To understand exactly what expenses can be classified as representative expenses, let us turn to clause 2 of Art. 264 Tax Code of the Russian Federation. It defines and provides an exhaustive (closed) list of entertainment expenses.

So, representative expenses include the taxpayer’s expenses for the official reception and (or) service of representatives of other organizations participating in negotiations in order to establish and (or) maintain mutual cooperation, as well as participants who arrived at meetings of the board of directors (board) or other governing body of the taxpayer , regardless of the location of these events. These are the costs for:

- holding an official reception (breakfast, lunch or other similar event) for these persons, as well as for officials of the taxpayer organization participating in the negotiations;

- transport support for the delivery of these persons to the venue of the representative event and (or) meeting of the governing body and back;

- buffet service during negotiations;

- payment for the services of translators who are not on the taxpayer’s staff to provide translation during entertainment events.

Representative expenses do not include expenses for organizing entertainment, recreation, prevention or treatment of diseases.

Attention!

The concept of entertainment expenses is used for tax purposes only. In accounting, entertainment expenses are taken into account as expenses for ordinary activities by debiting expense accounts 20, 26, 44 in correspondence with the accounts of the “Calculations” section (60, 71, 76). They are not standardized and are included in expenses in the amount of actual costs incurred.

Despite the detailed definition of entertainment expenses in the Tax Code of the Russian Federation, in practice questions arise when qualifying some expenses as entertainment expenses.

Let us consider in more detail the factors influencing the recognition of expenses as representative expenses.

What is included in the concept of “representation expenses” according to the norms of the Tax Code of the Russian Federation?

The norms set out in paragraph 2 of Art. 264 of the Tax Code of the Russian Federation, suggest the allocation of a special category of expenses among the enterprise’s expenses - entertainment expenses (PR). They can be presented:

- costs associated with organizing official events (for example, business breakfasts, meetings, negotiations ), servicing invited persons within the framework of these events;

- transport and catering expenses aimed at supporting official events;

- payment for services provided by a freelance translator, if the company organizing the event asked him for help.

Entertainment expenses are the above expenses that reduce taxable income and are incurred by the taxpayer to organize the reception of representatives of other organizations who participate in negotiations in order to establish and maintain cooperation, as well as to receive participants who arrive at a meeting of the governing body of the company.

The concept of entertainment expenses for the purpose of reducing the tax base for income tax does not include negotiations with individuals and individual entrepreneurs. However, there are letters from the Ministry of Finance in which the department allows the possibility of classifying the costs of negotiations with clients - individuals as entertainment expenses (see letters dated 07/05/2019 No. 03-03-06/1/49848, dated 06/05/2015 No. 03-03 -06/2/32859, etc.).

Taxpayers reducing their income tax base by the amount of entertainment expenses very often leads to disputes with tax authorities. Get trial access to the Tax Guide from ConsultantPlus and find out for free when entertainment expenses can be justified, and which expenses are better spent on the company’s net profit.

Entertainment expenses and income tax

Entertainment expenses - how are these expenses included in the calculation of income tax? The main feature of PR is that they can be used by a company operating on a special tax base to reduce the tax base. But not completely: in paragraph 2 of Art. 264 of the Tax Code of the Russian Federation establishes a limit for their use for the stated purposes, amounting to 4% of labor costs in the corresponding tax period.

How to achieve the most effective use of entertainment expenses in order to optimize the tax burden on an enterprise, read this article.

The list of labor costs is defined in Art. 255 Tax Code of the Russian Federation. It is closed, as is the list of entertainment expenses itself, which is given in the Tax Code of the Russian Federation.

For profit tax purposes, entertainment expenses must meet the criteria specified in paragraph 1 of Art. 252 Tax Code of the Russian Federation:

- be economically feasible;

- be documented.

The main sign of the economic feasibility of PR is its implementation for the purposes defined in clause 2 of Art. 264 of the Tax Code of the Russian Federation, that is, for the purpose of establishing or maintaining business relations between a taxpayer company and its business partners. We’ll look at how to document hospitality expenses a little later, but now let’s look at examples of expenses that organizations sometimes mistakenly include as hospitality expenses.

What is not included in the organization's entertainment expenses?

Some organizations include in the expenses under consideration those expenses that are associated with official events, but from the point of view of the Tax Code of the Russian Federation are not classified as representational. In particular, they cannot be classified as representative, based on the provisions of paragraph 2 of Art. 264 Tax Code of the Russian Federation:

- expenses for organizing entertainment for guests;

- Providing medical services to guests.

Entertainment expenses - how not to exceed these expenses by attributing them to unlawful expenses? In general, when determining the list of PR, you can rely on a simple rule according to which expenses should not be classified as representative expenses if:

1. They are not directly listed in paragraph 2 of Art. 264 Tax Code of the Russian Federation.

2. They are not allowed to be included in entertainment expenses by clarifications of the Federal Tax Service or the Ministry of Finance.

Thus, the letter of the Ministry of Finance of the Russian Federation dated August 16, 2006 No. 03-03-04/4/136 states that the purchase of souvenirs for guests of an official event should not be considered as PR. However, for souvenirs with the symbols of the organization, the Federal Tax Service and the courts of Moscow and the region make an exception (see letter of the Federal Tax Service of Russia for Moscow dated April 30, 2008 No. 20-12/041966.2, resolution of the Federal Antimonopoly Service of the Moscow District dated January 31, 2011 No. KA-A40/17593 -10 in case No. A40-55061/10-99-250, FAS Moscow District dated October 5, 2010 No. KA-A41/11224-10 in case No. A41-18513/08).

The letter of the Ministry of Finance dated December 1, 2011 No. 03-03-06/1/796 indicates the illegality of writing off expenses for an entertainment program (buffet table, boat, artists) to PR, which was organized after the official part of the event.

Costs incurred as part of events that are not of an official nature, for example, an informal dinner with partners in a restaurant cannot be classified as PR costs (letter of the Federal Tax Service in Moscow dated December 23, 2005 No. 20-12/95338).

Is it possible to include expenses for alcohol as part of the entertainment package? Find out here.

How are the differences between accounting and tax accounting taken into account?

The procedure for tax accounting of entertainment expenses is regulated by Art. 264 Tax Code of the Russian Federation. The list of these expenses is closed, and the amount is strictly limited. That is, such expenses reduce taxable profit within the established norms - no more than 4% of the amount of labor costs for the reporting tax period (clause 2 of Article 264 of the Tax Code of the Russian Federation).

The following expenses cannot be included as representative expenses:

- recreation;

- entertainment;

- treatment and prevention of diseases.

For more information about the rules for tax accounting of entertainment expenses, read the article “How are entertainment expenses correctly reflected in tax accounting?”

This norm of the Tax Code of the Russian Federation is explained in a number of letters from the Russian Ministry of Finance. Thus, the costs of organizing an entertainment program after the official part of the reception, classified as entertainment and reducing the tax base when calculating profits, will have to be defended in court (letter dated December 1, 2011 No. 03-03-06/1/796).

IMPORTANT! Organizations that apply the simplified tax system “income minus expenses” generally do not have the right to take into account entertainment expenses as expenses when calculating the simplified tax (letter of the Ministry of Finance of Russia dated October 11, 2004 No. 03-03-02/04/1/22).

As a result, permanent and temporary differences arise between tax and accounting accounting. Such differences are reflected separately in accounting in accordance with PBU 18/02.

Who is allowed not to apply the norms of PBU 18/02 is described in the article “PBU 18/02 - who should apply and who should not?”

Continuation of the example

In order not to argue with the tax authorities, the management of Azimut LLC decided not to include the amount of costs for the entertainment program as expenses when calculating profits. Thus, there is a constant difference between accounting and tax accounting:

- in accounting, the entire amount of costs incurred is accepted - 63,372.50 rubles;

- The tax authorities take into account only the costs of the official part of the event - 18,895.50 rubles. (63,372.50 – 8,677 – 35,800).

That is, the amount of expenses not accepted for tax accounting is 44,477 rubles. (8,677 + 35,800). This difference forms a permanent tax expense (hereinafter referred to as PTR) and is reflected in the accounting records by posting: Dt 99.2 Kt 68 - in the amount of RUB 8,895.40. (44,477 × 20%).

ConsultantPlus experts explained in detail when permanent differences arise, permanent tax expenses (income) and how they are reflected in accounting. Get trial demo access to the K+ system and upgrade to the Ready Solution for free.

In addition, in tax accounting it is necessary to calculate the standard - 4% of the amount of wages for the reporting period.

For the 1st and 2nd quarters of 2022, the amount of labor costs amounted to RUB 435,200. That is, no more than 4% of this amount can be accepted for tax accounting, namely 17,408 rubles. (435,200 × 4%).

Since the amount of labor costs will be increased in the next quarter, the balance of entertainment costs can be recognized in the future period (clause 42 of Article 270 of the Tax Code of the Russian Federation).

That is, a deductible temporary difference is formed in the amount of RUB 1,596.93. (19,004.93 – 17,408). In accounting, it is necessary to record the deferred tax asset (hereinafter referred to as DTA) by posting: Dt 09 Kt 68 - in the amount of 319.38 rubles. (1,596.93 × 20%).

Let us remind you that IT is a deferred part of income tax, which in future reporting periods should lead to a reduction in the calculated tax. With an increase in the volume of salary payments in the 3rd and 4th quarters of 2022, the LLC will be able to post: Dt 68 Kt 09 - in the amount of 319.38 rubles.

Look for the procedure for accounting for IT in the article “What is deferred income tax and how to take it into account?”

For more information on how to reflect the differences between accounting and tax accounting, see the article “Differences between accounting and tax accounting.”

Are expenses classified as representative expenses under the simplified tax system?

Entertainment expenses - how can these expenses be taken into account in different tax systems? PRs can reduce the tax base only for those firms that operate under the general tax system. In Art. 346.16 of the Tax Code of the Russian Federation, which contains a list of costs that reduce expenses for the simplified tax system “income minus expenses”; entertainment expenses are not indicated. This circumstance does not allow reducing the tax base under the simplified tax system for entertainment expenses.

Read about entertainment expenses under the simplified tax system in the article “Acceptable expenses under the simplified tax system in 2022 - 2022.”

Entertainment expenses - what are these expenses from an accounting point of view?

It is worth noting that PR is a category that characterizes only tax accounting. In accounting, these costs are not qualified in any way. In practice, accounting of such amounts is carried out using the norms of PBU 10/99. In accordance with them, the company’s expenses for ordinary activities should be divided:

- to material ones;

- those related to wages and social contributions;

- depreciation expenses,

- other costs.

So, entertainment expenses - what are these expenses from an accounting point of view? In terms of their economic meaning, PR is most suitable for the category of other costs. At the same time, the company can determine their list in accounting independently (clause 8 of PBU 10/99).

Now let’s consider the following question: “Representation expenses - what are these expenses from the point of view of reflecting transactions for them in accounting?” Most often, the corresponding transactions are recorded using accounts 26 or 44. The first account is mainly used by industrial companies, the second by trading companies. In non-commercial organizations, account 86 is most often used. Of course, when carrying out accounting for PR, it is also important to correctly follow the sequence of entries in terms of reflecting the stages of cash turnover. In practice they can be presented:

- issuing funds from the enterprise's cash desk to accountable persons for the purpose of spending as part of official events - Dt 71 Kt 50;

- provision of services by the supplier - Dt 26 Kt 60;

- receipt of an advance report from a person for whom he spent the received funds for its intended purpose (in order to pay for the services listed in clause 2 of Article 264 of the Tax Code of the Russian Federation) - Dt 26 Kt 71.

The next criterion for applying PR for the purpose of tax optimization is their documentary evidence.

Confirmation of entertainment expenses in 2022 - 2021: documents

Entertainment expenses - what are these expenses in terms of their documentary evidence?

Any expenses in order to reduce the tax base, by virtue of the provisions of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, must be documented. The Tax Code of the Russian Federation does not reflect the lists of documents by which a company can certify the facts of making relevant expenses.

In practice, these documents most often are:

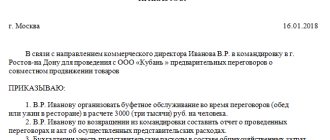

- order from the director to hold an official event;

- cost estimate for the relevant event;

- event expense report;

- act on write-off of expenses;

- official event program;

- agreements with service providers ordered for the purpose of holding the event;

- primary documents reflecting calculations for relevant services.

If a company regularly holds official events, the main document confirming PR may be a local regulation on PR. This document regulates the procedure for accounting for relevant expenses with the specific purpose of reducing the tax base. If the PR regulation is adopted by the company, then the documents indicated above in the list will supplement it. Moreover, they must be drawn up on the basis of forms approved as annexes to the regulations on PR.

It is worth noting that the above list of documents with which the PR can be confirmed was formed not on the basis of business practice (although its role in this case is also important), but on the basis, first of all, of rule-making. The fact is that virtually each of the types of sources discussed above was, one way or another, recommended by the Ministry of Finance in letters that the department publishes with some frequency in order to clarify the procedure for accounting for PR.

When carrying out events, as a rule, a responsible person is appointed, to whom money is given on account. ConsultantPlus experts tell you in detail how to correctly prepare an advance report for hospitality expenses. If you are not yet registered in the system, get trial online access. It's free.

See “How to properly document entertainment expenses - an example?”

Order on entertainment expenses: document structure

An order may consist of the following information blocks:

1. Reflecting the name of the business entity.

2. Including the name of the document (it may sound, for example, like “Order for holding a business breakfast”).

3. Reflecting the essence and purpose of the business event.

4. Including operative language (“I order...”).

This block may reflect:

- a list of specialists responsible for conducting a business event;

- a list of the tasks assigned to these employees.

5. Including the signature of the head of the company, which certifies the fact of approval of the document.

6. Including the signatures of responsible employees certifying the fact of their familiarization with the document.

7. A reflective list of appendices to the order - if available.

Such applications can be used, for example, the event program and estimate, that is, those sources that, like an order, are drawn up before the event.

In turn, the document may contain language about the need to draw up other certifying sources - such as an act and a report drawn up after the event.

You can order a representative event that corresponds to the structure considered on our website.

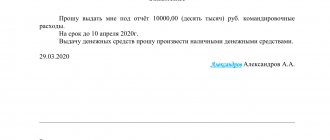

Entertainment expenses - how are these expenses reflected in the report?

The report on the representative event reflects:

- date of the event;

- the purpose of the official event;

- program and composition of event participants;

- the results of the relevant event;

- the amount of costs associated with the event;

- other significant facts about the event.

Note that in practice, many enterprises prefer to reflect the program of an official event not as part of a report, but in a separate document.

Primary requirements

In addition to the PR report, as well as the program that complements it in many cases, confirmation of the relevant expenses is carried out through various primary sources.

They can be classified into 2 main categories:

- contractual primary documents (agreements, acts, invoices - with contractors providing services as part of entertainment events);

- internal accounting documents (such as a report on a business event).

All types of primary equipment must comply with the general requirements reflected in paragraph 2 of Art. 9 of Law No. 402-FZ, and contain:

- Name;

- date of document preparation;

- company name;

- information about the economic fact being taken into account;

- information about the measurement value of the corresponding fact, the units of this measurement;

- information about persons related to the occurrence of the relevant fact, signatures of these persons.

The primary report is compiled at the moment of occurrence of the economic fact taken into account or, in extreme cases, immediately after its occurrence (Clause 3, Article 9 of Law No. 402-FZ). The head of the company must approve the forms of primary accounting used in the organization in the accounting policy (clause 4 of PBU 1/2008).

Entertainment expenses - what are these expenses, according to the judges?

There are known precedents when expenses incurred on the basis of an agreement for the provision of consulting services concluded between a company and its partner were recognized as representative expenses (Resolution of the Federal Antimonopoly Service of the North-Western District dated January 27, 2006 No. A42-8823/04-28).

Firms also have a chance to be recognized as representatives of the expenses incurred in organizing presentations for media representatives. Thus, the Federal Antimonopoly Service of the Central District, in its resolution dated January 12, 2006 No. A62-817/2005, established that the company organizing a business seminar rightfully attributed to PR the costs of transportation services for journalists of various media outlets who were invited to this seminar, while The Federal Tax Service refused to classify these expenses as representative expenses. However, in this case, what mattered was the purpose for which media representatives were invited - to establish business cooperation with print media and television companies, within the framework of which it was supposed to place advertisements and articles on the relevant media platforms.

The position of the Federal Tax Service and the courts is also different with regard to the recognition by the PR of payment for the accommodation of persons invited to an official event in a hotel. Tax authorities do not consider these expenses to be representative expenses due to the fact that they are not included in the list of expenses defined in clause 2 of Art. 264 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated April 16, 2007 No. 03-03-06/1/235). But the judicial precedent, according to which the FAS of the West Siberian District issued a resolution dated March 1, 2007 No. F04-9370/2006 (30552-A81-27), indicates that the arbitration may have a different opinion on this issue. Then the court considered that payment for hotel accommodation of invited persons is still a PR, since the concept of “service”, fixed in paragraph 2 of Art. 264 of the Tax Code of the Russian Federation, can be interpreted more broadly than in the context of the types of PR listed in the Tax Code of the Russian Federation, including payment for hotel accommodations for guests of an official event.

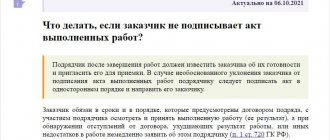

Documentation of entertainment expenses

Tax legislation does not contain a list of documents that must be used to confirm entertainment expenses, which officials themselves draw attention to (letter of the Ministry of Finance of Russia dated April 10, 2014 No. 03-03-RZ/16288). But it is clear that to confirm the fact of entertainment expenses, it is not enough to have only primary documents confirming the fact of payment for services. After all, the main condition for accounting for entertainment expenses is the business nature of the event. In other words, it should follow from the documents that the meeting was of an official nature and during it issues of potential or further cooperation were discussed.

Some letters from officials regarding the issues of accounting for entertainment expenses contain an approximate list of such documents. For example, the letter of the Ministry of Finance of the Russian Federation dated March 22, 2010 No. 03-03-06/4/26 states that documents used to confirm entertainment expenses may be, in particular:

- order (instruction) of the head of the organization on the implementation of expenses for these purposes;

- estimate of entertainment expenses;

- primary documents, including in the case of using any goods purchased externally for entertainment purposes, payment for services of third-party organizations;

- a report on entertainment expenses for entertainment events held, which reflects: the purpose of the entertainment events, the results of their implementation; other necessary information about the event, as well as the amount of expenses for entertainment purposes.

Judicial practice also shows that to account for entertainment expenses, a full package of documents is required. Just an advance report with attached cash receipts is clearly not enough, as stated, for example, in the decision of the Third Arbitration Court of Appeal dated November 27, 2012 in case No. A74-732/2012. In this case, the court did not support the company, since it did not present the orders of the director, estimates of entertainment expenses for each event, reports on entertainment expenses for the entertainment events held, which reflected with whom and when the meetings took place, for what purpose, what was the result of holding such meetings and negotiations has been achieved by society.

Moreover, when drawing up documents, it is important to avoid formalities. For example, if many reports contain the same goals, then tax authorities may see this as a formality, which, along with other reasons, will prevent you from winning the case in court (see, for example, the decision of the Fourteenth Arbitration Court of Appeal dated September 22, 2016 in case No. A66-17120/2015).

Next, we will look at what violations companies often commit in practice.

Results

The answer to the question “Entertainment expenses - what are these expenses?” gives us clause 2 of Art. 264 Tax Code of the Russian Federation. The list of expenses defined in the Tax Code is exhaustive: those expenses that do not correspond to it cannot be considered as representative expenses. The company can use the corresponding costs to reduce the tax base - within the limits established by the Tax Code of the Russian Federation, namely 4% of labor costs. As part of accounting, PR is included in other costs as part of expenses for ordinary activities.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Generally Allowable Costs of Representation

When making entertainment expenses, documentation is necessary only for official expenses, which include (clause 2 of Article 264 of the Tax Code of the Russian Federation):

- Conducting official receptions, meetings and meetings (breakfasts, lunches and other similar expenses are taken into account), taking place both on the territory of the organization and outside it (restaurants, hotels). This category also includes spending on alcoholic beverages.

- Transportation costs for transporting guests to and from the event venue.

- Buffet services and costs.

- Payment for the work of translators who are not on the company’s staff.

KEEP IN MIND

Expenses on alcohol can be taken into account as entertainment expenses if alcoholic beverages are intended specifically for an official event (letter of the Ministry of Finance dated January 22, 2019 No. 03-03-06/1/3120). The Tax Code of the Russian Federation does not specify the list of alcohol costs. Therefore, they can be taken into account without applying additional limits, but taking into account the general restrictions established by law for entertainment expenses.