In accordance with clause 3 of Article 1 of the Federal Law dated 03.08.2018 No. 303-FZ, from January 1, 2022 in relation to goods (works, services, property rights) provided for in clause 3 of Article 164 of the Tax Code of the Russian Federation, the tax rate according to VAT increased to 20%.

A VAT tax rate of 20% is applied to goods (work, services) shipped (performed, rendered) starting from January 1, 2022 (clause 4 of article 5 of Law No. 303-FZ).

At the same time, no exceptions are provided for goods (works, services) sold under contracts that were concluded before the VAT tax rate was increased (that is, before January 1, 2022).

Thus, in relation to goods (work, services), property rights sold (performed, provided) starting from January 1, 2019, a VAT tax rate of 20% is applied, regardless of the date and conditions of concluding contracts for the sale of these goods ( works, services), property rights.

Let's look at some of the most common situations that taxpayers may encounter during the transition period.

Prepayment was received in 2022, delivery in 2022

Upon receipt of an advance payment in 2022 for the supply of goods that will be shipped in 2022, the taxpayer must calculate VAT at the calculated rate of 18/118% (clause 4 of Article 164 of the Tax Code of the Russian Federation).

In 2022, at the time of shipment of goods, VAT will need to be charged at a rate of 20%. The tax previously calculated from the advance payment is reflected as part of tax deductions for VAT in the amount in which it was previously paid to the budget at a rate of 18/118% in the manner prescribed by clause 6 of Article 172 of the Tax Code of the Russian Federation.

Let us consider in more detail the procedure for calculating VAT in various situations, depending on the terms of the main agreement and additional agreements to it.

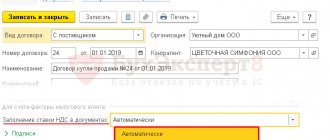

If, in accordance with the terms of the contract, the cost of goods (work, services) is indicated with the allocation of VAT at a rate of 18%, then the procedure for calculating the tax by the seller depends on the terms of additional agreements that will be concluded between the seller and the buyer.

If the total value of the contract remains unchanged

When shipping goods from January 1, 2022, the seller is obliged to calculate VAT at a rate of 20% , even if, under the terms of the contract, the total cost of the goods (work, services) supplied does not change (clause 4 of article 5 of Law No. 303-FZ).

However, due to an increase in the VAT rate, the cost of goods will decrease. In other words, in the situation under consideration, the difference in the VAT rate will be attributed to the reduction of the markup.

Example: in 2022, a 100% prepayment was received in the amount of 118,000 rubles, including VAT (18/118%) of 18,000 rubles. In 2022, goods were shipped in the amount of 180,000 rubles, including VAT (20%) of 19,666.67 rubles.

The parties agreed on an increase in the total cost of the contract due to a change in the VAT rate to 20%

The procedure for calculating VAT in the situation under consideration was commented on by specialists of the Federal Tax Service of Russia in a letter dated October 23, 2018 No. SD-4-3/ [email protected]

If the parties sign an additional agreement to the contract, according to which the total cost of shipped goods (work, services) increases, then VAT will be calculated by the seller in the following order:

- at a VAT rate of 18/118% upon receipt of an advance payment in 2022 (clause 4 of Article 164 of the Tax Code of the Russian Federation);

- at a VAT rate of 20% for shipment of goods in 2022. VAT previously calculated upon receipt of an advance is accepted for deduction (clause 6 of Article 172 of the Tax Code of the Russian Federation);

- the difference subject to additional payment by the buyer (in the amount of 2 percentage points due to a change in the VAT rate from 18% to 20%) - depending on the moment at which the specified additional payment will be made by the buyer (letter of the Federal Tax Service of Russia dated October 23, 2018 No. SD-4 -3/ [email protected] ):

- if an additional payment of tax in the amount of 2% is made by the buyer from 01/01/2019, then such an additional payment should be considered as an additional payment of the tax amount.

Upon receipt of the additional tax payment, the seller issues an adjustment invoice for the difference between the tax amount indicated on the invoice drawn up previously using a VAT rate of 18/118%, and the tax amount calculated taking into account the amount of the additional tax payment.

Example: in 2022, the buyer made an advance payment in the amount of 118,000 rubles, including VAT of 18,000 rubles. Upon receipt of an advance, VAT is calculated by the seller at a VAT rate of 18/118%.

The parties agreed to increase the cost of goods. In 2022, before the goods were shipped, the buyer paid the difference.

Having received the additional payment, the seller needs to issue an adjustment invoice for the advance payment, which will indicate the new data: VAT rate - 20/120, the amount of tax at this rate and the new cost including VAT.

- If an additional tax of 2% is paid by the buyer until December 31, 2018 inclusive, then this amount is considered as an additional payment for the cost of goods (work, services). VAT on the specified additional payment amount is subject to calculation at a rate of 18/118%.

Upon receipt of additional tax payment, the seller can issue an invoice for the advance payment and charge VAT on it at a rate of 18/118%, or issue an adjustment invoice for the advance payment and indicate in it the increased cost including VAT, the VAT rate - 18/118 and a new VAT amount.

Example: in 2022, the seller received an advance in the amount of 118,000 rubles, including VAT of 18,000 rubles. (at a rate of 18/118%). Upon receipt of the advance, the seller issued an invoice for the advance with these indicators.

The parties agreed that the price of the goods excluding VAT remains the same, but due to the change in the VAT rate, the total cost of the contract increases to 120,000 rubles. (including VAT 20%).

Upon receipt of an additional payment in 2022 before shipment, the seller issues an adjustment invoice and indicates in it the increased cost including VAT, the VAT rate - 18/118 and the new VAT amount.

The requirement to issue adjustment invoices when the cost of goods (work, services) changes is provided for in clause 3 of Article 168 of the Tax Code of the Russian Federation.

During the transition period, the Federal Tax Service allowed the issuance of adjustment invoices, including for advances (clause 1.1 of the Federal Tax Service letter No. SD-4-3/20667 dated October 23, 2018).

Delivery of goods in 2022, payment will be made in 2022

If the shipment of goods (works, services, property rights) is carried out in 2022, then the VAT calculated for payment is calculated at the rate in effect at the time of shipment, that is, 18%.

This is due to the fact that the new VAT rate of 20% does not apply to goods (work, services, property rights) whose shipment date fell before January 1, 2022 (clause 4 of article 5 of Law No. 303-FZ , letter of the Ministry of Finance of Russia dated 08/06/2018 No. 03-07-05/55290).

Thus, the change in the VAT rate does not affect shipments made in 2022 but paid for in 2022.

Where did they start collecting VAT?

The first territory that had the honor of experiencing (or taking the blow?) the delights of VAT was Cote d'Ivoire (which we recently stopped calling the Ivory Coast) - it was there that an unprecedented tax experiment began in 1954.

Maurice Loret, "father" of VAT

For several years, economists watched the progress of this experiment, gradually expanding its scope (soon VAT began to be paid in Equatorial Guinea and a number of other countries), and in 1958 they decided that the idea had shown itself to be excellent and it was time to introduce it in France too.

As Loret promised, this was not done all at once, which probably only complicated the introduction of this experience, but in the early 60s, VAT became commonplace and commonplace in France, and numerous observers from other countries rated the introduction of VAT very highly, and the EEC Council (There was no European Union yet) a special directive ordered all European countries to introduce VAT before 1972.

However, it didn’t work out so well and quickly - some countries delayed with this tax until the last minute (for example, Finland introduced it only in 1994, later than Russia).

But in general, this tax is triumphantly marching around the world, and today 137 countries already use it.

Advance received in 2022, returned in 2019

Upon receipt of the advance, the seller calculated VAT at the rate of 18/118. When returning such an advance, there is no need to determine a new tax base for either the seller or the buyer. Thus, when returning the advance:

- the seller accepts for deduction advance VAT in the previously calculated amount (clause 5 of Article 171 of the Tax Code of the Russian Federation);

- the buyer restores the VAT deduction in the amount that was previously declared by him for deduction. If the buyer did not claim a deduction for advance VAT, then he has nothing to recover (clause 3, clause 3, Article 170 of the Tax Code of the Russian Federation).

Ships in 2022, returns in 2022

Also in the commented letter there are recommendations for the case when a product shipped in 2022 is returned by the buyer in 2022.

Federal Tax Service specialists believe that in such a situation the supplier must issue an adjustment invoice. This must be done regardless of whether the returned goods were accepted for registration with the buyer or not.

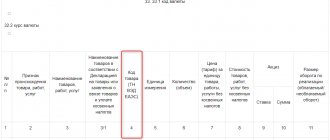

In column 7 of the adjustment invoice, you should indicate the rate that was listed on the original invoice. So, if the goods were delivered in 2022, and the VAT rate for it was 18%, then the same value must be entered in the adjustment invoice, despite the fact that it was issued in 2022.

Based on the adjustment invoice, the supplier will deduct the tax, and the buyer will refund the VAT on the returned goods. If the buyer is not a VAT payer or is exempt from paying this tax, a separate adjustment document must be issued instead of an adjustment invoice. It must include summary (summary) information about all cases when such customers returned goods during the month or quarter.

Background

Ideas about how to tax the ever-elusive merchants have strained the minds of administrations of all times and peoples since ancient times.

Basic income has always been provided by agriculture, and here they learned to fleece workers quite a long time ago - the harvest can be counted and part of what is grown can be taken away.

Even more progressive is to measure the cultivated area and charge money for its area, regardless of the peasants’ ability to cultivate it (and there have been wars, diseases, damage to tools, fires and simply crop failures).

In a word, there were a lot of all sorts of ideas regarding taxation of peasants, but it was difficult to keep track of traders and artisans; duties alone could not get rid of it. A fixed tax on the right to trade or set up a workshop also seemed insufficient to the authorities.

And production and trade became more and more complicated, and, in the end, by the end of the century before last, they began to represent supply chains, sometimes quite long, in which more and more people were involved:

- mining companies;

- manufacturers of various types of components and semi-finished products;

- manufacturers of final products;

- traders: buyers, wholesalers, small wholesalers, retail.

But there were also carriers...

Duty is the oldest of taxes. Each city and each territory took money for travel and the right to trade

Yes, of course, administrators introduced taxes and duties when moving goods across the border and fees in their favor for importing goods into markets (analogous to a municipal tax today, because the money collected in this way has been appropriated by a local official since ancient times), but they always suspected that they are not getting something from this trade...

Eventually there is a sales tax - everyone who sells something must share a portion of the proceeds with the administrators. Everything would be fine if it weren’t for the well-known mistrust between trade and the state: either traders hide profits (sometimes they succeed well), or administrators think that they are not receiving something.

It is impossible to establish exactly who came up with the idea of replacing sales tax with value added tax (VAT or, in the English version, VAT). Apparently, this idea was in the air and was wonderful because it made it possible to track the sales chain at each of its stages, and to do this with the hands of the merchants themselves, thereby reducing administrative costs for collections and sharply increasing tax collection.

The only bad thing about it was that the final price fell entirely on the shoulders of the buyer - well, who was interested in this buyer at the turn of the 19th and 20th centuries?

That is, it was interesting, since the concept of “rich buyer - growing business” was already taking shape, but no one had yet planned to ask the opinion of this buyer.