Accounting is a specific activity of specific structures of any organization, which is aimed at accounting for all internal and external business transactions, settlements with counterparties and calculating the property status of a legal entity. Accounting is needed not only to submit reports to the tax office, but also to maintain the proper functioning of the enterprise. The work of accounting is impossible without the use of special features. Accounting accounts stand out prominently among them. They are special accounting positions in which all transactions and data on the condition of the property are recorded. This process is aimed at grouping and accounting for business transactions that are homogeneous in economic content, their sources and final results. Among the large number of accounts, there is account number 90. It stores data on sales, expenses and income of the organization. The article will tell you what accounting account 90 is, what revenue is, which account reflects income and expenses, how it corresponds with other registers, passive or active account 90.

Account Description

Account 90 “Sales” is a special register that stores and summarizes data on the expenses and income of a legal entity associated with ordinary activities. It is also used to determine the financial result of this activity. Based on the turnover of a particular subaccount, it may be classified as passive-active. This may mean that it can fall into both the Asset and Liability of accounting.

The work of accounting is based on the use of various accounts

When recognized in accounting, the amount of income from the sale of goods, provision of services or performance of work is reflected in the credit of accounting account 90 and the debit of account 62 “Settlements with buyers and customers”. At the same time, the cost of inventory, services or work is written off from Kt 43 of the “Finished Products” account, 41 “Goods”, 20 “Main Production” and others in Dt 90 of the “Sales” special account.

For legal entities that are engaged in the production of agricultural products, according to Kt 90, the revenue from the sale of these products, corresponding to account 62, can be reflected, according to Dt - the planned cost of production. The latter is determined during the reporting year, since the actual one may not yet be identified.

One of the uses of 90 accounting is to determine the results of financial activities for the reporting period

Analytical accounting for special account 90 is carried out separately for each criterion. Among them: inventory items sold, products sold, work performed, services provided and much more. Moreover, analytics on this special account can be carried out by sales regions and other areas that are necessary for the effective management of the organization. For reports, SALT and special account cards are used.

Important! The planned cost of products sold and the amount of differences between the planned and actual costs are written off in Dt 90 “Sales” in conjunction with other accounting accounts in which the products were recorded.

For legal entities engaged in retail trade and maintaining inventory records at sales prices, Kt 90 “Sales” reflects the sales value of products, and Dt - the accounting value of products, corresponding with account 41 “Goods” and at the same time reversing the amount of discounts on sold inventory items (by contacting special account 42 “Trade margin”).

Determining the financial result for special account 90 through the formation of a balance sheet

Accounting for finished products

The manufactured products at any enterprise go through several stages: production, movement and sales. Production takes place in the workshop, then the GP moves from the workshop to the warehouse, and then goes to the buyer.

The production stage is the most important, since at this stage the cost of production is formed. It can be actual - calculated based on actual costs incurred, or normative - calculated based on write-off rates.

Accounting for finished products at actual cost

In this case, the cost of the GP is determined by the actual production costs incurred. When releasing, the accountant makes the following entry:

Dt 43 Kt 20 / 23 / 29—reflects the release of finished products

On account 20 “Main production”, all actually incurred costs are collected in the form of:

- spent raw materials - count 10;

- wages of production personnel - account 70;

- insurance premiums from wages of production personnel - account 69;

- depreciation of equipment used in production - account 02;

- services of third parties - count 60.

In addition, auxiliary production costs and defects may be written off on finished products.

In accordance with clause 23 of FSBU 5/2019, the real cost of production includes:

- material costs;

- labor costs;

- insurance contributions from salary;

- depreciation;

- other costs.

At the same time, in accordance with clause 26 of FSBU 5/2019, it is prohibited to include in the actual cost:

- costs resulting from natural disasters, fires, accidents, etc.;

- impairment of assets, even if they were used in production;

- administrative expenses not related to production;

- storage costs if storage is not part of the production cycle;

- advertising and promotion costs;

- and other costs that do not affect production.

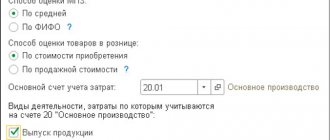

Accounting for finished products at planned (standard) cost

Planned cost is the estimated cost of finished products for the planned period. To calculate it, write-off rates for raw materials, supplies, fuel, labor costs, and so on are used. The method is allowed to be used in mass or serial production (clause 27 of FSBU 5/2019).

The cost price according to the standard is recorded on account 40 “Output of products (works, services)”. In this case, when releasing products, the accounting department makes the following entries:

Dt 43 Kt 40 - manufactured products are accounted for at standard cost

And then they build wiring to account for the actual cost:

Dt 40 Kt 20 - manufactured products are accounted for at actual cost

The main difficulty of such accounting is that the actual and planned costs usually do not coincide. Therefore, the balance on account 40 is:

- debit - if the actual cost is higher than the planned cost;

- credit - if the actual cost is lower than planned.

At the end of the month, the balance of account 40 is written off using one of the entries, depending on what balance is formed:

Dt 90.2 Kt 40 - “overspend” is written off as expenses (debit balance)

Dt 90.2 Kt 40 - “savings” are reversed (credit balance)

Important! Account 40 has no balances at the end of the month.

To account for cost according to the standard, it is not necessary to use account 40. It is enough to open a sub-account “Finished products at accounting prices” to account 43. Product output is reflected in the following entries:

Dt 43.GP at accounting prices Kt 20 / 23 - products are accounted for at accounting cost

At the end of the month, the difference between the two types of cost is determined, which is reflected in the subaccount “Deviation of actual cost from accounting cost.” And then they build one of the wiring:

Dt 43. Deviation of actual cost from accounting Kt 20 / 23 - if the actual cost is higher (overspend)

Dt 43. Deviation of the actual cost from the accounting cost Kt 20 / 23 - reversal for the amount of excess of the planned cost over the actual (savings)

Purpose

Special account 90 is used to reflect revenue and cost for:

- Various types of finished products and semi-finished products produced by the enterprise itself;

- Carrying out works and providing services of industrial specifications;

- Performing work and providing services of non-industrial specifications;

- Purchase of products purchased for complete sets;

- Carrying out construction, installation, design, research and geological exploration work;

- Inventory assets;

- Providing services for cargo and passenger transportation;

- Carrying out transport, forwarding and loading and unloading operations;

- Providing communication services;

- Providing for the use of their excise taxes upon concluding contracts for a fee for a certain time;

- Granting rights to patents of inventions, created industrial designs and any other intangible property rights for a fee;

- With the direct participation of a legal entity in the creation of authorized capitals of other legal entities and entrepreneurs.

A diagram explaining the operation of special account 90 for debit and credit

Annual account closure

At the end of the year, account 90 must be closed so that the balance for each subaccount becomes zero. The accounting entries for this operation will look like this:

- Dt90.1 – Kt90.9 – resetting the final balance for subaccount 90.1;

- Dt90.9 – Kt90.2 – resetting the final balance on subaccount 90.2;

- Dt90.9 – Kt90.3 – resetting the final balance on subaccount 90.3.

As a result of all operations, the final balance in subaccount 90.9 will become zero. From January 1 next year, account 90 will be reopened with a zero balance for each of the subaccounts.

Closing

The process of closing account 90 is one of the steps in generating the financial and economic result for the reporting period. Most often this is a month or reporting year. The peculiarity of this register is that at the end of the month there will be no balance according to synthetic accounting. Upon analysis, it is noticeable that amounts are accumulated in subaccounts 90 of the special account, which are written off only in December before the start of the new accounting year.

Important! Based on the results of closing an accounting period of one year, there cannot be a balance on the 90th accounting account “Sales” and its subaccounts. If it is, then this is an obvious error in the calculations.

Every month, the accounting department reports profit and loss indicators. This is done by closing special account 90. The transactions made will not affect the accumulated balances, which will remain until December 31. They will only affect the synthetic account.

First of all, determine the formula: Financial result = Revenue - Cost. The result is calculated over a period of one month. Revenue represents income received on loan 90.01. The cost includes the costs of performing operations described on debit subaccounts.

An example of a table that helps you understand how the 90 special account for debit and credit works

If a positive difference is obtained, then closing 90 accounts at the end of the reporting period will show a profit. A negative value will reflect the unprofitability of operations in this period.

The special account itself is closed as follows:

- If the FR is profitable, then the entry Debit 90.09 Credit 99 is created;

- If the financial account is unprofitable, then the entry Debit 99 Credit 90.09 is created.

Another option involves working with subaccounts:

- 90.1 The final balance is calculated. Since it is credit, then in order for it to be reset to zero, you need to post Debit 90.1 Credit 90.9;

- 90.2 The final balance is calculated. Since it is a debit, then in order for it to be reset to zero, you need to post Debit 90.9 Credit 90.2;

- 90.3 The final balance is calculated. Since it is a debit, then in order for it to be reset to zero, you need to post Debit 90.9 Credit 90.3;

- 90.9. If all of the above entries were completed successfully, then when calculating the final balance at 90.9 it will be equal to zero;

- Account 90 “Sales” is closed.

Account 90 is closed independently or when its subaccounts are closed

Determination of financial results for core activities

Postings to subaccounts of the 90th account are made throughout the year, accumulating the amounts of income and expenses. This approach makes it easy to generate the appropriate lines in the income statement. To obtain information about the organization's performance for the month, the accountant calculates expenses (turnover on the debit of the 90th account) and income (turnover on the credit of the 90th account). The difference between these values is profit or loss for the month; this value is reflected by posting Dt 90.9 Kt 99 when making a profit or Dt 99 Kt 90.9 when receiving a loss.

As a result, by the end of the year, a final balance will be formed on all subaccounts used by the organization, which must be reset to zero. For subaccounts with a debit balance, an entry for its full amount is made on the credit of this subaccount and the debit of subaccount 90.9, for subaccounts with a credit balance - vice versa:

Dt 90.1 Kt 90.9

Dt 90.9 Kt 90.2

Dt 90.9 Kt 90.3, etc.

Sales analysis is one of the main aspects that must be taken into account when developing an organization's marketing policy. Therefore, it is important to set up the correct analytics for account 90. Most often, sales analysis is carried out by type of product, by geographic location, by counterparty, by structural division of the organization, etc. Analytical accounting is organized depending on the needs of users for accounting information.

Subaccounts

Account 90, the subaccounts of which can be issued in connection with the specifics of the work of a legal entity, is aimed at summarizing data on expenses and income. The following subaccounts can be opened for it:

- 90.1 “Revenue”, the account of which takes into account the receipts of all assets recognized as revenue;

- 90.2 “Cost of sales”, taking into account the cost of sales for which revenue is recognized;

- 90.3 “VAT”, taking into account the amount of value added tax. It is due to be received from the client;

- 90.4 “Excise taxes”, taking into account the amounts of excise taxes. They are included in the final price of goods and materials;

- 90.9 “Profits and losses from sales”, taking into account the financial and economic results for the reporting period.

Important! Legal entities that pay export duties can open a subaccount 90.5, which takes into account the amount of export duties. In addition, separate sub-accounts can be established by the organization itself, based on the specifics of its activities. To do this, the list of subaccounts must be approved in the Chart of Accounts in the Accounting Policy.

Accounting for the process of selling inventory can be carried out in detail using subaccounts

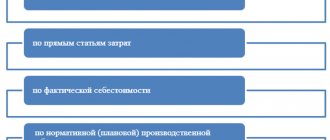

Accounting for sales of finished products

After the production is released, a balance is formed on account 43. This is the amount of finished products that the company has at its disposal and which can be sold. During implementation, the accounting department makes the following entries:

Dt 62 Kt 90.1 - income received from the sale of products

After this, the accountant writes off the cost of goods sold:

Dt 90.2 Kt 43 - cost of products sold is included in expenses

The cost of identical products may differ from each other. In order to determine at what cost to write off finished products upon sale, use one of three methods.

Write-off of finished products at the cost of each unit

This method is used for products that cannot replace each other. Therefore, upon sale, the cost of a specific unit is written off.

Write-off of product costs at average cost

To calculate the average cost per unit of production, the total cost of the GP is divided by the quantity. The average cost can be recalculated at regular intervals or as each new batch of products is released.

For example, within 3 days 300 loaves of bread were produced with different costs:

- on 1 day - 100 rolls, cost of 1 roll - 7 rubles;

- on day 2 - 100 rolls, cost of 1 roll - 6.8 rubles;

- on day 3 - 100 rolls, cost of 1 roll - 7.1 rubles.

The total cost of production is 2,090 rubles. Let's say we sold 230 buns.

We calculate the average unit cost using the formula:

(100 * 7 + 100 * 6.8 + 100 * 7.1) / (100 + 100+ 100) = 2,090 / 300 = 6.97 rub.

We calculate the cost of 230 rolls using the formula:

230 * 6.97 = 1,603.1 rub. — written-off cost.

Write-off of cost using the FIFO method

FIFO - first in, first out (First In, First Out). First of all, the cost of finished products that were previously produced is written off.

For example, within 3 days 300 loaves of bread were produced with different costs:

- on 1 day - 100 rolls, cost of 1 roll - 7 rubles;

- on day 2 - 100 rolls, cost of 1 roll - 6.8 rubles;

- on day 3 - 100 rolls, cost of 1 roll - 7.1 rubles.

The total cost of production is 2,090 rubles. 230 buns were sold. The cost price for write-off is calculated using the formula:

100 * 7 + 100 * 6.8 + 30 * 7.1 = 700 + 680 + 213 = 1,593 rub. — written-off cost.

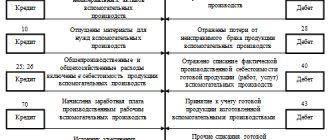

Correspondence with other accounts

The correspondence of account 90 in the accounting department is quite extensive, both in debit and credit. According to Dt he corresponds with:

- 11 — Animals for growing and fattening;

- 20 — Main production;

- 21 — Semi-finished products of own production;

- 23 - Auxiliary production;

- 26 — General business expenses;

- 29 — Service industries and farms;

- 40 — Output of products (works, services);

- 41 - Goods;

- 42 — Trade margin;

- 43 — Finished products;

- 44 — Selling expenses;

- 45 — Goods shipped;

- 58 — Financial investments;

- 68 — Calculations for taxes and fees;

- 79 — Intra-economic calculations;

- 99 - Profit and loss.

The correspondence of the account in question is extensive due to the commonality of operations in it.

According to Kt, special account 90 and its subaccounts have the following correspondence:

- 46 — Completed stages of unfinished work;

- 50 - Cash desk;

- 51 — Current accounts;

- 52 — Currency accounts;

- 57 — Transfers on the way;

- 62 — Settlements with buyers and customers;

- 76 - Settlements with various debtors and creditors;

- 79 — Calculations within the subject;

- 98 - Deferred income;

- 99 - Profits and losses.

The main stages of closing accounts when preparing interim or annual financial and economic reporting

Accounting accounts for accounting of finished products

Information about manufactured products is stored in account 43 “Finished products”.

This account is used by manufacturing enterprises that independently create products. In this case, the cost or complexity of the product does not play a role. Finished products for one company may be raw materials for another. For example, for a flour mill, flour is a finished product. But for a gingerbread factory it is raw material.

Important! Trade enterprises do not use account 43. To account for goods for resale, they use account 41 “Goods”.

Postings

Typical postings for account 90:

- Debit 62 Credit 90.1. Recognition of revenue from sales of inventory items, invoices and invoices;

- Debit 90.2 Credit 20, 26, 41, 42, 43. Write-off of cost of sales, Cost calculators;

- Debit 90.3 Credit 68. Accrual of VAT on sales, Invoice;

- Debit 90.4 Credit 68 Accrual of excise taxes on sales, Invoice;

- Debit 99 Credit 90.0 Reflection of unprofitable financial results from the sale;

- Debit 90.9 Credit 99 Reflection of profitable financial result from the sale.

A typical entry for accounting account 90 is a reflection of the result of financial activity

. Thus, a complete description of account 90 in accounting was given. It is a register in which generalized data on transactions related to expenses and income from the ordinary activities of an enterprise or organization is placed, as well as the financial result determined from them. Ordinary activities mean the sale of goods, provision of services and performance of work. Often, revenue and cost for various types of activities are displayed on account 90.

Examples of transactions using 90 accounts

Example 1

Artel Group LLC sold two batches of goods in May 2016. The cost of the 1st batch amounted to 90,000.00 rubles, revenue - 130,000.00 rubles. The cost of the 2nd batch was 96,000.00 rubles, the revenue amounted to 148,000.00 rubles. VAT accrued for the 1st batch - 19,830.42 rubles, for the 2nd batch - 22,576.27 rubles.

We calculate the sales result for the month: credit turnover (revenue), 130,000 + 148,000 minus debit turnover (VAT + cost), 19,830.42 + 22,576.27 + 90,000 + 96,000, it turns out 49,593.31 rubles.

The following entries were made for account 90 to reflect the sales results of Artel Group:

| Dt | CT | Operation description | Amount, rub. | Document |

| 62 | 90.1 | Reflection on the implementation of the 1st batch | 130 000,00 | Act |

| 90.3 | 68 | VAT accrual on sales | 19 830,42 | SF issued |

| 90.2 | 43 | Reflection of the cost of the 1st batch | 90 000,00 | Accounting information |

| 62 | 90.1 | Reflection of the implementation of the 2nd batch | 148 000,00 | Act |

| 90.3 | 68 | VAT calculation | 22 576,27 | SF issued |

| 90.2 | 43 | The cost of the 2nd batch is reflected | 96 000,00 | Accounting information |

| 90.9 | 99 | We reflect the sales result (profit) for May | 49 593,31 | Accounting information |

Analysis of account 90: sale of finished products, goods in 2022

Account 90 “Sales” is intended to reflect transactions related to the sale of finished products, goods, and services. Accounting account 90 is complex and has a number of sub-accounts. How are transactions recorded when selling on account 90? How is account 90 closed at the end of the year? We will conduct a detailed analysis of account 90, analyze the implementation process using the example of the sale of finished products and goods, as well as accounting entries for account 90.

As mentioned above, account 90 in the accounting department has several subaccounts; below are the main subaccounts used to reflect sales.

Main subaccounts to account 90

1 – the loan reflects revenue from the sale of goods and products;

2 – the cost of what we sell is entered in debit;

3 – the debit reflects VAT accrued on sales;

9 – at the end of the month, results are summed up in this subaccount: the financial result from sales for the month is calculated, profit is recorded in debit, and loss is recorded in credit.

Let us remember that an accounting account is a two-sided table, the left side of which is called debit, and the right side is called credit. The count of 90 can be represented schematically as follows:

The main distinctive feature of this account is that it closes completely (to zero) only at the end of the year. Throughout the calendar year, a balance accumulates in each subaccount from month to month. At the end of the year, each sub-account is closed, and the total financial result for the year is calculated.

Video - What you need to know about counting 90 :

Account 90 in accounting

The financial result from sales from the main activity is reflected on the account monthly. During the year, the account accumulates the financial result of the enterprise's main activities.

The movement pattern for the analytical subaccounts of account 90 is reflected in the table:

The main activity of the enterprise can be:

- sale of finished products and semi-finished products (own production);

- services of a non-productive or production nature;

- sale of purchased goods;

- construction, installation, research, geological exploration, etc.;

- rent;

- transport services;

- transportation of passengers;

- other.

Subaccounts of account 90

Closing a synthetic account is provided at the expense of your own analytical accounts. Some of them are active, some are passive. The difference between the active and passive balance is closed to account 90.09.

Sub-accounts can be opened for account 90:

- 90.1 - “Revenue”. The revenue subaccount reflects the amount of proceeds from sales. This is a passive subaccount;

- 90.2 - “Cost of sales”. Active subaccount reflects the cost of goods sold;

- 90.3 - “VAT on sales”. The VAT account is also active, in correspondence with account 68 it reflects the amount of VAT accrued to the budget;

- 90.4 - “Excise taxes”. The active excise subaccount reflects excise taxes included in the amount of goods sold;

- 90.9 - “Profit (loss) from sales.” The subaccount acts as a regulator; all other subaccounts are closed to it.