of rights to use assets".

Accounting for disposal of fixed assets

To account for fixed assets upon their disposal, separate analytical accounts of account 010100000 “Fixed Assets” are also used, ending with 410 and indicating a decrease in the value of the corresponding fixed assets.

For a selection of practical recommendations for writing off certain types of fixed assets in the accounting of public sector employees, see the analytical review from ConsultantPlus experts. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure. And in this publication you will find a sample order for writing off fixed assets in a budget institution.

Let us consider in the table the main entries for accounting for the disposal of fixed assets using the example of a budgetary institution (order 174n).

| Wiring | Description of posting in fixed asset accounting |

| Dt 040120271 “Depreciation costs of fixed assets and intangible assets”, 010900000 “Costs of manufacturing finished products, performing work, services” (010960271, 010970271, 010980271) Kt 010100000 “Fixed assets” (010110410, 010120410, 010130410)) Dt 21 “Fixed assets worth up to 10,000 rubles inclusive in operation” | Commissioning of an OS costing up to 10,000 rubles. |

| Dt 040120281 “Expenses on gratuitous transfers of a capital nature to state (municipal) institutions”, 040120251 “Expenditures on gratuitous transfers to the budgets of the budget system of the Russian Federation” Kt 010100000 “Fixed assets” (010110410, 010120410, 010130410) | Free transfer of an object (at book value) |

| Dt 010400000 “Depreciation” (010410410, 010420410, 010430410) Kt 010100000 “Fixed assets” (010110410, 010120410, 010130410) Dt 040110172 “Income from operations with assets” Kt 010100000 “Fixed assets” (010110410, 010120410, 010130410) | OS sales |

Step by step instructions

There is the following accepted algorithm for sequential decommissioning of the OS:

- Formation of a special commission - it is created for the purpose of implementing various procedures related to the OS (implementation, any other alternatives);

- Summing up the activities of the created commission is the creation of special documentary acts, on the basis of which the necessary write-off of fixed assets is formed.

The written write-off document must reflect the following points:

- Current date of commissioning of the production facility;

- The exact date of receipt of the technical object at the enterprise;

- The exact cost of a technical object is the original, revalued;

- Amount to be charged for depreciation of the object;

- Estimated service life;

- Actual period of technical use;

- Current grounds for writing off fixed assets.

If fixed assets are written off due to the occurrence of a certain emergency, then an additional act must be attached to the main documentation, which will reflect detailed information about the current incident and the extent of these actions. If theft has occurred or certain damage has been caused to the enterprise, then you must provide a copy of the criminal case initiated or documentation of the adoption of certain measures to protect the personal interests of the institution and compensate for the damage caused; as well as a copied order regarding the perpetrators, a copy of an important certificate on the necessary compensation for damage caused by persons called guilty of committing a certain theft.

In order to obtain consent to write off any property of a budgetary account from the manager of budget funds, it is necessary to create a special commission and provide the managers with a documented need to write off the property. The formed commission performs the following functions:

- Carrying out a complete inventory of existing property;

- Carrying out a detailed inspection of the property;

- Establishing specific reasons for writing off;

- Evaluates the further economic feasibility of using the property;

- As a result, an official act of writing off funds is drawn up.

Based on the results of its productive work, the special commission draws up a detailed protocol, to which are added inventory reports for assessing the technical condition, write-off acts and other important documents. When writing off a car, an assessment report from traffic police may be required.

Results

Budgetary accounting of fixed assets has a complex structure of accounts and their coding.

However, the instructions listed in the article contain detailed explanations and lists of possible entries that can help the accountant. Maintaining budgetary accounting of fixed assets is strictly regulated. All movements of fixed assets must be documented in primary documents and reflected in accounting by accounting entries. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to draw up an act correctly

Today, the act of writing off fixed assets can be written in any form, however, most enterprise employees, in the old fashioned way, prefer to use previously generally applicable mandatory forms in their work. Their advantage is obvious: there is no need to rack your brains over the structure and content of the document, since all the necessary positions are indicated in it. Such unified forms also include form OS-4. This act can be filled out both when writing off one object or several at once.